Manufacturers at the top of the order cycle

January 1998

In terms of orders, 1997 was a great year for the world’s aircraft manufacturers — particularly Airbus and Boeing, who now dominate the industry as never before. But increasing orderbooks at the two main manufacturers have been overshadowed by considerable internal problems — the effort to increase production rates in the case of Boeing, and the process of transforming from a consortium to a company in the case of Airbus.

And it is whether and how the manufacturers will overcome these challenges — rather than orders received — that is the more accurate guide as to which of Airbus and Boeing will dominate the industry into the next millennium.

Order bonanza

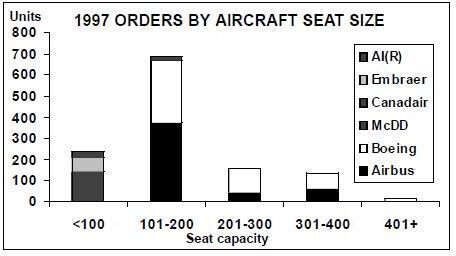

Apart from orders that manufacturers managed to squeeze into the last few days of December, Aviation Strategy’s survey of 1997 reveals 479 orders for Airbus, 515 for Boeing, 64 for Embraer, 15 for McDonnell Douglas (now part of Boeing), 144 for Bombardier and 29 for Aero International (Regional). Our order totals disregard options and any “firm” orders that we believe are not truly firm (such as LoIs, MoUs, double–counted orders etc). The total of 1,246 compares with 1,041 orders for 1996.

Looking at orders by aircraft seat size, the largest market by far was the 101–200 seat category — firmly occupied by the 737 and A319/320/321 series — which racked up an impressive 684 orders. Three–quarters of Boeing’s sales in this category are in the 737–600 to -900 family, launched at the end of 1993.

Airbus’s plans for this market rest on developing products in the lower seat capacity range, via partnerships with Finmeccanica and Asian companies. If fully developed, the AE316 would carry 95–106 passengers, and the AE317 115–125 passengers. But will there be enough demand for these aircraft?

Boeing has the largest market share in the 201–300 seat category, but shares are more even in the 301–400 seat category, a market that Airbus is keen to dominate. The consortium is spending $2.9bn on the launch of two four–engined variants of the A340 — a 380–seat A340–600 and a long range, 313–seat A340–500. With these and future models Airbus wants to win 50% of the 301–400 seat market, where its direct competition is the 777 and smaller versions of the 747.

Inevitably, however, there have been problems over the funding of these new models. Under the US–EU agreement up to a third of the cost of Airbus’s two new aircraft can be financed by the consortium’s respective governments.

But the British government is very reluctant to provide further launch aid or, as BAe prefers to call it, launch investment. Launch aid used to be regularly provided for new aerospace projects but has greatly diminished in recent years. It is a commercial transaction in that the recipient is charged an interest rate equivalent to the inflation rate plus eight points, but it is also subsidises risk as repayments are linked to sales of the products, and if there are no sales there are no repayments. The UK government’s position — that as BAe has a healthy balance sheet it should be able to find all its funding from commercial banks — seems perfectly logical.

The 400+ seat rainbow

The elusive pot of orders at the end of the 400+ seat rainbow is still attractive to the big two manufacturers, particularly Airbus. A cross–section of the A3XX was shown at the Paris air show in June 1997, but development costs of at least $8bn are still the main barrier to a launch.

Airbus has signed MoUs with virtually the entire European aerospace industry, but is is investment cash that Airbus needs most, not design engineers. This leaves just one market left — aircraft with up to 100 seats. It is the toughest market of all, for the simple fact that there are still (just) more manufacturers here than in any other category, and the market itself is comparatively small.

For the three remaining independent manufacturers who compete in this market — Aero International (Regional), Embraer and Bombardier — 1997 can be regarded as a breakthrough year. The CRJ and the Embraer lines did particularly well, but will all three manufacturers be robust enough to survive the next aviation recession — whenever that may be? The decision by Aero International (Regional) to scrap plans for a 70–seater aircraft may be a foretaste of things to come.

There is some hope, however, that a trend is emerging for a trade–up from turboprops to small jets — although that would obviously have grave consequences for turboprop manufacturers.

Elsewhere ...

Orders apart, it has been a problematical year for Airbus and Boeing. At Airbus the low point of 1997 was the continuing French versus British/German squabbling over the future of the consortium. The French idea of “balanced partnership” is likely to slow down crucial moves towards turning the consortium into a proper company, particularly as an “Airbus–plus” — combining aerospace and defence — is now a possibility.

If Europe’s defence industries are included, it could open up endless bickering on structuring and management/leadership. The British, via BAe, are Europe’s unofficial defence industry leaders, in direct contrast to the position in aerospace where the French, via Aerospatiale, lead.

An ongoing row about the future of Airbus would particularly suit Boeing, which is facing well–documented teething problems as it ramps up production There is some hope, however, that a trend is emerging for a trade–up from turboprops to small jets — although that would obviously have grave consequences for turboprop manufacturers.

If Europe’s defence industries are included, it could open up endless bickering on structuring and management/leadership. The British, via BAe, are Europe’s unofficial defence industry leaders, in direct contrast to the position in aerospace where the French, via Aerospatiale, lead.

Into 1998

An ongoing row about the future of Airbus would particularly suit Boeing, which is facing well–documented teething problems as it ramps up production from 18 aircraft per month in 1996 to 46 per month. However, Boeing’s production challenge, if overcome, will have a significant effect on profits long–term. Essentially, Boeing has switched to a JIT system, in which education of suppliers is a key priority, although not easy to achieve. Boeing is also cutting 12,000 jobs — around 10% of the workforce. Together, the workforce reduction combined with the increase in output will result in a massive improvement in productivity — and analysts are marking up 1998 earnings per share forecasts (by around 10 cents per share) as a result. In addition, Boeing claims it will save $1bn a year in costs from the merger with McDonnell Douglas by 1999. In 1998, orders are likely to be well down on 1997. Asia is more likely to have a net cancellation, most of the major US re–fleeting plans have been completed and European demand will come mainly from those state–aided carriers which are now allowed to re–equip. For manufacturers, the measure of success in 1998 will be production efficiency rather than order numbers.

| A300 | A310 | A319 | A320 | A321 | A330 | A330 | A330 | A340 | A340 | A340 | A340 | ||

| -600R | -300 | TBA | -200 | -300 | -300 | -500 | -600 | ||||||

| European airlines | |||||||||||||

| Aer Lingus | 4 | ||||||||||||

| Air France | 1 | ||||||||||||

| British Midland | 4 | 4 | |||||||||||

| Croatia AL | 6 | ||||||||||||

| Egyptair | 2 | ||||||||||||

| Eurowings | 1 | ||||||||||||

| Finnair | 5 | 3 | 4 | ||||||||||

| Lufthansa | 2 | 10 | |||||||||||

| Olympic AW | 2 | 2 | |||||||||||

| Swissair | 1 | 6 | |||||||||||

| Virgin Atlantic | 1 | 8 | |||||||||||

| European total | 66 | ||||||||||||

| North American airlines | |||||||||||||

| Air Canada | 5 | 3 | |||||||||||

| America West | 22 | 24 | |||||||||||

| NorthwestAL | 50 | ||||||||||||

| US Airways | 109 | 15 | |||||||||||

| North American total | 228 | ||||||||||||

| Asian airlines | |||||||||||||

| Air Macau | 1 | ||||||||||||

| Asiana AL | 3 | 3 | |||||||||||

| CASC | 10 | 20 | |||||||||||

| Cathay Pacific | 1 | 2 | |||||||||||

| EVA Air | 3 | 3 | |||||||||||

| Korean Air | 4 | ||||||||||||

| Silk Air | 3 | 5 | |||||||||||

| Thai Airways | 5 | 4 | |||||||||||

| Uzbekistan AL | 1 | ||||||||||||

| Asian total | 68 | ||||||||||||

| Others | |||||||||||||

| Al Kharafi Con. | 1 | ||||||||||||

| ILFC | 51 | 1 | 15 | ||||||||||

| Lotus Air | 1 | ||||||||||||

| Tunisair | 3 | 4 | |||||||||||

| Undisclosed | 8 | 9 | 3 | 14 | 7 | ||||||||

| Others total | 117 | ||||||||||||

| TOTAL | 5 | 1 | 209 | 126 | 38 | 33 | 9 | 13 | 12 | 7 | 3 | 23 | 479 |

| 737 | 737 | 737 | 737 | 737 | 737 | 737 | 747 | 747 | 747 | 757 | 757 | 767 | 767 | 777 | |

| -300 | -400 | -500 | -600 | -700 | -800 | -900 | -400 | -400F -400M | -200 | -300 -300ER-400ER -200 | |||||

| European airlines | |||||||||||||||

| Aeroflot (ARIA) | 10 | ||||||||||||||

| BA | 3 | 3 | 5 | ||||||||||||

| Braathens Safe | 6 | ||||||||||||||

| Cargolux | 6 | ||||||||||||||

| Deutsche BA | 13 | ||||||||||||||

| easyJet | 12 | ||||||||||||||

| GB Airways | 2 | ||||||||||||||

| Icelandair | 2 | 2 | |||||||||||||

| Lufthansa | 2 | ||||||||||||||

| KLM | 4 | ||||||||||||||

| Maersk Air | 2 | ||||||||||||||

| Pegasus AL | 1 | 1 | |||||||||||||

| Pro Air | 1 | ||||||||||||||

| Turkish AL | 26 | ||||||||||||||

| European total | 101 | ||||||||||||||

| North American airlines | |||||||||||||||

| Alaska AL | 2 | 3 | 10 | ||||||||||||

| American AL | 4 | 4 | |||||||||||||

| Atlas Air | 10 | ||||||||||||||

| Boeing Bus. Jet | 26 | ||||||||||||||

| Continental AL | 11 | 30 | 5 | ||||||||||||

| Delta AL | 70 | 5 | 10 | 21 | 10 | ||||||||||

| Eastwind AL | 2 | ||||||||||||||

| United AL | 3 | 8 | |||||||||||||

| Sunrock AC | 2 | 2 | 5 | ||||||||||||

| North American total | 243 | ||||||||||||||

| Asian airlines | |||||||||||||||

| Air China | 2 | 5 | |||||||||||||

| ANA | 1 | ||||||||||||||

| CAAC | 14 | 22 | 1 | 5 | 8 | ||||||||||

| China Yunnan AL | 3 | 2 | |||||||||||||

| Far Eastern AT | 5 | ||||||||||||||

| Qantas AW | 3 | ||||||||||||||

| Asian total | 4 | 75 | |||||||||||||

| Others | |||||||||||||||

| Boullioun AS | 3 | 2 | |||||||||||||

| Emirates | 2 | ||||||||||||||

| GECAS | 1 | ||||||||||||||

| GPA | 1 | ||||||||||||||

| ILFC | 31 | 2 | 6 | 7 | 5 | 10 | |||||||||

| Kenya AW | 1 | ||||||||||||||

| LanChile AL | 5 | ||||||||||||||

| Pembroke Capital | 4 | 8 | |||||||||||||

| Tunisair | 4 | ||||||||||||||

| US Navy | 2 | ||||||||||||||

| Undisclosed | 1 | 1 | |||||||||||||

| Others total | 96 | ||||||||||||||

| TOTAL | 55 | 19 | 2 | 40 | 69 | 101 | 10 | 13 | 16 | 2 | 38 | 2 | 41 | 56 | 51 515 |

| Emb | Emb | MD | MD | MD | MD | CRJ | RJ | RJ | |

| -145 | -145LR | -11 | -11F | -80 | -90-30ER | -85 | 1100 | ||

| European airlines | |||||||||

| Adria Airways | 2 | ||||||||

| AMC Aviation | 2 | ||||||||

| Brit Air | 8 | ||||||||

| British Regional AL | 15 | ||||||||

| CityFlyer Express | 1 | ||||||||

| Crossair | 4 | ||||||||

| Luxair | 2 | ||||||||

| Maersk Air | 3 | ||||||||

| Midway | 10 | ||||||||

| Portugalia AL | 4 | ||||||||

| Tyrolean AW | 1 | ||||||||

| European total | 52 | ||||||||

| North American airlines | |||||||||

| Air Canada | 2 | ||||||||

| American Eagle | 25 | ||||||||

| Atlantic Coast | 6 | ||||||||

| Atlantic SouthEast AL | 30 | ||||||||

| Comair | 30 | ||||||||

| Continental Exp. | 25 | ||||||||

| Mesa Air | 16 | ||||||||

| Northwest AL | 24 | ||||||||

| North American total | 158 | ||||||||

| Asian airlines | |||||||||

| Chinese government | 5 | ||||||||

| EVA Airways | 6 | ||||||||

| Asian total | 11 | ||||||||

| Others | |||||||||

| Brazilian government | 8 | ||||||||

| Rio-Sul | 10 | ||||||||

| South African Exp. | 6 | ||||||||

| Undisclosed | 1 | 4 | 2 | ||||||

| Others total | 31 | ||||||||

| TOTAL | 39 | 25 | 1 | 10 | 2 | 2 | 144 | 24 | 5 252 |