Central/Eastern European aviation trends

September 2008

The process of liberalising and rejuvenating the aviation industries of the countries in central and eastern Europe has taken place at varying rates.

Balkans

In the case of the former Soviet–controlled states, the new administrations found themselves in charge of a somewhat decrepit system. While many of the countries had airports with long runways, plus many other airfields that were used for military purposes, the national airlines often had old fleets of Russian aircraft for which there was little in the way of logistical support should the aircraft go technical in 'non- Soviet' countries. The former Yugoslavia was different. With a domestic market of nearly 22m, the former JAT Yugoslav Airlines was among the top 10 largest airlines in Europe, with a fleet of then–modern DC–10s and 737- 300s, for which JAT was the European launch customer. The break–up of the Soviet Union coincided with the violent break–up of Yugoslavia and years of war and bloodshed. Aviation Strategy will look at several markets in the region that are in the process of change or evolution as a result of privatisations and/or market liberalisations. Air traffic in the Balkan region is now growing rapidly, albeit from a low base. In the western Balkans air traffic growth was severely dampened by the break–up of the former Yugoslavia. The air transport sector has now resumed growth and, according to the European Commission, traffic between the EU and south east Europe (including Bulgaria and Romania, which are now part of the EU) rose by 121% between 2000 and 2005. The number of weekly departures from south eastern Europe (SEE) to France, for instance, doubled from 41 to 86 between 2001 and 2005, while the number of weekly flights to Italy grew from 65 to 345.

There are few high volume routes, and no single route accounts for more than 2% of regional traffic. The six busiest routes between the western Balkans and western Europe are:

- Zagreb to Frankfurt, Vienna and Munich;

- Belgrade to Zurich and Paris; and

- Tirana to Milan.

Most countries of the western Balkans are too small for domestic flights and thus the vast majority of traffic in the region flows across national borders. Some countries, such as Albania, have only one airport. The exceptions in the western Balkans are Croatia (which has a domestic public service subsidy) and the eastern Balkans — Romania and Bulgaria — which have a number of domestic services.

Much of the traffic flow from SEE countries is to countries in western Europe that have particularly strong migration and trade linkages with the Balkans; Germany, Italy and Austria, together account for 60% of the routes from the EU to south east Europe. Business travel and air cargo remain small market segments.

Zagreb and Belgrade are the main airports outside the liberalised markets of Romania and Bulgaria, but the region has no central hub. While the route network in the western Balkans has grown denser in recent years, no pre–eminent hub has yet emerged among the 19 commercial airports. This is likely to remain the case for the foreseeable future as it has become increasingly difficult to compete against the Star alliance hub airports at Munich, Frankfurt and — to a lesser extent — Vienna, where Austrian has exploited its historical connections to operate a mini–hub for the region. Paris, Amsterdam and, to a lesser extent, Istanbul also serve the region with onward connections to inter–continental flights. The main airports offering connecting flights are Zagreb and Belgrade.

Network structures

Levels of connecting traffic remain low; in 2007 the percentage of transfer passengers at Belgrade Airport was just 3%. Frequent regional connections are limited to the two airports in neighbouring Montenegro (Podgorica and Tivat). Belgrade’s hub status was much reduced following the closure of JAT’s long–haul network and retirement of their DC–10 fleet. The table, right, shows the largest airports serving the Balkan region.Key determinants of regional network structures are code–sharing agreements and airline alliances. Of the world’s three major alliances, Star is the dominant player in the region. Its members include Austrian Airlines, Lufthansa, Croatia Airlines and Slovenia’s Adria Airways.

Many new airlines have emerged in the region, but they are small scale. The break–up of Yugoslavia led to a proliferation of 'national' airlines. Jat emerged as the successor of Yugoslav Airlines, while Slovenia, Croatia, FYR Macedonia and Montenegro developed their own flag carriers that will be discussed individually later in this article.

Most of the new regional airlines are state–owned and loss–making. Perhaps the most successful regional carrier is Croatia Airlines, with a fleet of 11 aircraft and 1.4m passengers in 2006 and a stable operating environment over the past eight to 10 years. In the 1990s, Jat carried a total of 5m passengers per annum; today it carries just over 1.3m passengers per annum, making it the second largest airline in the western Balkans.

The few private airlines that have been established in the western Balkans remain small. The establishment of the European Common Aviation Area (ECAA) should provide opportunities for growth but will also attract EU airlines — particularly low cost carriers (LCCs) — into the region and put pressure on smaller airlines to either seek critical size through mergers or to exit the market.

As countries in the CEE become full members of the ECAA, the more liberalised environment will stimulate competition and reduce prices. According to a study on regional air traffic for the European Commission, more than two–thirds of routes between city–pairs to and from south east Europe are served by one airline only. Most of the remaining routes are operated on a duopoly basis. Where the most competition exists is on routes to the Croatian tourism destinations of Split and Dubrovnik that are well served by network carriers, LCCs and charters.

Up until recently, competition from LCCs has remained limited, with high market barriers to entry. However, this is now changing and LCCs are pivotal in the stimulation of competition and market development. In the table on page six, we show the countries in the region most impacted by LCCs.

Reasons why LCCs have grown rapidly in liberalised markets in the region include:

- The main drivers of passenger traffic in the region are tourism and the migrant communities, which are both more price–sensitive than business travellers;

- Much of the passenger traffic between the EU and the western Balkans is currently land–based. Hence, the opening of additional routes (accessibility) and lower prices (affordability) in air traffic should lead to modal substitution;

- Bulgaria and Romania have joined the EU, thus eliminating visa requirements for its citizens for intra–EU travel. Croatia joined the so–called "White Schengen" list that abolished many of the previous onerous visa requirements for local citizens. This allowed greater ability for travelling and fostered the entry of LCCs that stimulated demand through lower air fares. Serbia is expected to join the White Schengen list before the end of 2008.

Ex-Yugoslavia

Serbia

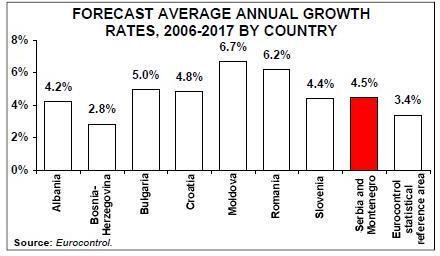

As well as liberalisation–induced traffic expansion, air transport in the western Balkans is likely to be driven by GDP growth and the exponential relationship between per capita income and the propensity to fly. Countries that have already joined the EU are likely to achieve strong economic growth as a result, at least in the short term, and there will be a beneficial spill–over effect for neighbouring states. In the chart below right, we show the average annual forecast growth rates for 2006–2017 by country. Yugoslavia consisted of one of the largest domestic markets in Europe, with the former JAT Yugoslavian Airlines and Aviogenex serving a domestic market of 22m. Following the start of the break–up of Yugoslavia in 1991, Croatia Airlines and Adria (Slovenia) started operations to serve their new domestic markets that were no longer allowed to be served by JAT. Zagreb had been one of JAT’s two main hubs (along with Belgrade). Serbian aviation was dealt a serious blow during the civil war and subsequent NATO bombings in 1999. During two separate periods, economic and United Nations sanctions (ironically numbered '757' — May 1992) prevented the operation of any commercial flights in or out of the country and many people had to travel by land to neighbouring Hungary or Romania to board a flight. At the time, the majority of Jat’s fleet was grounded in Belgrade and subsequently used for domestic services to Montenegro (which was part of Serbia at the time). Two 737- 300s and two 727–200s were grounded in Tunisia between 1992–1995 and two 737–300s were grounded in Turkey between 1992–1996 — one in Istanbul while the other had been undergoing a C–check at Aer Lingus' facility in Northern Ireland after which it returned to Turkey.

Following the removal of former Serbian president Slobodan Milosevic in 2000, the country has experienced a period of rapid and sustained economic growth. The government–owned JAT Yugoslav Airlines, now renamed Jat, is in the middle of a privatisation process that started in September 2007 and is part funded by the World Bank. The tender was launched at the end of July with deadlines for submissions of interest on 26th September. Speculation in the press since the outset of the process last year has centred on Aeroflot, Icelandair and even Italy’s Air One as likely acquirers. The timing of the privatisation coincides with the more highly publicised privatisations of both Austrian and CSA Czech Airlines, which are considered to be more strategic in nature.

Jat operates a fleet of 16 aircraft, 10 of which are 737–300s (for which Jat was the European launch customer for the type in 1985), one 737- 400 and five ATR 72s. While the average age of the aircraft is approaching 20 years, they have abnormally low levels of usage due to the aforementioned sanctions and subsequent low levels of usage.

As in other parts of the former Yugoslavia, US aid is helping to provide funds for the development of tourism and related infrastructure, such as the conversion of military air bases to civilian use and even greenfield development, due to the fact that the mountainous nature of some of the region (Bosnia in particular) makes travel times to relatively nearby airports lengthy and problematic.

Croatia

Another issue facing Serbia is the fact that its current status as an FAA IASA category 2 country prohibits the operation of direct commercial flights between Serbia and the US. Serbia has two international airports, Belgrade’s Nikola Tesla and Nis International Airport, some 180 miles (285km) south of Belgrade. Nis currently offers limited scheduled services to Zurich (Jat) and Montenegro (Jat and Montenegro Airlines). There is speculation that Ryanair had attempted to establish operations there, an offer that apparently was firmly rebuffed. Croatia Airlines was originally established as Zagal (Zagreb Airlines), operating a Cessna 402C as part of the UPS network. Following the break–up of the former Yugoslavia in 1991, Zagal was rebranded as Croatia Airlines and in May of that year started the first domestic service from Zagreb to Split using a MD–82 wet–leased from Adria Airways. In 1992 the company acquired three 737–200s from Lufthansa. Later that year the company became a member of IATA. The first of three 48–seat ATR42 turboprops arrived in 1993. A320s started to replace the 737 classics in 1997 and the first A319 entered the fleet in 1998. Croatia Airlines currently operates four A319s and four A320s. The three ATRs have recently been sold and the airline is in the process of replacing them with four new Bombardier Q400s to compliment the fleet of eight A319/A320 aircraft.

While Croatia Airlines has yet to exploit potential long haul markets, its membership as a regional affiliate of the Star alliance allows it to co–ordinate schedules with Lufthansa, Swiss and Zurich. Croatia operates a PSO (Public Service Obligation) domestic route system of which Croatia Airlines is a major benefactor.

Bosnia

The airline joined Star alliance as a regional member (along with Slovenia’s Adria Airways) in September 2004. Lufthansa acted as sponsors for the two carriers' application, which represented the second and third airlines to ascend to the 'Regional' level of membership within the alliance following Finland’s Blue1. B&H Airlines, the Sarajevo–based national flag carrier, was established as Air Bosna in August 1994 by the government of Bosnia and Herzegovina and re–branded from its original name in October 2006. The carrier, which employed 89 staff as of the end of last year, has more than doubled revenues since 2005 to reach KM24.2m (€12.1m) in 2007.

The airline is undergoing its own privatisation process that was formally launched on 30th June 2008. Bosnia and Herzegovina’s privatisation agency (PA) is aiming to find a strategic investor for B&H Airlines through a tender for 49% of the airline, and was seeking to receive bids by the end of July. The Bosnian PA has introduced an investment programme as part of the minimum conditions that need to be met by any potential acquirer. Any bidder must "introduce jet aircraft for company use with the capacity of at least 100 seats". The bidder may satisfy this condition in one of several ways:

- Procurement of the new A319 (which was a contract signed in 2000 by the Bosnian government through which some US$2.9m of pre–delivery payments — PDPs — have already been made);

- Procurement of used aircraft that should not be more than 10 years old;

- Introduction of the acquirer’s own used aircraft that should not be more than 10 years old.

It will be interesting to see what degree of flexibility exists with the Airbus contract, in particular if a potential acquirer could use the PDPs towards other aircraft types at prices that would undoubtedly be better than those which the Bosnian government was able to negotiate back in 2000. Earlier this year Turkish Airlines was reported to have held initial talks on taking a stake in B&H Airlines and recent media reports have indicated that they remain interested.

Montenegro

Elsewhere in Bosnia, the government of the semi–autonomous Serbian Republic (capital city: Banja Luka) is contemplating the development of greenfield airport sites, including the possibility of a new airport in Trebinje in the south west of the country (across the border from Dubrovnik, Croatia). Montenegro Airlines was founded in 1994 and in June added a new leased Embraer 195 from GECAS to compliment a fleet of four 115- seat Fokker 100s. The E195 will be used to serve its new route from the coastal city of Tivat to London Gatwick, which commenced on 15th June. Service will initially be on a twice weekly basis, moving to thrice weekly by the end of the summer. A second E195 is to be added before the end of the year. Montenegro’s flag–carrier provides scheduled flights to Budapest,Frankfurt, Ljubljana, Paris, Rome, Skopje, Vienna, London and Zurich, in addition to charter flights throughout Europe and the Middle East.

The Montenegro government announced in September 2007 that it was planning to sell a 30% stake in the airline, with local press reports indicating that the European Bank for Reconstruction and Development had expressed an interest in taking a 20% stake.

Czech Republic

As Montenegro is a mountainous country with poor road access from its neighbouring countries, air access is key to developing the country’s ambitious plans to increase tourism. Significant capex spend on tourist infrastructure is taking place with substantial numbers of resorts and hotels being constructed in the attractive coastal towns of Budva, Kotor and others — all of which are within 30 minutes drive of Tivat. Podgorica is the commercial centre of the country and its relatively new terminal facility is capable of handling significantly more capacity than the dozen or so daily flights at present (four of which are to Belgrade). Montenegro is an ECAA (European Common Aviation Area) signatory but has yet to ratify the agreement, which would effectively liberalise air traffic access to a country that currently operates a series of bilateral agreements. The Czech government is at the early stages in the privatisation of both Ruzyne airport in Prague and the main carrier, CSA Czech Airlines. The original plan was to privatise the airport prior to CSA, but ever–increasing fuel costs and the prospect of a liquidity shortage earlier than expected have forced the government’s hand in light of the so–called 'one–time' rule on state aid applied by the European Commission. The Czech government is believed to have selected sell–side advisors at the end of August. Aeroflot and Air France/KLM are the leading contenders to acquire the Czech flag carrier. It will be intriguing to see how the privatisation processes of both CSA and its main hub, Prague Ruzyne, are able to run in parallel. The future shape and stability of each entity represent a key variable in the valuation prospects for one another.

Both privatisation processes are further complicated by the potential development of a second airport in Prague (Vodochody). Unusually for a 'secondary airport', Vodochody is actually closer to the city centre of Prague than Ruzyne. The potential of a new lower cost facility opening in the short–medium term (using existing runway facilities adjacent to the Aero Vodochody aircraft and helicopter assembly facility) is likely to have a significant impact on the value of Ruzyne. Market shares at Ruzyne are shown in the table above.

Poland

Prague has become the most developed mini–hub in central/eastern Europe with connecting passengers accounting for approximately 24% of its 2007 total of 12.4m passengers. CSA has built up a strong network serving the central and eastbound markets in a similar fashion to Austrian Airlines. Ruzyne is a more modern and easier to navigate facility and this undoubtedly contributes to the attractiveness of Prague as a transfer point, in addition to the language commonality with the various Slavic speaking counties to the north, south and east. The Polish government is in the early phases of a privatisation/IPO process for state owned flag carrier LOT. Competition from LCCs has been intense and relentless as Ryanair, Wizz and easyJet have all established themselves as major players in the country. LOT, unlike its Hungarian and Czech counterparts (Malev and CSA respectively), is further advanced strategically with the development of long–haul services following its 2005 order for eight 787s, which should now arrive in 2010. New routes being contemplated include Beijing and/or Shanghai, and most of the 787s should be used as replacements for the six 767s that are currently serving the Toronto, New York and Chicago routes, where there are large numbers of Polish Diaspora.

| Country | Airport | 2006 | 2005 | 2004 |

| Romania | Bucharest | 3,514 | 3,036 | 2,644 |

| Serbia | Belgrade | 2,225 | 2,035 | 2,067 |

| Bulgaria | Sofia | 2,209 | 1,874 | 1,614 |

| Bulgaria | Bourgas | 1,816 | 1,574 | 1,361 |

| Croatia | Zagreb | 1,728 | 1,552 | 1,408 |

| Bulgaria | Varna | 1,533 | 1,559 | 1,339 |

| Slovenia | Ljubljana | 1,328 | 1,212 | 1,041 |

| Croatia | Dubrovnik | 1,120 | 1,083 | 881 |

| Croatia | Split | 1,086 | 927 | 789 |

| Romania | Timisoara | 755 | 371 | 304 |

| Macedonia | Skopje | 547 | 526 | 497 |

| Moldova | Chisinau | 547 | 481 | 419 |

| Bosnia/Herzegovina | Sarajevo | 456 | 433 | 400 |

| Montenegro | Tivat | 451 | 377 | 335 |

| Montenegro | Podorica | 384 | 323 | 328 |

| Country | 2005 | 2006 | % change |

| Romania | 123,410 | 531,076 | 330.3% |

| Croatia | 185,151 | 441,508 | 138.5% |

| Bulgaria | 35,386 | 146,884 | 315.1% |

| Slovenia | 106,149 | 104,967 | -1.1% |

| Macedonia | 36,800 | 26,100 | -29.1% |

| Serbia and Montenegro | 51,400 | 24,382 | -52.6% |

| Carrier | 2007 pax | Market share |

| CSA | 5,238,199 | 42.1% |

| easyJet | 977,002 | 7.9% |

| Travel Service | 871,495 | 7.0% |

| Skyeurope | 576,983 | 4.6% |

| Lufthansa | 565,511 | 4.5% |

| British Airways | 302,936 | 2.4% |