Icelandic hubbing:

Can Icelandair live with Wow?

Jul/Aug 2017

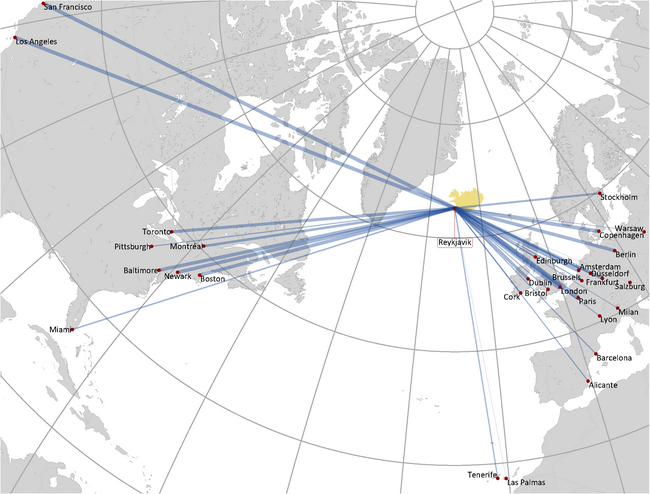

Iceland, population 334,000, plays an increasingly important, if widely unrecognised, role in the North Atlantic market, with two competing hub systems funnelling traffic from Europe to America via Keflavik Airport (KEF). But can Icelandair and Wow continue to co-exist with their rapid expansion strategies?

In the mid-2000s Iceland submitted to a bout of financial madness, turning from fishing to speculative trading as its main industry. Iceland’s banks, recently deregulated, accumulated foreign debt, invested ludicrously in subprime mortgages, complex financial instruments and global property markets. And when the financial crisis struck, and Lehmans collapsed, the three main Icelandic banks went spectacularly bankrupt, GDP plunged by over 10% in 2009 and 2010, and the country had to partly default on its foreign debt, which peaked at ISK15.7tr ($190bn).

The recovery has been as remarkable as the collapse. The government nationalised the banks (and sent dozens of bankers to jail, a stark contrast with the US fall-out), a support package from the IMF was agreed, debt was restructured and repaid — foreign debt today is down to ISK 280bn ($2.6bn). The Icelandic economy has rebounded, this time based on sustainable tourism, with GDP in 2016 growing by 7.2% (again a highly favourable contrast with some the EU states’ economic performance post the financial crisis).

Icelandair was in the centre of the financial crisis. The airline became a subsidiary of an investment/leasing company called Flugleiðir, owned largely by the leading banks; although Icelandair accounted for just over half of revenues, growth and profits were seen to come from the exciting world of financial and corporate investments (at one point it owned over 10% of easyJet).

Flugleiðir promised its shareholders an annual return of 20% pa, which of course did not materialise. In 2009 as the investments turned toxic, Icelandair had to announce a net loss of ISK10.8bn, a loss margin on revenues of 13.3%, and it teetered on the edge of bankruptcy. This was, however, a major turning point for the company as it reverted to concentrating on its aviation operations, specifically building its hub operation at KEF, as well as promoting inbound tourism to the island.

Coincidentally, this was the time when the North Atlantic market was rapidly consolidating with virtual mergers among the Lufthansa Group/United-Continental, Air France-KLM/Delta-Northwest and IAG/American-USAirways creating the conditions for oligopolistic profits in this region, and opening up opportunities for lower cost new entrants.

The KEF network is the only 24-hour hub system in Europe or North America, taking advantage of time differences between Iceland and Europe (minus 2-3hours) and N. America (plus 3-4 hours). Icelandair’s first wave departs from KEF in the morning, arriving in Europe around midday with the return flight scheduled for early afternoon, arriving back at KEF at midday. The eastbound wave then leaves in the early afternoon arriving at American cities in the early afternoon, departing in the late afternoon and arrive back at KEF in next morning to connect with the westbound wave. In the five peak months, May-September, a second eastbound wave starts up in the mid-morning.

The 28 European points and 18 North American points produce, according to Icelandair, a remarkable 496 connection options. How convenient many of these connection options are is, however, questionable: daily year-round flights are offered to only 11 European cities.

The hub system has been the main driver behind Icelandair’s rapid traffic growth — from 2.0m international passengers in 2012 to 3.7m in 2016 (plus 0.3m passengers on domestic and regional services to Greenland, the Faroes and northern Scotland operated by Air Iceland). Connecting Passengers, the “via” market in Icelandair’s terminology, now account for 54% or 2.2m of the projected 2017 total of 4m. The “to” market, mostly inbound tourism, accounts for about 34%, and is a target for expansion through the promotion of year-round holiday packages, with the aim of smoothing the high seasonality of the market. The “from” market, Icelandic outbound travel, accounts for the remaining 12%.

It is interesting to note that Aer Lingus, which carries about 1.6m passengers across the Atlantic, has identified Icelandair (and by implication, Wow) as one of its biggest threats. CEO Stephen Kavanagh earlier this year urged Dublin airport to improve its connectivity or lose business to Reykjavik. Passenger throughput at KEF has soared from 1.8m in 2009 to 6.8m last year.

KEF can offer very fast on the ground transfers for passengers simply because there is only one terminal with all the gates compacted into a small area. The downside is that at peak times it is uncomfortably overcrowded, stretched to the limit it appears, which must present a barrier, albeit a solvable one, to Icelandair’s and Wow’s expansion.

On the major transatlantic routes Icelandair has to sell flights which are apparently significantly less attractive than direct services — for example, London to New York via Reykjavik adds 500-600km to the aircraft routing and at least two and half hours to the passenger journey compared the LON-NYC direct. But for passengers from Scandinavia, or those originating or destined to smaller cities, whose alternative is a connection at a European global hub at LHR, CDG, AMS or FRA, the disadvantage reduces, disappears in many cases.

The range of secondary cities current served by Icelandair and Wow includes on the American side: Edmonton, Portland, Orlando, Pittsburgh, Halifax and Tampa; and on the European side: Hamburg, Edinburgh, Birmingham. Billund, Cork, Bristol, Gothenberg, Bergen and Lyon. This must raise a serious question about the long-haul low cost models that anticipate business from linking secondary points in Europe and America with direct service. The Icelandic carriers offer the alternative of consolidating thin traffic flows through their mid-Atlantic hub in a medium to low cost operation.

Just how far the mid-Atlantic hub concept can be taken is illustrated by the recent start-up of a three-times a week Q400 service from Belfast City (the downtown airport) by Air Iceland, the turboprop subsidiary, to KEF, providing multiple onward connections from Northern Ireland to North America, as an alternative to getting to, then connecting at, LHR or DUB.

Icelandair has remained profitable since the recovery from the financial melt-down, but pressure is mounting on both revenues and costs. In 2016 passenger volume grew by 20% but passenger revenues rose only 12%, from $849m to $947m. Total revenue increased by 13% from $1.14bn to $1.28 with an increased contribution from the hotel/tourism/airport division (which accounts for about 20% of the total).

Operating costs, however, shot up by 17% from $0.91bn to $1.06bn despite a decline in fuel costs of 5%. Costs that should be controllable looked as if they were out of control — personnel up 27% and ground handling, largely provided through the fully owned subsidiary IGS, also up 27%. Icelandair management attributed much of the inflation to the strengthening of the krona against the US dollar. (The Group reports in US dollars, which represent the largest proportion of its revenues, 37%; only 25% of revenues are generated from Icelandic residents; revenues in euros and Danish/Norwegian crowns account for 22%, and sterling 7%, with 9% others.) But a more fundamental reason was a 15% surge in employee numbers — 3,384 average FTEs in 2015, 3,900 in 2016 — a response to what Icelandair describe as the stresses of rapid expansion.

Consequently, EBIT fell to $120m in 2016, 12% down on 2015. Net income was down 20% to $89m.

The adverse trend has continued into this year, with Icelandair facing the twin problems of yield pressure due to increased competition and capacity, and an escalation in its operating expenses in what is a high cost country.

Figures for the first half of 2017 show passenger numbers up 14% to 1.76m, but passenger revenue only increased by 7% to $393m. Total revenues, including cargo and the hotel/tourism division, were $422m, up 9%. But operating costs grew by 16%; fuel was up slightly but again there was a huge increase in personnel costs, up by 40%.

There was a loss at EBIT level, $(31)m, in contrast to a $11m profit in the first half of 2016. The net loss was $(24)m, against a profit of $9m in the same period last year.

These trends should be worrisome for Björgólfur Jóhannsson, CEO since 2008 (though Icelanders are phlegmatic — one of the 757s is named Eyjafjallajökull, after the volcano which brought airline chaos when it erupted in 2010). His strategic response lies in a $30m profit improvement programme, focusing on network expansion, better connectivity with domestic flights, efficiencies in ground handling and rebranding of classes. This may seem a little low-key given the ever-growing threat posed by Wow Air.

Wow Air was founded as a A320- operating LCC in 2011 by IT and telecoms entrepreneur Skúli Mogensen. It took over Iceland Express in the following year. Morgensen retains tight control of the airline through an investment company called Titan, which has not as yet revealed any financial details, but it is clear that the airline is aiming at even faster growth than Icelandair’s. Estimated passenger volume was 1.6m in 2016, and 3.0m is the target for 2017.

Whereas Icelandair offers a medium service product — three classes, Economy, Economy Comfort (the main difference being that that food and alcohol are charged in the former, included in the latter) and Saga (40” pitch) — Wow is a ULCC model. The aircraft are densely configured with one class only, 220 seats on the A321, up to 350 on the A330. Passengers are encouraged to bring their own food and make their own entertainment. Fares on Wow are consistently the lowest across the Atlantic, undercutting Icelandair on Economy, and Icelandair’s fares are in turn very competitive especially on thinner routes where the only competition is a Legacy carrier.

Although a ULCC in product terms, Wow operates a very similar hub system to Icelandair, with waves of flights connecting up traffic flows between Europe and North America — Wow’s waves arrive about an hour before Icelandair’s .

In fact, there is a substantial overlap between the two systems: both carriers concentrate capacity on major cities — London (both Heathrow and Gatwick), Paris Amsterdam, Frankfurt Copenhagen and Stockholm, New York (JFK and Newark), Boston and Toronto. The cities where both carriers compete account for 48% of joint seat capacity on the European side and 27% on the American side. On the smaller routes there is generally no competition between the two airlines, either Icelandair or Wow operates. That is until this summer, when Icelandair announced the start-up of operations to Cleveland, Ohio, a city that has not registered on the radar of transatlantic airlines, and then Wow has committed to the same route. Perhaps an indication of an intensification of intra-Icelandic rivalry.

Up to now Icelandair has mostly utilised 757s and 767s but from next year will be introducing the 737MAX — three 154-seat MAX-8s, followed by another six plus seven 174-seat MAX-9s during 2019-2021. According to Icelandair, the MAXs will be an addition to the 757 fleet rather than a replacement. Meanwhile, Wow is planning for the delivery of 11 aircraft in the next couple of years, seven of which will arrive in 2018 — 220-seat A321neos and 350-seat A330-900neos — a doubling in seat capacity.

Can the KEF infrastructure absorb such an expansion in capacity? Can the two airlines continue to steal away traffic from the network carriers (and maybe thwart the expansion plans of the point-to-point long haul LCCs)?

Different airline models of course co-exist — point-to-point LCCs and networking global carriers — throughout the world, but they rarely have their bases of operations at the same airport. Nor do LCCs have the same base airport (Ryanair at Stansted and Dublin, easyJet at Luton and Gatwick). Nor are network carrier hubs based at the same airport in Europe, nor in the US (with the exception of United and American at ORD).

So Icelandair and Wow are a unique combination — long haul hubbing airlines, one medium service, the other very low cost, based at the same small airport and competing mostly for the same traffic. Could a take-over or merger be a possibility?

Icelandair’s balance sheet is fairly solid at the moment — a debt/equity ratio of 2/1 and $360m in cash. The Icelandair Group is listed on the Nasdaq Iceland exchange, and 76% of the shares are controlled by 20 local investment funds and financial institutions. Having been worth close to zero in 2010 the market capitalisation rose to ISK177bn in 2015 but has fallen back to ISK70bn ($672m) as at August 2017. Wow’s financial resources are not revealed but it is likely that the company is well capitalised as a result of the funds received from Morgenson’s sale of his telecom company, OX Communications, to Nokia in 2010.

(000 Seats to/from Reykjavik, 2016 est)

| TOTAL | 1,855 | 1,069 | 2,924 | 63% | TOTAL | 3,039 | 1,666 | 4,704 | 65% | |

| North America | Europe | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Icelandair | WOW | Total | Icelandair share | Icelandair | WOW | Total | Icelandair share | |||

| New York/Newark | 348 | 143 | 491 | 71% | London (LGW & LHR) | 456 | 260 | 717 | 64% | |

| Boston | 250 | 145 | 395 | 63% | Copenhagen | 409 | 153 | 562 | 73% | |

| Toronto | 180 | 125 | 305 | 59% | Paris | 287 | 209 | 496 | 58% | |

| Washington | 199 | 199 | 100% | Amsterdam | 232 | 209 | 441 | 53% | ||

| Seattle | 180 | 180 | 100% | Stockholm | 227 | 79 | 306 | 74% | ||

| San Francisco | 157 | 157 | Frankfurt | 165 | 129 | 295 | 56% | |||

| Los Angeles | 155 | 155 | Oslo | 207 | 207 | 100% | ||||

| Baltimore | 145 | 145 | Helsinki | 194 | 194 | 100% | ||||

| Montréal | 26 | 106 | 132 | 19% | Munich | 156 | 156 | 100% | ||

| Denver | 130 | 130 | 100% | Berlin | 143 | 143 | ||||

| Others (11 cities) | 544 | 93 | 636 | 85% | Others (26 cities) | 707 | 482 | 1,189 | 59% | |

Note: Destinations in blue served by both carriers. Also service by both carriers on Brussels and Milan

| TOTAL | 30 | 16 | 2 | 7 | 9 |

| ICELANDAIR | ICELANDAIR | LOFTLEIÐIR | AIR ICELAND | ||

|---|---|---|---|---|---|

| Fleet | Orders | CARGO | |||

| 757-200/300 | 26 | 2 | 2 | ||

| 767-300 | 4 | 2 | |||

| 737-700/800 | 3 | ||||

| 737-MAX 8/9 | 16 | ||||

| Q200/400 | 5 | ||||

| F50 | 4 | ||||

Note: MAX 8 deliveries, 2018-2021, MAX 9 deliveries 2019-2021

| TOTAL | 17 | 10 |

| Fleet | Orders | |

|---|---|---|

| A320-200/neo | 3 | |

| A321-200/neo | 11 | 6 |

| A330-300 | 3 | |

| A330-900neo | 4 |

Note: 7 deliveries scheduled for 2018

| June 30, 2017 | US$ millions |

|---|---|

| Fixed Assets (Fleet) | 642.8 |

| Intangibles & Investments | 208.6 |

| Deposits | 67.4 |

| Non-Current Assets | 918.8 |

| Cash and equiv. | 360.1 |

| Receivables | 211.6 |

| Inventories | 30.8 |

| Current Assets | 602.5 |

| Total Assets | 1,521.3 |

| Payables | 335.7 |

| Prepayments | 372.3 |

| Current Liabilities | 708 |

| Long-term Loans | 249.7 |

| Deferred Tax | 46.9 |

| Non-Current Liabilities | 296.6 |

| Total Liabilities | 1,004.6 |

| Shareholders' Equity | 516.7 |

Note: Equidistant map projection based on Reykjavik (great circle routes appear as straight lines). Thickness of lines directly related to seat capacity.

Note: Equidistant map projection based on Reykjavik

(great circle routes appear as straight lines).

Thickness of lines directly related to seat capacity.

Note: For defintions, see text