United Continental: Power of the combined networks

May 2011

Even though synergies from the October 2010 merger have not yet kicked in, the new United is already financially outperforming its peers. But there are challenges on the horizon: achieving successful labour and systems integration and de–leveraging the company to facilitate post–2012 fleet growth and modernisation.

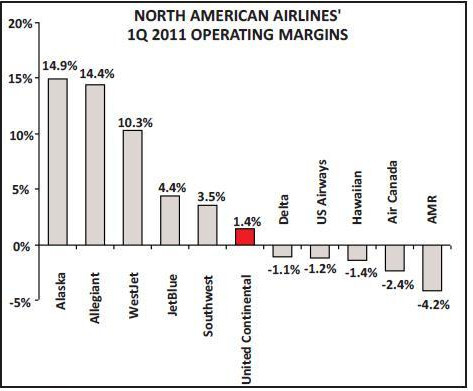

The first quarter results of United Continental Holdings (UAL) confirmed what was already evident in January: with the ink barely dry on the merger documents, the combined entity is already outperforming its peers in terms of profit margins and unit revenues.

UAL was the only one of the top three US legacies to post an operating profit for the March quarter: a modest $111m before special charges, or 1.4% of revenues.

By comparison, Delta and AMR had operating losses of $85m and $232m, respectively. Furthermore, United’s operating profit improved from the year–earlier pro forma result despite this year’s headwinds, namely the Japan crisis, severe weather and sharply higher fuel prices. UAL also escaped with a lower net loss than its peers — $213m, compared to Delta’s $318m and AMR’s $436m. UAL has also been outperforming the industry in terms of unit revenues. In late April BofA Merrill Lynch calculated that its consolidated first–quarter PRASM gain of 9.9% was 1.4 points above the industry average. Also, for the second quarter running, United’s PRASM gains exceeded the industry gains in all regions, led by Latin America (up 15.4%) and the Pacific (up 13.4%).

Of course, in the short term United’s relatively high exposure to Japan (5% of its total seats, second only to Delta’s 7%) may have temporarily eliminated its PRASM lead. BofA ML estimated that the Japan crisis has reduced United’s PRASM growth by 2–3 points, essentially bringing it in line with sector gains in March–April.

The first quarter results included “less than $30m” of actual merger synergies, which will start accelerating in the second half of this year. United still expects to harvest 25% of the total projected $1–1.2bn of annual net synergies in 2011.

So what is driving United’s margin and RASM gains at this point in time? First, it is clear that the powerful combined network is really paying off in terms of attracting extra business traffic. Calling the combined network a “potent asset”, CEO Jeff Smisek noted in UAL’s 1Q earnings call on April 25 that the network is “not only global but globally diverse, with broad presence in the Atlantic, Pacific and Latin America, allowing us to optimise our aircraft to best fit the current and expected demand in each market.”

It obviously helped that both United and Continental had strong networks that were performing well individually from the revenue perspective. When the merger closed, the two were quick to introduce reciprocal FFP and preferred seating benefits and to begin optimising the network and schedules, to offer customers more travel options.

Second, all the evidence suggests that the pricing, sales and revenue management teams from the two airlines have worked well together and that many “best practice” initiatives are paying dividends. The fact that United and Continental had been alliance and JV partners for two years has obviously helped.

Third, despite all the upheaval, so far at least the airlines have maintained high operational reliability – a key factor for retaining business traffic. The new United had the highest DOT ranking in terms of both on–time arrival and completion factor among the four US global carriers in 2010 (US Airways ranked second, American third and Delta last).Fourth, the new United offers an attractive, innovative product range and has an all–out focus on the business traveller.

As Smisek put it, “We run our airline with the business traveller in mind”.

The merger is obviously giving UAL added flexibility to maintain capacity discipline.

Since January the combined entity has trimmed its 2011 system capacity forecast from 1.5% to roughly flat. All of that positions UAL well for the recovery of the global economy and travel demand, which is led by bookings from large corporations, as well as the high fuel cost environment. As Smisek noted, the business travel mix provides “more stable demand even in times of rising fares”.

Add to that the accelerating merger synergies and the current growth and capital spending hiatus, and UAL should be able to generate significant free cash flow in the next year or two. BofA Merrill Lynch expects UAL’s free cash flow to exceed $2bn in both 2011 and 2012 (after last year’s $2.5bn).

But UAL also has significant near–term debt obligations, as well as increasing aircraft spending commitments from next year. It has a staggering $2.6bn of scheduled debt and capital lease payments in 2011. Aircraft spending will rise as the 787 deliveries begin in the first half of 2012 and as United focuses on modernising its fleet, which has an average age of 12 years.

However, the combine had an unprecedented $8.9bn in unrestricted cash, or about 25% of trailing 12–month revenues, at the end of March. Carrying such an amount of cash gives UAL flexibility as it integrates and manages its debt maturities.

The new United will be the first North American airline to operate the 787. The management believes that the “multi–year head–start over others” with that aircraft will give UAL a true competitive advantage.

With those considerations in mind, UAL’s top executives indicated that they are very focused on de–leveraging the company at the same time as the merger integration takes place.

Of course, the biggest challenge for the combine will be to successfully integrate labour groups and technology platforms. Those have traditionally been the riskiest aspects of airline mergers, though the Delta/Northwest experience offered much hope, as well as a useful blueprint for avoiding problems, for new–generation mergers (see Delta briefing, Aviation Strategy Jan/Feb 2010).

Merger integration

The integration efforts are proceeding as planned. To start with, the aim is to harmonise policies affecting the customer experience this year. From mid–May customers will begin to see more airport, process and branding harmonisation, starting at the hubs. But achieving truly seamless service requires integration of IT platforms and cross–training many employees – processes that take considerable time. A key milestone will be switching to a single reservations system, which is expected to take place in the spring of 2012.

Co–locating at airports and repainting the fleet will also take time. As of late April, check–in, ticket counter and gate facilities had been co–located at 36 airports, but the process is expected to continue through 2013. Some 30% of the fleet (460 aircraft) have so far been repainted in the United livery.

The combine expects to announce details of its new loyalty programme in the third quarter, for implementation in 2012. UAL continues to expect to secure a single operating certificate by the end of2011. Network optimisation is under way and the early stages of cross–fleeting began in the first quarter. By late April some 900 cross–fleeted mainline departures had been completed domestically and on the Houston–Lima route. The management noted that cross–fleeting is a valuable tool, allowing right–sized aircraft to be used to better match supply and demand across the networks.

Labour integration will be a long and arduous process because of the high degree of unionisation, the large number of unions and the fact that in many cases the same work groups at the two airlines are represented by different unions. But the process is under way and recent months have seen a steady stream of announcements of tentative or ratified agreements covering the earlier stages, including one with the flight attendants.

Progress is apparently also being made in negotiations with the pilots. Smisek originally set a rather ambitious goal of obtaining all of the joint collective bargaining agreements by the time a single operating certificate is secured.

In a recent Forbes video interview, Smisek spoke of his determination to develop a new culture at UAL, one in which people take pride in their work and respect each other and the management. In such a culture the workforce would be more likely to deliver a good product to customers. Smisek noted the risk in any integration that one ends up with mediocrity and that ideally the new culture would take the best of both companies.

In reality, United has a history of extremely poor labour relations while Continental’s have been among the industry’s best. However, much of the strife at United was directed at what the unions considered successive poor–quality managements.

With the Smisek team being highly regarded in the industry, there would seem to be a fair chance of achieving a good culture at the new United. The revenue synergies from the merger will ramp up much more significantly in 2012 after United has obtained its single operating certificate and moved to a single reservations system. The airline expects to achieve 75% of the total $1–1.2bn of net revenues synergies by the end of 2012, with the remainder following in 2013. The bulk of the estimated $1.2bn in one–time costs will be incurred this year and in early 2012.

Product considerations

With the strong customer focus at both United and Continental, the management regards determining the right product offering for the combine as one of their key early tasks. The main themes are to provide “best–in–class” products, to “de–commoditise” air travel, and to continue to be the leader in innovation and ancillary revenue generation.

In the first place, to cater for business travellers (which account for 65% of passenger revenues), UAL has continued to invest in its premium cabins. To match United’s policy, Continental’s international 757 fleet has already been fitted with lie–flat seats in BusinessFirst, meaning that the new United now offers more lie–flat premium seats than any other US airline.

Notably, after much consideration, the management recently decided to keep United’s “Economy Plus” seating and extend it to the Continental network.

Economy Plus offers up to five extra inches of legroom in the front rows of the economy cabin (65–plus seats on widebody aircraft).

Those seats are occupied by FFP members or can be purchased for $9-$109 one–way or $425 annually. Introduced in 1999, Economy Plus is popular with passengers, especially on longer–haul, and drives loyalty to United.

Interestingly, however, only United has been able to make that type of product work on a larger scale. AMR tried adding legroom to economy cabins by removing seats in 2000, but the revenue impact was negative and the move was reversed in 2005. This summer Delta is adding a premium economy section similar to United’s but only to its long–haul international aircraft. Continental never made such as move.

So why did the ex–Continental leadership in charge at UAL decide to do it now? Smisek said that it was really the improved ability to merchandise Economy Plus. Continental had looked at it in the days before more sophisticated web–based merchandising.

Smisek said that he was confident of the product’s success “given the performance of Economy Plus historically at United, coupled with the breath of the fleet and other product offerings and merchandising”.

So the new United will be the only US global carrier to have extra legroom in economy across the network. The multi–year process of converting Continental’s 350 mainline aircraft will begin in 2012. It appears that the company has not yet decided whether to adopt United’s 3- cabin or Continental’s 2–cabin layout on international aircraft.

In recent years United has led the way among the US legacies in “de–commoditising” air travel — a strategy that the ex–Continental leadership has wholeheartedly adopted. The management notes that customers have shown time and time again that they are willing to pay for products and services that customise the travel experience.

In the first quarter, ancillary revenue per passenger at UAL was over $16, up 15% on the previous year. Growth was due in part to innovative new products such as “Fare Lock”, which allows customers to purchase the option to lock in a fare before ticketing, and in part due to refinements in the way mature products such as Economy Plus are offered.

Even as the airlines integrate, the management is very focused on growing the portfolio of ancillary products. There are “many exciting products on the drawing board”. Smisek said that there would be more offerings targeted at specific customer types, facilitated by advances in technology and better customer relations management.

Fleet and funding plans

The new United expects to generate more than $2bn in ancillary revenue in 2011 As the two airlines are integrated, UAL expects to be able to operate the combined network with fewer aircraft. The combine has just four 737–800/900 deliveries scheduled for 2011. Four 737–500s were sold in the first quarter, and the company is in discussions to sell more aircraft later this year and continues to evaluate additional retirements and sales as it completes the joint fleet plan.

However, the new United has an industry- leading orderbook, which includes firm orders for 50 787s and 25 A350s. Under Boeing’s revised delivery schedule, UAL expects to introduce the 787 Dreamliner into service in the first half of 2012 – several years ahead of its North American competitors — and receive a total of six 787s next year. In addition to being substantially more fuel–efficient and customer- pleasing than current models, the 787 offers much flexibility in that it can be used as replacement aircraft, to up–gauge or down–gauge certain markets or to pursue new market opportunities.

Nearly half of UAL’s mainline aircraft (some 325) either have leases expiring or will become unencumbered by 2015. So, overall, UAL will have much flexibility to resize its fleet, up or down, to match the operating environment.

JP Morgan suggested in a late–April research note that UAL is likely to issue an EETC by the year–end to refinance some maturing aircraft, as well as pre–finance 2012 deliveries, including the 787–800s.

Network and JV plans

The new United has one of the world’s most formidable and well–balanced global networks. It has hubs at Chicago, Cleveland, Denver, Houston, Los Angeles, Newark, San Francisco, Washington DC, Guam and Tokyo. That line–up includes the four largest US cities and the headquarters of over 35% of Fortune 500 companies. The combine is the number one carrier in the US/Canada and across the Pacific, and number two across the Atlantic (after Delta) and to Latin America (after American). It has the largest shares of local traffic in key cities such as New York, Los Angeles and Chicago and boasts the most combined departures to key countries such as the UK and Germany and emerging growth markets such as China and India.

UAL also belongs to what is currently arguably the world’s leading global alliance. According to a recent presentation by the airline, Star is the number one alliance in seven of the top ten markets with the most premium traffic (Mumbai, Narita, Delhi, New York, Singapore, Frankfurt and Dubai). (Of the remaining three, oneworld leads at Heathrow and Hong Kong and SkyTeam at Paris).

Consequently, UAL is under no pressure to grow and can respond appropriately to the current fuel environment. Its latest (March) capacity plan trimmed one and four points from previously anticipated ASM growth rates effective with the May and September schedules, respectively.

Currently, the combine’s domestic capacity is slated to decline by 2–3% while international ASMs will increase by 3–4% in 2011. However, Delta and American are trimming their growth rates at least as sharply, while many US LCCs have also cut back their growth plans, so industry capacity is now expected to fall modestly in this year’s fourth quarter and in the first quarter of 2012.

The latest rounds of cuts by US airlines typically focus on international service.

UAL indicated that it would be reducing frequencies, eliminating less profitable routes and indefinitely postponing the start of flying in some markets. The first casualty was Continental’s planned Newark–Cairo service, which was due to start this month but had seen demand collapse due to the MENA uprisings. The management indicated that this autumn’s cuts would focus on the transatlantic market, where unit revenue performance has been disappointing due to a significant industry capacity surge last year (UAL’s Atlantic PRASM rose by only 1.3% in the first quarter).

UAL is likely to reduce frequencies, day of week operations and suchlike, similar to its strategy back in 2009.

UAL’s management warned that the capacity shrinkage will probably require some resizing of the business. Delta recently launched a new round of voluntary staff cuts associated with the four–point reduction in its planned growth rate after Labor Day. (Notably, Delta’s announcement came after the recent significant oil price correction; CEO Richard Anderson noted that the prices were still high and that airlines must think of the level as a “permanent reality of our business”.) But UAL will continue to grow “when and where it makes sense”. In the first place, this has meant new routes to the Caribbean and Mexico. Continental linked Newark with the popular tourist destination Providenciales (Turks & Caicos) in February and will add a Port–au–Prince (Haiti) connection in June.

Continental also began serving Guadalajara (Mexico’s second largest city) from Los Angeles this month and will add San Francisco–Guadalajara in June; these services take advantage of Mexicana’s demise and strengthen UAL’s position as the number one US carrier in the US–Mexico market, both in terms of destinations and departures.

Notably, United is also going ahead with its planned daily nonstop Los Angeles- Shanghai 777 service on May 20 (for a confrontation with American, which entered that market in April). Continental will launch daily Newark–Stuttgart 757–200 flights on June 9.

Interestingly, UAL launched a somewhat tasteless bid for Tokyo Haneda slots in early April. When Delta temporarily suspended its new Haneda flights after the Japan crisis, UAL asked the DOT to be considered for access rights to Haneda in the event that Delta does not resume flights.

Last year United and Continental failed to secure any Haneda slots, though UAL may well gain access there in future slot allocation rounds. It just shows that the airlines are thinking strategically for the longer term and that they expect the Japan market to recover.

As to where the six 787s arriving in 2012 might be deployed, UAL has said publicly that it would like to operate Houston–Auckland – described by the management as a “high–connect” route where a highly fuel–efficient aircraft is needed. Lagos has also been mentioned in the past. Otherwise the 787s will obviously be operated in international service from UAL’s gateway hubs.

On the joint venture front, UAL implemented its immunised alliance and JV with ANA on US–Japan routes on April 1 – the same day AMR and JAL launched their similar alliance. The UAL/ANA venture connects 295 US and 43 Japanese cities and covers 11 transpacific routes with nearly 120 weekly flights. The airlines have also coordinated fares and schedules for travel to and from certain other points in Asia, Latin America and the Caribbean.

Passengers enjoy improved FFP benefits. Like the transatlantic JV, the ANA JV is based on revenue sharing, which will begin later this year.

Although the transatlantic JV with Lufthansa and Air Canada is developing well, the revenue share structure only went in place in last year’s fourth quarter (retroactive to January 1, 2010). Because of that delay and because United and Continental had strong transatlantic results in 2010, they ended up in the odd situation of having a $100m liability for revenue sharing payments to their JV partners.

This has troubled some US–based analysts. In the 1Q call one analyst asked why UAL was compensating its JV partners for their under–performance and wondered if he had overestimated the value of the JVs. UAL executives were not able to give a very illuminating answer, because the JV agreements prohibit them from disclosing much financial detail about the workings of the alliances; the executives merely said that they were “very comfortable with how the JVs are developing”.

Financial outlook

In many ways, the new United is currently in a sweet spot: being able to take maximum advantage of the recovery of business travel by capitalising on the increased scale of the combined network, and being able to harvest some early cost savings from the merger (in overheads and procurement, for example), but still having the tough and risky aspects of integration tucked away in the relatively distant future.

UAL is expected to remain profitable in 2011 and 2012, though its earnings, like those of its peers, will decline this year because of fuel. The current consensus estimates project its revenues to grow by 9% and EPS to fall by 15% in 2011, but EPS is forecast to recover by 33% in 2012. In the next two years, UAL is likely to vastly outperform AMR (which is expected to continue to make losses) but probably not match Delta, which may be entering a period of strong profitability after its successful merger with Northwest.

Many analysts believe that UAL’s stock is undervalued in light of the RASM trends and the potential to generate free cash flow. Furthermore, recent weeks have brought good news for the industry on several fronts. Cost outlook has improved because of the oil price correction.

Japan demand is starting to come back. US economic data shows continued strength of the business sector. And, in contrast with IATA’s data, US airline data shows little sign of higher fares starting to cool travel demand.

| 1Q11 Operating revenue $ (m) |

% change vs 1Q10 |

1Q11 Operating result $ (m) |

Operating margin % |

1Q11 Reported Net result $ (m) |

Net margin % |

|

|---|---|---|---|---|---|---|

| United Continental | 8,202 | 10.8 | 111 | 1.4% | (213) | (2.6%) |

| Delta | 7,747 | 13.1 | (85) | (1.1%) | (318) | (4.1%) |

| AMR Corp. | 5,533 | 9.2 | (232) | (4.2%) | (436) | (7.9%) |

| Southwest | 3,103 | 18.0 | 110 | 3.5% | 5 | 0.2% |

| US Airways Group | 2,961 | 11.7 | (36) | (1.2%) | (114) | (3.9%) |

| JetBlue | 1,012 | 16.3 | 45 | 4.4% | 3 | 0.3% |

| Alaska Air Group | 965 | 16.3 | 144 | 14.9% | 74 | 7.7% |

| AirTran | 667 | 10.2 | (30) | (4.5%) | (9) | (1.3%) |

| Hawaiian | 366 | 22.5 | (4.9) | (1.4%) | 1 | 0.2% |

| Allegiant | 193 | 13.9 | 28 | 14.4% | 17 | 8.9% |

| Total | 30,749 | 12.3 | 50 | 0.2% | (990) | (3.2%) |