US airlines: Optimism about 2010 profits

June 2010

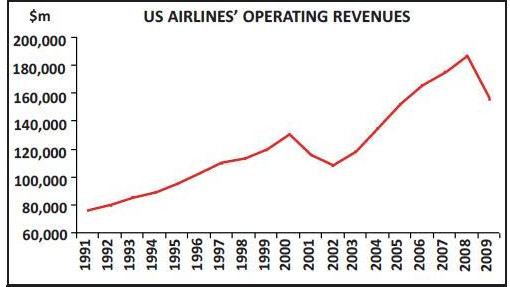

As the US airline industry heads into the peak summer travel season, all the indicators point to the sector returning to solid profitability in 2010. What are the key trends facilitating financial recovery? This year will also see some international growth as the US legacies and their global partners seek to strengthen their presence in high–growth markets. Where do the expansion efforts focus?

As of early June, all the key trends are positive for US airlines. Except for a dip in April due to the volcanic ash–related closures of European airspace, air travel demand has been rebounding steadily. Business travellers are returning. Capacity remains extremely tight. As a result, load factors are at record levels and the industry is regaining some pricing power.

The latest revenue trends are encouraging. Continental’s consolidated RASM surged by 23–24% in May, far exceeding expectations. US Airways, which reported 19% RASM growth for the month, described the revenue environment as “robust, with continued strength in close–in bookings and overall yields”.

The airlines are also benefiting from lower fuel prices. The past month’s jitters about the global economy have resulted in crude oil prices falling from over $80 per barrel to the $70–75 range.

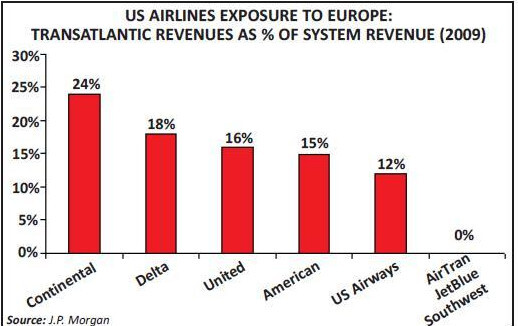

US legacies may not suffer any ill–effects from the sovereign–debt crisis in Europe because of their relatively limited exposure to the transatlantic market (12–24% of system revenue) and predominance of the US point of sale (75%). A recent report from JP Morgan noted that the “increased affordability of Europe may actually cause total demand for US legacies to rise, while the opposite may occur to their European peers”. Of course, should the crisis seriously hurt European banks and hence transatlantic travel by the financial services sector, the impact would likely be felt by US operators.

US airlines continue to benefit from incremental revenue streams. New bag and other fees and à $1 activities are boosting industry revenues by an estimated $4–5bn this year.

On the domestic front, the biggest positive is that LCCs are maintaining capacity discipline. Southwest has stopped growing for the first time in its history.

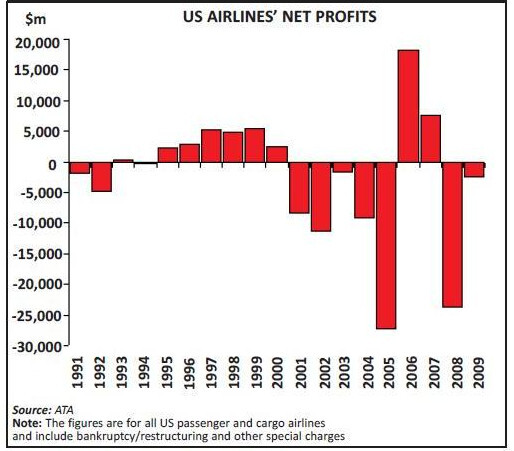

Back to profitability

And, as an unexpected bonus, more industry consolidation is under way in the form of a proposed United–Continental merger, which can only help keep a lid on industry capacity in the longer term. As a result of all those positives, US airlines are poised for what JP Morgan analysts call a “multi–year profit run”. In recent months the consensus estimate has been an industry operating profit of around $9bn in 2010 and $10–11bn in 2011, but those figures are likely to go up in the coming weeks as the forecasts are revised for the lower fuel prices.

On May 25 JP Morgan raised its 2011 industry operating profit forecast to an all–time record $13.4bn, reflecting $5.5bn in annualised savings from lower fuel prices and slightly softer revenue (2011 GDP growth falling from 3% to 2%). The analysts noted that improvement in 2010 was not as material, because the changes affect largely the second half of the year and near–term fuel hedges diminish some of the benefit.

As of early June, all of the US carriers except American were expected to be profitable in 2010. American is mainly suffering the consequences of avoiding Chapter 11 in the last decade (high labour costs).

With no significant aircraft deliveries scheduled in the near–term, US airlines could generate significant free cash flow in the next couple of years. This would enable them to modestly pay down debt, facilitating a gradual improvement in credit ratings (these processes are already under way).

As a result of last autumn’s significant liquidity- raising (see Aviation Strategy October 2009), US legacies’ cash reserves are at an all–time high, with unrestricted liquidity in some cases even exceeding 25% of annual revenues.

Manageable fuel prices

Of course, there are tough longer–term challenges, including significant labour cost pressures now that virtually all of the past decade’s concessionary contracts are open. US airlines will need more than a couple of profitable years to repair their balance sheets. They are a long way from earning acceptable returns on capital. In mid–to–late April, when the price of crude oil was approaching the mid–80s, it looked like fuel prices could impede airline recovery. But fears about Europe’s fiscal woes and the global economy sent the price of crude tumbling by 20% during May, to the $70–level (as of early June). This is significantly below the mid–2008 peaks though much higher than the low points in early 2009.

Perhaps the biggest positive is that there is now an even greater sense than before that oil prices have reached relative stability. Insofar as it affects oil prices, the European fiscal crisis will not be solved anytime soon. Crude oil seems certain to stay in the below-$100 range, which US airlines regard as manageable these days.

A recent communiqué from IATA suggested that oil prices are unlikely to break out of the $80–100 per–barrel range, because ample inventories would outweigh any resurgence in economic optimism.

Demand and revenue recovery

US airlines also currently benefit from reasonable fuel hedge positions. Their hedges cover 25–50% of their 2010 fuel needs and lesser portions of their 2011 needs, providing protection at oil prices somewhat above current levels. A notable exception is US Airways, which has no hedges in place. While US economic signals continue to be mixed – or basically suggest a long, slow road to recovery – there is little doubt that US airlines’ traffic, yields and unit revenues are recovering strongly from the extremely depressed 2009 levels. In recent months demand has been picking up across the board, including business and international traffic.

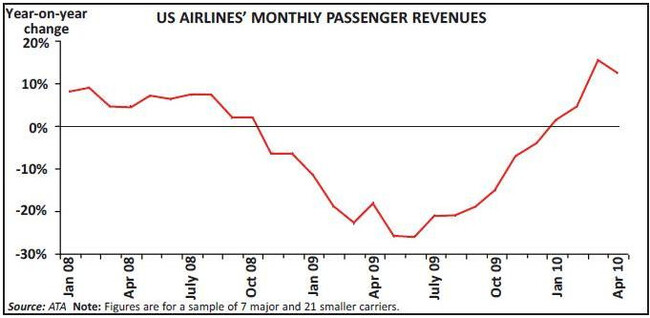

US airlines’ monthly passenger revenues turned positive in January, after 14 months of decline, as the average fare per mile inched up by 0.6% — the first increase since November 2008. Since then the trends have improved sharply. In March passenger revenues were up by 15.4% and ticket prices by 11.7%. April passenger revenues (up 12.5%) were negatively impacted by the volcanic ash–related cancellations, but international passenger revenues still rose by 15%, helped by a 37% surge in transpacific markets.

This year’s monthly revenue and RASM figures have benefited from progressively easier year–on–year comparisons, but a recent analysis by S&P, which compared the latest data to the average for the same month of the previous three years, found that the RASM upturn is real.

The spectacular 18–24% RASM surges reported by several carriers for May reflected not just easy comparisons but recovery of business traffic, higher than expected fares and surcharges introduced for peak travel days.

New revenue streams

In their first–quarter earnings calls, the US carriers reported surges in corporate contract revenues as high as 30–50% in March and April. But the levels were still well below 2008’s. With many companies clearly remaining nervous about spending in light of economic uncertainty, there is a long way to go to full recovery to pre–recession levels (if it ever happens). In the spring and summer of 2008 the US legacies moved en masse to increase existing ticketing, change and excess–baggage fees, create new revenue streams by charging for a la carte service such as checked bags and introduce new travel enhancement products such as cabin upgrades. These activities have only limited associated costs, are not particularly sensitive to the economy (rather, they are correlated to load factors) and are turning out to be a lucrative revenue source.

At United, ancillary revenues added up to more than $14 per passenger in the March quarter and more than offset a reduction in third–party maintenance work. At JetBlue, ancillary revenues were $18 per passenger, compared to an average fare of $142.

Continental, the last US legacy to serve free meals in economy class on longer domestic flights, is now falling in line with the rest of the industry: the airline will start charging for meals on many North American and some Latin American routes this autumn. The move is expected to save $35m annually, assuming that the food sales simply break even.

In March Continental also began offering economy class passengers the option to purchase roomier exit–row seats for a fee. This is not a branded product like United’s EconomyPlus but merely a quick way to generate extra revenues.

Most of the US airlines are working to offer additional unbundled products and services in the future. JetBlue, in particular, has promising prospects in this area because of the unique opportunities offered by its new Sabre plat–form when it is fully developed.

Southwest is benefiting enormously from the premium–type products introduced since late 2007. In the March quarter, its “other” revenues were up by 40% to $105m, which included a $21m contribution from the new “Business Select” product. As the largest domestic carrier, Southwest is uniquely well positioned to develop ancillary revenues and capitalise on southwest.com. The airline is working on enhancements to its FFP, web site and revenue management systems.

However, Southwest is sticking to what it calls a “no hidden fees” policy (meaning no fees on items that were previously included in the ticket price) and believes that it is gaining market share with its “Bags Fly Free” campaign. It is a lone holdout in the US in that respect. To reinforce the message this summer, 50 Southwest aircraft have been painted with the slogan “Free Bags Fly Here” on their fuselage, with an arrow pointing to the cargo bin.

Continued capacity discipline

At the opposite extreme, Spirit Airlines, which earned 21% of its total revenues from extra fees last year, has become the first US airline to decide to start charging for carry–on luggage. The privately held Florida–based LCC will charge up to $45 for a carry–on bag that is placed in the overhead bin from August. This move will be closely watched by the rest of the industry for any customer backlash, but some politicians feel that Spirit has crossed a line. The latest fees have prompted new legislative moves to protect customers, close tax loopholes and suchlike. The massive domestic capacity cuts in 2008 and 2009 helped the US airline industry through the mid–2008 oil price surge and the 2009 recession and are now fuelling a strong recovery. The cuts have been all the more beneficial because the airlines succeeded in removing many of the associated costs – easier because the fleets included large numbers of older, fully–depreciated aircraft. In some instances, whole domestic fleet types were retired.

According to ATA, US carriers’ scheduled domestic ASMs fell by 10.4% between 2007 and 2009, reaching a level that was below 1999’s. It was the result of a sharp 14.5% contraction by the five largest network carriers and the main LCCs essentially keeping their capacity flat (Southwest’s declined by 1.6%, JetBlue’s and AirTran’s was up by 2–3%). In the same two–year period, US carriers’ international ASMs were roughly unchanged (up 4.5% in 2008 and down 4.8% in 2009).

Capacity growth is expected to remain extremely constrained this year and in 2011, which bodes well for the pricing environment and financial recovery. In 2010 domestic ASMs are likely to be flattish and international ASMs will see growth in the low–to–mid single digits.

However, 2010 will have two very different halves: industry capacity was still down in the first six months but begins to return in the second half of the year. According to a late–May ATA report, in the September quarter US airlines’ ASMs per week will be up by 3.4% domestically and almost 6% internationally.

American’s CEO Gerard Arpey made the point recently that US airlines are currently in a “wait and see” mode, trying to ascertain what the new level of demand is. American expects its mainline capacity to inch up by only 1% this year, including a slight domestic reduction and 3% growth internationally. Virtually all of the international growth will be made up of flying that was either cancelled due to H1N1 or deferred for economic reasons (Chicago- Beijing) last year.

American’s fleet renewal programme is picking up speed; there are as many as 45 737- 800s arriving this year. But the aircraft are for MD–80 replacement and will not add to capacity. The main impact will be the financial pain of having to fund $2.1bn capex this year.

Delta expects to fly essentially the same amount of capacity in 2010 as last year, even though it is reducing its fleet by 71 aircraft in an effort to rationalise following the merger with Northwest. The idea is to maintain last year’s ASM level through increased utilisation. The airline has 15 deliveries scheduled for this year (including two 777LRs and 11 used MD–90s) and is retiring 36 mainline aircraft (DC–9s and 757s) and 50 regional aircraft.

The 787 orders inherited from Northwest are expected to be deferred or cancelled. While continuing to negotiate the matter with Boeing, Delta has extended the leases of its 747–400s by typically five years (having secured significant lease rate reductions) and is going through the process of installing flatbeds and new seating to those aircraft. The management commented recently that with 180 transocean aircraft and a fairly young average fleet age of 8–10 years, the airline is in good shape from the fleet perspective.

Despite having downsized more than the other legacies since 2007 (ASMs down 17.5%), United remains firmly committed to capacity discipline. Its mainline ASMs are expected to be flattish in 2010 (anywhere from a 1.1% reduction to 2.1% growth).

While United has very limited fixed obligations in the next few years, the airline recently finalised agreements for 25 787s and 25 A350XWBs (plus 50 purchase rights for each type), which will start arriving in 2016 to replace 747s and 767s. In late April, despite the impending merger announcement, United also said that it was still on track to finalise a narrowbody order by year–end, justifying it on a replacement basis and because it offered significant opportunity to down–gauge.

Continental, which in the past always grew a little faster than the other legacies, has finally fallen in line. After recently again trimming its 2010 ASM forecast, the airline now expects its domestic mainline ASMs to fall by 0.5–1.5% and international ASMs to increase by 2–3%. While 757–300 and 737NG deliveries continue, Continental is due to start receiving its 25 ordered 787s in August 2011.

US Airways is projecting 1% ASM growth in 2010, comprised of a 1–2% domestic reduction and 8–9% growth internationally. The airline has a much smaller international exposure than the other network carriers and therefore justifies the higher growth rate. However, some of this year’s growth is restoration of Mexico service that was cancelled due to H1N1. Having received two A320s and two A330s in the first quarter, US Airways has no further aircraft deliveries scheduled until the third quarter of 2011. With the continued removal of older 737s and 757s, the airline’s mainline fleet will actually contract by ten aircraft this year.

Most importantly, the main US LCCs have indicated that they will continue to keep capacity in check. They are more interested in margins than market share these days.

Having contracted by over 5% last year, Southwest is keeping its ASMs “roughly flat” in 2010, though there will be growth in the second- half following capacity declines in the early part of the year. The intention is to continue the same philosophy in 2011. CEO Gary Kelly noted recently that the company has not met its return on capital targets in a decade and is therefore going to “err on the side of caution”. “Until we are comfortable that we are getting our profit targets, it makes no sense to grow the fleet.”

However, Southwest will still be adding new destinations; it will simply cull or reduce service in less effective markets to keep overall capacity flat – a strategy that really helped revenue generation last year.

JetBlue has been criticised by some analysts for accelerating its ASM growth to 6–8% this year. But it will be opportunistic expansion in two targeted areas: Boston and the Caribbean; the rest of the network will still be flat.

Bolstering global presence

AirTran has indicated that as long as macroeconomic conditions remain uncertain, its growth plans remain “conservative”. In the first half of the year, ASMs were up by around 5%. There will be no aircraft deliveries until March 2011, and with only seven scheduled for 2011, next year’s ASM growth could be only 3–4%. US carriers’ international activities in 2010 have two broad themes: opportunistic expansion and, increasingly, preparing for or taking advantage of alliance relationships.

First, there are the special new high–growth markets such as China. After many delays, American finally launched a Chicago–Beijing service in late May, to complement its Shanghai flights that began in 2006 and to bolster Chicago’s role as the airline’s main gateway to Asia.

Delta, in turn, began Seattle–Beijing operations in early June, as part of its efforts to strengthen Seattle as its main West Coast gateway to Asia (with the help of code–share partner Alaska). Delta’s other new Asia service launches this summer have included Seattle–Osaka, Detroit–Seoul and Detroit–Hong Kong.

Then there are the special opportunities such as the opening of Tokyo’s Haneda Airport to more international flights when a fourth runway opens there in October 2010. In May the DOT tentatively awarded the four daily slot pairs that will be available to US airlines at Haneda this year, subject to the signing of the US–Japan open skies treaty. Delta was selected to serve Haneda from Detroit and Los Angeles, American from JFK and Hawaiian from Honolulu.

This was an important gain for Delta after it failed to win JAL as a partner earlier this year. But it also boosts Delta’s already strong position as the largest US carrier to Asia. The DOT apparently especially liked its plans to fly 747s, which offer more seats and hence competition than the 777s and 767s proposed by the other airlines. United and Continental got left out, meaning that they will not be able to link to their partner ANA’s extensive services at Haneda in the near term, but there will be more Haneda opportunities in future years.

The robust Latin America markets continue to be a major focus for US carriers. American began a New York–San Jose (Costa Rica) service in April. Delta plans Detroit–Sao Paulo flights from October and is looking to implement code–sharing with Gol. Much of US Airways’ international growth this year is due to a 20% increase in Latin American flying — mainly restoration of Mexico service and new service to Brazil. After launching Charlotte–Rio in December, US Airways hopes to gain access to Sao Paulo through a slot swap with Delta and plans to begin code–sharing with the newest Star partner TAM.

The under–served but promising African markets have caught the attention of at least two US legacies. Delta, which has served Africa since late 2006, has just launched Atlanta- Accra flights and hopes to extend that service Monrovia in September. United has introduced Washington–Accra flights this month.

The North Atlantic market, which was hit hard in 2009, is also seeing some new US carrier activity this year. United added Chicago- Rome flights in May, after launching a rather creative Dulles–Madrid service with partner Aer Lingus in the first quarter (taking advantage of the EU–US open skies treaty). US Airways began Charlotte–Rome flights in May with A330–300s. After joining Star late last year, Continental has been busy building connectivity with its new alliance partners, among other things, by launching Newark–Munich flights and boosting Newark–Heathrow frequencies. Delta has announced plans to add flights between New York and the key European business markets from September.

Looking further ahead, Continental recently became the first airline in the world to specify a route to be operated by the 787: Houston- Auckland from November 2011 (subject to government approvals).

In addition, there has been much strategic positioning at home aimed at bolstering key hubs and international gateways. Examples include American’s “corner–post” strategy and new interline/ticketing partnership with JetBlue in New York and Boston (see April issue of Aviation Strategy), United’s efforts to strengthen service at its Chicago and Los Angeles hubs, Delta’s New York revamp/strengthening and new code–share deal with WestJet, and the proposed Delta/US Airways slot/route rights swap.

In the coming months, some of the US legacies hope to be able to get busy implementing planned international JVs. American and BA are expecting final approvals from the DOT and EU on their planned transatlantic ATI and JV in mid–summer, while decisions on the American/JAL and United/Continental/ANA deals on the Pacific are expected in late 2010.