Lan Chile: global investment lessons from Latin America

January 1998

On November 7 Lan Chile became the first Latin American airline to be listed on US and European stock exchanges. How does a promising Latin American carrier sell itself to international investors?

The initial problem faced by bankers is how to value a typical Latin American carrier, which is like a hybrid of the different airline types currently familiar to international investors. Like European flag carriers, Latin American airlines typically enjoy the privilege of being their countries' sole representatives on long haul international routes. But since they are fully privatised, receive no government protection, are allowed to fail and frequently operate in fully deregulated domestic and liberal international regimes, should their valuations be closer to those of the US Majors?

The carriers resemble Southeast Asian operators in the sense that they are located in a high–growth region. Yet, many Latin American countries still carry an element of economic and political risk. Since the carriers are typically small and own few assets (most of their aircraft are leased), should they be classified as high–risk investments more along the lines of the US start–ups?

The approach adopted by Merrill Lynch, the leading underwriters of the Lan Chile offering, was to look at several valuation methodologies. The Chilean carrier was believed to be closest to the "high–growth" airline type, for which the highest P/E ratio is currently 14.5. Based on that criteria, Lan’s correct valuation was believed to be about 12–13 times estimated earnings. By comparison, the P/E ratios of the US Majors and European flag carriers are typically 8–9 and 13–14 respectively, while those of Southeast Asian operators average about 11.

Noting that airlines around the world trade at substantial discounts to industrial companies in their countries, Merrill decided that Hong Kong’s 40% discount (rather than the US average of 57%) should apply in Chile. That gave Lan a valuation of 10–11 times estimated earnings, compared to the 16–18 typical for high–quality Chilean industrial companies.

After also taking into account Latin America’s strong traffic growth rates (the forecast is 7% annually) and Lan’s good profit growth prospects over the next five years, Merrill began marketing the IPO at 12–13 times estimated 1998 earnings. Initially, the aim was to achieve a wide international distribution — 50% US, 25% Europe and 25% Chile — and a 75%/25% split between institutional and private investors. The roadshow (a total of 62 management presentations) was targeted mainly at institutional families and dedicated Latin America mutual funds, in the US, the UK and three continental European countries.

Armageddon intervenes

But the strategy had to be revised following the sudden change in the market conditions — referred to as "Armageddon" by those working in emerging markets — about halfway through the Lan Chile roadshow. Significantly, though, the deal went ahead even though the plunge in currencies and stock markets led to the postponement of other planned Latin American stock offerings.

The revised strategy meant more one–to–one meetings, more focus on the less market price–sensitive retail buyer, a reduction in the size of the offering and a lower offer price. In the end, the US IPO offering was reduced from 10.4m to 7.2m American Depository Shares (ADS) and the price was revised from $18 to $14 per ADS (each representing five common shares). This gave the airline a valuation of 10.3 times estimated 1998 earnings. Bearing in mind the changed market conditions, the IPO was a success. The issue was driven by US institutional and retail buyers, with Europeans showing much less interest, and Lan Chile obtained a listing on NYSE. However, as in many other recent IPOs, the post–offering stock performance has been disappointing: the share price dipped to $12 in late November and was still below the offer price in mid–December.

Net proceeds of the US and European offerings to Lan Chile were about $70m, down from the $80.8m envisaged in the pre–Armageddon days. The airline plans to use the funds to prepay $30m of short–term debt (of which half would cover down–payments to Boeing on five 767s), pay down the $14m balance due on the acquisition of Ladeco and to revamp cabin interiors and corporate image ($25m).

The IPO trend

The question now is whether Lan Chile is in some way unique or whether its successful IPO will set a trend in the region.

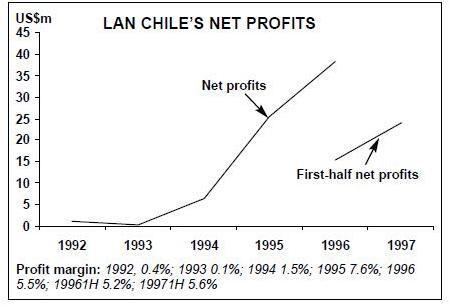

There is no doubt that Lan Chile possesses attributes that made it well qualified for a global IPO. After recovering from near–bankruptcy in 1991, the company has seen a strong and steady improvement in net profits to £38.3m in 1996 (5.5% of revenues). A profit of $24.1m was reported for first–half 1997 (up 55.4%), and the profit margin was maintained despite extremely rapid capacity growth.

Lan Chile has streamlined its fleet from six types six years ago to just three at present: the 767–300ER, 737–200 and DC–8–71F. It has labour agreements in place that allow high levels of productivity. It is one of Latin America’s most efficient operators, with unit costs well below the industry average and those of the US Majors.

Lan Chile has a relatively strong balance sheet, with total assets of $316m, shareholders' equity of $106m and long–term liabilities of $76m at the end of 1996. It recently secured investment grade debt ratings. The balance sheet will be further strengthened by the outright purchase of five new 767–300ERs currently on firm order.

Through a combination of smart management strategies, Lan has secured strong positions in different market segments and route areas. Its 1994 acquisition of FastAir gave it a firm footing in the region’s booming cargo market — freight now accounts for almost one third of it total revenue.

The recent purchase of Ladeco has taken care of the domestic market: the two now have a combined 75% market share (though they must remain separate entities). In the regional context, Lan already dominates the Southern Cone and continues to forge co–operative deals (most recently with Brazil’s TAM).

All of that, plus Chile’s liberal agreement with Peru which has enabled Lan to capture 6% of the US–Peru market, has put Lan into a strong position to compete under a possible Chile–US open skies regime (an MoU was signed on October 29), even if its proposed linkup with American does not win regulatory approval. But, Chile has rather smartly made the open skies deal contingent on the DoT granting antitrust immunity for the alliance. Lan has also signed a co–operative deal with American’s partner Canadian. While no other major South American operator can yet match Lan Chile’s credentials in the international capital markets, one Central American carrier group does and another is getting close.

The Aeromexico/Mexicana combine, organised under holding company Cintra and now very profitable, had planned to do a major $400m public offering in both Mexican and international stock markets in 1997. But in early December 1997 the plans were postponed due to some concerns by Mexican anti–trust regulators about the monopolisation of the Mexican market.

The successful privately–owned Taca Group is widely expected to go public in the US at some stage. While there are no other obvious candidates at present, it is worth noting that carriers such as Varig, TAM and ACES are now tapping their local equity markets.

ACES, the second largest Colombian carrier — which has ambitions “to become Latin America’s best airline by 2005” — is also at an advanced stage of negotiations for the sale of an equity stake, possibly 40%, to Continental. This follows American’s investment in 10% of Aerolineas Argentinas in a deal which involved Iberia, the former majority shareholder, whose share is now also 10%.

Latin American airlines will need increased access to international capital markets because their aircraft financing needs are substantial. Over the next five years, the region’s carriers are estimated to need 600 new aircraft, costing $18bn.

Two main forces are driving this trend. First, there is the need to replace geriatric fleets with new–generation aircraft — the average age of aircraft in Latin America is currently over 15 years. Second, the majority of the region’s fleets are on operating leases, but airlines are increasingly perceiving ownership to be a more cost–effective option.

In recent years the Latin American airline industry has staged a spectacular return to profitability. The ten major carriers that publicly report their results earned a combined net profit of $870m in 1996, representing a 10% profit margin. But most of the balance sheets are still weak and much more restructuring is needed before the airlines can sell themselves to international investors — items on bankers' wish lists include further fleet and route rationalisation, labour productivity and service quality improvements, strategic partners and intra–regional alliances, consistent earnings growth, a solid ownership (i.e. no criminal investigations) and timely financial reporting.

Since building trust is a vital prerequisite to going public, communication must improve. Bankers complain that most Latin American carriers seem unprepared for the volume and quality of information needed to negotiate financing deals, let alone the rigours of being a public company.

There is a need to improve accounting systems, as well as investor and press relations. Some bankers and investors, in turn, should get rid of their preconceived notions about Latin America built decades ago — European and Asian lenders tend to be more prone to that than their US counterparts. Change in the region has been so swift that the financial community has struggled to keep up with it, but some have simply not By Heini Nuutinen taken the time to understand the marketplace.

|

|

1996 revenue ($m) |

1996 net profit ($m) | Profit margin |

| Aeromexico | 953.8 | 263.9 | 27.7% |

| VASP | 1200 | 157.5 | 13.1% |

| Mexicana | 725.9 | 141.9 | 18.8% |

| VARIG | 3032.2 | 132.7 | 4.4% |

| TAM Group | 600 | 65 | 10.8% |

| Transbrasil | 834.4 | 44.9 | 5.4% |

| Lan Chile | 697.7 | 38.3 | 5.5% |

| AVIANCA | 629 | 18.9 | 3.0% |

| ACES | 170.3 | 5.3 | 3.1% |

| Lloyd Aereo Boliviano | 142.9 | 1.3 | 0.9% |