easyJet: A tale of two strategies

Jul/Aug 2011

Once again easyJet appears to be running into a conflict with founder and major shareholder Sir Stelios Haji–Ioannou. This month the chairman of easyGroup published an open letter to the board of easyJet questioning the legality and requesting further clarification of the company’s announcement in January this year – when it stated that it had converted 15 existing A320 options to firm orders, 20 existing A319 contracted deliveries to A320 deliveries and had secured options on a further 33 A320s.

In particular he seems to be demanding that the shareholders should be given a chance of reflecting on a new Class 1 Circular detailing the order (a document to shareholders required under stock market regulations in particular circumstances that could have material impact on a company’s financial position), given that its size will impact the company’s valuation – these aircraft represent capex of $5.75bn at list prices against easyJet’s market capitalisation of $3.2bn at the time of the announcement. He also required that the confidential discounts to list price be disclosed (that really would please Airbus). Whatever might be said about the personalities involved, there is a fundamental difference of opinion: the pursuit of market share and growth or the generation of profits and dividends.

As Ryanair with Boeing, easyJet created a substantial advantage for itself by signing a long–term deal with Airbus in 2002 (expanded in 2006) for up to 120 A319s (and a further 120 purchase rights) at a time when both the major aircraft manufacturers were desperate for orders of any kind. At the time the A319 had a “list price” of around $50m but (although the negotiated price is highly confidential) we would estimate that the company achieved a discount to list of well over 50%, giving an in–price in the low $20m range — and that this superior discount has had a lasting positive impact on the company’s cost base: indeed it is possible to calculate that the sum of these superior discounts of those aircraft delivered could equate to some 80% of the company’s total balance sheet equity. In the announcement in January the company said that the new aircraft order (and the conversions) were all related to the original deal, the A320s must be coming into the fleet well below current “fair values”. This should still give easyJet a continuing ownership cost competitive advantage.

At the time of the original order it appeared that the 156 seat A319 offered superior operating economics for easyJet’s then route profile; it is only in recent years as the network has been maturing and (perhaps more particularly) fuel prices have risen that the higher capacity 180 seat A320 has appeared more attractive, since when easyJet has been gradually increasing the sub–fleet. Stelios may have a point in his letter that the board should have considered discussions with Boeing perhaps for the 737–800 as an alternative. But the board probably did; and it would have been intriguing to know whether they could have bettered the advantageous Airbus contract considering that order books are now so full.

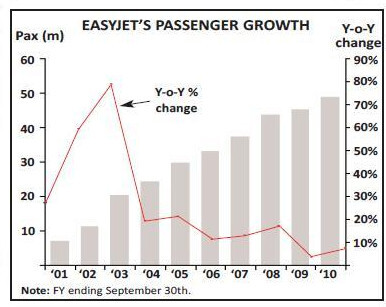

The company’s growth since that aircraft order in the early 2000s has been substantial – from 26 aircraft at the end of 2001 to 196 by the end of 2010. The number of passengers booked has increased by a compound annual average 24% from 7m in 2001 to 48m in the year ended September 2010. According to IATA in 2010 it was the world’s third largest carrier by numbers of international passengers carried and the 14th largest by total numbers of passengers. The operation currently has 19 bases in the UK, France, Germany, Italy and Spain (with the twentieth, in Lisbon, due to open in winter 2011).

easyJet can claim to be one of only two carriers with a truly pan–European brand; and by 2010 has built a share of intra–European traffic of over 8% (albeit two–thirds the size of Ryanair). It is the largest intra–European carrier by number of departing seats in the UK, and second largest behind the incumbent flag carrier groups in the Netherlands, Switzerland, Portugal, France, Greece (assuming the effective non–competition pact between Olympic and Aegean), Gibraltar and Slovenia. The UK is still its largest area of operation accounting for 35% of departing seats in 2010, while Italy, France and Spain each accounted for a further 13%.

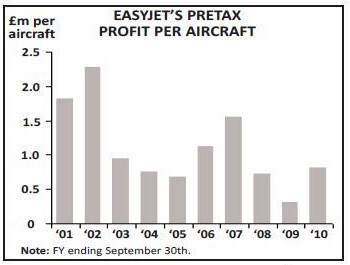

Over the same period revenues have grown by a compound annual average 26% to £2.9bn from £356m and profits went from £40m in 2001 to a peak of £202m in 2007 – dipping thereafter but at least have recovered to £154m in the year to end September 2010 despite an estimated £57m impact of the eruption of Eyjafjallajøkull.

However, whereas fuel accounted for a mere 15% of easyJet’s operating costs in fiscal 2001, in the last financial year it accounted for nearly 30% (and without hedging gains could have accounted for nearly 40%) of costs. With energy costs likely to remain high, with the introduction of ETS on top of other passenger taxes, and the sluggish recovery in European economies the effect on demand must be depressing – and this certainly raises questions about the advisability of pursuing growth per se. Another changed factor is that Europe’s largest airline, Ryanair, has seemingly announced plans to halt growth and switch to generating cash and dividends to shareholders.

Still, the fleet order in January was probably necessary – and heralded at the announcement of the annual results in November 2010 when the management pointed out that firm orders from Airbus would finish in 2012 – as some of the earlier A319s are eight years old. As the plan stands the company suggests that its fleet will grow from 196 at the end of September 2010 by an average net eight units a year to end September 2013 with a fleet of 220 aircraft (all Airbus A320 family). The company maintains a significant level of flexibility with 74 of the current fleet on operating lease and 111 owned – and has a target of maintaining 30% of the fleet leased.

In its response to Stelios the board mentioned that it would be ensuring a winter fleet capacity of 204 aircraft for the next two years (emphasised in its recent interim management statement) – suggesting perhaps that as with Ryanair it is looking at increased seasonality of business and the sense of parking aircraft in the winter (see Aviation Strategy, June 2011), At the time of the annual results last November, easyJet revealed elements of its strategic review. Under the grand vision of “turning Europe orange”, it highlighted its intention to build towards a 10% share of intra- European traffic with annual increases in capacity for the next couple of years of around 7–8%; while emphasising that its fleet flexibility allowed it a longer term range of 4–8% growth thereafter. Seemingly bowing to the pressure from Stelios, it announced the intention to declare a modest dividend for the year ended September 2011 (and payable in 2012) along with targets of achieving profits of £5 per passenger (against an underlying profit per pax in 2010 of £3.36) and returns on capital employed of 12% through the cycle.

At the same time the company stated its intention to pursue more business–orientated markets and traffic – though its own figures indicate that it only has a 4% share of intra–European business passengers. easyJet has a preference for mainstream primary and secondary airports, and increasingly operates business–friendly schedules (three daily rotations being the prerequisite). It had already been promoting through the GDSs and noted that on such ticket sales it achieves a 20–30% uplift in yield.easyJet is recruiting a corporate sales team, has already introduced an online flexible fare and has been increasing frequencies and improving time of day departures on key weekday business routes further to increase attractiveness for business day- and short–trips. In addition some of the usual “perks” of intra- European business travel can be bought on the website – including priority boarding and business lounge access. It has yet to go as far as introducing seat assignment or a frequent flyer plan; but these will come in time.

In the Q3 interim management statement (for the period up to June) the management emphasised progress in this strategy. Passenger and seat numbers were up by 17% year on year in the quarter (9% excluding the closure of European airspace last year) and total revenue per passenger climbed by 5%, including a strong 17% increase in ancillary revenues per passenger – due in part to the improvements in “quality” of the network structure, and particularly on capacity based in France, Switzerland, Spain and Italy, and higher yield routes out of London. At the same time it stated that it expected to be able to announce a pre–tax profit for the full year to September of between £200m and £230m (giving a return on capital of between 10% and 12% and bringing it back to reporting profits of over £1m per aircraft). However, it has reined in its plans for 2012. The company now expects to keep capacity flat in the winter – with a maximum of 204 aircraft in the fleet for the next two winter seasons – and expects capacity for the full year to September 2012 to rise by 3- 4% (implying an 8% increase in peak season seats); and by implication capacity growth in FY 2013 looks set to be similar. As with Ryanair, if it sticks to its plans to have 220 aircraft in the fleet by end 2013, it will be grounding increasing numbers of aircraft in the off–season.

easyJet has tended to differentiate itself from Ryanair and now is trying to move even more “up market” by chasing the higher yielding business passenger. This, by its nature could lead to increasing operations at congested primary airports and perhaps a deterioration of its ability to maintain the high utilisation and quick turnaround times essential to keep costs to a minimum, while it certainly adds to the complexity of operation and may blur the LCC KISS principle and make it increasingly look like a “normal” airline.

There is still a wide gap between easyJet’s costs and those of its legacy carrier competitors, which may mean that this will not necessarily act as a constraint on growth potential (and there may of course be the possibility of linking with one of the legacy carriers to provide feed, as Air Berlin has done by joining oneworld). easyJet could achieve its stated aim of a 10% share of intra–European traffic within five or six years with an annual 8% growth but with the next two years' capacity possibly running at half this level that target may be extended to the end of the decade. If on the other hand easyJet were to abandon this stated aim and not take on new aircraft beyond 2012, growth would be muted and it could perhaps concentrate on the more profitable elements of the route network to achieve that £5/pax target quicker, and some £400m a year capital expenditure would be avoided to flow straight through to increasing cash balances (and paying dividends) – although storing up pressures on direct operating costs as the fleet ages.