US airlines focus on liquidity

October 2009

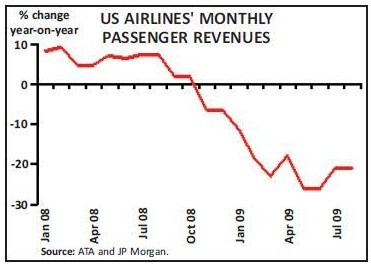

In recent weeks US airlines have raised at least $8.4bn in new liquidity and financings, even though the legacy sector continues to post losses, economic recovery seems tentative at best and there is no tangible evidence of any recovery in business travel. Why the success in fund–raising and what are the implications?

September was a month that had been anticipated with great trepidation in the US. After Labor Day, which marks the end of the peak summer travel season that is characterised by strong leisure demand, airlines rely heavily on business traffic. But business travel had collapsed earlier this year due to the global recession. Would it be back after Labor Day? If not, the airlines would be in trouble.

Capital markets reopen

Since most economic forecasts anticipated a painfully slow recovery, back in July there was much pessimism about airlines’ prospects this winter. There were fears that United, and possibly American and US Airways, could have serious liquidity issues and even end up in bankruptcy. Labor Day passed, with no tangible evidence of recovery in business travel. But, to everyone’s surprise, in mid–September the bank and capital markets suddenly swung open to airlines. The markets were liquid and bankers and strategic partners were keen to do deals. The airlines jumped at the opportunity, with American and Delta leading the way.

The massive capital–raising spree that followed was unique not just because of the volume raised but because of the enormous variety of the transactions. “Equity, converts, refinancings, EETCs, mileage forward sales … you name it, it probably occurred in September”, quipped one Wall Street analyst.

AMR raised $4.2bn in additional cash and financings in the second half of September through multiple transactions, including a public stock offering, a public convertible debt offering, a private bond offering, a new secured loan, sale–leaseback commitments and an advance sale of frequent–flyer miles.

Delta completed $2.1bn of financings on September 28th that included a two–tranche private bond offering, a revolving credit facility and a term loan. The transactions refinanced Northwest’s bankruptcy exit facility and other near–term debt maturities and bolstered liquidity by $600m.

UAL followed at the end of the month with public stock and convertible note offerings that raised $424m in net proceeds. After that the airline launched a $659m public EETC offering that primarily refinanced its outstanding 2001 EETC debt but also raised a little extra to boost cash reserves. US Airways successfully completed a public share offering in late September that raised $137m in net proceeds. Low–cost carrier AirTran raised around $173m from public share and convertible note offerings that were due to close on October 14. The airline also refinanced its $90m revolver and up–sized it to $125m.

And Southwest found it an opportune time to negotiate a replacement for its currently unused $600m revolving credit facility that was set to expire in August 2010 (the new facility is available for three years).

JP Morgan analysts estimated in an October 9th report that US airlines had raised $3.9bn in “incremental liquidity”(excluding refinancings) since mid- September, against a roughly $15bn equity capitalisation of the participating carriers.

Standard & Poor’s suggested in its October 9th industry credit outlook report that the capital markets became much more receptive to airlines because of a combination of “more hopeful economic news, somewhat improved prospects for airlines and a strong overall corporate debt market”.

Early September saw some tentative positive economic indicators. In mid–September Federal Reserve chief Ben Bernanke noted that technically the recession was “very likely over”, though he did warn of ongoing pain in the labour market.

There was also a perception that airlines were, as one analyst put it, “in the process of turning a financial corner”. US Airways reported seeing more close–in bookings, which is a possible sign of increased business travel. Several legacy carriers issued improved third–quarter earnings guidance in mid–September.

American was able to raise such a significant amount of new funding because it relied partly on its long–time strategic business partners, GE and Citibank. The post–2001 era has seen many similar instances of symbiotic relationships at work, often involving GE. But this was the conglomerate’s largest aviation finance deal in a decade. It involved American obtaining from GECAS a new $280m secured loan and $1.6bn of sale–leaseback financing commitments for previously ordered 737s; in return, American selected GE engines for its future 787–9 order. GE said that while the deals were complementary, each had to stand by itself.

The deal with Citibank was an advance sale of frequent–flyer miles, which gave AMR $1bn cash while Citibank secured an extension of the co–branded credit card programme. It had been in the works for a long time, resulting in American becoming the last of the US legacy carriers to raise cash through that method. The delay probably had much to do with Citibank’s earlier precarious financial situation.

Cash boost

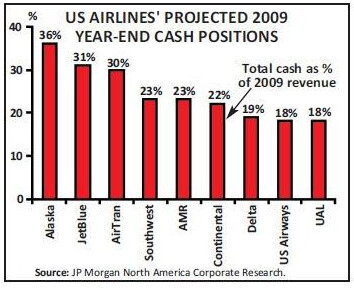

US airlines needed the additional liquidity because losses since mid–2008 and heavy debt payments had eroded their cash balances. Many of the carriers have substantial near term debt and capital lease obligations. The industry is now entering the weaker winter season and economic recovery may be slow. The past month’s transactions have dramatically improved cash positions. In JP Morgan’s estimates, at year–end 2009 each US airline will now have total cash reserves accounting for at least 18% of annual revenues. Unrestricted cash positions should be in the healthy 15–20% range. The consensus is that, barring unforeseen fuel or demand shocks, there will not be any bankruptcies this winter.

Some of the balance sheets have been modestly strengthened by the secondary share issuances (AMR, UAL, US Airways and AirTran), which may help those carriers improve their credit ratings. The downside, of course, has been dilution to shareholders, but averting bankruptcy risk was clearly more important.

As to whether the US legacies are in a position to start investing in foreign carriers, the answer is: probably yes, if they have to. American and Delta were earlier in separate alliance talks with JAL, which could require the winner to make an investment of reportedly several hundred million dollars; the talks have been postponed as JAL focuses on restructuring. The US carriers would undoubtedly prefer not to have to invest, but they will do what it takes to retain and improve access to that important market.

BofA Merrill Lynch is forecasting an aggregate net loss of $550m for the eight largest US carriers in the third quarter, down from an $825m net loss a year ago. Operating result is expected to be positive to the tune of $475m, up from $50m a year ago. All of the large carriers except Continental will be posting losses (including Southwest). Continental is expected to break even, while the smaller LCCs will be profitable.

For the full year 2009, all of the network carriers are likely to post losses, Southwest will hover around break–even and the smaller carriers will be profitable.

As of October 9th, consensus estimates for 2010 still anticipated losses for AMR, UAL and US Airways. However, estimates are likely to start inching upward as the third–quarter reports (in the second–half of October) may include evidence of business travel finally picking up. BofA Merrill Lynch’s newly revised estimates expect all of the US carriers to be profitable in 2010.

The key question is when business travel will return. Some analysts believe that there is already evidence of a modest upturn, particularly domestically. But many remain convinced that international business travel will not start recovering until the year–end or in early 2010.

US carriers will continue to benefit from domestic capacity discipline. The past year’s sharp cuts have brought domestic industry capacity back to levels not seen since the late 1990s. BofA Merrill Lynch analysts suggested that economic recovery was not likely to result in meaningful capacity additions given other forces at play, including permanently higher energy costs, higher capital costs, higher environmental costs and higher regulatory costs.

Many people feel that the ability to raise capital so easily has been a mixed blessing for US airlines. The latest JP Morgan report noted: “Meaningful upheaval seems to have been averted again, with the industry apparently no closer to generating what we consider to be acceptable returns on capital”. By upheaval, the analysts were referring to structural changes such as bankruptcies, liquidations, consolidation and sizeable capacity cuts.

But some of that may well come in the next round – when the airlines need more liquidity but have fewer traditional options available. Many of them are running out of unencumbered assets and will have to become ever–more creative.