Asian airlines: the SARS rebound

November 2003

Asian airlines' traffic rebound from the SARS crisis shows just how resilient air travel demand can be (as we predicted in Aviation Strategy, May 2003).

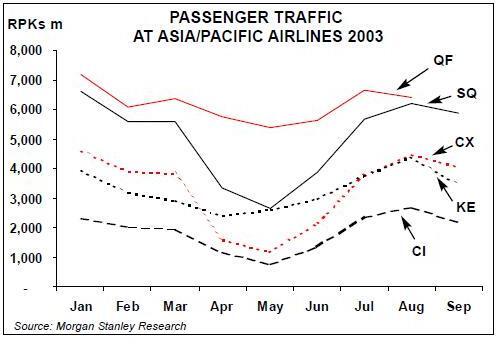

In April, when SARS became widespread in Asia, combined passenger traffic at the region’s major airlines (Singapore, Cathay, Qantas, China Southern, China Eastern, Dragonair, China Airlines, EVA, Korean and Asiana), was down 35% on a year–on–year basis, while at the height of the outbreak in May, year–on–year traffic was a staggering 48% down.

Since then, however, recovery had been surprisingly rapid. In June, combined traffic at these 10 airlines was down 18% year–on–year, but in July traffic was just 8% down, in August it was level and in September traffic was 4% up on September 2002 (although Qantas has yet to report its September traffic statistics).

And it’s almost the same story with IATA statistics, which cover all airlines in the Asia/Pacific region; passenger traffic was 51% down in May but just 1.6% down in September on a year–on–year basis.

SARS also had an effect on airlines outside the Asia/Pacific region, with long–haul routes into the affected areas being the worst hit. In May, global traffic fell by 21% according to IATA. However, by September, global passenger traffic increased by 1% year–on–year, the first rise in the seven months since the SARS and Iraq crises began. Naturally, there are exceptions to the global recovery from SARS. In early November, Northwest — which generates at least 20% of its revenue from the Asia/Pacific region — said it was still suffering from an adverse SARS effect, although not as bad as in the key April–June quarter.

Not all Asia/Pacific traffic was devastated by SARS. Long–haul travel out of the Asia/Pacific region actually grew during June, although admittedly this was because Asian travellers were "escaping" to SARS–free areas. More importantly, other than China, the largest Asian domestic markets remained strong throughout the crisis, including Indonesia, Malaysia and India.

Once the epidemic was declared over by the World Health Organisation, it appears that tourists and business travellers to and within the region were prepared to travel again by air almost immediately, although credit should go to Asia’s governments and airlines, which were quick to advertise the fact that air travel was now perfectly safe (a contrast to the actions of the US authorities, who took over two years after September 11).

The better–than–expected recovery from the SARS events has encouraged IATA to revise downwards by $1.6bn its estimate of global airline losses due to the crisis and Iraq this year (the forecast loss from the combined events is now $4.9bn).

Of course these aggregated traffic statistics hide the effects on individual airlines, with those based in China being the most severely hit. In May, China Southern saw its passenger traffic collapse by 84% year–on–year, with China Eastern down by 82%. Yet, by September, China Southern’s traffic was up by 18% year–on–year and China Eastern’s by 22%.

With the crisis now over (although, according to the WHO, the virus could still exist in animals and be re–transmitted to humans), the main question to be answered is how much has SARS cost the airlines? Though most airlines hacked back capacity and cut costs as best they could, the losses mounted up for the two or three months until the substantial passenger recovery kicked in. And even though passenger numbers may now be back to normal, many of them were lured back by cheap flights, with a subsequent negative effect on yields.

For the effect on China Southern and China Eastern, see Aviation Strategy October 2003, while other airlines are covered below:

Singapore Airline Group

The SARS crisis forced Singapore Airline Group (SIA) into the red for the first time ever in a quarterly reporting period, with a S$377m (€189m) operating loss in April–June 2003, compared with a S$244m profit in the same quarter of 2002 — a serious S$621m difference. However, in its second fiscal quarter (July–September) SIArecorded a S$315m operating profit, compared with a $265m profit in 2Q 2002. The SARS effect meant that half–year results were negative.

For April–September, SIA’s operating loss was S$63m, compared with a S$510m profit in 2Q 2002, and the group declared it would not be paying an interim dividend this year.

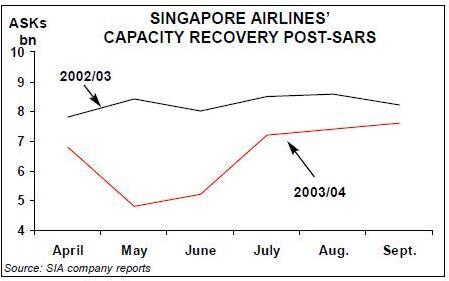

If the non–airline businesses are stripped out of SIA’s results, the effect of SARS is marginally less bad. The airline operation racked up a S$443m operating loss in the first quarter and a S$175m operating profit in the second quarter, resulting in a S$268m loss for the half–year — as compared with an airline operating profit of S$256m in April–September 2002. So SARS cost the airline at least S$524m (€262m) in operating profits during the half year. By the end of September 2003 SIA’s capacity was around 90% of pre–SARS levels, and September passenger traffic was still some 6% down on September 2002. Overall, airline revenue fell 10% in the quarter.

SIA’s financial recovery was based on substantial cost cutting in June and July. This included the axing of more than 400 jobs, equivalent to 1.5% of the workforce — the first time in 20 years that such a move had been made. In addition, management implemented a pay cut of up to 11% on ground staff and up to 16.5% on cockpit crew, and made employees take unpaid leave.

Altogether, airline costs fell by 13% in July- September 2003 compared with 2Q 2002. Now that the worst is over, SIA has started to add new routes — a service to Bangalore was launched in August and routes to Shenzen and Los Angeles will start in January and February 2004 respectively.

Cathay Pacific

Cathay was badly hit by SARS — what it called "the greatest commercial challenge in the company’s history". In April, the group issued its first ever profit warning, and indeed for the first half of 2003 Cathay reported an operating loss of HK$760m (€85m), compared with a profit of HK$1.8bn in January–June 2002. This was based on a 21% reduction in revenue to HK$12.3bn in the six–month period.

Cathay’s immediate response to "a devastating impact on our passenger business" was to cut capacity by 45%, parking 22 aircraft. Most staff took one month’s unpaid leave.

This effort reduced operating expenses by HK$640m over January–June 2003 — around 5% of the cost base, but was way behind the collapse in revenues.

Fortunately for Cathay, passenger recovery began in June, once the WHO lifted the travel advisory against Hong Kong, and traffic sprinted back to pre–SARS levels by August.

Cathay’s renewed confidence is such that it is launching services to Beijing in December after a 10–year absence, following the resolution of a long–running battle on traffic rights with subsidiary Dragonair, now controlled by mainland Chinese interests.

Qantas

SARS forced Qantas Airways to issue two profit warnings, the first in March and the second in May, and implement three rounds of cost cutting.

In March, management announced 2,500 staff would take leave in the next three months, and in April 1,000 employees were made redundant, another 400 went through natural wastage and 300 full–time staff were converted to part–time.

The final round of SARS–related cost cutting was announced in May and included capex reductions on aircraft investments (through retirements and deferrals), changes to working practices and increased use of part–time rather than full–time staff.

The cost–cutting wasn’t enough to overcome the effects of SARS however, and in Qantas’s latest financial year, July 2002 to June 2003 — which covers the worst of the crisis — operating profit fell by 17% to A$567m (€351m). Revenue in the Japan region fell by 19% (equivalent to €86m) and in South East & North East Asia by 33% (€144m) in 2002/03, and much can be attributed to the effects of SARS. On some Asian routes, traffic fell by as much as 45% during the crisis, the airline states. However, revenue increases in other areas (most notably in the domestic market) meant that overall turnover at Qantas grew by 1.5% in 2002/03.

Korean

Korean Air saw passenger traffic slump 40% from January to April as the crisis hit many of its routes. However, appreciation in the Korean Won helped the airline lessen the impact of SARS, and it posted a KRW14bn (€10m) operating profit for January–June 2003, compared with a KRW191bn operating profit in 1H 2002. At the net level, Korean posted a KRW285bn (€210m) loss for the first half of 2003, compared with a KRW486bn net profit in January–June 2002.

Nevertheless, Korean expects to record a net profit for the full year 2003, and in September its passenger RPKs were up 4.4% on a year–on–year basis. In late October, Korean appeared sufficiently confident about the future to convert a previous MoU for A380s into a firm order for five of the aircraft, to be delivered over 2007–09.

China Airlines

Taiwan–based China Airlines was severely affected by SARS, with passenger load factor plunging to less than 40% at the height of the crisis. Unsurprisingly, passenger revenue during the first six months of 2003 fell by 31%, helping it to a TW$905m (€23m) net loss in the period.

This compares with a TW$1.3bn (€33m) net profit for January–June 2002. The loss would have been worse if not for cost–cutting measures that knocked 7.2% off operational costs in the half–year, as well as a strong performance from the airline’s cargo operations.

China Airlines saw passenger traffic rebound back sharply in the second half of 2003, with passenger load factor rising to 75% in July and 86% in August, five percentage points better than August 2002.

The strength of the recovery was revealed in third quarter results released on October 31, when the airline posted a net profit of TW$1.3bn (€33m), wiping out the first–half losses and ensuring that the full year will be profitable. Average passenger load factor for July–September was 78.9% — 3.2 percentage points better than 3Q 2002. The airline also reported that average yields had returned to pre–SARS levels.

China Airlines is now pressing ahead with network expansion plans, with new routes to Hanoi, Honolulu and Brisbane already added, and in June the airline finally implemented a code–share deal with Delta, nearly a year after agreeing the deal in principle.

Other airlines

Elsewhere, pick any other Asia/Pacific airline and the cost of SARS is now painfully apparent.

Thai Airways estimates the crisis to have cost around Bht 10bn (€218m) in revenue, while at Garuda, net profits for the first half of 2003 were IDR 32.8bn (€3.4m) — some € 8.6m less than it had forecasted pre–SARS. Philippine Airlines recorded net losses of more than Pesos 900m (€14m) in April–July, most of which were down to the SARS effect, with Andrew Huang, PAL senior VP for finance, saying in late August that "the after–effects of SARS are far worse than that of September 11" and that "the time needed to recover is longer."

The total financial losses arising from SARS cannot yet be estimated, given that some airlines are still not quite back to pre–SARS traffic levels, but it’s likely to be the wrong side of €1bn.