Boeing recovers - but are its problems over yet?

May 1999

The ninefold increase in its first quarter 1999 results is one sign that Boeing is not taking its reverses of the past two years lying down.

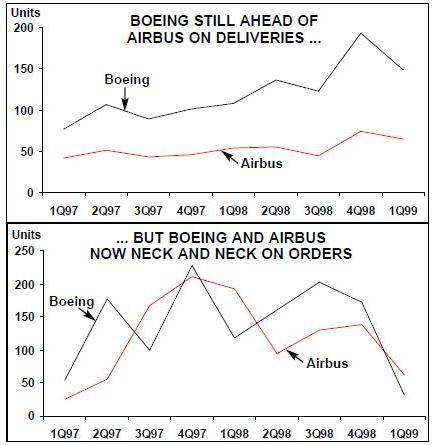

Analysts are now beginning to think that the current year’s earnings might end up at the top end of the $1.5bn-$2bn bracket, despite warnings by the company last December that they would fall as much as 25% short of the earlier $2bn forecast. The latest view from the company reporting its first quarter results in mid–April was that this year’s net earnings should still fall in the $1.6bn- $1.8bn range. The first quarter of this year saw deliveries rise to 148 from 108 in 1Q 1998 (also see pages 8–9). This helped operating margins rise from 0.3% to 3.9% and produced net earnings of $469m, compared with $50m a year earlier. Sales of commercial aircraft rose from $8.1bn to $9.8bn in the quarter.

Boeing is now undertaking an aggressive management rethink, starting with improving the financial data about every product and project and testing their actual and potential returns to see if they should be fixed, sold or closed down. A feisty new CFO, Deborah Hopkins, has been hired to go around preaching the message of bottom–line responsibility to Boeing managers, who had been more concerned with programmes than profits.

Already the commercial helicopter business has been sold; the company has decided to move into aircraft servicing; the MD- 11 is being phased out and the MD–95 — now known as the 717 — is being scrutinised to see if it has any real chance of making a profit long–term.

Below this corporate level shake–up, responsibilities have been more clearly defined inside the troubled Boeing Commercial Airplane Group. New boss Alan Mulally has formed his division into three departments — widebody, narrowbody and spares and service — each run by a manager responsible not for the number of aircraft he or she sells or produces but for making a profit. The target is to get operating margins on civil jets up from below 1% last year to 8% within a few years.

Wall Street has responded to Boeing’s changes and to the first quarter earnings by marking up its shares from just over $30 earlier in the year to $40 a share, but they are still well off the $60 peak of July 1997, when it acquired McDonnell Douglas. In January chairman Phil Condit bluntly warned 280 managers at a special retreat that Boeing was vulnerable to a takeover since its market capitalisation was less than its net asset value. If the share price can keep climbing through $50, that threat is totally empty. Anyway, just about the only company with the muscle and the motive to move in on Boeing is General Electric, and it has denied any such intentions. Even so, investors who put $100 into Boeing shares in 1993 would be sitting on only $163 today, compared with $221 if they had bought into the whole aerospace sector and $294 if they had tracked the S&P index. (Continued on page 2)

The real point of Mr Condit’s remarks to his top managers was to highlight the need to fix Boeing quickly, before someone else came in and did it for them. Certainly, the recent history of Boeing is likely to spawn business school case studies for three reasons:

- How does a dominant company in a high–ticket market hold on to its position against a government–sponsored rival?

- How does a supplier to a regulated, uncompetitive industry adapt to that market’s liberalisation?

- How was it that Boeing ran up such unprecedented losses at the peak of the biggest boom in civil aircraft? The answer is that Boeing got caught in a tangle of all these forces, and lacked the management rigour to see what its problem was and then wrest itself free. Since October 1997 Boeing has been apparently hit by one problem after another. In fact, these problems had been around for some time, but only surfaced when the company had to admit to problems doubling production to meet a boom in orders.

Ever since he took over as chief executive of Boeing three years ago, Condit had understood that life was going to become more difficult. The establishment he inherited had historically manufactured three out of every four aircraft in the skies and was still delivering two out of three, despite the incursions of Airbus Industrie that was challenging Boeing by landing nearly half the orders, from a civil jet market that was reviving faster than either manufacturer thought possible.

But there was a more fundamental shift in the market going on, masked by the arrival of Airbus. Airlines competing in deregulated markets increasingly demanded their versions of each Boeing be tweaked to suit their needs. Boeing obliged, leading to an infinite variety of expensive design modifications.

At the same time, Boeing had recently decided to challenge Airbus’s emergence in the narrowbody market by re–vamping its 737 range, rather than launch a wholly new aircraft. All this was going on while the world’s airlines were facing increasing competition and commercial pressures as more and more governments sought to push state–owned flag–carriers into the private sector. This meant that the price of aircraft became sensitive, especially when there were two rival suppliers for all but 747s. Since 1989 the price of a 100–120–seater jet has not risen at all, and discounts of up to 50% are common on many bigger models.

Into this market maelstrom came Ron Woodard, head of Boeing Commercial Airplane Group, a super–salesman rather than a systematic manager. He was determined to hold off Airbus by offering discounts of up to 50% to stem Airbus’s incursion into the market. The European group fought back with its own discounts; it kept on winning market share and Boeing’s strategy soon failed.

What made it an even more dramatic failure was that Boeing had assumed that it could hack 25% out of production costs from a programme started in 1993 to improve the way it designed and manufactured civil aircraft. Basically, because it has a newer production system and a modular assembly technique that flows from its partnership structure, Airbus landed on its feet with a leaner manufacturing set–up. Last year Boeing had 216 workers for every jet it made, while the Airbus system (i.e. including partners’ sub–contract factories) had only 143. Boeing also had 450 computer systems that barely talked to each other.

As it ramped up production in 1997, the number of aircraft with unfinished jobs on them grew so large the lines had to be stopped to catch up. By the time Boeing emerged from all this and from costs associated with its acquisition of McDonnell Douglas, it had had to make provisions of more than $4bn and reported its first loss. Woodard was fired last October.

Data salvation

Boeing Commercial Airplane Group’s failure was not just one of marketing strategy in narrowbodies, but incoherence on the shop–floor. Boeing bosses from Condit down knew they had to become more efficient and scores of managers were sent to Japan to learn about lean manufacturing from Toyota Motor Corporation which more or less invented it.

But all this learning and benchmarking fell foul of the collision between the rise in production volumes, the low pricing strategy and the lack of information on what it costs to make an aircraft. Again, Boeing’s top bosses knew they needed a new way to design and manufacture aircraft: they even had an acronym for the magic system that would deliver them from all their evils: it is called DCAC–MRM. Now, after a delay caused by the production chaos, the system is coming in. The DCAC stands for Define and Control Airplane Configuration.

This means that Boeing is trying to keep the number of changes for individual customers down to a minimum, hoping also that the emergence of alliances will lead to some standardisation. DCAC will result in four computer systems working together, replacing a mish–mash of 450 old systems. The hope is that information will be clearer, and engineers and managers will have a better view of the financial impact of any changes.

The other half of the DCAC–MRM acronym stands for Manufacturing Resource Management. This is a fancy version of the sort of “enterprise computing” systems that are sweeping through most global industries, such as motor manufacturing. The basic idea is that all separate information flows in the company can be related to each other, so that inter–connections between, for instance, order intake, delivery rates, stock levels, assembly–line productivity, cash flows and so on can all be tracked.

Woodard famously said at the last Paris Air Show two years ago that this system would “bury Airbus”. In fact, its botched introduction nearly buried Boeing instead. When things got to their worst in late 1997, Boeing sensibly suspended the system’s implementation while it concentrated on more immediate tasks. Armed with better information systems, Boeing is hoping that, in addition to lower working capital and better shop–floor productivity, it may be able to shorten the development time for new products and derivatives of existing planes.

Another objective is to modernise its relationships with suppliers. Part of the previous problem was that suppliers were reluctant to suddenly increase production when Boeing wanted to raise its output, because they had seen Boeing cut off their orders overnight in the downturn of the early 1990s. Now Boeing is anxious to increase the amount of work that it outsources in a way which might provide more stable, long–term contracts for suppliers, while still insulating the company from the worst ups and downs of the demand cycle.

Managing the downturn

This year Boeing will seek to deliver 620 civil aircraft, about 70 more than last year. This will bring revenues (counting military sales as well) of around $58bn. But for the year 2000, the outlook is for civil deliveries of only 480, reflecting partly the slowing down of the market, and partly the advances Airbus has made in recent years towards grabbing half of all sales. But as total aircraft deliveries subside from the 940 registered last year to around 600–700, Boeing is going to have to shrink its manufacturing capacity dramatically.

Already more than 50,000 jobs will have gone by the end of this year as extra labour hired to cope with the ramp–up of production is laid off. Many of the 50,000 are white–collar jobs being eliminated partly by the increasing computerisation but also because Boeing sees the need to become leaner and less bureaucratic.

Boeing’s difficulty is not only that it has to sort out its internal difficulties just as the aircraft order cycle begins its downturn, but that it also has to do so at a time when its whole product strategy is under stress. Boeing’s strategy has been to preserve its monopoly at the top end of the market, keeping the 747 going for as long as it could. At the lower end, similarly, it has sought to milk the 737 single–aisle “cash cow” for as long as it could in the face of real competition from the more modern Airbus A320 family, which starts with the advantage of a wider fuselage, electronic controls and a more modern design.

With hindsight the decision to replace the 737 with a major derivative rather than an all–new aircraft might be seen as a mistake, leaving Boeing perhaps with a need to develop a radical new single–aisle aircraft before very long, if it wants to draw ahead of Airbus in this segment.

But Boeing also faces problems at the top end of its range, as the old 747 comes close to the end of its working life. The 777 has still to win launch orders for its long range stretched versions, the 777–200X and the larger 300X, although John Roundhill, head of product strategy and development, hopes to win launch orders next year for delivery in 2003 — about the same time the stretches of Airbus’s A340 (already ordered) come off the production line.

Boeing now thinks it has found a convincing way of prolonging the life of the 747, with a new wing and electronic fly–by–wire technology. This aircraft would aim to scupper the Airbus plans to launch an A3XX, a 550–seater that would attack Boeing’s 30- year–old monopoly in aircraft carrying more than 400 passengers. But an earlier version of a 747 stretch project failed to impress airlines because it did not offer a big enough step forward in operational economics. Boeing is convinced the latest one passes that test. More ambitiously, Boeing has an alternative draft plan for an ultra–wide, single deck aircraft capable of carrying 450–550 passengers, which has been designed to have lower operating costs than the Airbus A3XX. Passengers would sit 12–abreast, and the aircraft would have sleeper berths above and below the main cabin deck. To minimise development costs, it would use parts from the 747 and the 777.

The real problem at Boeing is that it is having to put all these things right at once. It got into trouble because a series of internal weaknesses and bad decisions coincided with a boom in the market that put its system under stress. Now it is having to repair these shortcomings and generate better margins to convince investors it can develop new products — just as the market is turning down.