Nordic noir aviation: Wow, Icelandair

and Norwegian

Jan/Feb 2019

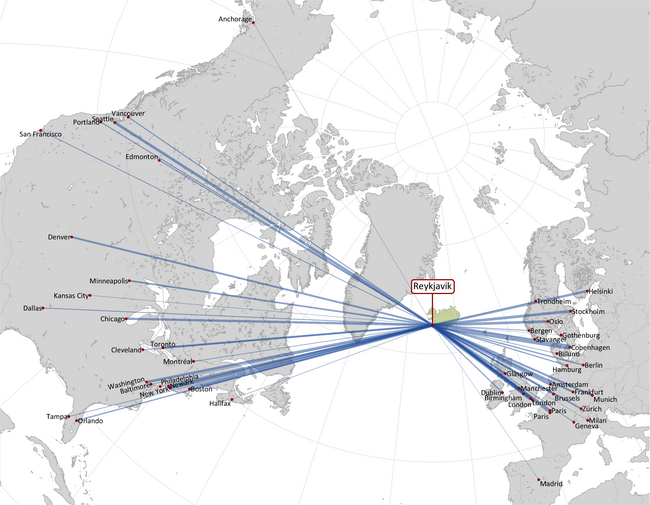

Icelandair was one of the most important factors in Iceland’s remarkable recovery from the financial crisis, in which its banking sector played a disproportionately large and dangerously speculative role. Icelandair developed a 24-hour hub operation at Keflavik Airport (KEF), introducing a new competitive element to the oligopolised Atlantic market. The national carrier enjoyed a period of rapid growth and good profitability during 2014-16.

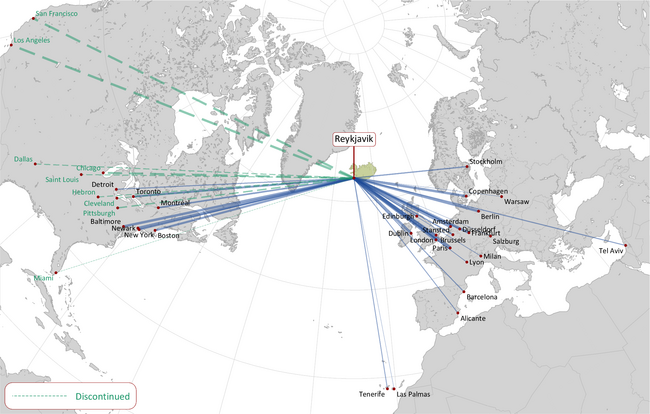

But in 2015 Wow appeared on the hubbing scene, operating new A320/321s with a pure LCC product concept and with an almost identical connecting strategy to Icelandair (its waves typically scheduled an hour after Icelandair’s), owned and headed by the dynamic, triathlon-running, telecom entrepreneur Skúli Mogensen. Wow presented itself as no-frills and trendy, targeting European and American Millennials, and “providing lower prices than anyone else flying across the Atlantic”. Icelandair, flying 757s and 767s, is more traditional, offering some frills and better seats, appealing to a wide demographic, particularly older, richer vacationers, with moderately priced tickets.

Traffic flows over KEF are very seasonal with a pronounced summer peak, and it is clear that the airport and ATC are struggling to cope with the two hub systems. For example, Icelandair’s ontime performance fluctuates around the 80% during the low season but in the high season it collapses — in July and August last year it was 55% and 64%, in June a remarkable 39%. Icelandair estimates that IRROPS (irregular operations) cost $45m in 2018, or 80% of its total operating loss.

Conventional aviation wisdom states that two near-identical hub systems, in KEF’s case funnelling traffic between Europe and America, cannot work at the same airport for logistical and economic reasons (one exception might be United and American at Chicago, but O’Hare is a domestic mega-airport). Icelanders, it must be said, appear to delight in challenging conventional wisdom — the country, population 334,000, accumulated nearly $200bn in foreign debt during its financing boom in the mid-2000s, but that ended in a spectacular bust and a bailout from the IMF.

According to its own analysis, 78% of Wow’s capacity overlaps with Icelandair’s. Back in 2017 (August edition), we posed the question: Can Icelandair live with Wow?

Wow’s financials were opaque then, but it seemed that it must have a substantial cost advantage over Icelandair, which would normally prove decisive. In fact, Wow’s operating unit cost (CASK), as revealed in the bond prospectus issued last summer, was about US¢4.3, less than half of Icelandair’s US¢8.8. But low operating costs were not enough; Wow’s unit revenue, including ancillaries, (RASK) was about US¢4.6, against US¢9.3 at Icelandair.

While Wow grew exponentially, Icelandair also continued to grow albeit at a more modest rate. Both carriers suffered the financial consequences of over-expansion, turning Icelandair from a profitable to a loss-making company and pushing Wow to the edge of bankruptcy.

The table summarises the traffic trends by segment. The two carriers’ combined passenger volumes more than doubled from 2015 to 2018 to 7.4m pax. Their combined connecting traffic (the “Via” segment) almost trebled to 3.9m pax. For comparison, Norwegian the low-cost long-haul pioneer, with its 787 point-to-point operation, carried an estimated 4.6m pax on the Atlantic in 2018. Aer Lingus, the lowest cost Legacy, carried around 2.6m.

The Wow factor

Icelandair’s unaudited financials for the year 2018 show the Wow factor. Although revenues increased by 7% to $1.5bn, a loss of $57m were recorded at EBIT level (a profit of $50m in 2017). The pre-tax loss was $68m compared to a profit of $38m the previous year.

It has been protected by a reasonably solid balance sheet. Shareholders’ equity at the end of 2018 was $471m against total liabilities of $992m. Cash was a comfortable $300m (thanks to aircraft refinancing, see below).

Wow’s financials for the first nine months of 2018 were much worse. Total revenue grew by 35% to $501m, but a marginal operating profit in 2017 turned into a loss of $19m. From the data presented in the bond prospectus it looks as if Wow will have accumulated $50m loss at the EBIT level for 2015 through 2018. At the net level, Wow’s loss for the nine months was $34m against a $13m loss the previous year,

Its balance sheet is very weak: at the end of September shareholders’ equity of $27m against total liabilities of $393m. Cash was $41m, rescued from practically zero by a bond issued in September 2018.

Wow raised €60m through this bond issue, which officially was supposed to help prepare the airline for an IPO in 2020. But the interest rate attached to the 3-year bonds — in effect 9% pa, plus options to convert to shares — indicated investors’ increasing concerns about the carrier, concerns which were underestimated.

That funding proved to be inadequate, and Wow, under pressure from lessors and other creditors, was obliged to seek a merger with, or rather a takeover by, Icelandair. In early November Icelandair came to agreement to buy out Wow at a price equivalent to 2-6% of Icelandair’s stock value (currently $330m in total, having fallen over 50% over the past 12 months). The transaction, however, was contingent on various conditions relating to the satisfactory completion of due diligence. These conditions, for unclear reasons, were not met, though the suspicion was that the due diligence uncovered further financial problems, and Icelandair abandoned its offer at the end of November.

Almost immediately Indigo Partners — the private equity airline specialist company headed by Bill Franke (see Aviation Strategy, February 2018) — stepped in with an offer to invest in Wow and turn it around. However, the offer is provisional, and the sums involved are yet to be determined. Wow itself states:

“Should the investment be completed as planned, the actual investment amount will depend on the capital needs of the business through the turn-around of Wow. Indigo Partners intends to … adequately capitalize Wow through the turn-around as they have done before with other successful aviation investments they have made. Indigo Partners has repeatedly demonstrated that they are long-term and patient investors, for example with their investments in Wizz (14 years), Volaris (8 years) and Frontier Airlines (5 years).

“When concluded, the investment will primarily be in the form of a convertible loan with a 10-year maturity, whereby annual interest will be, at Indigo Partners’ election, payable in kind or in cash on an annual basis. The principal and all accrued interest will be payable at the loan’s maturity. The initial shareholding of Indigo Partners will be 49%.“

Indigo’s rationale for investing in Wow is not as clear as at its other airlines — Wizz Air, Frontier, Volaris (Mexico and Costa Rica) and new Chilean start-up JetSMART — which are short-haul, point to-point ULCCs, modelled to differing degrees on Ryanair.

Wow presents a new set of challenges. It would be Indigo’s first venture into low-cost long-haul and its first into a designed connecting hub operation, which because of its complexity and peakiness is more labour-intensive than a typical LCC. For example, by mid-2018 Wow’s workforce had soared to 1,400 (from 290 in 2015) — 70 personnel per aircraft whereas a Ryanair-type target ratio would be in the low 30s.

More fundamentally, to succeed and expand Wow would have to be able to win in another battle against Icelandair, to become the dominant or sole hubbing airline in Iceland.

However, Wow’s stated strategy is now the opposite of expansion: in December it announced a fleet restructuring whereby it will almost halve its fleet from 20 units to 11, all A321s, with the three A330s and the other A320 Family aircraft being returned to lessors. Staff numbers are being cut by 40% to around 1,000.

By contrast, Icelandair has confirmed that it will take six new 737 MAXs scheduled for delivery this year and another five in 2020. It aims again to increase capacity (ASKs) by 10% this year, mostly through increasing schedules to/from Europe while leaving American capacity at current levels, the idea being to rectify an imbalance in seats offered to/from the two continents. The precise target for 2019 passengers is 4.66m, 13% up on 2018. Icelandair has actually used the fleet expansion to improve its liquidity: funds raised from financing the new aircraft significantly exceeded its own funds expended on PDPs, leaving the airline with a surplus of $160m, which explains why the airline’s cash balance improved to $300m at the end of 2018 from $221m a year previously.

The final form of Indigo’s investment in Wow, if indeed it materialises, is expected fairly soon, at which point Indigo’s plans for Wow may be unveiled. Interestingly, there is an Indigo connection that predates the current proposed investment. Ben Baldanza, from 2005 to 2016 CEO of Spirit Airlines, the Florida-headquartered ULCC, and probably the most successful investment by Indigo, is also on the Board of Wow. Could some form of A320 fleet sharing plan between Wow and other Indigo carriers, which would help solve Wow’s seasonality issues, be an option?

And Norwegian

Continuing the Scandi-noir aviation theme, Norwegian’s 40% capacity growth in 2018 resulted in a pre-tax loss of $300m on revenues of $4.8bn. Its balance sheet is precarious: shareholders’ equity of $200m against total liabilities of $8.3bn. Then there are 190 aircraft on firm order with a theoretical capex totalling over $10bn.

Following the termination of IAG’s interest in acquiring the carrier and the disposal of its 4% stake, the short-term solution for Norwegian is a discounted rights issue designed to raise about $350m. The rights issue is underwritten by John Fredriksen, a shipping magnate who was Norway’s richest man until he decided to become a Cypriot national.

However, it is probable that the funds will be insufficient to see Norwegian through this year, unless the market turns in its favour. Depending on whether Wow continues in its downsized form or goes out of business 0.6m to 1.5m pax (these figures are adjusted for Icelandair’s planned growth) will be taken out of the low cost transatlantic market. With Norwegian carrying about 4.6m pax across the Atlantic this development might be key to whether Norwegian survives. It would take some pressure off Norwegian’s unit revenues, maybe giving it the chance to restructure its network and fleet, and raise further funds through the sale of its leasing operation to a Chinese investor.

(Pax millions from/to and via KEF)

| 2015 | 2016 | 2017 | 2018 | Change 2018/2015 | |

|---|---|---|---|---|---|

| Icelandair | |||||

| From | 0.4 | 0.4 | 0.5 | 0.5 | 38% |

| To | 1.0 | 1.2 | 1.5 | 1.5 | 55% |

| Via | 1.2 | 1.5 | 2.1 | 2.1 | 69% |

| Total | 2.6 | 3.1 | 4.0 | 4.1 | 59% |

| Wow Air | |||||

| From | 0.2 | 0.4 | 0.5 | 0.5 | 131% |

| To | 0.4 | 0.7 | 1.0 | 1.1 | 172% |

| Via | 0.1 | 0.6 | 1.3 | 1.7 | 1,649% |

| Total | 0.7 | 1.7 | 2.8 | 3.3 | 371% |

| Total Icelandic | |||||

| From | 0.6 | 0.8 | 1.0 | 1.0 | 69% |

| To | 1.4 | 1.9 | 2.5 | 2.6 | 89% |

| Via | 1.3 | 2.1 | 3.4 | 3.9 | 186% |

| Total | 3.3 | 4.8 | 6.8 | 7.4 | 125% |

Note: Wow 2018 partly estimated