GOL: Comprehensive restructuring

but is it enough?

Aug/Sep 2016

GOL Linhas Aéreas Intelligentes, Latin America’s leading LCC, is nearing the completion of a comprehensive and intense restructuring, initiated in mid-2015 when the carrier faced ballooning debt, increasing cash burn and a deteriorating economy.

Brazil is mired in a deep recession for the second consecutive year; the IMF’s current projection is that the country’s GDP will decline by 3.3% in 2016, after last year’s 3.8% contraction.

Over the past 12 months, Brazil has also seen unprecedented political turmoil, resulting from presidential impeachment proceedings and a widening corruption scandal involving the state-controlled oil company.

Despite weaker air travel demand, 2014 and 2015 saw continued domestic overcapacity, as growth by smaller competitors (mainly Azul and Avianca Brasil) offset a disciplined approach by the two largest carriers (GOL and TAM). That led to a weak pricing environment.

Business travel demand and yields have declined sharply. GOL reported that its corporate travel revenues fell from a historical average of around 70% of total travel to 58% in 2015.

GOL has been hit especially hard by the adverse trends because the bulk of its operations are domestic. Although the carrier has maintained healthy cash reserves and was never a near-term bankruptcy candidate, in February all three main rating agencies warned of a cash crunch in the next 12-18 months as debt payments were coming due and demand and yields in Brazil continued to deteriorate.

Consequently, GOL formulated a plan to “comprehensively address liquidity and capital structure concerns” and ensure that it emerges from the tough economic and airline industry conditions in Brazil “in the best competitive position”.

In the past 12 months, the São Paulo-based carrier has implemented what may be one of the strongest and fastest restructurings by an airline outside of bankruptcy.

Among other things, GOL has raised new equity from key shareholders, completed an advance ticket sale to its loyalty programme, renegotiated supplier contracts, slashed capacity, restructured its network, downsized its fleet, negotiated concessions from lessors, deferred aircraft deliveries, and reduced and deferred debt obligations.

Most of it has gone according to plan, but earlier this summer GOL notably failed to persuade the majority of its US bondholders to agree to a US$780m debt restructuring.

However, the Brazilian currency’s 20% appreciation against the US dollar this year has amply compensated for that setback. The real’s surge has reduced GOL’s dollar-denominated debt obligations far more than could have been accomplished with the debt exchange.

As a result of the currency swing, GOL has also reported net profits for the past two quarters. In the three months ended June 30, it had a net profit of R$309.5m, thanks to a massive R$778.8m foreign exchange gain resulting from the real’s 9.8% appreciation between March 31 and June 30.

Although the operating result was negative in what is GOL’s seasonally weakest quarter — a loss of R$149.6m or 7.2% of revenues — it represented a 5.1-point improvement from the year-earlier negative margin of 12.3%, amid signs that GOL’s restructuring is beginning to pay dividends.

One of the key questions now being asked is: Given that Brazil’s recession may have bottomed out and domestic industry capacity is falling sharply, is GOL is now out of the woods? Or will the recovery be so slow that GOL will have to continue to restructure?

Another interesting question: With the likely (though by no means certain) lifting of foreign ownership restrictions in Brazil’s airlines in the next 6-9 months, will GOL be an early participant in the resulting M&A? In other words, will Delta fully acquire its Brazilian partner in 2017?

Comprehensive restructuring

GOL’s 2015-2016 restructuring has involved most of the carrier’s stakeholders — with the notable exception of labour, which in Brazil gets industry-wide annual pay increases tied to inflation (even in the worst recession in 30 years).

The management’s key message throughout the restructuring has been that all of the components are vital and that “everyone must contribute”. As CEO Paulo Kakinoff put it in May: “All pieces of this plan are critical, work together and should allow us to achieve our targets”.

Many of the concessions granted were conditioned on other components of the plan being achieved. For example, the aircraft returns and order deferrals were conditioned on the US bondholders agreeing to the debt exchange offer. But when the latter flopped, it seems that GOL got the other concessions anyway — perhaps not surprising as the lessors and Boeing probably had little choice, and they have had a policy of being extremely flexible with Latin American airlines during the current economic downturn in the region.

The following is a summary of the key components of GOL’s restructuring, some of which have already been completed and some are still in the process of being finalised:

US$150m equity infusion from key shareholders

GOL kicked off the restructuring in the summer of 2015 by raising US$100m from its controlling Brazilian shareholders and US$50m from its strategic partner Delta. The controlling shareholders’ equity stake remained at 63%, while Delta’s increased from 2.9% to 9.5%. (The US carrier acquired its original stake in 2011.)

US$300m term loan guaranteed by Delta

In August 2015 GOL secured a new US$300m five-year loan that has an effective average interest rate of 6.5%. The loan, arranged by Morgan Stanley, is guaranteed by Delta and is secured by GOL’s shares in its publicly listed SMILES loyalty programme.

Other assistance from Delta

In March Delta agreed to reduce the collateral backing up the term loan, subject to the US dollar debt exchange being successful. But since the latter was taken up by only 22% of the bondholders, it is not known if any of the SMILES shares were freed up.

According to reports in late August, Delta participated in GOL’s negotiations with its lessors and has agreed to buy eight aircraft that GOL currently leases from GECAS (four 737-700s and four 737-800s).

Supplier concessions/other cost cuts

During 2015 GOL’s suppliers agreed to new contract terms, resulting in R$300m of annual cash savings to the airline.

GOL’s cost cutting moves have also included overhead reductions, hiring freeze and the introduction of part-time employees.

Advance ticket sales to SMILES

In early 2016 GOL entered into an advance ticket sale agreement with SMILES totalling R$1bn through June 2017. The first tranche of R$376m was paid in February.

The airline said in early August that it had received a second tranche of R$600m and that an “outstanding balance of R$400m” would probably be paid in the fourth quarter. That suggested that the total amount to be received, which was linked to cash generated from the restructuring plan, will be higher than the originally envisaged R$1bn.

Revised delivery schedule with Boeing

In the first quarter GOL secured an agreement with Boeing to defer all further new aircraft deliveries until mid-2018 and have the associated pre-delivery deposits (PDPs) returned.

Before that agreement GOL had 15 additional 737-700/800 deliveries scheduled for 2016-2017; now the airline took only one of those aircraft in early 2016.

The return of the PDPs was expected to boost cash flow by R$555m, which was to be used to fund the US dollar debt exchange offers. But since only 22% of the bondholders took up the offer, it is not known if GOL received all of those funds.

GOL retains a substantial longer-term orderbook with Boeing consisting of 120 firm orders for fleet renewal through 2027.

In June GOL had a total fleet of 139 737-NGs (105 737-800s and 34 737-700s), of which 119 were in operation (nine were subleased to other airlines and 11 were in the process of being returned to lessors).

Changes to route network

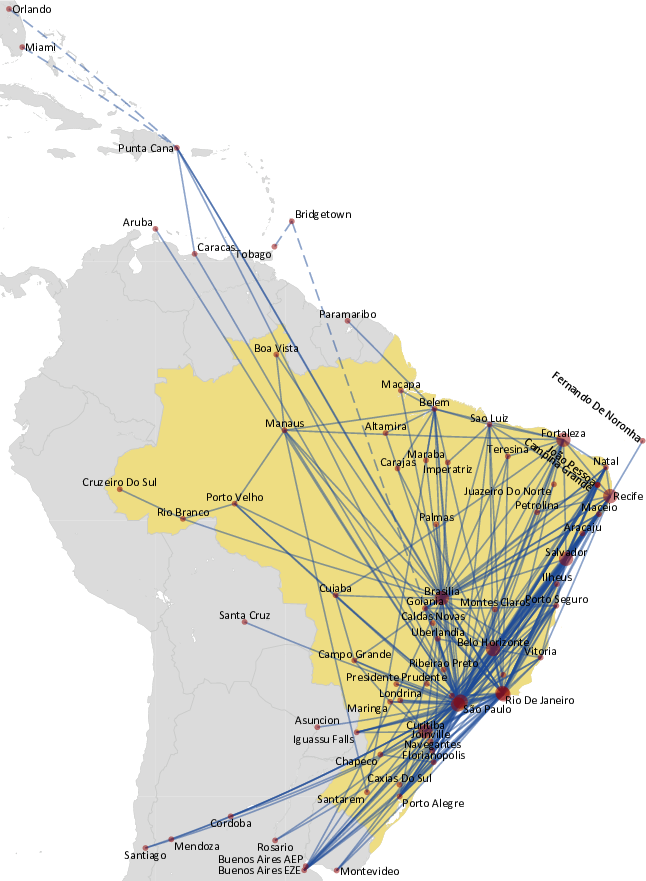

To improve profitability, GOL has made major changes to its network this year. The main actions can be summarised as follows:

First, GOL has suspended a large number of routes and destinations, including its US services. The latter were no longer viable as Brazil-originating travel had fallen sharply due to recession and the currency’s devaluation. GOL had operated one-stop São Paulo-Miami and Rio-Orlando flights via Santo Domingo (the Dominican Republic) because the 737-800s needed a fuel stop.

Second, GOL has added more long-haul flights out of São Paulo’s Congonhas to the north and northeast regions of Brazil, while reducing short-haul leisure operations. Its average stage length has increased by 41% at Congonhas and by 14.2% systemwide. This will help reduce unit costs.

Third, GOL has made adjustments to routes and schedules aimed at providing better options for business travellers at Congonhas, a key hub for business travel in Brazil. Those moves will improve yield and compensate for the negative impact on RASK of the increased average stage length. GOL claims that it is now the leader in the number of cities served from Congonhas (33).

Fourth, GOL has worked with its strategic partners Delta and Air France-KLM to become “the most comprehensive network for both domestic and international passengers” at Rio de Janeiro’s Santos Dumont and Galeao airports. The combine now apparently offers the most nonstop flights out of Rio and the best connections for domestic corporate passengers.

Fifth, GOL has added some international services out of Recife and other cities in Brazil’s northeast. The new routes include Buenos Aires and Montevideo.

Deep capacity cuts

GOL has implemented the Brazilian industry’s sharpest capacity cuts in the past 18 months. Since the beginning of 2015 its ASKs have fallen by 10.6%, which is 2.3 points more than TAM’s and 5.1 points more than the industry average.

Despite that, though, GOL has maintained its leading market shares of domestic passengers and tickets issued to corporate customers. In the first half of 2016, it apparently also for the first time led in the sales volume to the corporate sector (travel association ABRACORP data).

This year GOL is slashing its total seats and flight departures by 15-18%. The ASK (capacity) reduction will be less — around 5-8% — because of the increased average stage length.

US dollar debt exchange offers

Reducing US dollar-denominated debt was a priority in the financial restructuring because the real’s weakening in 2012-2015 had caused that debt to soar. In early May GOL launched a voluntary private exchange offer for five classes of US dollar unsecured notes issued in international capital markets. The notes totalled US$780m and had maturities in 2018-2023. The bondholders were asked to swap them for new 8.75% secured notes due in 2022 and 2028 that had spare parts owned by GOL as collateral.

The offer represented a 20-50% premium over market prices, but the bondholders would have taken losses of up to 55% (70% originally). Most of them baulked at the idea. Despite several extensions and a considerable sweetening of the terms, when the offer closed in early July the acceptance rate was only 22%, compared to GOL’s original target of 95%. The resulting US$102m debt reduction represents only a US$9.3m saving in annual interest expenses.

The bondholders were unhappy about several issues, including an unequal treatment of US and Brazilian lenders (the latter were not asked to take haircuts) and that no equity was being offered. GOL also noted that the real’s continued appreciation and a “drop in the Brazil risk perception” did not help.

Covenant waivers and maturity extensions with Brazilian banks

In recent months GOL has obtained two types of assistance from its local credit providers and bondholders — two major Brazilian banks that it has had long-term relationships with.

First, in June GOL secured waivers on debt covenants that it was about to violate. Second, since then it has also restructured R$1.05bn of locally issued debt. The amount of debt has not been reduced but the principal payments have been deferred from 2016-2017 to 2019, saving GOL R$225m in debt payments through 2018.

GOL was originally also seeking R$300m in new credit lines from the local banks but has not yet announced any such agreements.

Fleet reductions

GOL is in the process of “rightsizing” its fleet from 144 aircraft at year-end 2015 to 122 at the end of 2016 — a reduction of 22 units or 15.3%.

Some aircraft have been sold, but since almost three quarters of GOL’s fleet has been leased, aircraft lessors are playing a key role in the restructuring. The airline has been in talks with all of its lessors this year about returning aircraft early, reducing monthly lease rates and deferring payments. It was looking to secure concessions from lessors worth R$220m in net present value savings.

As of early August, GOL had already returned seven of the 22 aircraft and was in the final stage of negotiations to return the other 15. Two of those will be sold and 13 are early lease terminations (with Delta apparently buying eight of those aircraft from GECAS). So GOL is on track to reach the 122-aircraft target by year-end.

The Real impact

Until recently, GOL’s biggest problem was the sharp depreciation of the Brazilian currency. The real almost halved in value relative to the US dollar between year-end 2012 (2.04) and year-end 2015 (3.9). During 2015 alone the real weakened by 47%.

GOL has more than 50% of its costs denominated in US dollars (fuel, aircraft rentals, etc.) but earns revenues mainly in local currencies. So the airline saw terrible cost headwinds and foreign exchange losses. And it benefited only modestly from the decline in oil prices; while oil prices fell by 48% in 2015, GOL’s fuel expenses dropped by only 14%.

The impact on the balance sheet was devastating: GOL’s debt soared from R$6.2bn at year-end 2014 to R$9.3bn at the end of 2015. In the same period, the airline’s adjusted gross debt (which includes operating leases capitalised at seven times annual costs) surged from R$12.1bn to R$17bn.

Most alarmingly, GOL’s short-term liabilities increased dramatically during 2015. At the end of the year there was a R$3bn shortfall between current assets and current liabilities.

The key goals of the financial restructuring have been to reduce adjusted net debt, which amounted to R$14.7bn at year-end 2015, to below R$13bn and to avoid large debt repayments in the next two years.

But the R$/US$ trend reversed at the end of 2015. Reflecting renewed investor optimism, the real has been the world’s best-performing currency this year. As of August 27, it had appreciated against the US dollar by 17.5% since January 1 (from 3.95 to 3.26), or by 21% since its lowest point on January 22 (4.15). Of course, this trend may not continue (given all the economic and political uncertainty).

GOL’s balance sheet has benefited greatly from the real’s strengthening. Pro forma for the conclusion of the US dollar debt exchange offer, GOL’s total debt decreased by R$1.2bn during 2Q, and more than half of that (R$667m) was due to the exchange rate variation. The debt exchange’s contribution was a modest R$327m, and the remaining R$240m was the result of the shedding of aircraft-related debt.

GOL’s adjusted gross debt/EBITDAR declined from 12.7x at year-end 2015 to 8.4x at the end of June. The airline projects the ratio to fall to 6-6.5x in the next 12-24 months, which would still be relatively high by industry standards.

GOL estimated in early August that when all of the initiatives in the restructuring plan were completed, the total adjusted debt reduction would be R$3.8bn. Of that, fleet restructuring would account for R$2bn and the real’s appreciation R$1.3bn.

GOL saw its unrestricted cash shrink in the second quarter to R$1.4bn or 13.7% of lagging 12-month revenues. But total liquidity was healthy at R$2.1bn or 21.4% of revenues.

The management has indicated that they now expect GOL to be able to meet its obligations in 2016 and in 2017. But they have also said that GOL is looking to further reduce debt, given that it remains highly leveraged.

Economic and profit outlook

GOL’s recovery prospects will obviously depend on the timing and speed of Brazil’s economic recovery. There are some positive signs. The recession may have bottomed out and some data even point to a resumption of GDP growth before year-end. Inflation has been brought under control. The political situation has stabilised somewhat. The impeachment of suspended president Dilma Rousseff at the end of August should help further stabilise the situation and facilitate needed reforms.

One major positive is that, for the first time, 2016 will see airline industry capacity decline in Brazil. The domestic pricing environment has already improved. Based on the cuts announced by airlines so far, aggregate domestic capacity is expected to fall by 8-10% this year.

Then again, Brazil’s economic recovery could be painfully slow, and there is uncertainty about how quickly political stability can be restored. And, with the smaller airlines keen to increase market share, and hence resume growth at the earliest opportunity, there is no guarantee that industry capacity discipline will continue in 2017.

But GOL reported promisingly in early August that it was already more or less breaking even on an operating basis. The yield-depressing effect of the Rio Olympics has not been systemic (unlike the World Cup’s effect two years ago). The second half of the year is typically stronger for the airline. GOL is tentatively projecting a positive 4-6% operating margin for 2016, which would represent a modest turnaround from last year’s negative 1.9% margin. The forecast assumes the exchange rate averaging R$3.5-3.9 this year.

Analysts at Bradesco BBI have suggested in recent research notes that GOL’s margin forecast may be conservative, because it assumes further macroeconomic deterioration and delays with the early return of aircraft. They believe that GOL can deliver 6% and have retained an “outperform” rating on the stock (which is listed in both São Paulo and New York).

The Bradesco analysts also noted that Brazil’s Senate could vote in September to cap the VAT on jet fuel at 12% in Brazil — something that they estimate could boost GOL’s annual EBIT margin by 160 basis points.

GOL also has more core cost cutting and profitability initiatives in progress or planned. One promising area is maintenance. The US FAA recently certified GOL to execute C-checks, which will reduce maintenance costs.

Bradesco also noted that air fares in Brazil continue to recover. Despite the recession, GOL recently raised its fares by 9% — the third consecutive quarter of fare increases. As GDP growth turns positive next year, Bradesco believes that fares could rise by 5% and GOL could achieve a 9.6% EBIT margin in 2017.

Will Delta acquire GOL?

GOL’s late-July CFO change renewed speculation that the carrier’s focus is now shifting to M&A. Richard Lark, who was GOL’s CFO in the strong growth years of 2003-2008 and subsequently became a board director, has returned to the CFO’s role, replacing Edmar Lopes, who oversaw the restructuring. Lark has an impressive résumé, with significant experience also on the equity side.

When asked on GOL’s 2Q call about his focus in the next 6-12 months, Lark mentioned rebuilding, “final resolving of the capital structure and profitability” and “ultimately other issues that would help GOL competitively in the region”.

Before those comments, the Bradesco analysts had already suggested that Lark’s return meant that M&A would soon dominate the agenda. The analysts wrote on July 29: “We believe that installing someone with his investment banking experience suggests that GOL may seek to close a deal with Delta”.

While the airlines have stated that no such talks have taken place, the likelihood that Delta will fully acquire GOL has increased also because Brazil is finally getting close to lifting foreign ownership restrictions in the country’s airlines. Interim president Michel Temer wants to abolish the current 20% cap altogether. Although there has continued to be opposition among Senators, the government is reportedly determined to push the legislation through by the end of this year.

Delta could, of course, increase its stake in GOL to 20% under the current rules, but the motivation may be greater after the cap is abolished and there is a surge of interest in Brazil’s airlines. It could be partly a defensive move by Delta. A delay undoubtedly suits Delta because it is committed to making a $750m investment in Aeromexico this year (currently expected in Q4).

Another thing that will help GOL in the future is an immunised joint venture with Delta, possible after Brazil ratifies the US-Brazil open skies ASA.

| Total | 141 | 141 | 144 | 122 | 125 | 128 | 131 | 130 | |

| Aircraft @ 31 Dec | Seats | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| 737-700 | 144 | 36 | 35 | 36 | |||||

| 737-800 | 177 | 17 | 9 | 5 | |||||

| 737-800SFP† | 177 | 88 | 97 | 103 |

Source: Company reports. Note: † short-field performance.

Source: Company reports and SEC filings

BOVESPA GOLL4