Air France/KLM: a defensive merger

October 2003

The Air France/KLM merger proposal has been interpreted as an innovative move, the start of the long–awaited European flag carrier consolidation process. In reality, the commercial benefits are questionable in the short and medium term, and the deal raises complex competition issues.

Air France has agreed to pay the equivalent of €784m for KLM, through a share exchange mechanism, with the finalisation of the transaction scheduled for next April. The price represents a premium of 40% over the pre–announcement KLM share price, and , more significantly, a premium of 84% over the average KLM share price during the previous six moths.

For KLM management this is the exit they have been seeking for some years. Having decided that that couldn’t get the airline’s costs down sufficiently to make it profitable, their strategy for creating shareholder value has been to find a purchaser who, for whatever reason, is willing to pay a premium over the stock–market valuation. (This recalls the actions of Steven Wolf’s management at US Airways and the Belgian government’s attitude to Sabena, though in both these case a sale was not concluded.)

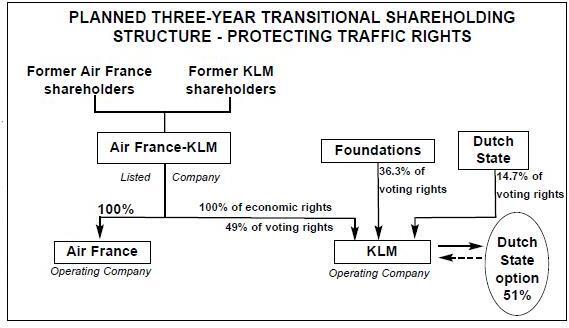

A new company, Air France–KLM, will be created to carry the transaction through, and KLM itself will be quarantined in a special purpose company for at least three and a half years, with the Dutch government given options to re–establish majority control if the ownership of the airline is challenged by bilateral partners. (see chart). By the end of that period it is assumed a US–EC Open Access agreement will be in place, and intra–European nationality restrictions on operating intercontinental service will have gone.

Commercial logic

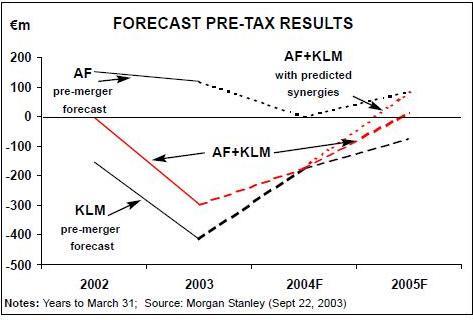

Despite the loose claims for synergistic benefits made by some analysts, Air France is not actually predicting any significant financial benefits in the short term — the opposite in fact. Adding in the identified synergies for the year 2004/05, about €70m, to Morgan Stanley’s financial forecasts for the two carriers, published just before the merger announcement, suggests a pre–tax profit total of €44m for AF/KLM combined. This compares with an original forecast for a €78m profit for Air France alone (and a pretax loss of €104m for KLM).

It is claimed that the main benefits will emerge over the long term, as a consequence of the dominant position the merger will create. Standard statistics nave been trotted out to illustrate that AF/KL will be a leading global force: their combined revenue of €19bn would put them in the number one spot. This is a dangerous assumption.

To take some recent counter examples: the Air Canada/Canadian merger drove Air Canada into bankruptcy even though it apparently created a huge market advantage for Air Canada.

The American/TWA merger produced a detailed and plausible synergistic benefit forecast (see Aviation Strategy, June 2001) but helped push American into (virtual) bankruptcy, despite moving American into the number one market share position in the US. The Swissair–Sabena and Air New Zealand- Ansett cross–border mergers were total disasters despite far fewer political obstacles than AF/KL will face.

There are no synergies between European hubs in terms of purely intra- European traffic. Zurich and Brussels didn’t find any and neither will CDG and Schiphol.

Cost synergies

The projected cost savings come from the usual sources (see table, below) but are remarkably modest. Year 3 (2006/07) synergies are put at €220–260, about 1% of combined operating costs. And can anyone in today’s deregulated market seriously specify a cost saving for the year 2008/09 (Year 5)?The synergy problem with AF/KL is that it the combined network is complementary rather than overlapping and that it is impossible to relocate and rationalise services at one main base in the foreseeable future. Successful mergers — historically, BA/BCal, Air France/UTA, Northwest/Republic, and more recently, easyJet/Go and Ryanair/Buzz — depend on taking out cost at the same time as rapidly consolidating operations and completely subsuming the minor brand.

Air France cannot achieve these cost benefits because it cannot absorb KLM in the short/medium term, and it is unlikely that Air France has much to teach KLM about cost control.

The cost risks, in fact, are significant and unquantified. To take one minor example: IT synergies are estimated at positive €20–70m in the AF/KL plan. Anyone who has been involved in IT harmonisation knows the opposite is likely to be the reality. The intangible cost , which is not quantified, relates to management diversion or confusion. It will be interesting to see how HR works at the combined airline; French morale must have been boosted by headlines proclaiming Air France to be " le leader mondial de l'aviation" and “un géant du ciel” (Le Figaro/LeMonde), while Dutch employees will have to come to terms with the slow death of the famous KLM brand.

Hub consolidation

European industry consolidation is usually represented in terms of the number of flag–carriers. An alternative way is to look at the evolution of hubs.

Four years ago there were four major intercontinental hubs in Europe, accounting in total for 64% of long–haul departures — Heathrow, Frankfurt, CDG and Amsterdam. There were also ten second–level intercontinental hubs — Gatwick, Zurich, Madrid, Milan, Brussels, Copenhagen, Munich, Rome, Vienna and Munich — which accounted for the other 36%.

Since then BA has de–hubbed Gatwick and has refocused Heathrow on point–to–point services, moving away from fifth freedom operations. Swissair’s aim of finding a sustainable role as Europe’s fifth intercontinental hub operator ended with bankruptcy; its successor, SWISS, has been forced to rapidly downsize its long–haul hub operation and will probably have to dismantle it totally if it is to survive. Sabena too has gone, with most of its intercontinental Brussels hub traffic being picked up by Lufthansa and Air France.

SAS and Austrian have reduced marginally their intercontinental flights in the context of their alliances with Lufthansa. Alitalia has retreated from the idea of building up Milan Malpensa as a global hub, instead splitting long–haul services between Milan and Rome.

So there has already been a substantial consolidation of the European intercontinental hub systems with the three immunised alliances — Air France/Delta, Lufthansa/United and KLM/Northwest — competing effectively for transatlantic traffic at CDG, Frankfurt and Amsterdam.

The AF/KL transaction in effect proposes to reduce the number of main competitors in this market from three to two. It is a defensive merger rather than one that attempts to create a more competitive network. A defensive merger usually implies taking capacity out of the market, but in the short/medium term (five years) Air France is very limited in what it can do with the existing Amsterdam operation: the terms of the agreement with KLM and the Dutch authorities require the KLM network stays more or less intact. Moreover, there has to be "fair long term development" of services between the two hubs.

Amsterdam, in the recent industry recession, has been an loss–making hub, whereas CDG has succeeded in generating profits.

The fundamental reason for this difference is that, because of its limited home market, Amsterdam has a much higher proportion of connecting as against local traffic compared to Paris and the other major hubs.

The split between sixth freedom and other traffic for KLM at Amsterdam is about 45/55 compared to 20/80 for Air France at CDG and 27/73 for Lufthansa at Frankfurt.

As a consequence KLM’s average yields are much lower than Air France’s or Lufthansa’s.

So could Air France in the short term accurately identify the markets behind or beyond the Amsterdam and Paris hubs where they are competing between themselves for connecting traffic, then push yields up in these markets? The big risk of Air France imposing its pricing on KLM is that KLM’s discount traffic will shift to other carriers, KLM’s load factors will drop but its cost base will stay the same.

For its investment to make sense in the long term, Air France will want to have the option of combining the two hubs, in the process downsizing and repositioning the weaker hub (Amsterdam). This would take capacity out of the market, and thus reduce pricing pressure. But there is an obvious problem with paying big money for KLM assets, revenue streams and labour obligations and then liquidating some part of them.

Air France would be paying all the money up front, waiting for over five years for uncertain returns, which if they do materialise will be diffused across the entire industry.

Transatlantic gamble

The big commercial upside for Air France in on the Atlantic, but this also raises the gravest anti–competitive concerns, which may scupper the whole deal.

The AF/KL combination implies a four–way transatlantic alliance including Northwest and Delta. This could quickly become a six–way alliance if Continental, which has a US domestic marketing alliance with the other two US carriers, and Alitalia, already in SkyTeam and desperate to firm up its links with Air France, are included.

The six–way alliance would have a 50% share of the North Atlantic market. SkyTeam and Star combined would have about an 85% share of North Atlantic capacity to continental Europe.

The central question for the US authorities is antitrust immunity and joint pricing (if the four or six carriers just want to combine lounges and frequent flyer programmes there would be no problem).

KLM and Northwest and Air France and Delta have immunised alliances that allow them to share information, set joint fares and jointly manage inventories on their North Atlantic routes. But Northwest, Delta and Continental just have a marketing alliance, and it would be highly illegal for them to share seat inventory information or collude on fares.

The logic behind the US Department of Transportation granting antitrust immunity was that overall competition would be improved because of the parallel introduction of open skies bilaterals and that the alliance partners had relatively small market shares (KLM and Northwest had about 4% each of the market when their ground–breaking alliance was sanctioned). A 50% market share is a very different matter, especially when it implies that two or three US Majors would be involved in collusive fare setting.

This could result in US moves to strip antitrust immunity from both KL/NW and DL/AF.

The situation probably returns BA to the moral high ground in transatlantic bilateral affairs. It can now do a lot to undermine AF/KL by resurrecting its claims for an immunised alliance with American.

As for the EC, it has evolved an industry view which conflates flag–carrier consolidation with its North Atlantic Open Access proposal.

AF/KL will force it to re–consider whether greater consolidation really does mean greater competition.

| Total annual synergies (€m EBIT) |

|||

|---|---|---|---|

| Main actions | Year 3 | Year 5 | |

| Sales/Distribution | Coordination of sales structures | 40 | 100 |

| Sales cost improvements | |||

| Handling and catering | |||

| Network | Network/scheduling optimisation | 95-130 | 130-195 |

| Revenue Management | Revenue management harmonisation | ||

| Fleet | Optimisation of fleet utilisation | ||

| Coordinated management | |||

| Cargo | Network optimisation | 35 | 35 |

| Commercial alignments | |||

| Support services | |||

| Maintenance | Procurement | 25 | 60-65 |

| Insourcing | |||

| Pooling (stocks, etc.) | |||

| IT Systems | Progressive convergence of IT systems | 20 | 50-70 |

| Other | Procurement synergies | 5-10 | 10-30 |

| TOTAL* | 220-260 | 385-495 | |

| Source: Air France and KLM. Note: *= Before remedies which may be requested by the EC | |||

| KLM | NW | KL/NW | AF | DL | AF/DL | TOTAL | ||

| AMS-JFK* | 13 | 13 | CDG-JFK | 28 | 14 | 42 | 55 | |

| AMS-DTW | 28 | 28 | 28 | |||||

| CDG-ATL | 14 | 14 | 28 | 28 | ||||

| AMS-BOS | 7 | 7 | CDG-BOS | 14 | 14 | 21 | ||

| AMS-IAD | 7 | 7 | CDG-IAD | 14 | 14 | 21 | ||

| AMS-MSP | 14 | 14 | 14 | |||||

| AMS-SFO | 7 | 7 | CDG-SFO | 7 | 7 | 14 | ||

| AMS-LAX | 7 | 7 | CDG-LAX | 7 | 7 | 14 | ||

| AMS-CHI | 7 | 7 | CDG-CHI | 7 | 7 | 14 | ||

| AMS-MIA | 7 | 7 | CDG-MIA | 7 | 7 | 14 | ||

| Note: * = plus 7 DL flights weekly Source: OAG | ||||||||

| As of March 31, 2003 - in €m | Air France (1) | KLM (1) | Air France-KLM (2) |

|---|---|---|---|

| Gross debt | 4,147 | 3,805 | 7,952 |

| Cash and near cash | 1,232 | 919 | 2,137* |

| Net debt | 2,915 | 2,886 | 5,815 |

| Shareholders’ equity | 3,994 | 1,476 | 4,778 |

| Gearing | 72% | 195% | 121% |

| EBITDAR/Net financial changes | 7.9x | 3.6x | 6.2x |

| * Including transaction impact of €14m Notes: (1) figures in local GAAPs; (2) Air France-KLM: aggregate numbers which may be subject to adjustment upon preparation of pro-forma financial statements |

|||