Gol: "Back to basics" strategy helps Brazilian LCC back to profits

September 2009

Gol Linhas Aereas Inteligentes, Latin America’s leading LCC, is staging a promising turnaround, amid signs that the April 2007 Varig acquisition is at last paying dividends. But much work remains to be done in terms of rebuilding profit margins and repairing the balance sheet. Gol wants to “get back to basics” of being an LCC, while capitalising on the competitive strengths gained through the merger.

Although Gol incurred heavy losses only for a couple of quarters last year (and much of it was due to exchange rate developments), the Varig acquisition, which caused greater problems than the management ever anticipated, took a heavy toll on the company. It damaged the proven, simple, low–cost business model, which had facilitated rapid growth and superior profit margins. It forced Gol temporarily into a contraction mode. And it brought Gol close to a liquidity crunch, with unrestricted cash reserves amounting to only 6% of annual revenues at the end of March 2009.

Until very recently, many in the financial community feared that Gol would not be able to recover from the stresses of the Varig integration. So it is very heartening that Gol has seen a reversal of its fortunes in recent months. Thanks to a combination of smart management actions, hard work and some luck, and perhaps the right strategies, Gol now looks like a long–term survivor.

Most importantly, Gol averted a liquidity crisis with timely fund–raising. The company has raised a total of R$856m ($465m) through equity, debt and other transactions since March. In late August Gol announced plans to raise another R$550–650m ($300–353m) through a global share offering. Who would have thought six months ago that a large public equity offering would be possible?

Gol’s second–quarter earnings call in mid- August provided much tangible evidence that the carrier is on the mend and that its earnings outlook is quite promising.

First of all, Gol has put the Varig problems behind it. Operating synergies from the GOL/VRG integration were apparently fully realised in the second quarter. Of course, some thorny issues remain – notably, being stuck with Varig’s remaining six 767–300s, which are grounded and are costing the company a fortune in lease payments.

Second, Gol is making good progress with restoring its pre–Varig cost structure. The management stressed that the aim is to “again achieve the lowest costs per ASK in the world”.

Third, Gol is seeing promising benefits from the Varig assets. The acquisition has enhanced Gol’s competitive position domestically and within South America. It has also given the carrier new tools to tap the high–yield segment – notably Smiles, Latin America’s largest FFP.

Fourth, like other Brazilian carriers, Gol is benefiting from its home country’s resilient economy. Brazil entered the global recession late, escaped the worst of its effects and now looks likely to be among the first to recover.

Fifth — although this may only be a short–term benefit — currency movements are again going in Brazilian carriers’ favour and are expected to boost profits in the short–term.

Gol’s amazing R$354m net profit in the second quarter (25% of revenues) was the result of a massive non–cash gain related to the Real’s appreciation, but it was great news for shareholders who by law are entitled to dividend payouts of at least 25%. On an operating basis, Gol had an R$89.9m profit (6.5% of revenues) in the second quarter, which is seasonally its weakest, up from a R$295m loss in the year–earlier period.

However, the 6.5% margin in the second quarter was much lower than those achieved by many North American LCCs (though similar to Southwest’s and WestJet’s 7%), indicating that Gol has some way to go in its recovery efforts.

Post-2006 struggles

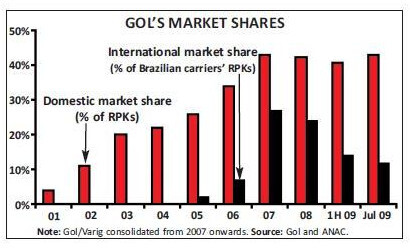

Also, Gol’s liquidity position is still very weak compared to the industry norm. The massive fundraising effort in the spring boosted cash reserves to only 9.8% of annual revenues on June 30th, when most airlines these days have 15–20% or more. The Sao Paulo–based airline, which began flying in January 2001, is Latin America’s first (and so far the only) true LCC. As a pioneer of low fares in Brazil, Gol has had tremendous positive social impact. Because of its ability to stimulate traffic and the dismal financial state of the other (high–cost) airlines in Brazil at that time, Gol captured a 22% domestic market share in just three years. Now, with most of the other airlines gone, Gol and TAM have a domestic duopoly with virtually identical (43%) domestic market shares in July.

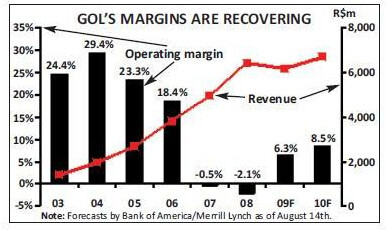

Up to and including 2006, Gol was one of the world’s most profitable and rapidly growing airlines. It achieved annual operating margins in the 19–29% range and net margins in the 13–20% range in 2003–2006 – a period during which its ASMs almost tripled.

Gol’s preferred shares have been listed on the NYSE and Sao Paulo’s Bovespa stock exchange since 2004. However, the free float is only 25% of all shares. The company’s founders, the Oliveira family, hold a controlling 75% stake.

But the good times ended in late 2006, when the Brazilian airline industry faced a structural crisis that lasted through the first quarter of 2008. Continued double–digit traffic growth, problems with air traffic control, lack of government investment in aviation infrastructure over several decades and airline strategies that sought to maximise market share all contributed to the crisis. ATC slowdowns and worsening airport bottlenecks led to a sharp increase in flight delays and cancellations, making travel a hassle and increasing costs for airlines.

The situation was aggravated by two fatal crashes: the September 2006 collision of a Gol 737 with a Legacy executive jet over the Amazon, which killed 154 people, and the July 2007 crash of a TAM A320 while trying to land in heavy rain at Congonhas airport in Sao Paulo, which killed 199. After the crashes the government imposed ATC and airport restrictions, which had a severe financial impact on the airlines over an 18–month period.

In the middle of that turbulence, Gol acquired bankrupt Varig, Brazil’s flag carrier and one of the oldest brands in Latin America. Varig was in a sorry state after years of mismanagement and had already shrunk significantly in efforts to stay afloat. The R$562m acquisition turned out to be very problematic, partly because of the delay in getting government approval to combine the companies. The approval was finally obtained in September 2008, meaning no synergies for 18 months. Varig was also unable to execute its growth plans because of the Sao Paulo airport restrictions.

With losses mounting, Gol was not able to stick to its original plan of gaining a presence in longhaul international markets through Varig. In the spring and summer of 2008, Gol shut down Varig’s remaining long–haul operation (Frankfurt, London, Rome, Madrid, Mexico City and Paris) in favour of focusing on serving markets within South America.

To add insult to injury, this gave Gol’s main competitor TAM a unique opportunity to expand to Europe and the US. TAM took full advantage of it, quickly becoming Brazil’s only flag carrier on intercontinental routes (see Aviation Strategy, December 2008).

The shutdown of Varig’s long–haul operations left Gol with seven grounded 767–300s, each of which was costing it $0.5m per month in lease payments. Gol was able to swap one 767–300 for a 737- 800, but is still stuck with the remaining six aircraft.

2008 was a tough year for Gol also because of the extraordinary surge in oil prices and the sharp depreciation of the Real (after many years of appreciation). The Brazilian currency lost nearly one third of its value against the US dollar over some six months after the start of the global financial crisis in late–summer 2008, resulting in steep foreign exchange losses on Gol’s dollar denominated debt.

On the positive side, the aviation sector’s structural crisis and the new macroeconomic challenges led to changes in attitudes that have benefited both Gol and TAM. The government is now fully committed to improving aviation infrastructure. The airlines are now more cautious about adding capacity and focus more on profitability than market share. One analyst noted at the time that Gol and TAM had “finally learned how to price as a duopoly”.

Last year’s October 19th was an important date on the Varig front: Gol was then finally able to integrate the two carriers’ networks. That quarter marked the beginning of Gol’s financial turnaround. Having completed the integration in January, Gol realised some synergies in this year’s first quarter. More substantial savings, especially in sales, advertising and maintenance, were realised in the second quarter. Earlier this year Gol estimated that annual revenue and cost synergies from the integration would eventually add up to R$180m ($98m).

The GOL/VRG strategy

Gol wants to “remain true to its identity as a low–cost, low price airline with high quality standards” (as expressed in the latest annual report). Therefore, while integrating the two companies and introducing a unified 737- 700/800 fleet, Gol has maintained two airline brands. Varig continues to offer a business class (recently revamped “Comfort Class”), while Gol remains single–class.

Gol is also sticking to its original mission, which is to “democratise air travel in Brazil and throughout South America”. The airline has made it clear that it is not considering a return to long–haul markets in the foreseeable future.

Varig’s new role is to operate medium–haul international service to major destinations in South America (currently four: Bogotá, Caracas, Santiago and Buenos Aires), while Gol focuses on domestic service and short–haul international (currently 49 and nine destinations, respectively).

The two most valuable things that Varig has brought to Gol are the Smiles FFP and additional slots at key airports such as Sao Paulo’s Congonhas. These assets are all the more valuable because they help strengthen Gol’s position in the high–yield market.

The extra slots at Congonhas, Brazil’s most important business hub, have given the Gol/Varig combination an unbeatable 48% market share at that airport. After eliminating overlapping routes and services and optimising slots, Gol has been able to offer shuttle flights departing every 30 minutes on the Rio–Sao Paulo route. The airline has introduced a special on–board dining service on the route called “Bistroda Ponte” (Shuttle Bistro).

As well as being able to offer a more consistent, high–frequency service in the key domestic markets, the Varig integration has enabled Gol to open new routes, such as Sao Paulo–Londrina and Sao Paulo–Caxias do Sur.

The Smiles FFP, which has over 6.2m members and which Gol has extended to the unified company, is an important competitive advantage. It will help Gol capture additional business traffic and retain existing customers. Some 65% of Gol’s traffic is business–oriented (because Brazil’s leisure air travel segment is still relatively undeveloped).

Gol remains committed to providing for low income leisure passengers – the emerging middle class in Brazil that is the fastest–growing passenger segment. Key programmes include VoeFacil (“Fly Easy”), which lets Gol customers finance their tickets in up to 36 monthly payments at a relatively low interest rate.

Gol’s management noted in the second–quarter call that the company is now able to explore all segments of the domestic market. Its offerings have expanded to five brands: Gol, Varig, Smiles, VoeFacil and Gollog (cargo subsidiary).

To obtain feed to its services and to generate more value for Smiles members, Gol is seeking to forge code–share partnerships with “the most important airlines in the long–haul segment”. Recent months have seen new deals with Air France–KLM and American Airlines.

Of course, Gol is not the only airline in Brazil aggressively implementing these types of new strategies. However, one early encouraging sign (other than the improving financials) is that Gol’s domestic market share stopped declining in the spring and has increased steadily in recent months. So Gol is probably on the right path with its post–Varig strategy. That said, bearing in mind the financial damage caused by the acquisition, many in the financial community still feel that Gol might have been better off without the Varig adventure.

Back to basics

The recent “back to basics of being an LCC” message was exactly what many people wanted to hear. It means that the focus now is on restoring productivity, efficiency and the former advantageous unit cost structure.

Gol’s cost structure was damaged by the capacity cuts at Varig, a sharp reduction in aircraft utilisation resulting from the shedding of unprofitable routes and long–haul service, and costs associated with aircraft returns. But the second quarter saw positive trends. Total operating costs were down by 26%, due to operating synergies from the merger and the decline in fuel prices. CASK was down by 18%, despite a 10% capacity reduction.

Aircraft utilisation is seen as the key to reducing unit costs. The target is believed to be 14 hours daily. To aid the process, in the second quarter Gol deferred the deliveries of 20 737NGs from 2010–2011 to 2014–2015 (reportedly without penalties). Gol’s cost structure will benefit from the phasing out of its remaining 737–300s by the end of this year. The fleet will then be all- 737NGs, totalling 108 (40 -700s, 16 -800s and 52 -800SFPs). The management is also working hard on getting rid of the six remaining 767–300s.

Rebuilding liquidity

Gol’s updated cost guidance in mid–August envisaged ex–fuel CASK of R$9.3 cents in 2009, which would be a modest decline from last year’s R$9.4 cents. But further reductions are expected in 2010. Of course, currency developments are the wild card. The 2009 CASK forecast is based on an average exchange rate of R$2.09 to the dollar. But if the exchange rate stays at the current (early September) level of around 1.84 in 2010, Gol’s unit costs could fall to the 8–something range next year. Some 96% of Gol’s debt and about 60% of its costs are in US dollars, while nearly all of its revenues are in Reals. Gol made promising progress on the cash–raising front in the spring and early summer. First, the controlling shareholders provided R$203.5m through a rights offering to avoid a liquidity crunch. After that Gol issued R$400m of two–year debentures. And in June there was the co–branded credit card deal, which provided R$104m of cash immediately and R$151m to be paid over five years.

Demand and profit outlook

But the R$613.7m ($334m) unrestricted cash position at the end of June, at 9.8% of annual revenues, was far from adequate, so building up cash is an urgent priority. Gol is now hoping to raise up to R$650m ($353m) through a global share offering, which would involve the issuance of new common and preferred shares. The Oliveiras plan to sell preferred shares in the offering and use the proceeds to buy Gol’s common stock in the primary offering. It has been a difficult winter in Latin America generally, because countries such as Argentina and Chile had severe outbreaks of the H1N1 flu and many countries in the hemisphere have been hit hard by recession. Gol had to rearrange its international network quite a bit, suspending or reducing services, particularly to Argentina and Chile after sharp declines in travel in those markets, and transferring the capacity to the Caribbean or the sun destinations in Brazil’s Northeast.

However, the Brazilian domestic market, where Gol generates 90% of its revenues, has been a rare bright spot. There was a strong demand surge in July, when industry RPKs increased by 25.7% (following modest growth in June and a decline in May), and early reports indicate that August was also strong. Yields held up in both months.

All of this, in combination with the tentative signs in recent weeks that Brazil is emerging from recession, bodes well for the country’s carriers. It may even mean that Gol’s current earnings forecasts are underestimates. As of mid–August, analysts were expecting Gol to achieve operating margins in the region of 6–8% in 2009 and 9–10% in 2010, following marginal operating losses of 1- 2% of revenues in the past two years.

The key question is: Will domestic capacity restraint prevail? Some analysts are concerned about potential significant capacity addition, which could have detrimental impact on yields. Gol, for one, is under pressure to refill its network and get its unit costs down. Then there are the new entrants – Azul, Webjet, OceanAir, TRIP and others – that are growing rapidly and pricing aggressively; those carriers are far too small to be a real threat to Gol or TAM, but they could inflict serious damage to the pricing environment.