Operational problems bug America West recovery

October 1998

After 18 months of strong profit recovery, America West is again struggling with operational reliability problems that look likely to result in flat earnings for the third quarter of 1998. A hefty fine for maintenance violations, FAA–imposed revisions to work practices, lagging staff morale and tough labour negotiations are the latest challenges facing the second smallest US Major, which has otherwise kept its unit costs low and positioned itself well to capture higher–yield traffic. How quickly can America West pull out of its present crisis?

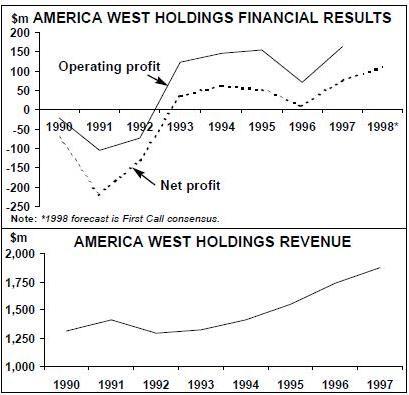

Unlike its partner Continental and other airlines, America West met with immediate financial success after its Chapter 11 reorganisation. It emerged from a three–year spell in Chapter 11 in August 1994 with six consecutive profitable quarters under its belt, a slightly reduced scale of operation, low unit costs and one of the strongest balance sheets in the industry. It was one of only two US Majors to report a profit for 1993. Its operating profits of $146m and $156m in 1994 and 1995 respectively gave it the highest profit margins (about 10%) among the full–service Majors.

But earnings dipped sharply in 1996, in part because of a $65m special charge (related to an earlier A320 order) but also due to a decline in yield and operational problems experienced in the third quarter. The latter meant record cancellations and poor on–time performance, as a result of which the airline ranked near the bottom of consumer surveys in 1996. The situation was not helped by the resumption of rapid growth and a late–1995 decision to outsource heavy maintenance,which angered the unions.

In late 1996 and 1997 various programmes were initiated to improve operational performance, customer service and staff morale. These included task forces to tackle specific areas, focus groups with high–profile customers, employee incentive programmes, hiring extra staff in maintenance and key customer service areas, developing a more efficient reservations system, and improving in–flight food service.

These efforts paid off. America West climbed to top position in “least mishandled baggage” in the DoT’s domestic service quality rankings for 1997 and significantly improved its on–time performance.

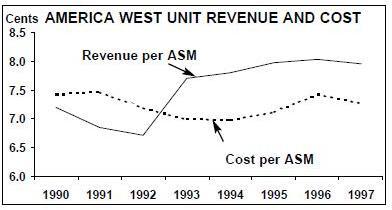

America West has succeeded in consistently maintaining its unit costs at around the 7 to 7.5 cent mark. But its yields and unit revenues have lagged well behind those of competitors. The resumption of profit growth in 1997 and the excellent profit margins achieved in the first six months of 1998 were possible only because of significant improvements on the revenue side.

The company posted record operating and net earnings for 1997: $162m and $75m respectively. The second quarter net profit of $41.4m was the best quarterly result in its 15–year history. In the first six months of this year, operating income rose by 50% to $126.1m and net profit by 80% to $66.6m.

Much of this was attributed to a “re–engineered revenue management strategy”, which meant cutting back on fare sales and shifting focus to business travellers by improving schedules, boosting frequencies and adding flights to key business centres. However, America West has also benefited from the general stabilisation of the West coast competitive environment.

These factors led to a 11.5% surge in yield in the March 1998 quarter, while traffic and load factor fell by 8.7% and 6.6 points respectively. The yield rose by another 5.3% in the June quarter (or 7% if adjusted for an increase in the average stage length).

So it very much looked liked America West had come of age. The first–half results represented 12.4% and 6.5% operating and net profit mar–gins respectively — no longer out of line with those reported by the larger Majors. The first quarter yield of 12.2 cents per RPM was similar to competitors’. With further revenue benefits in sight (at least $20m annually from new technology), the company appears to have positioned itself well for further yield and profit improvement.

Like its larger competitors, America West has used profits to strengthen its balance sheet and enhance shareholder value. Long–term debt fell from $468m at the end of 1994 to $227m at the end of June 1998. The company had an adequate $230m in cash on June 30. It has repurchased some $125m of its equity since early 1996, and a new buy–back programme was authorised in August 1998.

But the celebrations about the yield recovery and the prestigious customer service award turned out to be short–lived, as America West again began experiencing operational problems in the summer. In July America West came last in the DoT’s on–time performance rankings and it had the second highest number of customer complaints.

In early September 1998 the company warned analysts that its third–quarter earnings would fall short of the previous estimate of 61 cents per share due to “unsatisfactory operational performance”. This prompted a 29% fall in its share price, which has now more than halved since April–May (well exceeding the general sharp decline in US airline stocks).

America West is now expected to merely match last year’s third–quarter earnings of 40 cents per share. Solving the problems must be an urgent priority to prevent the loss of hard fought–for business travellers. The First Call consensus estimate is that full–year 1998 profits will be up from last year’s $1.63 to $2.29 per share (about $110m).

Why the operational problems?

The airline blames many of the problems on the lengthy FAA investigation, which resulted in the agency imposing a record $5m fine in July for maintenance and operating violations (half of the amount will be waived subject to compliance). The violations included operating 17 A320s that were overdue for major structural inspections, although airworthiness or safety were apparently not compromised. America West says that the efforts to implement new practices and make sure that correct procedures were followed led to many flight delays.

The management also cited bad weather and “protracted and difficult negotiations” with the Teamsters’ union, which represents the airline’s 450 mechanics, as reasons for the operational problems. The union says that there never was an organised work slowdown, but rallies were held against job outsourcing. Relations with both the mechanics and flight attendants have been turbulent and the contract talks with both unions have been under federal mediation.

The unions, in turn, have blamed the management for excessive cost–cutting, too frequent operations staff changes and bad management generally. The leadership, led by chairman William Franke, who steered the company through Chapter 11, and president/CEO Richard Goodmanson, has accepted responsibility for the concerns raised by the FAA and other matters, as they have also come under some criticism from analysts.

America West’s labour problems and poor morale date back to the Chapter 11 filing in 1991, when workers saw their shareholding wiped out. Franke’s confrontational leadership style then led to unionisation efforts, though workers have given him credit for bringing in new management talent. The decision to outsource heavy maintenance led to a bitter dispute with the mechanics, who elected to be represented by the Teamsters in April 1996.

Ongoing projects such as upgrading computer systems and improving training may improve morale and help restore operational reliability, but the only real solution is to secure contracts with the unions. As a major breakthrough development, management and the Teamsters reached tentative agreement on their first–ever contract on September 20.

Fleet plans

The Chapter 11 restructuring, which included the elimination of 747s and Dash–8s, gave America West a fleet that was basically well–matched to its needs but needed some fine–tuning. The only major change so far has been the addition of A320s with more powerful engines, to supplement the earlier leased A320–200s that incur payload/range penalties when operated from the Phoenix hub in high temperatures.

The current 106–strong fleet includes 13 757- 200s, 29 A320s, 46 737–300s and 18 older–generation 737s. The first A319 is due to join the fleet this month (October) and two more are scheduled to arrive by year–end.

In September 1997 America West finally announced the restructuring and expansion of its earlier Airbus order, making a firm commitment to purchase 22 A319–100s and 12 A320–200s, valued at $1.4bn. The new arrangements secured lower prices and financing assistance. Deliveries began earlier this year and will continue through 2000.

The new deal provides much flexibility, enabling the carrier to either maintain a relatively stable size or grow if opportunities materialise. Another 12 A320s are subject to reconfirmation. There are options on 40 aircraft of the A320 family, for delivery in 2001–2005, and certain rights to convert firmly ordered A319s and A320s to the larger A321.

Route expansion strategy

In the autumn of 1995 America West embarked on a “two–year flexible growth strategy” to rebuild its Phoenix and Las Vegas hubs, which had shrunk since the Chapter 11 filing in 1991. The plan was to increase ASMs by 29% and total departures by 17% by adding service to eight new cities and introducing twice as many non stops from Phoenix as its closest competitor.

Consequently, in 1996 America West was one of the fastest–growing major airlines, adding eight aircraft to its fleet and recording an 11.3% increase in ASMs. But the combination of a sharp hike in aircraft leasing costs and operational reliability problems prompted the carrier to scale back its plans. Yet its capacity still rose by 9% in 1997.

Over the past year, America West has focused on trying to increase its local hub market share and the proportion of high–yield business traffic. It has also spent much time developing better schedules. Its previous strategy of operating low frequencies meant that it lacked dominance in any market. The new emphasis is on frequency, better times and key cities.

There has been a major focus on boosting service from Phoenix and Las Vegas to the East coast business centres of Boston, Washington (Dulles), Baltimore, Philadelphia and Newark. The summer schedule included seven daily flights to New York from Phoenix and three to most of the other cities. Services to the Pacific Northwest, California and Florida from the two main hubs have also been expanded. The Las Vegas night flights operation has been restructured to improve arrival times.

The mini–hub at Columbus (Ohio) has been strengthened with new services to Florida. The fourth quarter will see substantial expansion at Columbus, from 29 to 37 daily flights, and more convenient schedules on numerous business–oriented routes.

The acquisition of five new slots at Chicago O’Hare and additional A320 deliveries will enable the airline to boost its Phoenix–Chicago frequencies in October (from the present three to six daily flights by January 1999).

America West’s long–standing regional partner Mesa Airlines will also feature in the expansion plans. The deal came briefly under threat in March 1998, after Mesa defaulted on the contract by failing to reach a completion factor of 97%, but a new six–year agreement on expanded co–operation was signed in July.

Mesa currently operates as America West Express out of Phoenix to 17 cities in Arizona, New Mexico, Iowa, Colorado and California. The new agreement will expand co–operation to additional points in those states, northern Mexico and the Las Vegas and Columbus hubs.

Most of the routes will be served by Mesa’s 50–seat CRJs and 37–seat Dash–8s, replacing many of the 19–seat Beech 1900s that have in the past been the mainstay of the America West Express fleet. The new agreement stipulates growth in the size of the CRJ and Dash–8 fleets to 12 and 14 respectively by the end of 1999, with options for further growth in 2000–2001. The longer ranges of those types will allow expansion to new markets “throughout the US and northern Mexico”.

Position vis-à-vis alliances

America West’s strategic alliances with Continental and Mesa, as well as its code–share agreement with Northwest, were all put in place by the Chapter 11 reorganisation process. Continental and Mesa were investors in AmWest Partners, which provided the $214.9m cash investment in 1994.

The code–share arrangement with Continental, which began in October 1994 and has been expanded in stages, is the largest of its kind ever implemented in the US. The two have also consolidated ground handling and customer service functions at a large number of airports.

The actual revenue benefits derived from the Continental alliance are believed to be fairly modest — probably well below the $40m annually to America West envisaged initially. But the longstanding links with Continental and Northwest must have effectively secured America West’s long term strategic position in a future domestic marketplace possibly dominated by a few megaalliances.

As an indication of things to come, America West was one of the four US airline signatories in a marketing and code–share agreement forged with Air China in May 1998 (the others were Continental, Northwest and Alaska). America West’s role will be to provide connecting service between its Phoenix and Las Vegas hubs and the West coast. A similar (but independent) agreement with Taiwan’s EVA was signed in April.

America West and British Airways have code–shared and had FFP links since July 1997, when BA began serving Phoenix from London. The initial co–operation was so successful that late last year the agreement was expanded to include America West’s Las Vegas and Columbus hubs (linking them to BA’s services to Los Angeles, San Francisco and Philadelphia).

Labour challenges

America West was fortunate in securing a five–year contract with its pilots in May 1995 that included an immediate 16% pay rise but also significant productivity improvements. But ratification had to wait for agreement on the issue of computerised pilot scheduling, which was finally reached in August 1998.

Dispatchers, represented by TWU, ratified a five–year contract in April this year that included pay increases, productivity improvements and flexible work rules. And over the past year, two labour groups — fleet–service workers and stock clerks — have actually rejected bids by TWU and the Teamsters to organise them.

But securing initial contracts with the mechanics (Teamsters) and flight attendants (AFA) has proved challenging. A breakthrough with the Teamsters came on September 20, when the two sides reached tentative agreement on a five–year contract. The deal is believed to include an immediate 14.4% wage increase, an additional rise of up to 34% over five years and, significantly, the recall of 375 mechanics laid off three years ago. As a major policy reversal — no doubt influenced by the re–emergence of operational problems — the company seems to have agreed to bring some heavy maintenance work back in–house.

The biggest remaining challenge is to sign with the 2000–plus flight attendants, who late last year overwhelmingly rejected a tentative five–year contract agreed to by the union’s board. The two sides are believed to be far apart, but being the last remaining labour group without a contract puts some pressure on the flight attendants.

| Current Fleet | Order options | Delivery/retirement schedule/notes | |

| 757-200 | 13 | 0 | |

| 737-100 | 1 | 0 | |

| 737-200 | 17 | 0 | |

| 737-300 | 46 | 0 | |

| A319 | 0 | 22 | 3 in 1998, rest in 1999-2000 |

| A320 | 29 | 21*(40) | 2 in 1998, rest in 1999-2000. |

| Options are for A320 family | |||

| TOTAL | 106 | 43 (40) |