Vienna hub the key to Austrian's entry into a global alliance

August 1999

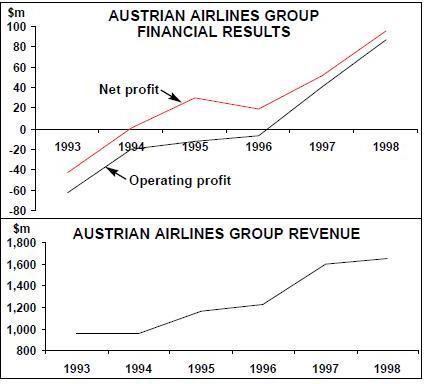

In 1998 Austrian Airlines Group posted the best results in its 40–year history (see chart, right). So far this year, the Austrian government has reduced its stake to below 50% for the first time, and the Group is well on target to produce another record performance. But despite this success, can Austrian Airlines really succeed long–term in an aviation world where small carriers appear vulnerable and powerless?

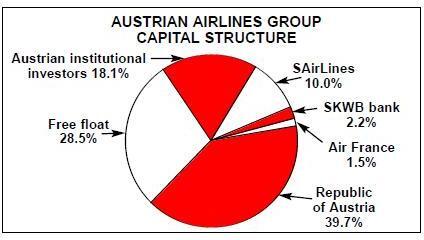

Austrian Airlines was founded in 1957, and shares were first listed on the Vienna stock exchange in 1988. By the following year 37.9% of the company was in private hands, with Swissair increasing its stake to 8% and ANA owning 3.5%. In 1990 the Austrian government’s stake fell to 51.9% as Swissair upped its interest to 10%, ANA to 9% and Air France took a 1.5% share. In April 1999, however, ANA sold its stake to two Austrian banks and the following month an issue of 800m shares (which raised ATS 3bn — all of it earmarked for aircraft purchases) resulted in the Austrian government’s stake being reduced to 39.7%, thereby doubling the free float to 28%. The current capital split is shown on page 19, and market capitalisation as of the end of July is ATS 8.3bn ($713m).

The Austrian Airlines Group includes Austrian Airlines, Lauda–air and Tyrolean Airways (which is now responsible for the Group’s domestic and regional traffic). Austrian bought a 42.9% stake in Tyrolean in 1994, and increased its share to 85.7% in 1997 and 100% in 1998. A 36% stake in Lauda–air was acquired in 1997. The Group carried 7.8m passengers in 1998 — 12.2% up on 1997, and the network covers 160 scheduled destinations in 68 countries, plus 80 charter destinations. The Group also includes shareholdings in financial and insurance companies, IT and travel firms.

The record results of 1998 look set to continue. First–quarter 1999 Austrian Airlines Group figures show a 17.0% increase in RPKs, helping the company achieve a 3.8% increase in turnover. The Group recorded an ATS 155m ($11m) pretax loss in the quarter compared with an ATS 42.3m loss in 1Q98, but this comparison is distorted by aircraft and investment sales in 1998. Once these have been stripped out, the net result for the first quarter of 1999 was 14.3% up, which “exceeded expectations”, the company says. The Kosovo crisis and the situation in Turkey — which has hit charter flights — will affect second–quarter results (half–year results are released on August 18), but the airline is still on target to beat 1998 profits in full–year 1999. Traffic was up by 9.3% in January–May 1999 compared with the same period in 1998.

The Group’s management has set ROE and ROCE as the benchmarks for Austrian’s performance. ROE increased from 3.2% in 1996 to 18.4% in 1998 and ROCE rose from 3.6% to 9.6% over the same period, and these will be key indicators for 1999 results.

Top-ranked management

Much of the credit for Austrian’s success in recent years must go to Herbert Bammer and Mario Rehulka, who were appointed as joint presidents in 1993 (when the airline’s losses were at their greatest). Both men have been with Austrian since the 1960s, and so know the company inside–out. Despite the theoretical problems of having two executives in charge in an airline, the Bammer/Rehulka double act appears to work smoothly.

The turnaround they engineered has been based on three principles: keeping a grip on the domestic market by investing in potential competitors (most crucially Laudaair); building up Vienna as an east–west hub; and cost–cutting. These efforts are still continuing, but it is a more recent fourth strand of their strategy — international alliances — that holds the key to the future of Austrian Airlines.

The Austrian market and the Vienna hub

Austrian Airlines Group’s acquisition of 100% of Tyrolean Airways and 36% of Lauda–air means that the Group’s share of the domestic market is approximately 60%. However, Austria is tiny compared with the major European markets (its population is just 8.1m), although Austrian is trying to extend its catchment areas into the neighbouring countries of Slovakia and Hungary.

Because of geography, the Vienna hub is an important asset for the group. Transfer passengers are growing at around 18% per annum for Austrian — almost three times the rate of growth for direct passengers. The Group accounts for 60% of slots at Vienna, which has been developed by the Group as a key connector to central and eastern Europe, and the central Asian republics of the former USSR. Austrian operates to 28 destinations in these regions, all linked via a four waves per day system at the Vienna hub. Minimum connection time at Vienna is 25 minutes (although in practice it can be a bit longer than this as there are two terminals). There is a reasonable amount of capacity left at Vienna, although plans are being prepared for a third runway in the next decade.

Curiously, Vienna has a rather odd advantage for Austrian in that it is among the more expensive airports in Europe — and that discourages other airlines from starting operations there. Although the local ground–handling monopoly is starting to break up, Vienna will remain a high–cost hub. Bammer insists that moving operations to the most obvious alternative — Bratislava, just 60km away in Slovakia — is a complete non–starter, and that Vienna will remain as the Group’s hub.

Planned new destinations for the spring of 1999 included Atyrau in Kazakhstan, Baku in Azerbaijan and Yerevan in Armenia, but delays in acquiring the relevant traffic rights have meant a postponement of these routes until the summer of 2000. Tashkent in Uzbekistan is another possible new destination. Austrian is particularly looking to launch services into eastern European cities that are economically important, such as ports or cities in oil–producing regions. At present, eastern Europe accounts for just 16% of passengers carried by Austrian, although this proportion is rising rapidly. The Austrian Airlines Group also indirectly owns 19.4% of Ukraine International Airlines, which operates three aircraft.

At present, Austrian’s main rival as a connector into eastern Europe is Lufthansa, with two east–west hubs — Frankfurt and Munich.

Global alliances

The importance of the Vienna hub gives Austrian a key bargaining chip in the hunt for international alliances. Austrian established the Atlantic Excellence alliance with Delta, Swissair and Sabena in 1997, and the Qualiflyer alliance with Swissair and Sabena in March 1998. However, the future of Austrian’s alliance strategy is uncertain following the announcement of the Air France/Delta tie–up.

As Aviation Strategy commented in the July issue (see pages 1–2), the Air France/Delta alliance could eventually lead to Swissair joining the oneworld group (although this is now looking less likely). Such a move would seal the fate of the Atlantic Excellence alliance, but at the same time Swissair would want to keep Qualiflyer going whoever it links up with, as Qualiflyer is central to Swissair’s strategy. But whether Austrian would want to stay within Qualiflyer if it/Swissair aligns itself with a global alliance is another matter.

The Vienna hub’s importance as a gateway to eastern Europe might even prompt British Airways or Lufthansa or whoever into insisting that Swissair brings in Austrian as a condition of joining a specific global alliance. In that case Austrian would have a very strong hand — although this does assume that Austrian would want to join whichever global alliance Swissair eventually picks.

One thing is certain, however, and that is that Qualiflyer is now dwarfed by the megaalliances of oneworld, Star, Wings and Air France/Delta. Sooner or later Qualiflyer/ Austrian/Swissair will have to link up with one of these alliances, but for the moment, Austrian is keeping its views to itself. All Bammer will say is that: “Ideally, the most comfortable arrangement with a partner is when we own it 100%! But we realise that we must be part of a global alliance, although we would prefer not to have equity links.”

Cost-cutting

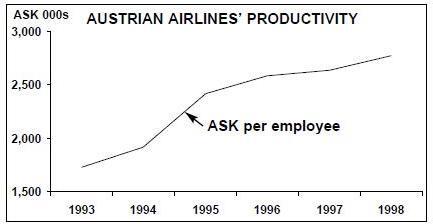

Operating costs per ASK have fallen by 20% over 1993–1998. Over that period — and despite large increases in capacity — staff numbers have fallen by 1,000 to 4,600 today. Yet Bammer and Rehulka have taken a softly–softly approach to staff reductions in a (successful) effort to maintain staff morale. Reductions have come through natural wastage and voluntary redundancies; there have been no involuntary job–losses. In a small company such as Austrian, whose culture is essentially very conservative and slow–moving, forced job losses would have had a disastrous effect on how remaining staff view the company. Today, most staff have share options and all employees receive a performance–related bonus.

One informal goal has been to reduce costs per ASK to the AEA average, says Bammer (Austrian had one of the highest unit costs five years ago). According to Austrian, the company has almost achieved this goal, and is now aiming to stay below the AEA unit cost average. However, Bammer admits that “cost–cutting is getting harder”, as the first cuts are always the easiest.

Cost–cutting will not affect planned capacity growth. Target capacity growth for 1999 was 16%, but this is now more likely to be 11–12% due to the effects of the Kosovo crisis. At one time this forced the cancellation of services to 10 destination in the region, costing Austrian ATS 10m ($740,000) per week, although the only route still cancelled is Belgrade. The Kosovo crisis also prompted Austrian to impose an indefinite freeze on staff recruitment.

But despite the Kosovo effect, route expansion has gone ahead with the start of services to Chisinau, Tripoli, Montreal, Edinburgh, Lyon, Orlando and Puerto Plata so far this year. Capacity has also been increased on selected existing routes.

Capacity increases will largely be served by a substantial A320 order placed earlier this year (see table, page 16). The aircraft will be delivered over 2000–2005, and will help reduce the fleet’s average age to five years.

The government stake

The government’s stake — held through OIAG, the Austrian privatisation agency — will be diluted again if any further capital increases are undertaken (as the government has stated it will not participate in them), but at present there is no timetable for a sale of the government’s interest. Bammer claims that the government stake, now it is a minority, will not affect decision–making at the airline. That may be so, but in any other market investors would be nervous at such a substantial government stake in a national airline.

Bammer counters this by claiming that the Austrian stock–market is substantially different to, for example, the London market. “Here the small shareholders and the banks hold stocks for the long–term,” he says “and are much less likely to react to any short–term developments”.

The key decision

Despite all their success since 1993, Bammer and Rehulka could undo the good work by making the wrong global alliance choice. “If we pick the wrong partner” says Bammer, “that is all we will be remembered for.” Austrian insists its partnership with Delta will continue and deepen (code–sharing between Austrian and Delta began on Vienna–Dubai from June 25, and will be extended to Vienna–Tblisi in August and Vienna–Atlanta from October) — just as it insists that Qualiflyer will continue as well. But there is little else that the airline can say publicly.

Niki Lauda, now a minority shareholder in Lauda–air, has recently urged Austrian to make a decision on an alliance partner as soon as possible. There is even speculation that Lauda may prefer Star as the ideal candidate. That’s an interesting proposition, as between them Lufthansa and Austrian would control the three main hubs into eastern Europe, effectively locking out all the other global alliances from easy access to the region. It’s a scenario that the other global alliances — and in particular oneworld — should be extremely wary of. If a Star/Austrian deal did come off then oneworld’s gateways into eastern Europe would have to come from Warsaw/LOT and/or Budapest/Malev.

Austrian may therefore find that it is wooed by both oneworld and Star — a situation that Bammer and Rehulka would relish. Yet Bammer’s views on Niki Lauda’s presumed preference for Lufthansa are firm. “Niki Lauda doesn’t speak for Austrian” he says, “and anyway it is us that owns 36% of Lauda–air.” However, this may be more a case of damping down alliance speculation than a direct rebuff of the Lufthansa/Star alliance option.

Bammer says that Austrian’s global alliance decision will be made by the end of 1999 at the latest, and that any speculation by outsiders on the preferred partner is just fruitless. Maybe so, but Austrian must realise that its choice can only be decided once Swissair makes its own global alliance decision. Although Bammer will not comment, Austrian may be adopting a wait–and see strategy. It certainly cannot afford to make a premature choice that could be made totally irrelevant by a different Swissair move (which would then split Qualiflyer). It would be far better, surely, to let Swissair choose first. Not only would the options available become far clearer to Austrian, but which way Swissair swings may make the “losing” global alliances even more keen to prevent Austrian going the same way.

With the Vienna east–west hub Austrian holds an important card, and Bammer is astute enough to know that not only is it Austrian’s entry into the global alliance game, but that he doesn’t have to play it until absolutely necessary.

| Current | Orders | ||

| fleet | (options) | Delivery/retirement schedule/notes | |

| MD-80 | 15 | 0 | All to be retired by 2002 |

| A310 | 3 | 0 | All to be retired by 1Q2000 |

| A320 | 3 | 10 | Delivery in 2000-2005 |

| A321 | 5 | 2 | One in 1999, one in 2001 |

| A330 | 2 | 2 | Delivery in 1Q2000 |

| A340 | 4 | (2) | |

| Fokker 70 | 6 | 0 | |

| TOTAL | 38 | 14 (2) | Average fleet age = 7 years |