Fastjet: Right strategic message, terrible financials

September 2014

Fastjet when it launched in 2012 appeared to have the right strategy at the right time — adapting the LCC model to open up the African market (see Aviation Strategy, September 2013). But things have not gone to plan, and financial results have been terrible.

Part of the losses are attributable to the mistake made by Fastjet before start-up when it bought into Lonrho’s Fly540 airline operations as a short-cut to obtaining multiple AOCs and implementing a pan-African LCC strategy. It rapidly became clear that the Due Diligence process had failed to identify numerous difficulties with Fly540 and that Fastjet had invested in a major hidden liability which drained cash.

While Fastjet successfully established a Tanzanian airline, the other Fly540 airlines were all suspended and are being disposed of. The Kenyan business was appraised as not being convertible into an LCC. In Ghana the restructuring of Fly540 was blighted by “infrastructure issues at Ghanaian airports” and “adverse economic conditions”. In Angola there were, among other things, “logistical hurdles of importing aircraft spares”, which made the country a poor investment opportunity.

Fastjet Group’s accounts for 2013, published in July, lack detailed P&L analysis, but there is a segmental break-down — see table above.

The three suspended Fly540 airlines (in Angola and Ghana plus the catch-all “Central” division) accounted for $59m or 73% of the Group’s net losses, mostly as the result of the original investment being written down or off. However, at the EBITDA level they accounted for just $19.8m or 48% of Fastjet’s total operating loss of $41.2m on revenues of $53.4m.

An operating loss is expected in the first years of any airline start-up, but the scale of losses at Fastjet Tanzania, the core LCC operation, is disturbing. At EBITDA level Fastjet lost $21.4m on $26.1m of revenues, an operating loss margin of 82%. Air Arabia, the first Middle East LCC, was making a profit in its second year of operation in 2005.

Understandably, Fastjet management prefers to focus on the discontinued operations when commenting on the losses. CEO Ed Winter: “When we started we thought [the various Fly540 operating licences] would have a benefit that would outweigh management time and cost but the more we worked on transforming those businesses we realised they weren’t viable.”

The explanation has been persuasive; Fastjet, which is quoted on AIM (London’s Alternative Investment Market) has attracted new investors, raising £15m in new equity in April and May. But this amount of new capital will be nowhere near enough to fund continuing losses. Interim results for the first half of 2014, released at the end of September, showed an EBIT loss of $30.5m, of which $13.9m was from the Tanzanian operation, most of the rest from Fly540 Ghana and Angola operations.

Some LCC metrics may shed light on Fastjet’s financial performance.

-

Aircraft utilisation, which is a function of the network and schedule from the Dar es Saleem base, was only averaging 5.7 hours a day in the first quarter of this year though this has now improved to 9.9 hours a day by August. The target is 11.7 hours by the end of the year, which is what would be expected for a fleet of modern A319s. Fastjet’s dilemma is that by adding new flights it may damage its yield and/or its load factor. It also has to maintain its very good punctuality record — 90% (arrival within 15 minutes).

-

Fastjet set out to stimulate new traffic, including a high proportion of first time flyers, with some very low initial fares – under $50 on average in early 2013. However, average revenue per passenger (including ancillaries) improved to $82 in the first half of 2014, which is in line with LCC norms for this type of network.

-

Load factor averaged just 72% in 2013, though in August Fastjet reported 79%. The airline needs to get its load factor up to at least easyJet levels, mid 80s, which would mean that it would be carrying about 280,000 passengers per aircraft per year.

-

Unit costs are out of line with those of successful LCCs. In 2013 costs averaged US¢16.7 per ASK (of which only US¢3.6 was fuel), well over twice the required level. Fastjet suggests that the airline will grow out of this problem, as there is a high proportion of fixed costs which will be unchanged by additions in capacity. The target is to reduce unit costs by 27% by the end of this year.

-

Unlike other start-ups Fastjet, because of the Fly540 legacy, has an over-manning issue. There are 433 staff on the payroll, at an average remuneration of $34,000. Around 120 employees would be an efficient level for its current A319 operations. There are 130 flight crew which implies about 8 crews per A319; an efficient level would be 5 crews assuming 11.7 hours/day aircraft utilisation (rather than the current level).

Rapid growth is therefore essential for Fastjet. The plan is to go to 24 A319s by 2018, though a 34-unit fleet by that date has recently been mentioned by Ed Winter. Negotiations have apparently been held with Airbus. The immediate challenge, however, is to source two A319s to replace aircraft due to returned to a lessor.

Expansion will require another major round of funding. Fastjet has mentioned both new African backers and an airline investor. Etihad inevitably has been mooted though, with Fastjet in talks with Emirates about a code-share at Dar es Salaam, there is an outside possibility of a deal with flyDubai. EasyJet doesn’t seem interested despite, or perhaps because of, the Stelios Haji-Ioannou link (he owns about 10% of Fastjet, having invested $1.6m in the latest funding round and swapped his €605,000/year consultancy contract for shares).

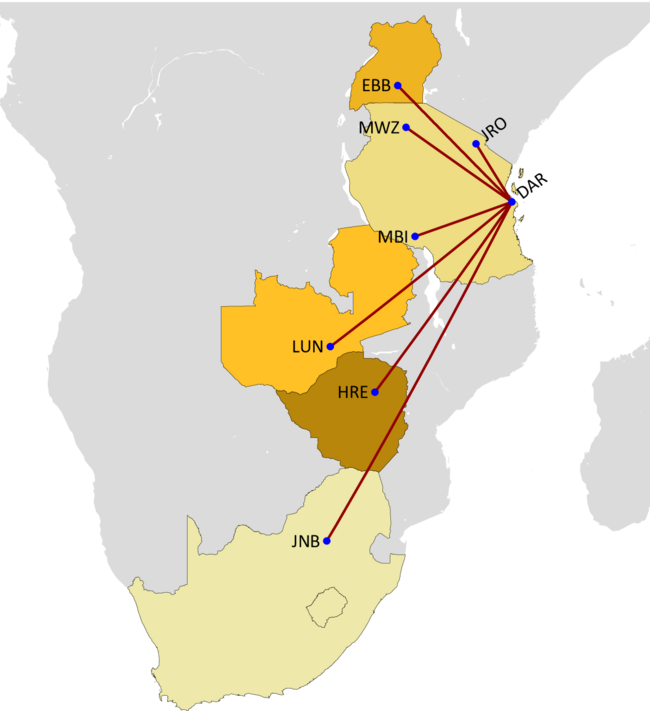

Meanwhile, Fastjet has to accelerate the establishment of new operating bases. It aim to obtain its AOC for Zambia by the end of 2014, but Kenya, which was to have been the first base outside Tanzania has been proving problematic (one issue is that Fastjet would be obliged to fly domestically for a year before adding international services). Potential bases in Uganda and Zimbabwe are also being explored.

So far Fastjet has not attempted to enter Africa’s huge potential domestic markets – Nigeria and South Africa (see chart below) – simply because they are perceived as being too difficult. However, Fastjet’s first international route, launched last November, was to Johannesburg, and a base there is slated for 2016.

Stelios Haji-Ioannou has again been rude about Fastjet management but probably with more justification that at easyJet. The airline is not only legally based in the UK but also its top managers work out of London Gatwick, which seems a little remote from the key African markets. And despite the huge losses and a share price languishing at 1p, the CEO earned $794,000 last year and the CFO, recently departed, $412,000.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Tanzania | 3 | 3 | 5 | 6 | 6 | 6 |

| Kenya | 3 | 6 | 8 | 8 | ||

| Zambia | 2 | 3 | 3 | 3 | ||

| S. Africa | 3 | 5 | 7 | 7 | ||

| TOTAL | 3 | 3 | 13 | 20 | 24 | 24 |

| Tanzania | Angola | Ghana | "Central" | TOTAL | |

| Revenue | 26.1 | 18.8 | 8.5 | 53.4 | |

| EBITDA | -21.4 | -6.8 | -2.1 | -10.9 | -41.2 |

| Interest | -1.3 | -1.5 | -0.5 | -3.3 | |

| Depreciation | -0.6 | -2.4 | -2.2 | -1.2 | -6.4 |

| Impairments | -12.2 | -5.9 | -13.4 | -31.5 | |

| Tax | 1.5 | 1.5 | |||

| Sub-total | -0.6 | -15.9 | -9.6 | -13.6 | -39.7 |

| Net Result | -22.0 | -22.7 | -11.7 | -24.5 | -80.9 |