JAL and ANA implement LCC JVs: Jetstar Japan, AirAsia Japan and Peach

September 2011

Six months after the devastating earthquake and tsunami that hit north–eastern Japan and the subsequent nuclear crisis, recovery in the Japan inbound travel market remains painfully slow. Japan’s economy and tourism industry have taken a massive hit. However, the country’s leading carriers, Japan Airlines (JAL) and All Nippon Airways (ANA) have weathered the crisis well.

From the airlines’ point of view, perhaps the most gratifying development was the quick recovery of business travel. ANA reported that business passenger numbers, which had bottomed out in April, were almost back to the year–earlier levels in June. This reflected the strong economic growth in many Asian countries and the reconstruction work in Japan.

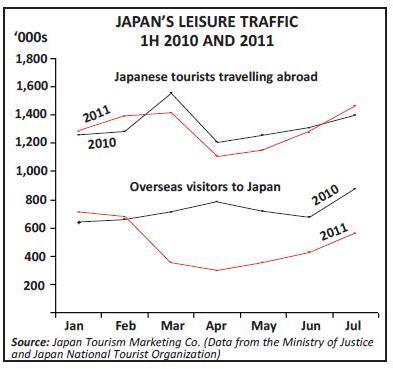

The airlines were also helped by the fact that the Japan outbound travel market, which for obvious reasons was not so severely affected by the crisis, is twice as large as the inbound market even in normal times. By July there were more Japanese tourists travelling abroad than a year earlier, while overseas visitors to Japan were still down by 36.1% (see chart, right). The very weak state of the inbound leisure market is illustrated by the fact that both Delta and American have suspended their new Haneda flights until next spring or summer.

Domestically, JAL and ANA did not fare too badly because most regions in Japan were largely unaffected by the crisis (except for nationwide problems such as lingering power shortages), because in the affected areas air travel was often the only possible mode of transport, and because the rebuilding efforts generated new travel.

JAL and ANA coped with the crisis, in the first place, by reducing frequencies or switching to smaller aircraft in the worst affected markets. But they were able to limit the impact by stimulating leisure demand with discount fares, capturing more international connecting traffic through Narita, carrying more traffic to Western Japan and operating special flights to the north as part of support for rescue and recovery efforts.

Those factors — and especially the rapid recovery of business travel and the airlines’ sharp capacity cuts and service adjustments — helped rescue JAL’s and ANA’s June quarter financial results. JAL even achieved profits in the quarter, thanks to its earlier bankruptcy–related drastic restructuring and downsizing.

JAL and ANA now expect to post profits for the current fiscal year (to March 31, 2012) and maybe even achieve their pre–crisis earnings targets. JAL is on track to re–list its shares on the Tokyo Stock Exchange by March 2013, as originally envisaged.

Although the airlines say that they do not expect leisure travel demand to recover fully before next spring, they are working aggressively with the government and tourism authorities to try to stimulate inbound demand. For example, visa regulations have been eased and aggressive joint advertising campaigns have been mounted in Australia and elsewhere promoting Japan as a cultural and skiing destination.

Importantly, JAL and ANA have moved aggressively to position themselves for the longer term. They have embraced international collaboration on a major scale.

First, the immunised joint ventures in the Japan–US market – JAL’s with American and ANA’s with United Continental – went into effect in April, as planned. These JVs have also helped the Japanese carriers weather this year’s challenges.

ANA is preparing to launch a similar JV with Lufthansa on Japan–Europe routes next month (October), after receiving antitrust immunity (ATI) from Japan in June. All eyes are now on JAL and BA/IAG to see if and when they will follow suit.

As the latest development, to take advantage of Asia’s enormous growth potential and safeguard their market shares in Japan, ANA and JAL have teamed up with Asia’s leading LCCs — AirAsia and Jetstar — to establish new Japan–based joint venture LCCs.

As a result, 2012 will be a pivotal year for LCC activity in Japan. Including ANA’s Peach, the next 12 months or so will witness the launch of three LCC units partially owned by ANA and JAL.

2012 is also likely to be a spectacular growth year in Japan, as the aviation market recovers from this year’s crisis. And, following the long–awaited first delivery of the 787 Dreamliner to ANA this month, and subsequently to JAL this winter, the next six months or so will see many exciting 787 plans come to fruition.

At long last, Japan is beginning to come up with solutions to the problem of exorbitant airport charges. Two key airports are building low–cost terminals for LCCs. Will the government now take the big decision to fully privatise the country’s airports, which could help normalise user charges?

JAL’s spectacular turnaround

JAL emerged from its 14–month court–led restructuring on schedule at the end of March. Having received a ¥350bn ($4.6bn) equity injection from state–backed ETIC in December 2010, which made ETIC its sole shareholder, by the time it exited bankruptcy JAL had procured ¥255bn ($3.3bn) in loans from 11 banks, repaid debt totalling ¥395bn ($5.1bn) and raised an additional ¥12.7bn ($165m) through a share sale to eight companies.

The only disappointment was that JAL was not able to meet its fundraising goal, leaving it under–capitalised just as it faced extra challenges and uncertainty. That said, JAL has accomplished an amazing financial turnaround in the past year, having gone through a much more substantial and swift business restructuring than anyone could have imagined.

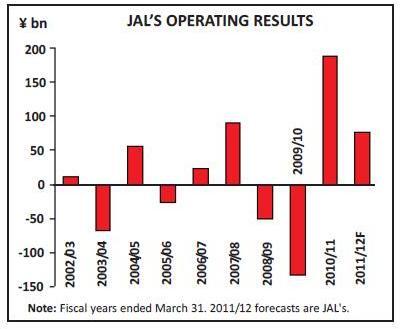

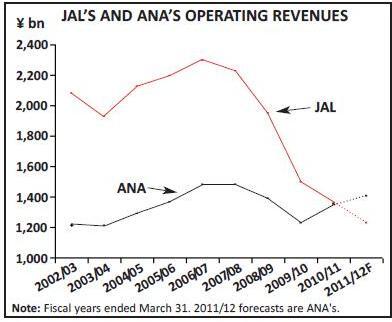

In the fiscal year ended March 31, JAL achieved a group operating profit of ¥188.4bn ($2.5bn) on revenues of ¥1,362.2bn ($17.7bn). The profit was almost triple that targeted in the August 2010 rehabilitation plan and represented a very strong 13.8% margin. It contrasted with a ¥133.7bn operating loss in FY 2009/10.

JAL also achieved a ¥17.2bn ($224m) operating profit (6.7% of revenues) in the three months ended June 30. This was similar to the year–earlier result despite a sharp decline in traffic, which was largely due to the drastic downsizing rather than the March 11 effects.

JAL’s restructuring in FY 2010/11 included closing some 49 unprofitable routes, withdrawing from 11 overseas and eight domestic destinations, shedding more than 100 aircraft, slashing the headcount by about one third and implementing sharp pay reductions. The airline has disposed of its 747–400s and A300–600s (with MD–81s and MD–90s still to go) as part of a strategy to switch to smaller, more fuel efficient aircraft and rationalise the mainline fleet from seven to four types.

All of that has collectively led to a dramatic reduction in operating costs.

Between 2008’s and 2011’s June quarters, as JAL’s ASKs fell by 43%, its total operating costs more than halved, leading to a 14.3% reduction in unit costs.

Importantly, JAL’s restructuring has included changing from a rigid, multi–layer organisational structure to a more streamlined managerial framework. This has been one of the contributions of Kazuo Inamori, the 79–year old founder of electronics maker Kyocera who took over as chairman when JAL filed for bankruptcy. Inamori trained JAL’s management to better monitor cash flow and profits on a daily, weekly and monthly basis and to execute business plans more reliably. A key part of this effort was to update JAL’s overly complicated and obsolete IT systems.

The effects of this year’s crisis are obscured by the drastic downsizing; perhaps the most visible effect was the 11- point decline in the international passenger load in the June quarter (international ASKs fell by 29.4% and RPKs by 40.2%). But international yields improved because premium traffic recovered quickly.

Domestically, JAL was able to limit the load factor decline to only 1.9 points.

JAL is now confident of meeting or exceeding the ¥75.7bn ($985m) operating profit target set by the August 2010 rehabilitation plan for the current fiscal year.

But JAL’s management will be kept busy in the next 18 months. In addition to dealing with the post–March 11 crisis, they will have to complete the restructuring and cost cutting programmes initiated in bankruptcy, find ways to strengthen the balance sheet, fund the 787 acquisitions, win market confidence and prepare for the IPO. The IPO has to take place because ETIC needs to recoup its investment. In July JAL took the first step by selecting the lead underwriter (Nomura Holdings).

ANA’s temporary losses

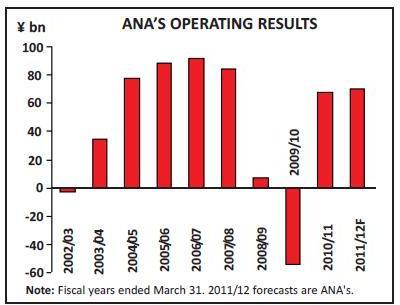

While ANA also staged a strong turnaround in FY 2010/11 from the recession hit 2009, it has posted small losses for the past two quarters – undoubtedly a temporary phenomenon.

The ¥67.8bn ($882m) operating profit posted for FY 2010/11 represented a 5% margin and contrasted with a ¥54.2bn loss in the previous year. Revenues rose by 10.5% thanks to traffic growth and expansion of services from Tokyo Haneda.

International revenues soared by 31%, reflecting a strong recovery in business demand and the Haneda services. ANA also benefited from a ¥86bn ($1.1bn) cost cutting programme.

In the June quarter ANA’s total revenues declined by only 0.6%, but since costs rose by 3.1%, the airline swung to a small operating loss of ¥8.1bn ($105m).

The measures taken in the wake of the March events, which included a new ¥30bn ($390m) cost cutting programme, and the relatively swift business traffic recovery helped rescue ANA’s domestic revenues, which declined by only 6.2% in the June quarter, despite a 14.7% fall in passenger numbers. International passenger revenues rose by 8%, reflecting 25% ASK growth, but the load factor plummeted by 11.2 points to 65.7%.Despite the June quarter losses, ANA expects to be profitable in FY 2011/12 and is currently projecting broadly similar earnings to last year’s: an operating profit of ¥70bn (5% of revenues) and a net profit of ¥20bn. The airline is aiming for 10% operating margins in 3–4 years’ time.

Even though it has under–performed JAL in recent months, ANA of course remains much stronger financially. In FY 2010/11 it also overtook JAL to become Japan’s largest airline in terms of passenger numbers, and this year it is also likely to become the largest in terms of revenues.

Long-haul plans: 787s and immunised JVs

ANA’s immediate focus is to successfully introduce to service the 787 Dreamliner, for which it is the launch customer. After a seven–year wait since the initial order was placed, all now seems set for the first delivery on September 26.

ANA has 55 of the type on firm order. It recently deferred four deliveries to the post–March 2013 period, so the current near–term delivery schedule is 12 aircraft in FY 1011/12 and eight in FY 2012/13.

The first commercial 787 service will be a one–off Narita–Hong Kong charter flight on October 26. The type will enter regular domestic service from Haneda on November 1, initially to Okayama and Hiroshima. December will see the 787 enter international service on the Haneda- Beijing route. In January the 787 will be deployed on Haneda–Frankfurt, a new route that will be operated as part of the planned JV with Lufthansa.

After previously intending to operate the 787 only domestically and in Asia this winter, ANA is now taking the 787 to Frankfurt and is believed to be considering deploying it also on other European and US routes this winter.

ANA could use the 787 to add new European cities that would not support larger aircraft; Brussels, Düsseldorf and Barcelona have been mentioned as potential additions to the current roster of four cities (London, Paris, Frankfurt and Munich). In the US, ANA is believed to be considering new cities such as Houston (United Continental’s hub), Boston and Miami. All of the long–haul operations would be from Haneda. Of course, the 787 will also play a significant role in ANA’s Asian expansion plans, which continue to be a major focus for the company.

ANA does not appear to have scaled down its growth plans at all, which projected 33% international ASK growth in the two years to March 2013. In the near term the airline faces a fine balancing act between the need to stay disciplined on the capacity front until demand recovers and the desire to quickly take advantage of unique growth opportunities before new competitors enter the scene. The opportunities arise from JAL’s contraction, the substantial increase in slots at Tokyo airports, the opening of Haneda to international flights and new open skies ASAs.

ANA has two new weapons at its disposal that will help it strike the right balance: the Japan–US immunised joint venture with United Continental and the upcoming Japan–Europe immunised joint venture with Lufthansa. The latter represents the first granting of ATI on Asia- Europe routes.

In contrast to ANA, JAL (having just shrunk to profitability) is not looking to grow in the short- to medium–term. However, the JV with American and the upcoming 787 deliveries will open up some new long–haul opportunities. JALwill use the 787s to add Boston to its network in April 2012 — its first new gateway in the US in 13 years and its fifth continental US city. The four–per–week service from Narita (daily from June) will be operated as a code–share with American.

Interestingly, since there are currently no direct connections between Tokyo and Boston and the market is dominated by Delta and United, JAL is in discussions with JetBlue (which has a hub operation in Boston and a marketing partnership with American) to provide additional feed in Boston.

Of course, JAL will be introducing the 787 first on regional routes this winter, most likely on Tokyo–Singapore. JAL has 35 firm orders and 20 options for the 787.

Having contracted sharply internationally, JAL’s post–bankruptcy strategy is to “maintain a global network with a focus on pivotal routes that can yield higher business demand”. The surviving network centres on major US and European cities and the high–growth Asian routes. Of the Pacific resort routes, JAL will specialise on Honolulu and Guam. JAL’s long–term strategy includes major expansion of international flights at Haneda and strengthening Narita’s role as a global hub between North America and Asia. The plan is to also continue operating short–haul Asian flights from Osaka’s Kansai and Nagoya’s Chubu with smaller aircraft.

Domestically, the strategy emphasises maintaining a network centred on Haneda and operating more frequent service using smaller aircraft. In respect to cargo, JAL terminated its scheduled freighter operations in favour of solely utilising the belly space of its passenger flights.

Alliances and JVs are especially important to JAL because of its drastic downsizing.

The rehabilitation plan called for “aggressive utilisation of alliances” and stipulated that JAL should also reap benefits from the “managerial know–how, facilities, IT systems and other tangible and intangible assets of alliance partners”.

Bloomberg News recently quoted JAL’s president Masaru Onishi saying that the JV with American had boosted JAL’s competitiveness on the Pacific and that JAL had even learned from American new techniques for adjusting its schedule on a weekly basis after the earthquake.

However, Onishi’s comments in that same interview that even though JAL’s alliance with oneworld partner BA “is the key”, “we could expand our business in Europe with Air France and KLM” added an interesting twist to the speculation about JAL’s European intentions. IAG CEO Willie Walsh has stated that the company is keen to enter a JV with JAL on Europe- Japan routes. But Paris is historically a key destination for the Japanese and JAL currently code–shares on Air France to 13 cities around Europe. The most likely scenario is that BA and JAL will go for ATI and JAL and AF will just retain their existing code–share relationship.

ANA’s LCC JVs

Peach Aviation, the JV that ANA established earlier this year with Hong Kongbased First Eastern Investment Group, will be the first of the three planned LCCs to take to the air in March 2012. It has an initial capitalisation of ¥30m ($390m), with Far Eastern holding 33.3%, ANA 33.4% and Innovation Network Corporation of Japan 33.3%. The venture hopes to raise up to ¥15bn in additional funding prior to start of service.

Three years in the making, Peach was ANA’s first major response to the growing competitive threat from LCCs. But ANA’s and AirAsia’s announcement on July 21 that they were forming another LCC joint venture, AirAsia Japan, to operate from Narita from August 2012, stole the limelight from Peach. AirAsia Japan clearly looks potentially more powerful.

There may also be overlap issues, even though the two will be operating from different bases.

Peach, which will operate independently from ANA, will be based at Osaka’s Kansai International Airport, which has better immediate slot availability than the Tokyo airports. It will serve both domestic and Asian destinations. The first routes will be Osaka–Sapporo and Osaka–Fukuoka. Since the AirAsia announcement there has been talk that Peach’s international operations may focus on mainline China. The venture has signed agreements to lease 10 A320s from GECAS and hopes to grow the fleet to 15- 20 aircraft within five years.

Peach aims to create new demand with domestic fares that are competitive with bus and rail fares and international fares that are 50% below current prices. To achieve the required low costs, the business model will be Ryanair–style: point–to point operations, single aircraft type, maximum seating, high aircraft utilisation, extensive use of automation, bare–bones service, charging for extras and high employee productivity.

Importantly, Kansai airport is making special provisions for Peach and other LCCs that will lower their user costs. It will offer simpler facilities with options, for example, to omit boarding bridges, and even has plans to build a dedicated terminal for budget airlines. Kansai is also offering airlines that start service there a year’s exemption from landing fees. But Kansai’s normal charges are even higher than Narita’s, because it is saddled with debt. It has reportedly mapped out a turnaround strategy based on attracting LCCs.

The other low–cost JV planned by ANA, AirAsia Japan, will be the first LCC based at Narita. It will benefit from the successful business model and well–known brand of AirAsia. The venture was established in August with initial paid–in capital of ¥5bn ($65m). ANA contributed 51% and AirAsia 49%, though ANA holds 67% of the voting shares.

Like Peach, AirAsia Japan will operate both domestically and to Northeast Asia.

It is likely to get an A320 fleet (and eventually A320neos) from AirAsia’s orderbook.

It is targeting annual revenues of ¥150bn ($1.9bn) and a fleet of over 30 aircraft in five years’ time.

AirAsia Japan intends to undercut ANA’s current fares by 33–50% to offer the lowest fares in every market. Its unit costs will be “less than half” of ANA’s though more than double Malaysiabased AirAsia’s.

The AirAsia brand is already known in Japan thanks to AirAsia X, which began serving Haneda from Kuala Lumpur in December 2010. This November AirAsia X is adding Osaka as its second destination in Japan. It is expected to gain access to Narita by the time AirAsia Japan begins operations, facilitating connections between the two networks.

ANA is clearly confident of making the dual–LCC strategy work. On the one hand, Tokyo and Kansai are different markets, catering for leisure travel originating in eastern and western Japan, respectively.

The cities themselves will generate much local traffic. So Peach and AirAsia Japan can probably coexist nicely for many years.

But eventually the strategy will limit their growth because they will not be able to establish second bases at each other’s hubs. ANA, Peach, AirAsia Japan and AirAsia X are bound to pinch traffic from one another, and the web of relationships will get even more complicated if AirAsia sets up another branded unit in northern Asia (as its leadership has hinted).

That said, ANA has indicated that its priority is to quickly cover as many future LCC markets as possible. The business models are experimental, totally new to Japan. Who knows what will happen in a few years’ time in a market that is seeing so much structural change. Perhaps AirAsia Japan will eventually acquire Peach?

JAL’s LCC JV

JAL finally confirmed on August 16 that it is teaming up with Qantas’ Jetstar and the Japanese trading house Mitsubishi Corp to form Jetstar Japan, which is expected to commence operations by the end of 2012, probably from Narita.

The venture will be initially capitalised at ¥4.8bn ($62.4m), with JAL and Jetstar each contributing 42% and Mitsubishi 16%, though the three partners will have equal voting interests. After start of service the capitalisation will be increased to a maximum of ¥12bn ($156m) and more Japanese shareholders may be invited to invest. Qantas’ Jetstar will have operational control of the carrier.

Many aspects of Jetstar Japan’s strategy are virtually identical to AirAsia Japan’s: operate to domestic and Asian leisure destinations with A320s (and later A320neos) provided by the foreign airline partner, leverage the partner’s brand position, stimulate fresh travel demand in Japan with fares about 40% below current fares and achieve low cost levels.

However, there are differences. Jetstar Japan will have more flexibility in terms of bases and markets than the other LCCs. It may set up bases at both Narita and Kansai (partly depending on the outcome of negotiations with Narita) and certainly expects to fly from both airports.

According to Jetstar Group CEO Bruce Buchanan, it is also exploring other potential bases in Japan that might offer the right infrastructure, cost levels and operating efficiencies.

Domestic destinations under consideration include Sapporo, Fukuoka and Okinawa. International destinations are likely to include China, Korea and Southeast Asia. In the longer term, Jetstar Japan will consider any destination within the A320’s range from Japan.

The venture will launch with an initial fleet of three A320s, which will grow to 24 “within a few years”. The aircraft will be part of a $9bn order for 110 A320/A320neos that Qantas announced that same day for the group businesses.

The Jetstar Japan A320s will be off balance sheet to Qantas.

Jetstar is comparable in size and reach to AirAsia. While AirAsia is the region’s largest LCC in terms of passengers carried, Jetstar has the highest sales. The group comprises Jetstar Airways in Australia and New Zealand, as well as Singapore–based Jetstar Asia and Vietnam–based Jetstar Pacific.

This partnership offers several special advantages. First, Qantas is particularly well–qualified to help JAL on the LCC front because of its experience with Jetstar.

Second, Jetstar is already used to working closely with a full–service airline and its business model is open to code–sharing.

Third, JAL and Qantas are already partners through oneworld and have a history of code–sharing (as do JAL and Jetstar).

Fourth, Jetstar is arguably the most experienced foreign LCC in the Japan market, because it began serving Tokyo and Osaka from Cairns and the Gold Coast in 2007 and in July 2010 also connected Osaka to Singapore and Taipei. JAL’s new venture will be able to get feed from those services to its domestic network. Also, the Jetstar brand is already well known in Japan.

JAL’s and ANA’s LCC plans are in line with the trends in Asia, where multiple brands and JV airlines have become commonplace.

According to CAPA, at least 13 full–service airlines have LCC units operating or planned in the region. However, such units have a dismal track record in the more mature US and European markets, and even in Asia only Qantas/Jetstar seems a proven financial success.

LCC units have become popular in Asia because of the rapid demand growth (especially at the low end of the market), relatively low LCC penetration (about 20%), flag carriers’ determination to maintain leisure traffic market share, and their greater success in negotiating the labour issues. A recent CAPA report suggested that there was a “seemingly unavoidable imperative to adopt the low–cost sub–brand model” in the region.

Within Asia, the best market opportunities for LCCs are currently in the northern part of the region, where LCC penetration is the lowest. LCCs account for just 6.8% of intra–northern Asia industry seats and 9.1% of the capacity in Japan (according to CAPA). Reasons for the low penetration include government policies protecting flag carriers and — in Japan’s case historically — airport capacity constraints and high cost levels.

Japan’s domestic aviation market is particularly attractive because of its size (83 million passengers) and immediate development potential. Gaining access to that market is the main attraction in the JV deals for AirAsia and Qantas/Jetstar. Eventhough it is not certain that the Japanese will be as quick as other Asian consumers to identify with a low–cost brand (they like package holidays, to start with), AirAsia noted in a regulatory filing that the Japanese market “possesses the necessary ingredients for growth such as the population’s strong propensity to travel, its high per–capita income coupled with its deep and significant internet penetration”.

But AirAsia and Jetstar are considering branded units also in other northern Asia countries, with China being the ultimate and highest–prized target. The eventual China–based units could be a mixed blessing for AirAsia Japan, Jetstar Japan and Peach, but at least the Japan–based airlines will have several years’ head–start in developing the Japan–China LCC market.

Opportunities for LCCs in Japan are suddenly improving dramatically because of a massive increase in airport capacity in the Tokyo metropolitan area in 2010- 2013. The opening of a fourth runway and a new passenger terminal at Haneda in October 2010 boosted maximum annual aircraft movements there by 43%. Haneda was opened to scheduled international flights. LCCs are getting their fair share of the new slots, which are allocated in stages over three years. Narita, in turn, will also have space for LCCs, in part because of the shift of many long–haul services to Haneda and because a new terminal is being built. Total slots at Narita are slated to increase by 40% in 2013.

Since part of the impetus to expand Haneda and Narita is to attract more visitors to Japan, LCCs will be particularly welcome.

The Japanese government is sticking to its earlier target of 30m visitors by 2020. Over the past year Japan has signed new open skies ASAs with several Asian countries that fully liberalise access to Tokyo from 2013.

It is easy to see why JAL and ANA found the JV option attractive. First, they lack experience with developing LCCs. Second, given the mistakes made by their counterparts in Europe and the US, they liked the proven business models of AirAsia and Jetstar (which expect the Japan–based units to become profitable early). Third, the brands are already known in Japan, thus requiring less investment to build brand awareness. Fourth, JAL and ANA have high cost levels in Japan, making it hard to set up home–grown LCCs.

The single largest challenge that the planned ventures will face is Japan’s high cost environment. As well as having steep labour costs, Japan has the highest airport charges and jet fuel taxes in the world. The high cost levels have prevented the emergence of a full–fledged sizeable Japan–based LCC. Are fleet sizes of 20–30 really large enough to profitably operate in that environment?

However, there are positive developments.

One early solution: low–cost terminals at airports that offer minimal services.

After receiving permission from local governments to increase slots, Narita decided late last year to build a terminal exclusively for LCCs. The airport expects seven or eight LCCs to use the facility when it opens in FY 2013.

After dabbling with temporary fuel tax reductions, the Japanese government is now considering major airport reforms in an effort to reduce the exorbitant user charges. Currently, runways are operated by the central government and terminals are operated by private companies or public- private partnerships. The separate management of facilities makes it hard to use profits from non–aeronautical activities to lower landing fees. So Japan’s airports may be fully privatised from FY 2014; the decision is expected in 2012.

As ANA’s and JAL’s LCC units prepare to launch, there is likely to be a scramble by the existing Japan–based LCCs (Skymark, Starflyer, Solaseed — formerly Skynet Asia, etc.) to position themselves for the new environment. The airlines will accelerate and refine their growth strategies and perhaps even enter into joint ventures of their own. Also, more Asian LCCs will be entering the Tokyo market as more slots become available. The good news is that the market is believed to be large enough for them all.