Air Canada: Seeking creative solutions to avert bankruptcy

Jul/Aug 2009

Facing a potential cash crunch, Air Canada is scrambling to put together a package of measures to avoid a second bankruptcy visit in six years. One critical step was accomplished in June: tentative agreement with unions on a 21–month freeze on pension contributions and wage rates, which provided relief from credit card covenant issues this summer. Assuming that the labour deals are ratified, the next step is equally challenging: raising C$600m–plus in new liquidity in the current environment.

Of course, even if all of the pieces in the “near–term survival” puzzle fall into place, all that additional debt will not make it easier for Air Canada to become viable in the long run. The airline needs equity, not more debt. Perhaps a future project for Lufthansa?

Like other global carriers, Air Canada has been hit hard by the collapse of premium traffic due to recession. It has also faced stiff competition from LCCs, particularly WestJet, which has been pricing aggressively in recent months, is rapidly gaining market share and remains highly profitable.

There are special challenges, including a pension deficit of almost C$3bn ($2.6bn) and heavy debt obligations. Also, nearly all of Air Canada’s union contracts became amendable in May and June. The workforce is unhappy, having made significant concessions in the last bankruptcy.

Air Canada completed an 18–month bankruptcy reorganisation in September 2004, emerging with a reduced cost structure and an improved balance sheet. The restructuring reduced net debt and capitalised leases from C$12bn to C$5bn and gave the company a relatively healthy cash position of C$1.9bn ($1.6bn). But the cost cutting programme initiated in bankruptcy fell far short of giving Air Canada a competitive cost structure (see Aviation Strategy, November 2004).

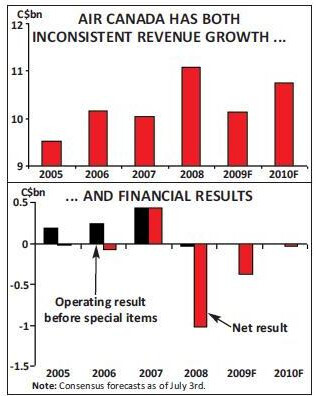

After a promising early turnaround in late 2004 (in the wake of three and a half years of losses totalling C$1.7bn), Air Canada was never able to consolidate it, achieving only marginal operating profits in 2005–2007 (2–4% of revenues) and an annual net profit only once this decade (in 2007).

Last year saw a steep C$1bn ($860m) net loss, and the first–quarter 2009 results were truly horrendous: operating and net losses of C$188m ($162m) and C$400m ($344m), respectively (7.9% and 16.7% of revenues). The net results included sizeable foreign exchange losses.

Leadership turmoil

Despite raising more than C$800m ($688m) in asset–backed financings since late 2008, Air Canada’s cash reserves amounted to only C$1bn ($860m) or 10% of last year’s revenues in early May. The reserves would not have covered the C$1.2bn ($1bn) of debt and pension obligations coming due in the next 12 months (before relief from labour deals). But the immediate concern was that Air Canada seemed certain to violate covenants in a credit card processor agreement on June 30th, potentially requiring it to post C$300m–plus ($258m) extra cash with the counterparty. Not surprisingly, there has been leadership turmoil. In late March Montie Brewer resigned from the president/CEO position, which he had held since December 2004, and was subsequently replaced by Calin Rovinescu, who was the chief restructuring officer during the 2003–2004 bankruptcy. Also, COO Bill Bredt retired and was replaced by Duncan Dee.

Because of Rovinescu’s earlier role, there was initially much speculation that he was brought in to prepare Air Canada for a second round of bankruptcy. But the new CEO has made it clear that he is determined to avoid this. Furthermore, he wants to safeguard Air Canada’s brand, network and other strengths, “so we can take advantage of the economic recovery when it comes, which it surely will”.

At Air Canada’s AGM on May 8th, Rovinescu outlined five priorities that Air Canada must tackle: finding an alternative pension funding solution, achieving labour stability (likely to be required by financial institutions before providing assistance), building liquidity, attaining a competitive cost structure and finding new sources of revenue.

In late May, Air Canada won some breathing space by obtaining covenant relief with one of its main credit card processors. The problem had been that the unrestricted cash requirement in that particular agreement was due to increase from C$900m ($774m) to C$1.3bn ($1.1bn) on June 30. The MoU, dated May 25, lowered the minimum cash requirement to C$800m ($688m), in return for Air Canada providing the processor with some undisclosed security.

The credit card deal was conditional on Air Canada’s unions agreeing to pension relief and labour stability by June 15th. Amazingly, the airline was able to secure tentative deals with all five of its unions in that tight timeframe. However, members of the largest union (machinists) narrowly rejected their pension deal on June 30th (50.8% voted against) – a disappointing but hopefully only temporary setback as Air Canada continues to work on other pieces of the puzzle.

Despite contributing more than C$1.7bn ($1.46bn) into its pension plans since 2004, Air Canada has a huge pension deficit, estimated at C$2.85bn ($2.45bn) at the end of March. The airline’s defined benefit pension plans, covering some 25,000 retirees, were originally expected to require a staggering C$865m ($744m) cash contribution this year (a February estimate by Bank of America/ Merrill Lynch). In March the Canadian government proposed temporary relief measures for federally regulated pension plans that, among other things, extended the funding timeline from five to 10 years. Under the proposed new rules, Air Canada would have had to make a contribution of around C$570m ($490m) this year, of which some C$225m ($194m) was due in July.

But Air Canada needed a more radical interim solution, so it approached its unions in the spring. The tentative labour deals concluded in June include a 21–month moratorium on pension plan contributions, to be followed by modest fixed payments for three years: C$150m in 2011, C$175m in 2012 and C$225m in 2013.

Concurrently, Air Canada secured what it calls “labour stability” agreements for the same period, meaning extension of existing contracts “on a cost–neutral basis” (no changes to wage rates) and “no strike” provisions.

As of July 6th, two of the five unions had ratified their agreements, and flight attendants and pilots were expected to conclude voting on July 12th. After a weekend of talks and “clarification of certain issues”, the machinists’ agreement was due to be resubmitted for ratification on July 14th. It appears that the deal was sweetened to include job security assurances. Union members had worried that their aircraft maintenance, repair and overhaul could in the future be transferred to Air Canada’s El Salvador–based sister company Aveos Fleet Performance (formerly Air Canada Technical Services), which ACE spun off in 2007 (retaining a 27.8% stake). Aveos currently does not have the capability to do that work but could expand facilities.

All the labour deals are contingent on Air Canada raising a minimum of C$600m ($516m) in new financing. The pension plan moratoriums also require government approval.

As part of the deals, unionised employees will take a 15% equity stake in the airline and receive a board seat. Proceeds from the stock sale will be used to reduce the pension deficit.

Significantly, the unions got the pension protections they had hoped for. Air Canada has promised its workers that it will retain the current defined benefit plans without restructuring the pension benefit formula. The benefits offered by the current plans are believed to be among the best in the private sector. Nor does Air Canada contemplate a transition to a defined contribution plan design — the cheaper formula that the US legacies have typically adopted after terminating their defined benefit plans in Chapter 11.

Building liquidity

Pension protections are without concessions – it would seem that Air Canada’s unionised workers are getting a great deal under the circumstances. Add to that the strong possibility that the pension plans would be terminated in a new round of bankruptcy, and it seems inconceivable that the labour deals would not be ratified. Raising C$600m–plus of fresh liquidity — which can probably only be through debt issuance — will be a challenge even if the labour deals are ratified, given the horrendous combination of tight credit markets, lack of any sign of economic upturn, banks being less interested in aircraft and related assets these days, and Air Canada’s perilous financial position and already highly leveraged capital structure.

But the credit markets appear to be stabilising. US airlines have been very active in raising funds through secured financings in recent weeks. Even United, which many fear could face liquidity pressures this winter, managed to sell US$175m of bonds secured by aircraft spare parts in late June. But United paid a very high price, and rating agencies warned that it may have difficulty raising a large amount of new capital in the near term.

Air Canada was able to raise C$800m ($688m) in December–May through a multitude of small secured transactions, including many sale–leasebacks with GE Capital. It still has up to C$1bn ($860m) of assets that could be monetised, including 777s, Embraer aircraft, airport slots and real estate. But CEO Rovinescu noted at the AGM that “creative solutions will be required”.

Air Canada is casting its net wide and has said that it is in talks with “several potential lenders”. To start with, it is believed to have asked Export Development Canada, the federal financing agency, for a C$200m ($172m) asset–backed commercial loan.

Then there are the “key corporate and commercial partners that derive benefit and expect to continue to benefit from a financially strong Air Canada” (as Rovinescu put it). The most obvious of those is Groupe Aeroplan, which operates Air Canada’s FFP.

Air Canada is disadvantaged, compared with its US legacy counterparts, in that it no longer owns key assets such as an FFP that could be used to generate liquidity. In the past two years US carriers have raised significant cash through the forward–sale of frequent–flyer miles to financial institutions. Air Canada’s FFP, maintenance unit and regional feeder Jazz were sold to parent company ACE as part of the restructuring in September 2004.

However, Rovinescu made the point recently that ACE purchased those subsidiaries at fair market value from Air Canada, based on independent valuations, and that the C$2.2bn ($1.9bn) proceeds collected by Air Canada helped fund essential fleet renewal (60 Embraer aircraft and 16 777s), aircraft refurbishment and the pension plan.

Nevertheless, it is an odd situation. One would think that ACE, as the 75% owner of Air Canada and with C$800m–plus in cash at year–end, would be the first to come to the airline’s rescue. But, having spun off most of its stakes in the former Air Canada units, ACE is looking to wind down the holding company structure and distribute its net assets to shareholders at the earliest opportunity.

Aeroplan, a key partner that depends on its commercial relationship with Air Canada, has been helping out. At the end of June, it provided Air Canada with a new secured, revolving loan of up to C$100m (equal to the previous 60 days’ purchases of reward seats). This effectively replaced a November 2008 “faster payment” agreement and will terminate in June 2010 or when Air Canada has raised the C$600m required by the union agreements. The loan is secured by the airline’s interest in Air Canada Vacations.

Cost cuts, no major shrinkage

Air Canada’s ability to raise the full C$600m – and whether that will be enough – will also depend on how the current July/August peak demand period shapes out and whether the economy shows any sign of improvement by the autumn. In the absence of the latter, lenders might balk at helping Air Canada and, as demand weakens into the winter, its problems could intensify. Air Canada now aims to trim “at least C$250m ($215m)” from its annual costs by 2011. But that would be only 2.2% of last year’s C$11.1bn operating costs. Capacity is now slated to fall by 4–5% in 2009 (slightly more than previously envisaged), following a 1.2% decline last year.

Some analysts have called for much tougher measures. In April one Torontobased analyst suggested that Air Canada needed to cut over C$2bn ($1.72bn) from its fixed costs, that it had spread its operations too thin, that the number of routes should be slashed by over 50% and that such a drastic surgery could best be achieved in bankruptcy (an unusual argument from an equity analyst, but at that point the stock had probably already lost most of its value).

Air Canada’s management has firmly rejected the “shrink to profitability” calls. Rovinescu said in May that “this is not about massive layoffs or shrinkage, but about operating in a better, smarter, more effective way with a benchmarked matrix for ‘best of class’ while not conceding market share”. Also, an overriding consideration would be to safeguard the brand.

This is an understandable (and reasonable) strategy for a carrier that enjoys so many inherent advantages. Air Canada still controls 60% of the domestic market, is the only airline in Canada that offers a business class product, has well–situated hubs (Toronto, Montreal, Vancouver and Calgary), has a strong global network and is likely to remain Canada’s dominant long–haul international carrier for many years to come. It has a new fleet – the renewal programme will be completed in the current quarter with the delivery of the 18th and final 777 – and one of the world’s best customer loyalty programmes. When economic growth resumes and business travel comes back, Air Canada is uniquely placed to benefit from it.

So while cutting capacity in the weakest markets, Air Canada has undertaken a surprising amount of new expansion. This year has already seen three new long–haul destinations (Geneva, Fort de France and a return to Rome), a 35% increase in transatlantic capacity from Montreal, more Toronto–Italy and Vancouver–China flights, new transborder routes such as Calgary to San Diego and Portland, and many new domestic routes. Nevertheless, mainline ASMs still fell by 8.1% in January–June, slightly less than the 9% traffic decline.

Air Canada is also trying to “put creativity to work to generate new sources of revenue”. But most of the initiatives announced so far (a low fare guarantee, elimination of the call centre booking fee, planned FFP enhancements, etc) seem more aimed at defending market share from WestJet than creating new revenue streams, for example, with new travel enhancement products. Ancillary revenues have proved lucrative and recession–resistant in the US. Then again, Air Canada is the expert: it pioneered à $1 offerings and other innovative revenue strategies in North America earlier this decade, so perhaps those activities are already fully developed.

Air Canada is well aware that it needs to get its costs down to levels that make it competitive in North America. Its non–fuel unit costs are significantly higher than the US network carriers’. It does have a unit revenue advantage. But as Rovinescu put it: “while premium customers will continue to be a priority for us, we cannot rely on this market segment to fully cover our cost disadvantage”.

The other long–term goal is to get EBITDAR margins to a “more competitive and financeable 16% once we see the end of the recession”. But, as with the unit cost reduction goal, it is not at all clear how Air Canada will get there.