Grupo Marsans: building a South Atlantic empire

December 2007

Grupo Marsans, the Spanish transport and tourism giant, astonished the aviation industry by signing an MoU for 61 Airbus aircraft in October, with a list price of more than €5bn. What are Marsans' long term ambitions, and how will the expansion of its airlines impact on Iberia, the group’s key competitor?

The origin of Marsans dated back to 1910 but today the group is owned by entrepreneurs Gonzalo Pascual and Gerardo Diaz and encompasses businesses across the whole of the travel and tourism industry, from tour operators and travel agencies to hotels and airlines.

Until recently, however, Marsans' airline operation has been seen as just one part of the group’s many travel and tourism businesses (last year Marsans had revenue of €4.5bn, of which 40% — €1.8bn — came from the group’s airlines), and one that had relatively little impact on the global aviation industry — but that all changed in October this year.

The MoU agreed that month is for 12 A319s, 25 A320s, five A321s, five A330- 200s, 10 A350–900s and four A380s, and along with an existing order for 12 A330- 200s placed in December 2006, this brings the total order book for Marsans to 73 aircraft.

Though timetables are not definitive until the MoU is formally turned into an order, it is believed that the A380s (for which Marsans will become the launch customer in both Spain and Latin America) will be delivered from 2010, with two aircraft destined for each of Air Comet and Aerolineas Argentinas, the main parts of Marsans' aviation division, with two aircraft stationed at Buenos Aires and two at El Prat airport in Barcelona. The A350s will arrive in 2013- 2014, while the other aircraft will be delivered over 2008–2014, although Marsans has not yet disclosed precisely where these aircraft will be placed among its airlines.

However, what is known is that the new fleet will be used to build up a substantial operation based around hubs in Madrid, Barcelona and Buenos Aires in a direct challenge to the majors operating on European–South American routes, and specifically to Iberia.

The rationale for Marsans' aggressive expansion is straightforward: the group’s management has identified Spain–Latin America as a high margin, growing market, with relatively little competition to the established flag carriers on the sector.

A booming market

A key driver is demographics, with the latest forecasts showing that Latin America’s population is expected to increase by almost 50% over the next 50 years — compared with an expected population decrease over the same period in Europe.

Also crucial is the economic resurgence in much of Latin America, which is nudging upwards the disposable income of the expanding "middle classes" in the region. Although politically much of Latin America has turned leftwards in protest at what is seen as the patronising attitude of the Bush administration towards the continent, more often than not this is being accompanied by economic liberalisation from the region’s governments. As Boeing puts it, better access to private capital is having "a profound impact", and "the ability to fund new aircraft purchases is allowing airlines to revitalise their fleets and pursue growth strategies".

Gradual liberalisation of the aviation regulatory regime in Latin America (including the spread of fifth freedoms) is also helping, and the emergence of a wave of LCCs has transformed the two largest markets in Latin America: Brazil and Mexico. Boeing’s latest market forecast, released in the summer of 2007, forecasts a 6.6% average annual growth rate in intra–Latin American traffic over the 2006–2025 period, well above the global growth rate of 5% p.a.

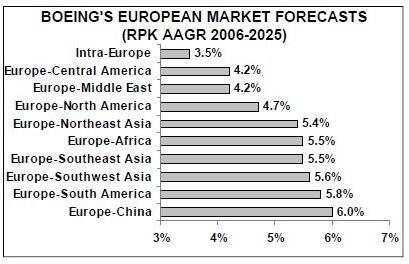

But much more exciting from Marsans' point of view is the potential for traffic growth to/from Latin America, and the overall Latin America–Europe market is expected to have above average traffic growth over the next 20 years. Traditionally, the largest continental traffic flow has been to North America, accounting for up to 60% of all international traffic to/from Latin America, with Europe at around 20% — but Europe’s share is rising. According to Airbus, traffic between Western Europe and South America will see average annual traffic growth of 6.4% over the 2006–2025 period, which by 2025 will make it the fourth–largest intra–continental passenger market in the world, behind Western Europe–North America, Asia/Pacific–North America and Western Europe–Asia/Pacific. Over 2006- 2025, Boeing forecasts the European–South American market will have the second–highest growth rate of any international market out of Europe (see chart), behind only the Europe–China market.

What is even better news for Marsans is that a large part of this Latin America- Europe traffic passes through or arrives at/departs from Spain. According to data from Iberia, in 2006 there were 4.8m passengers carried between Spain and Latin America, and this flow to/from Spain represented a hefty 30% of all passengers between Europe and Latin America (the country with the next biggest share was the UK, with 13%). Spain’s share has grown from 20% since 1999, with Spain–Latin America traffic increasing by an average annual growth rate of 8.3% over the last seven years, compared with a 1.3% growth rate in traffic between Latin America and the rest of Europe.

Iberia says that 10% of passengers carried on the Europe–Latin America sector are business travellers, of which Spain–Latin America has a 23% market share (16% in 1999), and again there has been a greater increase in business traffic on routes to/from Spain and Latin America (6.6%growth p.a. over 1999–2006) than between the rest of Europe and Latin America (0.7% annual growth).

Spain’s share of the Europe–Latin America market is set to keep growing, fuelled by trends in business (Spain is the single most important foreign investor in the whole of South America, and the number one foreign investor in Argentina) and — crucially — by immigration. The booming Spanish economy, along with the fact that Spain’s birth rate is the lowest in Europe, has forced the government to encourage migration. An estimated 300,000 Argentines entered Spain in 2001 following the country’s economic collapse then, and Spain’s socialist administration (elected in 2004) has granted an amnesty for up to 1m illegal immigrants living in the country.But according to the United Nations Population Division, Spain needs a substantial 12m immigrants from 2004 until 2050 in order to maintain the labour force level it needs.

It’s against this background of increasing demand on Spanish–Latin America routes that Marsans placed the largest ever aircraft order by a Spanish company, which are destined for the group’s various airline interests:

Aerolineas Argentinas

Aerolineas Argentinas was launched back in 1949 and privatised in 1990, but despite Iberia and then American Airlines taking stakes and investing substantial sums, dismal management meant that the airline lurched from one crisis to another, culminating in the events of 2001 when the airline went into bankruptcy protection, suspended all long–haul flights and sold aircraft and other assets in a desperate attempt to keep operating.

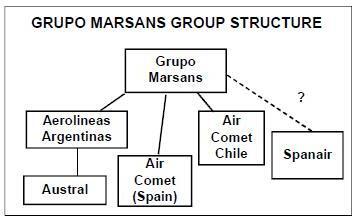

Air Comet/Marsans acquired a 92.1% stake in Aerolineas in October 2001 in exchange for assuming the airline’s $1.8bn debt. Marsans also injected €40m and — helped by the devaluation of the Argentine peso, an increase in tourism and new management — the airline came out of administration in 2002. Fleet renewal was started in 2004, and for the last few years the airline has been expanding its route network, particularly in South America. Today the airline has approximately 7,000 employees, which operate a fleet of 41 aircraft to 33 domestic and 22 international destinations, of which 11 are in South America, four in North America, five in Europe and two in the Asia/Pacific region.

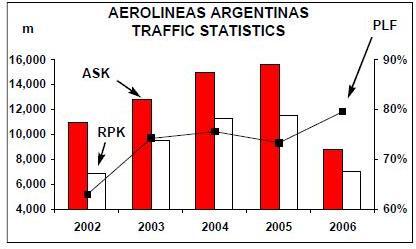

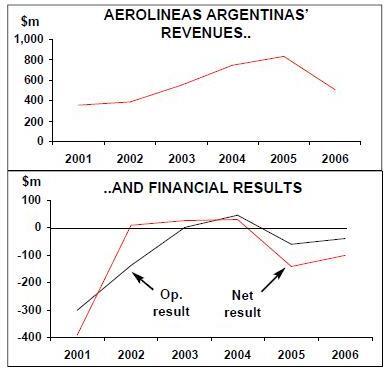

Aerolineas is based in Buenos Aires (where 11.5m people live, out of a total population of 38.5m) and carried 2.4m passengers in 2006. But despite the resurgence in the Latin American aviation industry in general and a reduction in the airline’s net loss to $100m in 2006 (see charts), all is not well at the carrier.

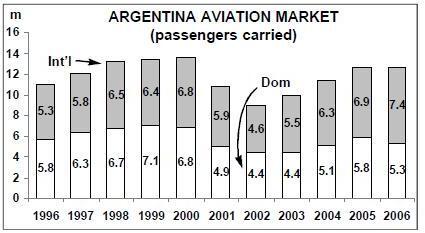

Firstly, Aerolineas had expected to break even in 2006, but the latest forecast is for this to occur no earlier than 2008, and the main reason for this is that the economic recovery in Argentina — though impressive — has still not returned the economy to the strength it had back in the 1990s. While GDP has grown in Argentina by at least 8% a year since 2002, this has to be set against the context of the staggering 62% collapse in GDP in 2002 compared with 2001, which means that Argentina’s annual GDP is still below the levels recorded in 1990s.This pattern has repeated itself in terms of aviation demand, and although traffic has recovered through the 2000s, while international traffic has recovered to (and beaten) the 2000 figure, domestic traffic still lags behind the levels achieved in the 1990s (see chart, below). Indeed Argentina’s domestic traffic fell in 2006 compared with 2005 due to industry labour conflicts and safety issues in the domestic aviation infrastructure (when radars had to be operated manually).As Aerolineas Argentinas and its affiliate Austral (see below) have just under an 80% share of the domestic market, this sluggishness in non–international traffic has slowed the airline’s return to profitability.

To make matters worse, the relatively weak challenge that Aerolineas and Austral have faced from competitors cannot last forever. While Latin American airlines only provide 25% of international capacity to/from Latin America as a whole, in 2006 Aerolineas had an approximate 33% market share of international traffic to/from Argentina. Aerolineas is still increasing international capacity; for example, a daily Buenos Aires–Asuncion (Paraguay) route was restarted in August after being axed back in 2001, while Aerolineas increased frequency over the summer on routes to Auckland and Sydney. However, Aerolineas’s international market share is vulnerable.

Currently the main competitor to Aerolineas is LAN Argentina, which started operations in 2005 and today operates a fleet of five A320s and two 767–300ERs to nine domestic and five international destinations.

It had a 20% domestic market share in 2006 but has substantial expansion plans, and has applied to serve another four domestic and 20 international destinations.

The Argentine government has complained previously about Aerolineas’s scaling back of services to secondary domestic destinations, and is keen to encourage new services. Unlike the situation in Brazil and Mexico, Aerolineas has never faced a challenge from a LCC (Aerolineas signed an interline deal with Brazilian LCC Gol over the summer), but a number of new airlines have applied for permission to launch domestic operations in Argentina, including Silver Sky, Sudamerica Air and Crucero del Norte.It’s inevitable that some of these will operate an LCC business model, and one low cost competitor will definitely be AirPampas, which former Aerolineas Argentinas president Antonio Mata aims to launch with a fleet of MD–80s before the end of the year.

Additionally, while Aerolineas still benefits from the government’s policy of subsiding fuel costs for domestic airlines, in other areas the government is liberalising, and in 2006 restrictions on foreign ownership of airlines were abolished, which will only encourage foreign airlines to launch operations in Argentina.

Marsans has long had a troubled relationship with the Argentine government and unions over Aerolineas, which was only improved in 2006 after a restructuring of management, when Mata — the previous president — was replaced by direct control from Marsans' owners Pascual and Diaz. In an unofficial agreement, Marsans (via a holding company called Interinvest) gave some of its shareholding to the Argentine government (increasing its share from 1.4% to 5%) and granted the government a second seat on the airline’s 12–strong board in exchange for the government’s permission for a 20% -plus rise in domestic and international fares (the government controls fares as part of fiscal efforts to control the inflation rate) and approval of the airline’s accounts. The government had previously refused to approve any of Aerolineas’s accounts since 2001 after the airline reduced the debt it owed to the Argentinean air force as part of the bankruptcy process,

The 2006 accounts were also approved in July this year, but there were objections from employee shareholders (who own 3%),which reflects that fact that although the government and Marsans may have agreed a "ceasefire", large differences still remain between Aerolineas’s workforce and Marsans.

Management concluded a round of pay talks with unions earlier this year, but a 16.5% pay rise for pilots, engineers and ground staff came about only after industrial action by check–in staff in June, which was initially countered by a threat of dismissal by the airline. That episode left resentment among the seven major unions that represent staff at Aerolineas, and this increased after Pascual stated that aircraft from the recent order will only be given to Aerolineas if the unions, management and Argentine government sign an "accord" that will ensure stability at the airline over the next few years. Negotiations are ongoing with unions, and Marsans expects to sign a pact before Christmas, but it is unclear what exactly this accord will contain, although union sources suggest it will cover a five–year period and that at its heart is a no–strike clause that management wants from unions. For unions that are naturally suspicious about Spanish control over a South American airline, this may be a concession too far.

The continuing tension between staff, management and the government has encouraged some observers to believe that Marsans would prefer to exit from Aerolineas at some point in the not–so–distant future. By doing this, Marsans wouldn’t just free itself from the never–ending financial and labour problems of Aerolineas, but it would also raise funds for its aircraft orders and possible bids for other airlines.

By making an exit Marsans would also escape the need to continue fleet renewal at Aerolineas, whose aircraft still have an average age of just less than 20 years; in 2006 the airline had to temporarily suspend its key Buenos Aires–New York route following a shortage of aircraft. In the summer of 2007 Aerolineas leased a number of A320s, A330s and A340s, which are replacing 747- 200s and 737–300s. Of the current 41–strong fleet 18 are 737–200s, although there are now 13 737–500s, of which seven were added on leases this year (three of which came from BCI). Two A340s–300s and two A310s were also added to Aerolineas’s fleet in 2007, again all on leases.

With sources indicating that as many as 40 of the 73 aircraft Marsans has on order could be destined for Aerolineas Argentinas, if Marsans did sell its stake in the airline this would free up a tremendous amount of capacity that Marsans could place elsewhere in its growing aviation empire.

Marsans continues to deny that it wants to sell Aerolineas, but there have been tentative plans for a partial float of between 20%-25% of the airline since early 2006.

However, complicating the issue is the fact that in November the Argentine government said it was exercising an option to acquire another 15% in Aerolineas (which will bring its stake to 20%). The method is yet to be confirmed, but will be either via an issue of new shares or by acquiring some of Marsans' stake. Sources indicate that Marsans would prefer to sell 15% of its stake for cash, whereas the Argentine government would prefer to "pay" for the shares by writing off Aerolineas’s tax liabilities. But before this can happen the wide gulf in the airline’s estimated value will have to be bridged, with the government’s reported estimate of around $400m being significantly lower than the $1bn–plus that Marsans is believed to value Aerolineas at.

Austral

Speculation over Marsans’ commitment to Aerolineas has only been encouraged by developments at Austral Lineas Aereas, the Buenos Aires–based regional subsidiary of Aerolineas that was launched in 1971 and which merged with Aerolineas Argentinas in 1999. The airline operates a fleet of 16 MD- 80s on regional and feed routes to around 18 domestic destinations, and carried 1.8m passengers in 2006.

If Marsans did want to sell Aerolineas, then a logical first step would be to separate out Austral from Aerolineas, because Marsans could then use Austral as a feeder into the long–haul routes offered by Air Comet, which could be upgraded to be the main transatlantic airline for Marsans. And indeed Marsans now appears to be separating out the previously integrated operations of Aerolineas and Austral, with a reshuffling of fleet that has turned Austral into an all MD–80 operator, with its former 737–200s and 737–500s being transferred to Aerolineas — although in the medium–term the MD–80s may be replaced by the A320s on order by Marsans. Additionally, from this summer Austral aircraft have dropped the AA condor logo on their livery, replacing it with AU letters.

Air Comet Chile

Marsans' other asset in Latin America is Air Comet Chile, which was launched by Marsans as a domestic carrier called Aerolineas del Sur in 2004. However, it was rebranded in September this year as Air Comet Chile, and accompanying the new name was a change in strategy, with a much greater focus on feeding passengers into Air Comet and Aerolineas Argentinas at Buenos Aires and elsewhere in Latin America.

Air Comet Chile has just under a 20% market share of the domestic Chilean market, having overtaken rival Sky Airlines (with which Marsans has been linked as a potential acquisition), although it is substantially behind LAN, which has a 65% domestic market share. Air Comet Chile has expansion plans, and has been opening new routes (both domestic and international) at the rate of around one per month this year, with international routes to Buenos Aires and Lima planned before the end of 2007. The airline currently operates five 737–200s on six domestic routes.

Air Comet

Madrid–based Air Comet is a scheduled airline that was originally launched as a longhaul charter carrier in 1997, operating out of Madrid and Palma de Mallorca under the name Air Plus Comet. Marsans acquired 100% last year after buying the 30% owned by Antonio Mata for a reported €100m, which followed Mata’s exit as Aerolineas’s president in order to cool the worsening relations between that airline and the Argentine government.

It became Air Comet in January 2007, relaunching itself as a full–service, scheduled airline with a new livery and logo. At the same time it was designated as an airline between Latin America and Spain after taking over the Latin American routes operated by LCC Air Madrid, which collapsed in December 2006.

At that time Air Comet transported home 5,600 passengers stranded throughout South America for a flat fee of €200, but although the airline agreed with the Spanish ministry of industry to hire half of the Air Madrid workforce (578 out of 1,156), in actual fact Air Comet only took on 247, thanks to fewer staff than anticipated wanting to transfer across, as well as the rejection of "unsuitable" people.

While Air Madrid was a LCC, Air Comet relaunched itself as a full service airline, even though only a few months earlier — in September 2006 — Pascual said Air Plus Comet would restructure itself as a LCC. Precisely when the change of strategy came about is uncertain, but it must have been made between September and December, when the order for the initial 12 A330s was placed, and when Marsans first started to exploit synergies between its carriers in a meaningful way. Certainly before late 2006 there was no sign that Marsans was pursing a group strategy for its aviation assets, and until then Air Plus Comet, Air Pullmantur (a small charter carrier and associated cruise ship business that Marsans sold in 2006 for €450m) and Aerolineas Argentinas had operated independently.

Today Air Comet operates a fleet of 13 air–craft, and these are used on 13 routes out of Madrid to Latin America (Buenos Aires, Santiago de Chile, Bogotá, Lima, Quito, Guayaquil, Havana, Santo Domingo, San Jose, Santa Cruz) and Europe (Paris CDG, Rome and London Gatwick). Since January Air Comet has steadily been launching further routes and frequencies as it seeks to build up a network of daily flights to "all the important business centres in Latin America" (although it also operates some charter flights out of Madrid and Barcelona to Latin America and the Canary Islands).

For example in March it launched a three–times–a-week service between Madrid and Santiago de Chile in competition — naturally — against Iberia.

And that’s the key to Air Comet’s (and Marsans') long–term strategy: a focus on constructing a network of routes out of Spain to all the main city destinations in Latin America.

While the A380s it will receive (at least two and possibly four if Marsans exits from Aerolineas Argentinas) are likely to be used on shuttle routes between Madrid and Buenos Aires (but only if Madrid Barajas can handle them) and possibly to other destinations such as Sao Paulo and Mexico City, it is the A330s and A350s that will be at the heart of Air Comet’s strategy as it constructs a dense network of routes into Latin America.

In 2008 Air Comet will increase frequency on Madrid–Lima to a daily service and on Madrid–Bogota to a five–a-week service, and new routes under consideration include Madrid–Cartegena–Medellin.

This would be worrying enough for Iberia on its own, but Marsans also intends to outflank the flag carrier by building up a long–haul hub not only at Madrid but at Barcelona as well. In fact Marsans intends to build Barcelona’s El Prat airport into its prime European hub, with longhaul flights to Latin America, North America and the Asia/Pacific region connecting in with European feed flights.

For historical reasons Barcelona versus Madrid issues are sensitive in Spain, but Barcelona is better suited to be the prime hub in Spain for a variety of reasons, including geography (Barcelona is closer to the centre of Europe than Madrid); business travellers (given the concentration of commerce in Catalonia, Barcelona has a better catchment area for business passengers than Madrid) and infrastructure (according to Marsans, Madrid’s Barajas airport is not prepared for A380 operations, unlike El Prat).

On long–haul, Marsans is analysing a number of routes out of Barcelona, with Buenos Aires, Mexico City, Lima and Quito on a long list of destinations under consideration, but of course what Marsans does not have at Barcelona is the depth of domestic and European feeder flights that Iberia has at Madrid, and creating such a network is a priority with Marsans. It’s possible that a large part of the 42 A320–family aircraft on order will be heading for Air Comet, but the only definite European destination among the large number that Air Comet is believed to be considering is Milan. However, growing Air Comet organically is not the only option that Marsans has in building a European network.

The Spanair bid

Spanair is second–largest Spanish airline after Iberia, employing 3,600 and carrying 18.8m passengers in 2006. It’s currently owned 100% by SAS, but in June the Scandinavian group announced it would sell the airline as part of restructuring (see Aviation Strategy, May 2007).

That decision appears unrelated to labour unrest at the airline, where cabin crew unions staged industrial action in the summer over disagreements on the implementation of a collective pay deal (although the dispute was settled after a month).

Pascual and Diaz, the owners of Marsans, co–founded Spanair with SAS in 1986, but gradually sold off their 51% stake to SAS in late 2001 and 2003. In a move to simplify the process of a full bid, in June this year Marsans sold its remaining 5.1% stake in Spanair (held via an affiliated company called Tenvier) to SAS for an undisclosed sum, with Marsans saying it now had an "all or nothing" strategy for Spanair.

Gonzalo Pascual, the president of Marsans, also stepped down as chairman of Spanair in October this year in order to prepare the Marsans bid for Spanair without having a conflict of interest, and his departure followed the resignation of Gerardo Diaz as CEO of Spanair.

The acquisition of Spanair would increase Marsans' aviation revenue by two–thirds — in 2006 Spanair had turnover of €1.2bn (and an operating profit of €23m). More importantly, the move would make strategic sense for Marsans: Spanair is based in Palma de Mallorca and operates a fleet of 60 aircraft domestically and within Europe to almost 40 destinations, (of which 20 are in Spain).

There would have to be a reshuffling of services, but Spanair would deliver large amount of feed for Air Comet’s long–haul network, although Pascual says that if Marsans acquires Spanair, it will be changed from being a feeder airline only into a classic short–and longhaul network carrier. Spanair used to operate long–haul routes to North America with 767s, but SAS closed down the routes in 2002 because of the intensive competition on the sector.

A Marsans–owned Spanair would restart long–haul routes, though the precise destinations will depend on the co–ordinated network strategy with Air Comet (and Aerolineas Argentinas, if it remains part of the Marsans group).

Spanair is part of Star (it joined in 2003), and Marsans hints that not only would Spanair remain in the global alliance if the group succeeds in acquiring it, but that both Air Comet and Aerolineas could join Star in the future. Star has a gap in its South American network following Varig’s forced withdrawal from Star earlier this year, and the Marsans group would be an attractive addition to the existing Star members.

However, Marsans acquisition of Spanair is not 100% certain, even though in October Marsans (via Tenvier) paid SAS €43.5m for 55% of Newco, which provides ground handling services to Spanair and other airlines at a number of Spanish airports, including Barcelona. In June (at the time of the sale of Marsans' last 5% in Spanair) Pascual said that a formal bid for Spanair would be launched by the end of September, but this did not happen, and the timetable for a completion now appears to have slipped to early 2008 at best, and is more likely to happen in the second quarter of 2008. In October SAS appointed a foreign bank to look for other bidders for Spanair (Air Berlin was reported as being interested in Spanair, although the airline denies this), but this may be a means of getting a higher price from Marsans, with the airline believed to be valued at around €0.5bn.

Even though the Marsans acquisition is still expected to go through in 2008, Pascual has warned publicly that Marsans will not pay an inflated price for Spanair, and that if SAS holds out for too much money Marsans will walk away.

Intriguingly, Marsans says it may bid for Iberia if the Spanair bid fails, but this may be an attempt to warn off Iberia, which itself is said to be interested in buying Spanair — though a flag carrier bid for Spanair would surely be blocked by Spanish or EU regulatory authorities. But what is certain is that if Marsans does buy Spanair then the challenge to Iberia from the Marsans group will be even greater.

Iberia danger

Even without the Spanair factor, Marsans' plans are a huge problem for Iberia. Spain- Latin America is the area where the Spanish flag carrier earns its highest margins, and the airline want to expand significantly on the sector while cutting back on unprofitable short–haul routes in Europe (see Aviation Strategy, December 2006).

Sources suggest that growth of Air Madrid’s long–haul routes out of Barajas airport prior to its collapse in December 2006 had significantly worried senior Iberia management, but that once the airlines' routes were rescued by Air Comet, some Iberia executives believed that the competitive threat would be minimal. However, now that Marsans has committed to a huge Airbus order and large capacity increases on Spain- Latin America routes, Iberia’s executives are no doubt scurrying to analyse how they can react. Iberia will be desperate to avoid fare wars on routes out of Madrid, but maybe even more of a worry in the long–term will Marsans' commitment to building a long–haul hub out of Barcelona, because if a significant chunk of business travellers get used to flying out of Barcelona there will be relatively little that Iberia can do about it.

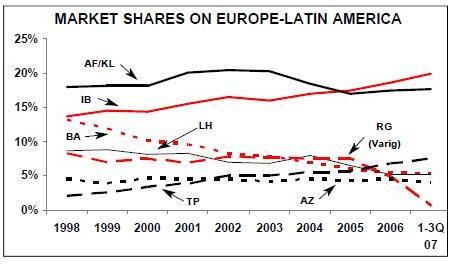

Iberia has steadily increased its market share on Europe–Latin America routes to 20% in the January–September 2007 period (see chart), helped by Lufthansa’s strategic retreat from South America–European routes and the crisis at Varig, but given the Marsans push it’s inevitable that Iberia’s market share will start to retreat in the near future. The vital question, of course, is what will happen to margins? If — and it’s a big if — Marsans' deep pockets encourage cut–throat price competition on routes out of Madrid in order to win market share and/or damage Iberia, then Iberia will be in deep trouble given the contribution that this sector makes to Iberia’s bottom line.

Interestingly, in an exhaustive 134 slide presentation given by Iberia to analysts and investors in early November, Marsans was not mentioned at all and Air Comet referred to only once (and only as a maintenance customer).

In terms of competitors, the focus of that presentation was almost exclusively on flag carriers — but this doesn’t necessarily mean that Iberia is underestimating the threat from Marsans.

Though Iberia has been adding larger capacity aircraft on its routes to Argentina through 2007, the prospect of Air Comet (and Aerolineas Argentinas) potentially operating A380s on the key Madrid–Buenos Aires route (the most lucrative long–haul market out of Spain) cannot be pleasant for Iberia’s management.

Currently Iberia operates 30 direct flights a week on Madrid–Buenos Aires, competing against 10 flights a week from Air Comet and 32 from Aerolineas Argentinas.

In the January–September 2007 period 68% of Iberia’s long–haul traffic at Madrid connected to domestic or European destinations, and it is this connecting network that Marsans is trying to replicate through Air Comet and — if successful — via the acquisition of Spanair.

Within Spain there is speculation that Marsans' ultimate goal really is to make a bid for Iberia, and now that the BA/Texas Pacific bid for Iberia has been withdrawn, then irrespective of what happens with Spanair, Marsans may move for Iberia. All Marsans will say on the record is that it does have the ability to make a bid for Iberia, although there are unconfirmed reports that it has lined up a major bank to advise it on a bid for Iberia.

Flexibility

Whether Marsans will make a serious bid to acquire Iberia is unknown at this stage, but the key to understanding Marsans' future strategy is to realise that while its vision is clear — of building a substantial Spain–Latin America network, with feeder routes at both ends — Marsans' tactics in achieving this goal are flexible.

The giant Airbus order gives Marsans assured capacity over the next decade, and just which airline is operating those aircraft — whether Air Comet, Spanair, Aerolineas Argentinas or anyone else — is unimportant.

What does count is where those aircraft operate to/from and, on the European side, building up a network at Barcelona (and to a lesser extent at Madrid) is the priority, no matter what livery the aircraft fly under. If the Spanair deal does not come off, then Marsans will simply use many of the 42 A320 family aircraft on order to build up large feed network in Spain via Air Comet regardless.

Marsans executives confirm that the size of the Airbus order will not be altered according to whether the Spanair deal succeeds or fails, and indeed they hint that further aircraft orders are likely, possibly as early as next year, with the emphasis being on even more long–haul capacity. For Iberia’s management, that’s not good news at all.

| Fleet | Orders | Options | |

| Aerolineas Argentinas | |||

| A310 | 2 | ||

| A340 | 5 | ||

| 737-200 | 18 | ||

| 737-500 | 13 | ||

| 747-200B | 1 | ||

| 747-400 | 2 | ||

| Total | 41 | 0 | 0 |

| Austral Lineas Aereas | |||

| MD-80 | 16 | 0 | 0 |

| Air Comet Chile | |||

| 737-200 | 5 | 0 | 0 |

| Air Comet | |||

| A310 | 4 | ||

| A320 | 3 | ||

| A330 | 3 | ||

| A340 | 3 | ||

| Total | 13 | 0 | 0 |

| Unassigned orders | |||

| A319 | 12 | ||

| A320 | 25 | ||

| A321 | 5 | ||

| A330-200 | 17 | 10 | |

| A350-900 | 10 | ||

| A380 | 4 | ||

| Grupo Marsans Total | 75 | 73 | 10 |