US Airways - juggling planes, unions and US2

January 1998

US Airways' new pilots contract offers only modest up–front cost savings, but the deal has enabled the company to go ahead with various strategies that will reduce costs in the long term. Will the $5bn Airbus order, a low–cost airline venture and transatlantic expansion ensure US Airways' survival in a more competitive East coast environment?

Securing an acceptable agreement with ALPA was a major accomplishment in a climate where airline workers not only balk at the idea of concessions but demand hefty pay rises. Since US Airways' unions could not agree to concessions in 1995, they could hardly be expected to soften their attitude at a time when profits are soaring. The pilots did not budge even in the face of a downsizing strategy introduced by chairman and CEO Stephen Wolf earlier this year.

It was the "carrot" part of Wolf’s negotiating strategy that eventually worked: the promise of a firm order for 124 Airbus aircraft, which had to be confirmed by the end of September, and a commitment to levels of growth for the company. This is the first time ever that a growth clause has been included in an airline labour contract. The management has guaranteed that output (measured in block hours) will grow at either 2% p.a. or at 120% of the average of the four largest majors (i.e. if their growth rate averages 2%, US Airways will have to grow at 2.4%). However, there are a number of let–out clauses allowing, for instance, the growth rate to be curtailed if the economy runs into a recession.

The union forwent pay rises and a much desired seat on the board for a package that also included 11.5m stock options, no–furlough protection, an early retirement incentive plan and the recall of all pilots furloughed since 1991. The early retirement plan covers 325 of the company’s most senior captains and will facilitate a quick upward movement in the seniority list. The two most significant parts of the deal are greater scheduling flexibility and the creation of a low–cost airline division, dubbed "US2". The new venture can account for up to 23% of US Airways' total flying hours, or 25% if the Shuttle is included. Its pilots will be paid at Southwest’s rates and will fly up to 13% more hours than those in mainline operations.

Since the deal was ratified with a 84% majority and Wolf has so far lived up to his promises, the pilots are now expected to cooperate fully with the management.

Relations have been further smoothed by the fact that all the pilots furloughed this year have already been recalled and that the 283 still on furlough (since 1991) will in all probability be recalled by the end of 1998 — well ahead of the 2001 deadline stipulated in the contract.

The Airbus order for is A319s, A320s and A321s and takes care of the US Airways' narrowbody replacement and growth requirements for the foreseeable future. The first 4–6 A319s are due to arrive in late 1998, another 20 or so in 1999 and the rest in 2000–2003. In addition to the firm order, 116 delivery positions are subject to confirmation and 160 aircraft are on option.

New labour agreements still need to be clinched with the other two main unions, AFA and IAM, as well as TWU and the Communications Workers of America (which the airline’s 10,000 reservations clerks and ticket sellers recently voted to join). The expectation has always been that once the ALPA deal was in place, the other contracts would be a mere formality. However, IAM has been angered by the decisions to close three maintenance facilities and outsource the maintenance of the GE engines chosen to power the future Airbus fleet, so securing an acceptable deal may require give–backs from the management.

The potential overall cost savings offered by the pilots' contract and the other union deals will clearly not go anywhere near the $500m annual total sought from the workforce two or three years ago. No estimates are yet available of the overall impact of the ALPA deal, but a spokesman for the pilots' Master Executive Council suggested that the savings from sick leave reduction, greater scheduling flexibility and other productivity measures in mainline operations may add up to $70m-$80m annually. As part of the deal, US Airways' pilot costs (excluding benefits) will decline to the average of the four largest majors, plus 1%, by 2001.

On top of that, there will be the operating benefits of a more modern and streamlined fleet — estimated by Aviation Strategy to be about $70m a year in cash terms to begin with, building eventually to about $250m a year — and the yet to be determined cost savings derived from US2. US Airways has not released any specific cost–cutting targets — it is simply seeking to reduce its unit costs "as close as possible to Southwest's”.

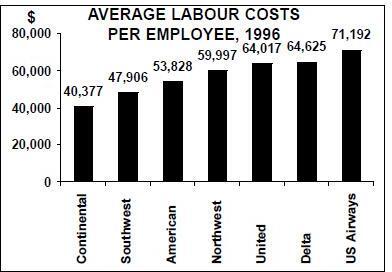

Despite a longer average stage length, US Airway’s unit costs (12.5 cents per ASM) in 1996 were 63% above those of the ultimate benchmark for the industry, Southwest (7.5 cents). Unit labour costs were over twice as high, the result of a 50% difference in salaries and benefits per employee and a 40% difference in productivity.

Because of its location in the Northeast (cold winters, crowded airspace, etc) and because it will remain a full–service airline, US Airways cannot expect to get its cost structure right down to Southwest levels.

One US Airways insider suggested that the unit cost level generally considered appropriate would be around 10 cents per ASM. But even that may be a little unrealistic as the unit costs of carriers like American and Continental, which have longer average stage lengths and less focus on the Northeast, hover around the 9 cent mark. Whatever the exact numbers, US Airways is expected to outperform the industry in terms of unit cost reduction over the next five years. The key question now is: to what extent will it also lose its revenue–premium and under–perform the industry in terms of yield?

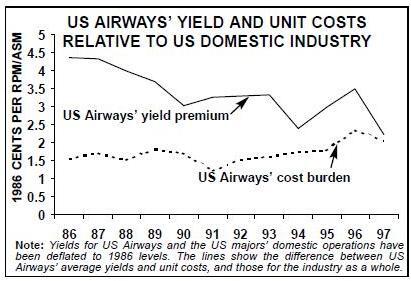

As the graph above illustrates, US Airways' yield premium in real terms has been steadily eroding over the past ten years compared with the US domestic industry. And the airline’s vulnerability to low–cost competition was vividly illustrated when Continental Lite invaded US Airways' territory in 1994 — its yields fell by 15%. A further risk to its yield structure may arise from the establishment of its low–cost subsidiary.

US2: protector of US Airways' franchise Since the early part of November, an employee task force at US Airways has been looking into every aspect of setting up a new low–cost division, including brand identity, style of service, fleet, route network and scheduling. The venture, which the company considers as "the single most important thing US Airways can do to protect and enhance our franchise", will be directly targeted at Southwest and Delta Express and is expected to be launched in early 1998.

The weekly reports of the task force are confidential, but details are beginning to emerge. Not surprisingly, US2 will be a hybrid of Southwest and Delta Express, possibly with elements of United’s Shuttle thrown in. It will operate point–to–point services with a focus on Baltimore–Washington.

The pilots' contract limits US2’s operations to sectors shorter than 1,000 miles, except between Florida and east of the Mississippi (including St. Louis). The venture will not be allowed to serve mainline city pairs except to connect to international flights.

The company has apparently decided to utilise the 737–200, of which there are currently 64 in US Airways' fleet (the pilots' contract permits any aircraft up to the A320’s size). Although US2’s operations are initially limited to 54 aircraft, provisions in the contract appear to allow rapid additions to the fleet once US Airways' mainline growth gathers pace.

Now that US Airways has exercised its option to buy the (New York–Boston- Washington) Shuttle, which it has partly owned and managed since 1992, there is the option of adding the 12–aircraft 727 operation into US2. However, this move is unlikely at present.

One inherent risk faced by a full–service carrier when setting up a low–cost operation is that the new venture may attract substantial volumes of premium–fare traffic from the mainline operation. This problem is particularly relevant for US Airways because it has such a high–yield franchise. For example, what will happen to yields at Columbus (Ohio) if US2 begins serving that city from Baltimore?

Yield deterioration in mainline operations is probably inevitable when setting up a low cost subsidiary. However, Delta’s experience has shown that going point–to–point should enable US Airways to free up slots and capacity for premium–fare traffic at hubs. Also, the initial impact may not be that detrimental because US2 will be employed in markets where yields are already affected by low–cost competition, but the situation is likely to change as competition heats up and US2 expands its operations.

In its efforts to minimise the impact on yields, US Airways will benefit from the hard lessons learned by its competitors. Like Delta, it will take care to separate the identity of its subsidiary from the mainline operation. But, unlike Delta, which earlier cut too deeply in areas affecting service quality, US Airways has no image or quality problems to grapple with. It will continue to spend heavily on customer service in mainline operations, the latest example being the mid- December launch of a new premium "Envoy Class" on transatlantic routes.

All in all, US Airways really has no choice other than to get on the low–cost bandwagon. Although it currently faces competition from Southwest and Delta Express in only 6–10% of its markets, a new wave of low–cost carriers' expansion in East coast markets in 1997 sent US Airways' yield plummeting by 5–6% in the April–June and July–September quarters, after a period of relative stability in 1996.

There is a pressing need to take back Baltimore, where US Airways has contracted as Southwest has built up a major presence. As much as 80% of traffic in markets such as Washington–Cleveland now goes through Baltimore because of the availability of low fares. And, with 20% of its assets engaged in operations to and from Florida, which has become a hotbed of low–cost competition, US Airways needs to secure its position in those markets.

Although not immediately on the cards, Southwest’s interest in serving points such as Islip (Long Island), Allentown (Pennsylvania) and Manchester (New Hampshire) are a cause for concern. Allentown is only a 30–minute drive from US Airways' Philadelphia hub.

Will international expansion help?

US Airways' initial efforts to become a "global competitor" inevitably focus on the transatlantic market, where expansion was announced following the ratification of the pilots' deal. London Gatwick and Amsterdam will be added to the route system in the spring of 1998, to bring the total European destinations to seven, while applications have been filed to serve Philadelphia–Milan and Pittsburgh–Paris.

Much of the expansion focuses on Philadelphia, where the carrier plans to spend $300m over three years to build new international and commuter airline terminals. The facilities will allow for ample future growth and eventually make Philadelphia a larger hub than Pittsburgh.

The new route licences will come in handy in the absence of obvious domestic growth opportunities. However, the scope for growth in the short–to–medium term will be limited by the lack of an appropriate long haul fleet. The 767–200ER is too small — its economics work only in selected high–yield markets — and there are currently only 12 in the fleet.

Talks have begun with both Airbus and Boeing about a possible widebody order, either for the A330 or the 777. But it is not expected in the near future, and the long lead times will mean that the carrier is probably years away from fixing that particular problem.

Going West?

US Airways could do with a strong international airline partner, now that its relationship with BA is firmly history. It can offer a good East coast franchise, but Philadelphia is not New York and that is a major limiting factor. In contrast to the domestic situation, US Airways' international yields are lower than its larger competitors like American and United because traffic mix is poorer. The recent decision to add Canadair Regional Jets to US Airways Express operator Mesa’s fleet from January — a total of 12 will be introduced in 1998 — will help to enhance the breadth of US Airways' domestic network. However, at some stage the carrier will need to tackle effectively the potential problem of having such a geographically limited network.

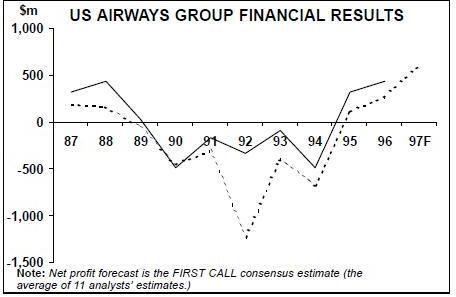

The short–term outlook for the US industry is spectacular, with businesses showing exceptional tolerance for high fares in the premium East coast markets. This should enable US Airways to consolidate profitability — its profit margins have so far lagged a little behind those of the other Majors.

But when the next economic downturn approaches, by which time more of the East coast will have been transformed into low yield markets, US Airways would probably be better off as part of a larger airline system. The carrier would like to create a Midwest hub, but how will it do it? The pilots' contract includes provisions to discuss a hub for US2 in the Midwest. St. Louis would be ideal — in theory something that could be achieved through a merger with TWA but, having recovered from serious financial losses itself, US Airways is not likely to ally with a major whose balance sheet is very weak.

| Current | Orders | Delivery/retirement | |

| fleet | (options) | schedule | |

| 767-200ER | 12 | - | |

| 757-200 | 34 | - | |

| 737-200 | 64 | - | Expected to go to US2 in 1H98 |

| 737-300 | 85 | - | |

| 737-400 | 54 | - | |

| A319/320/321 | - | 124 | 4-6 in 98, 20 in 99, and about |

| (276) | 25 per year in 00-03 | ||

| MD-80 | 31 | - | |

| DC-9-30 | 57 | - | All to be retired by around 00/01 |

| F-100 | 40 | - | |

| TOTAL | 377 | 124 | |

| (276) |