ANA: Preparing for the Haneda "big bang"

September 2007

Having staged an impressive financial recovery in recent years, All Nippon Airways (ANA), Japan’s largest domestic carrier and world’s fourth largest airline in terms of passengers, is now working to consolidate profitability and prepare for major post–2009 growth opportunities. The long term mission is to become "Asia’s number one airline" in terms of "quality, customer satisfaction and value creation" and attain the sort of profit margins enjoyed by the top rank of Asian carriers (Cathay Pacific, SIA, etc.). What strategies will ANA deploy to reach those goals?

2010 is an important year on the Japanese aviation calendar because that is when major expansion projects are completed at Tokyo’s congested Haneda and Narita airports. Haneda will get a new international terminal in December 2009 and a fourth runway in October 2010. Narita will have an extended 2,500–metre B runway operational by March 2010. In particular, the opening of the new runway at Haneda, the world’s fourth busiest airport in terms of passengers (65.2m in 2006) and the only domestic airport serving Tokyo, will be a watershed event – a “big bang”, as ANA described it in its latest annual report.

Haneda’s fourth runway will dramatically increase slot availability, boosting maximum annual movements by 43%, from 285,000 to 407,000. This is significant because Haneda accounts for 62% of all domestic traffic but has suffered from a chronic capacity shortage. It will mean major growth opportunities for ANA and Japan Airlines (JAL), as well as increased competition from LCCs.

ANA is expected to disclose more detail of its post–2009 growth plans in early 2008 in its next "mid–term corporate plan". However, the current plan for the 2006–2009 period, aircraft orders placed in recent years, new experimental strategies already in place or planned and comments made by the leadership give indication of where the airline is heading.

First of all, ANA’s main post–2009 growth focus will be on Asian international markets, especially China. This is in contrast with JAL’s plans, which primarily aim to strengthen the carrier’s domestic position (its weaker area).

It is also clear that, while ANA will continue to give priority to the high–yield segment when allocating aircraft, the post–2009 plan is to aggressively battle it out in all market segments. This will mean interesting new strategies such as business class–only flights and potentially an Asian LCC subsidiary. Will ANA set up an LCC in China or buy into an existing Chinese carrier?

Some of those strategies are already being tested. This year ANA and Asiana have taken symbolic equity stakes in each other. On September 1, ANA became the first airline in Asia to offer business class–only flights when it returned to India with Tokyo–Mumbai 737–700ER service.

A key part of ANA’s post–2009 strategy will be to develop Haneda into a hub for short–haul international operations. The new runway will facilitate increased frequencies using smaller aircraft.

ANA is also expected to significantly grow its cargo operations post–2009, having sold its stake in Nippon Cargo Airlines (NCA) two years ago.

Financial turnaround

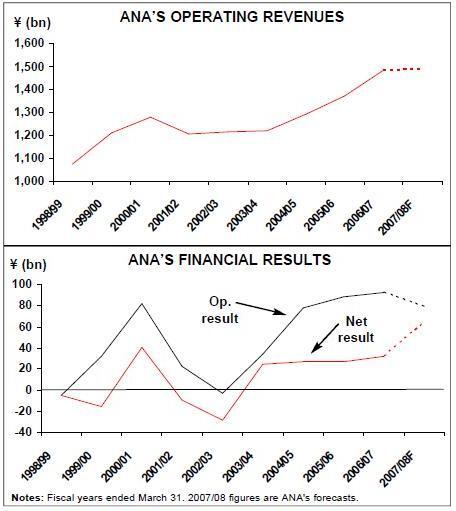

ANA is in the middle of a major fleet renewal and restructuring programme, which will facilitate post–2009 growth and help keep unit costs in check. Next year it will be the first airline to introduce to service the 787, which its president/CEO Mineo Yamamoto has described as "epoch–making aircraft". What are the airline’s plans for the 787? Unlike JAL, which continues to struggle financially (see Aviation Strategy briefing, May 2007), ANA turned itself around in 2002–2003 and has since then achieved relatively healthy, stable earnings, with annual operating margins in the 6–6.5% range.

The airline began restructuring in the late 1990s, after realising that it had grown too rapidly without much consideration for profitability. While September 11 had negative impact, the biggest catalyst for change was actually the 2002 merger between JAL and the third–ranked Japan Air System (JAS). It was the first major realignment in Japan’s airline industry in 30 years, and it significantly strengthened JAL’s domestic position.

ANA has benefited as demand in the Asia- Pacific region has strengthened and domestic business travel has bounced back, reflecting Japan’s recovery from a decade–long economic slump. But the improved results also reflect a three–year ¥30bn (US$253m) cost–cutting programme (primarily labour cost reductions) that was completed a year ahead of schedule in early 2005.

ANA has also made a formidable effort on the revenue side, introducing numerous initiatives aimed at the high–yield segment. And it has captured domestic market share, particularly premium passengers, from JAL in recent years, due to a series of safety lapses at JAL in 2005 (which did not result in fatal accidents). The shift in the high–yield segment may have been permanent, as many of those passengers have joined ANA’s FFP.

The result has been strong yield and unit revenue improvements throughout the network. Domestically, passenger unit revenues (RASK) and yield have risen by 12–13% in the past four years, as total capacity has remained largely unchanged. Internationally, ANA has almost doubled its RASK in the past seven years, while capacity has fallen 14.6%. The ASK decline actually bottomed out in 2003/04, and the following year ANA reported a profit from international operations for the first time since venturing to those markets in 1986.

For the latest fiscal year ended March 31, 2007 (FY 2006), ANA reported operating and net profits of ¥92.1bn (US$777m) and ¥32.6bn (US$275m), respectively, up 3.8% and 22.2% on the previous year and representing 6.2% and 2.2% margins. Revenues rose by 8.8% to ¥1,490bn (US$12.6bn). The results reflected strong demand for both business and leisure travel and were achieved despite a 31% higher fuel bill.

The current year will see some unusual earnings variation because of the April sale of ANA’s 13 hotels in Japan to Morgan Stanley for ¥281bn (US$2.4bn). ANA estimates that, largely because of the disappearance of contributions from the hotel business, its operating profit will fall by 13% to ¥79bn (US$667m) in FY 2007, while net profit will double to ¥64bn (US$540m) because of the extraordinary gain.

The June quarter results (ANA’s first fiscal quarter) reflected those anomalies. Operating income was ¥13.2bn, down from ¥19.5bn, while net income surged from ¥7.6bn to ¥87bn. But ANA’s ¥13.2bn (US$111m) operating profit compared very favourably with JAL’s ¥8.6bn (US$73m) operating loss.

This year is likely to be just a blip in an otherwise steady upward earnings growth trend. ANA is targeting operating income of ¥100bn and a margin of 6.5% for the fiscal year ending March 2010. Analysts consider that achievable: as of early August, Morgan Stanley, Goldman Sachs and Credit Suisse were forecasting operating income in the ¥90–98bn range for FY 2008 and ¥101–114bn for FY 2009.

The 6.5% operating margin target seems modest compared to the 10%-plus margins that major carriers in other world regions usually strive for. But perhaps it is a reasonable target in a high–cost country and for a period that will see only marginal revenue growth.

ANA’s goal is to build a corporate structure that is resilient to changes in the business environment — in other words, remain profitable even if fuel prices surge. It is aiming to cut direct costs by another ¥10bn (US84m) annually by FY 2009 through labour and aircraft productivity improvements and expects to achieve a similar (¥10bn) reduction in indirect fixed costs in the current fiscal year.

Unlike JAL, ANA has also strengthened its balance sheet: its total interest–bearing debt and lease obligations fell by 19% in the past three years, from ¥1,354bn (US$11.4bn) in March 2004 to ¥1,100bn (US$9.3bn) in March 2007, while the debt–equity ratio (including leases) declined from 6.9 times to 2.8 times. The airline is getting close to reaching its business plan targets for March 2010 two years ahead of schedule; its total debt and leases are projected to decline to ¥931m and debt–equity ratio to 2 times by March 2008 (compared to March 2010 targets of ¥898m and 1.8 times). The ROA (return on assets) target for March 2010 is 6–7%, compared to 5.2% projected for the current year.

ANA’s shareholders have little to complain about. The company resumed paying dividends in FY 2003 after a six–year gap. The plan is to raise the dividend to ¥5 per share in the current year, from ¥3 last year. ANA’s shares have performed well in recent years (at least in comparison with JAL's). The price rose from ¥200 in early 2003 to a peak of almost ¥500 in late 2005 and since then has hovered in the ¥420–Y480 range.

Recent months have seen a declining trend in the share price, reflecting ANA’s guidance about this year’s reduced operating profits and increased capital spending. Most analysts currently have a "hold" recommendation on the stock, based on valuation and the softer near–term profit outlook.

ANA's competitive strengths

However, sentiment about ANA’s longer–term prospects is near–universally positive, so the share price is likely to rise when investors start focusing on the post–2007/08 profit projections. Many will obviously jump in earlier if the price falls further. Morgan Stanley suggested in a June 18 report that there could be trading interest if the stock fell to around the 52–week low of ¥400 (the price was ¥459 on August 27). ANA is stronger than JAL in part because of historical advantages. First, it has always been privately owned and therefore it never developed the sort of state–carrier mentality that has plagued JAL, which was 34% government–owned until 1987. ANA was established in 1952 and the present name was adopted in 1957. The airline was listed on stock markets relatively early: Tokyo and Osaka secondary markets in 1961 (full listings in 1972), Frankfurt in 1978 and London in 1991 (the Frankfurt listing was withdrawn in 2004 due to low trading volume).

Second, despite being privately owned, ANA enjoyed near–monopoly of the domestic market until the mid–1980s. Under Japan’s former "45/47 aviation constitution", ANA was the designated domestic carrier and JAL the international flag carrier, though there was some overlap in that JAL was allowed to operate trunk routes between five domestic points and ANA was permitted to operate short haul international charters (which it has done since 1971).

This division meant that ANA gained a firm foothold in a huge, lucrative, business–oriented market — Japan is the world’s third largest domestic market (after the US and China), with 96m passengers in the year ended March 31. JAL, in turn, was exposed to more volatility in the international markets. It partly explains why ANA’s profits have historically been higher and more stable than JAL’s.

The 45/47 system was formally abolished in 1985 and ANA began scheduled international passenger service in 1986. Both JAL and ANA grew rapidly in the subsequent years, expanding into each other’s territories and becoming head–to head competitors on many routes. By 1992 ANA had a 20–point international network spanning the globe, including key cities such as Los Angeles, Washington, New York, London, Paris, Beijing, Hong Kong, Seoul and Sydney.

As a newcomer, ANA embraced international alliances, starting with one with American in the late 1980s. In 1998 it became the first Japanese airline to code–share with a US carrier (United). ANA joined the Star Alliance in 1999 — eight years before JAL became part of a multilateral global alliance (oneworld, April 2007). ANA has reaped significant benefits from Star membership, including recognition in global markets where it was unknown, yield management programmes and know–how from other world regions.

ANA has shown itself to be more entrepreneurial than JAL, leading the way in marketing and projecting a trendier image. It has often been a leader in introducing innovative products or strategies and harnessing the latest technologies. For example, it launched the world’s first mobile phone international check–in service and was the first Asian airline to offer in–flight internet access (both in 2004).

In addition to innovation, ANA believes that the words "simple" and "convenient" differentiate its service from that of its rivals. The approach is well illustrated by the "SKIP service", introduced in 2006, which enables domestic passengers to board aircraft without checking in. ANA also strives to "make short–haul international travel as easy as domestic travel from the customer’s point of view".

ANA has a more modern culture and better employee relations than JAL. It has a leaner business model, having kept labour costs in check and maintained a younger, more fuel–efficient fleet.

ANA is clearly much stronger than JAL in terms of organisational structure and corporate governance, having undertaken a thorough corporate restructuring in 1998–2001 in preparation for changes in the Japanese business environment and increased competition. Among other things, the reforms reduced the size of the board and improved the management’s ability to "make swift and timely decisions". ANA has continued to strengthen its internal control systems to enhance transparency and keep stakeholders happy.

The airline has a 16–member board, of which 14 are corporate executive officers. The ownership structure is diffuse; as of March 31, there were 264,700 shareholders and the largest, Nagoya Railroad Company, held only 3.69%. ANA employees had a 1.53% stake.

One of the most impressive things about ANA has been the continuity of its strategy. One midterm plan just flows into another, making necessary adjustments but maintaining the fundamental direction of the previous plan. This reflects high–quality leadership and unusually disciplined succession policies: when a new president/CEO is appointed, the previous one becomes chairman and the previous chairman typically becomes "executive advisor".

The three latest president/CEOs have been law graduates, with lifetime careers at ANA. All have been hands–on leaders who got personally involved with staff and union issues. Kichisaburo Nomura was credited for stopping over–aggressive expansion in the late 1990s. Yoji Ohashi, who took over in April 2001, implemented cost cuts, oversaw ANA’s financial recovery and ordered the 787. Mineo Yamamoto, who became president/CEO in April 2005, has continued to implement Ohashi’s policies and is overseeing the preparations for post–2009 growth.

ANA is clearly determined to remain on the cutting edge. Last year it spun off its research department into a separate subsidiary to "allow it greater autonomy in the development of ideas for new products, strategy and business models". The mission of the grandly named "ANA Strategic Research Institute" is to "explore and nurture possible new systems and structures for the Group beyond 2010".

Two decades after the abolition of the "45/47 system", Japan now has effectively a domestic duopoly. ANA and JAL are head–to–head competitors on all major domestic routes. The two have very similar domestic passenger shares: ANA 48.4%, JAL 45.8% and others 5.7% (year ended March 31). However, ANA still has higher domestic premium passenger shares and yields.

JAL and ANA have been able to continue to dominate the Japanese aviation scene not just because of the airport capacity constraints but also because over the years they have set up numerous support businesses and airline units to cater for different market niches. As of March 31, ANA had 128 subsidiaries and 44 affiliates. The ANA Group comprises four business segments: air transportation (72.6% of group revenues in FY 2006), travel services (12.1%), hotel operations (3.9%) and other businesses (11.4%).

The 38 air transport–related subsidiaries include six airlines in addition to ANA. The largest is Air Nippon, an old–established Tokyo–based unit that operates about 25 of ANA’s 737–500/700s mainly on domestic medium and long–haul routes. Air Nippon, in turn, owns Air Nippon Network (ANet), which was formed in May 2001 to operate Dash 8 feeder services to and from Tokyo and Sapporo. Air Central is a Nagoya–based turboprop operator in which ANA acquired a majority stake in 2004. There is also Air Next, a new lower–cost Fukuoka–based airline established by ANA in August 2004 to operate 737–500s on domestic routes mainly out of Fukuoka and Nagoya (operations began in June 2005). The line–up is completed by Air Japan, which was originally ANA’s charter arm but was relaunched in 2001 and now operates ANA’s 767–300ERs mainly on Asian resort routes, and "ANA & JP Express", a new majority–owned cargo subsidiary that started operations in August 2006.

Focus on Asian growth

ANA is predominantly a domestic carrier, earning 65% of its air transport revenues from domestic passenger operations in FY 2006. But its expansion efforts focus squarely on the other two segments: international passenger services and cargo operations, which accounted for 25% and 10% of air transport revenues last year.

On the passenger side, ANA is very much focused on expanding its East Asia network centred on China. Those markets are seeing robust demand growth, particularly for business travel. Expansion in Asia is being facilitated by the progressive relaxation of ASAs, and there is always a chance that the ASEAN open skies initiative will take off. One of the Japanese government’s policy priorities is to achieve Asian open skies.

In contrast, the Japanese domestic market has seen no overall growth in passengers in the past five years and offers few new growth opportunities. The market is mature and air services face increasing competition from the Shinkansen bullet train (the average stage length is only 679 kilometres). ANA’s domestic efforts focus on retaining high–yield market share and improving unit revenues and profits.

The current East Asian growth phase began about four years ago, following international service rationalisation that included withdrawal from markets such as Australia, India and Malaysia (late 1990s) and heavy cuts due to SARS, September 11, etc. Since 2003 ANA has added numerous new routes and boosted frequencies to East Asian cities from Tokyo, Kansai and Nagoya (where a new airport, known as Centrair or Chubu, opened in February 2005). The airline now operates 20 routes to China and has returned to the Malaysian and Indian markets.

In the past three years, ANA’s Asian passenger revenues have doubled and the region’s revenue share has surged by eight percentage points — largely at the expense of Europe, which has seen a five–point share decline (even though European revenues grew by 28%). The result is a nicely balanced international network, with North America accounting for 26%, Europe 24%, China 22%, other Asia 23% and "resort flights" (Guam, Hawaii, etc.) 5% of international passenger revenues in FY 2006.

ANA is determined to grow profitably. This has meant giving priority to routes that have a high business traffic content (such as many of the Japan–China routes), rigorous revenue management, better matching of supply and demand, expanding business class sections on aircraft, introducing some all–business class flights and forging alliances with Asian carriers.

ANA’s post–2009 plans centre on developing Haneda into a hub for China/Asia services and offering more frequent flights with smaller aircraft in the 150–seat category. This strategy will be possible because, when the fourth runway comes on line in late 2010, Haneda will be formally opened up for scheduled short–haul international services and the government plans to allocate a portion of the new slots to such flights.

The 737–700, which entered service with ANA on the Nagoya–Taipei route in January 2006 and will be added in stages, plays a key role in the post–2009 plans. ANA will operate it on both domestic and short–haul Asian routes. The aircraft are fitted with special economy seats that permit a quick conversion between an all–economy 136- seat domestic configuration and a 118–seat Asian layout; the latter includes a 36–seat "Premium Economy Asia" section created by converting 18 seats into centre tables.

In January 2006 ANA converted two of its 45 original 737–700 orders into 737–700ERs, which have enabled it to experiment with new service concepts aimed at the business traveller on longer–haul Asian routes. The first 737–700ER, fitted with 48 seats in two classes (24 "premium economy" and 24 "Club ANA BJ" seats with a 61–inch pitch), was used to launch daily Nagoya–Guangzhou flights in March. The second "BusinessJet", fitted with just 36 seats, was due to launch a six–per week business class–only service on the Narita- Mumbai route on September 1.

ANA is believed to be the first Asian airline to offer business class–only flights. However, ANA will use the concept mainly as a tool for developing new business–oriented markets. The airline has indicated that the Mumbai service, which marks its return to India after a six–year gap, will be upgraded to larger aircraft with a mixed configuration if traffic builds up.

In the past couple of years, ANA has been right–sizing aircraft on Asian routes. This year has seen some China routes down–gauged from 767s to A320s, though Narita–Beijing has been upgraded from 767s to 777s. A business class has been introduced on the A320–200s.

China continues to be the primary focus for growth in the near term because of the booming trade — mainland China became Japan’s top commercial partner last year, overtaking the US — and because of the Beijing Olympics, which start on August 8, 2008.

In June, Japan and China again agreed on service expansion. The new deal also facilitated the introduction of shuttle–type flights from Haneda. As a result, ANA will start its first scheduled flights from Haneda to China, to Shanghai’s Hongqiao International Airport, in October. Up to four daily flights are permitted (two from each country). Until now all of the Tokyo–China service has been from Narita. Shuttle–type service between Tokyo and Beijing is expected to follow next year.

Of course, ANA is hoping to showcase its first 787 on the Beijing route in time for the Olympics. The type will be flown exclusively on domestic and short–haul Asian routes for the first couple of years, until ETOPS approval is obtained for transpacific operations.

In addition to China, markets such as India and Korea offer good post–2009 growth opportunities. Last year Japan and India agreed to more than double the passenger flight allocation, from 18 to 42 per week. Just last month, Japan and South Korea reached an open skies agreement, though flights to Tokyo will be limited to 73 per week until 2010 due to lack of airport capacity.

ANA’s efforts on its North American and European routes in the past couple of years have focused on replacing the 747–400 with the 777- 300ER — a move designed to improve passenger comfort and increase profitability. Also, the airline restarted Tokyo–Chicago passenger service in October 2006.

The switch to the 777–300ER has meant an upgraded business class, with lie–flat beds, and a new premium economy class. The process began on the Japan–US routes, with New York switched in May 2005, Los Angeles and Washington DC in 2006 and San Francisco earlier this year. In May London became the first European destination to receive the 777–300ER. The move appears to be producing the desired results: ANA’s North American passenger revenues surged by 27.4% last year, after recording mostly single–digit growth in the previous three years.

ANA has said that it will probably introduce the 787 on the Tokyo–New York route in late 2009 or 2010, when ETOPS approval has been obtained. The type will be used both as a companion to the 777–300ERs and to open new US and European destinations.

Otherwise, ANA’s long–haul strategy relies heavily on the Star Alliance. The airline has been expanding service to partners' hubs, particularly those that have high business traffic volumes, improving connectivity and building feed. ANA has already achieved good results at Frankfurt (Lufthansa’s hub) and is seeing greatly improved feed at Chicago (United’s hub), which it has designated as its strategic base for the US and Central America.

In turn, ANA’s role is to provide the "Asia hub airport for Star". A significant milestone was reached in June 2006 when ten Star members moved to a new joint state–of–the–art facility at the South Wing of Terminal 1 at Narita. The move has enabled Star members to better exploit alliance synergies and has substantially reduced connecting times.

Since joining Star in October 1999, ANA has continuously added new and expanded existing code–share and FFP partnerships with other Star members. On the long–haul front, the latest new deals have been with Swissair (June 2006) and South African Airways (March 2007). ANA has also forged an alliance with non–Star member Virgin Atlantic, initially to tie up FFPs (2003) and since April also to offer combined round–the–world fares and e–tickets — a potentially useful way to balance the JAL/BA oneworld combination, since Virgin is the UK’s second largest long–haul carrier and serves Tokyo.

But Asia is the main focus also for alliance building efforts. ANA is, first of all, strengthening cooperation with fellow Star member SIA. This autumn, the two are expanding their code–sharing, which began in 2004, beyond the Narita and Singapore hubs to include five cities in Japan, two in the US and four in India, plus Jakarta and Johannesburg. The main benefit to ANA is gaining access to multiple cities in India just as it begins its own operations to Mumbai.

Second, ANA is cementing its relationship with Star partner Asiana through a symbolic (fraction of a per cent) equity swap. The two airlines, which have code–shared since 2000, announced in May that they were acquiring $12m of each other’s shares, expanding code–sharing beyond the Japan- Korea routes and forging new forms of cooperation in marketing, sales and purchasing. The move helps ensure ANA future access to a major growth market.

Third, ANA can be expected to further strengthen its ties with Air China and Shanghai Airlines, which are joining Star in December. It has had alliances, including code–sharing, in place with both since 2002. There has been some speculation of a potential equity investment; SIA is in the process of acquiring a 20% stake in China Eastern, and other Chinese carriers are also expected to want to sell stakes to strategic partners. Such a move cannot be ruled out, given the importance of that market to ANA.

Alternatively (and this is pure speculation), ANA might prefer to set up a new China–based LCC with the help of local partners. Its president Yamamoto has said publicly on several occasions in recent months that the airline is considering establishing an LCC to strengthen its competitive position in Asia and that the LCC could be overseas–based. Yamamoto has said that the decision may not be taken until 2010 — the earliest time competition from foreign LCCs can intensify on the Tokyo routes.

By its own estimates, ANA’s unit costs are up to twice as high as those of Asian LCCs. The likelihood that there will be new Chinese LCCs is a particular concern, because those carriers could be ultra low–cost. Also, Japan and China have agreed to more than double, from six to 13, the number of airlines permitted on routes between the two countries.

If ANA decides to go the LCC route, it will be able to draw on its experience with Air Next and other subsidiaries set up for niche markets. Air Next was designed to enable more efficient operation of narrowbody aircraft domestically, though it is not an LCC.

Domestically, ANA’s efforts to improve unit revenues and profitability have meant strategies such as withdrawing from less profitable markets, shifting capacity to lucrative routes, switching to narrowbody aircraft and boosting frequencies in some markets, improving revenue management, expanding "Super Seat Premium" seats and raising fares. Product improvements have included new economy class seats, the SKIP Service and enhancements to the "ANA Mileage Club". The airline has also improved connectivity and convenience by building new domestic feeder networks and expanding code–sharing with partners.

ANA has strengthened its position at Haneda in several ways. First, ANA, Air Nippon and A–Net united under a common brand in April 2004. Second, at the end of that year the ANA Group moved to a new terminal at Haneda. Third, since launching code–sharing with Air Do in 2003, ANA has secured two additional code–share partners at Haneda: Skynet Asia Airways and StarFlyer. (Skynet is a Fukuokabased 737–400 operator launched in 2002. StarFlyer is a Kitakyushu–based A320 operator modelled after JetBlue that began flying in March 2006.)

At Narita, the airline has developed a very successful "ANA Connection" service that provides convenient connections from US and European flights to eight domestic destinations. The typically twice–daily domestic flights are operated by Air Nippon with 737s or regional partners such as Air Central and IPEX Airlines with turboprops.

New airports at Kobe, Kitakyushu and Chubu have provided some domestic growth opportunities. ANA established six domestic routes from Osaka’s new Kobe Airport when it opened in February 2006.

Cargo development

Haneda’s expansion will mean increased competition domestically but it will not be like the opening of the floodgates. First, with JAL, ANA and foreign operators all clamouring for slots, it is not at all certain that the newcomers in Japan will get enough slots to seriously eat into the JAL/ANA duopoly and achieve the critical mass they need to earn profits. Second, with JAL still struggling to turn itself around, the government may not rush to deregulate domestically. Third, new airlines in Japan face high start–up and fixed costs. Fourth, rather than constituting threats to the incumbents, many of the recent entrants have needed help; it is indicative that ANA is providing support services to StarFlyer and Skynet and has even taken an equity stake in the latter. Cargo features prominently in ANA’s post–2009 plans because demand growth is expected to be strong, particularly on Japan–Asia routes. Also, ANA is relatively late in the game and therefore has modest cargo operations by Asian airline standards.

ANA only began developing own–account freighter operations in 2005, after selling its 27.6% stake in Nippon Cargo Airlines (NCA) to the venture’s co–owner, shipping company Nippon Yusen Kaisha (NYK). NYK and ANA had founded NCA in 1978 and grown it into Japan’s largest cargo airline that operated worldwide with a fleet of 747 freighters, but the two now wanted to pursue separate strategies.

While ANA will continue to provide operational support to NCA until 2009, it has moved quickly to implement a new cargo strategy. A new majority–owned cargo airline, ANA & JP Express (AJV), was formed in early 2006 as a joint venture with Japan Post to operate freighters for ANA and develop international express courier services. AJV, which began flying in August 2006, is 51.7%-owned by ANA, while Japan Post has a 33.3% stake and logistics company Nippon Express and Mitsui O.S.K. Lines are minority stakeholders.

It was felt that the new strategy would achieve greater operational efficiencies and enable ANA to better cater for the strong demand for international cargo services especially in Asia. The plan is to establish basic networks linking Japan with China, the US and new Asian markets. The airline wants to grow cargo operations into the "third pillar" of its business (after domestic and international passenger operations).

Two years ago, ANA had only one 767–300 freighter; the rest of its cargo was carried in the belly holds of passenger aircraft. When AJV took over a year ago, the fleet had grown to three 767- 300Fs. The fourth 767–300F, delivered in October 2006, was used to launch a Centrair–Anchorage- Chicago service. The four freighters now plough 20 international and five domestic routes. Two additional 767–200Fs have been wet–leased for this winter.

ANA's fleet strategy

ANA is looking to expand its cargo fleet at a rate of one or two aircraft per year. In the medium–term, the airline will be taking 767–300ERs converted from passenger operations. Post–2009, there will also be growth from Haneda, in addition to Kansai, Centrair, Okinawa and other hubs. ANA’s fleet strategy is a key part of its efforts to further reduce its unit costs and establish a "sustainable competitive edge". The airline is in the process of drastically reducing the number of aircraft types, boosting the ratio of smaller aircraft and adding new fuel–efficient models.

The basic aim is to standardise the jet fleet on three types: the 737–700, the 787 and the 777. However, the fleet will not actually be that streamlined at any point, because the plan will be implemented in stages, some 767–300ERs will be converted to freighters (rather than retired) and because ANA may still need an aircraft larger than the 777. The airline has not ruled out the A380 or the 747–8; its executives have said on several occasions recently that they would monitor passenger reaction to the A380s introduced by Star partners (launch customer SIA is currently expected to receive its first A380 in mid–October).

ANA has already made much progress with fleet rationalisation. Between 2002 and early 2006, it eliminated three aircraft types: the 747SR–100, the 747–200 and the 767–200. The A321–100 will be next; there were only three in the fleet in March 2007 and two of those are slated to go in the current fiscal year.

At the end of March 2007, ANA operated a 189- strong jet fleet consisting of 61 large widebody aircraft (23 747–400s — including 13 in 569–passenger domestic configuration, 15 777–300s and 23 777- 200s), 63 "medium–sized" aircraft (60 767–300s and three A321–100s) and 65 narrowbody aircraft (29 A320–200s, 10 737–700s, one 737–400 and 25 737- 500s).

The long–term aim is to dispose of the entire 747–400 fleet and focus on the 777–300ER as the main large aircraft on international routes until a new future widebody type has been determined. However, ANA still expects 747–400s to account for 20% of the large–widebody fleet in March 2012, with 777–300ERs and 777–200s accounting for about 40% each. By comparison, the percentages in March 2004 were: 747–400s roughly 42%, 747- 100/200s 19%, 777–200s 30% and 777–300ERs 9%.

The 747–400 retirements begin this year, following the advance sales of nine aircraft in the past year. Five 747–400s will leave ANA’s fleet in the current fiscal year, followed by two each in FY 2008 and FY 2009. As of March 2007, ANA had five 777- 300ERs on firm order, for delivery through FY 2009.

The "medium–sized" aircraft strategy envisages the 787 eventually replacing the 767–300s in domestic and Asian operations. The 787 will also be used to complement 777–300ERs on Pacific and European routes and to open new long–haul destinations. The aircraft will have the range to operate Japan–US West Coast with a full passenger and cargo load.

ANA’s 787 launch order in April 2004 was for 20 787–8s for long–haul operations (the standard 200- 250 seat version) and 30 787–3s for domestic routes (the short–range, 300–plus seat version that will be available from 2010). The airline has promised a "super–comfortable" passenger experience, with bidet–toilets as standard "to refresh the parts other airlines cannot reach".

The first 787 delivery is scheduled for late May 2008, which Boeing has continued to insist is still possible even though the test flight has been delayed to mid November/mid December. ANA will receive about six aircraft per year through 2015. The airline said recently that it was considering ordering 10–20 additional 787s.

On the narrowbody front, the plan is to standardise the fleet, which currently includes many different 737 variants and A320–200s, on essentially the 737–700. ANA placed a firm order for 45 737NGs (mainly 737–700s) in June 2003 and had received ten by the end of March 2007. Deliveries are running at seven aircraft per year through FY 2012. In January 2006 ANA converted two of the 737–700 orders into ERs, becoming the long–range version’s launch customer.

ANA’s regional subsidiaries operate a combined turboprop fleet of 22 aircraft, including three F50s, five Dash 8–300s and 14 Dash 8–400s (plus three on order). The plan is to rationalise to one type, the Dash 8, with the 74–seat 400–series being the preferred aircraft for expanding service in many markets. There are currently no plans to add regional jets.

Funding the plan

ANA found a very cost–effective and timely solution to expanding its freighter fleet: the 767–300ERs retired from passenger service. The airline launched the 767–BCF (Boeing Converted Freighter) programme in October 2005 and currently has five conversions on order, with deliveries beginning this December. The BCFs will increase the freighter fleet to nine aircraft by March 2010. In the longer term, ANA may consider operating larger freighters, such as 777Fs, 747–8Fs or A380Fs. The 2006–2009 mid–term plan envisaged a total investment of about ¥700bn (US$5.9bn) on new aircraft purchases and information systems. So far the plan has been funded mainly with operating cash flow and asset sales, though ANA also raised ¥95.8bn (US$809m) from a share offering in February 2006 and obtained a ¥100bn (US$844m) credit facility with 15 Japanese banks earlier this year.

Operating cash flow amounted to ¥128bn (US$1.1bn) in FY 2005 and ¥159bn (US$1.3bn) in FY 2006, and the current year’s forecast is ¥183bn (US$1.5bn). Aircraft sales raised a highly respectable ¥172bn (US$1.4bn) in FY 2005 and ¥108bn (US912m) in FY 2006. But all of that paled in comparison with the cash flow boost provided by the sale of 13 hotels and two property management units in this year’s June quarter, which raised ¥281bn (US$2.4bn) in gross proceeds — much more than had been expected. It was an opportune time to sell commercial property in Japan, because land prices there rose in 2006 for the first time in 16 years, and there has been considerable investor interest and liquidity, helped by tourism recovery and low interest rates. JAL and other Japanese companies have also been selling hotels and other high–value assets bought in the late 1980s.

Credit Suisse noted in early June that the hotel sale enabled ANA to "accelerate the replacement of aircraft and upgrade cabin products" and would therefore give it a "stronger competitive edge". Morgan Stanley argued in a June 18 report that in addition to improving balance sheet health, the sale would form a "buffer for management strategy from angles including availability of funds". The move was also in line with ANA’s strategy of focusing management resources on air transport.

ANA is wisely striving to strengthen its balance sheet ahead of the post–2009 growth years — a period when it is likely to want to return to the capital markets to raise more debt or equity. That said, the balance sheet is already in reasonably good shape; the only unusual aspect is that cash and short–term investments on March 31 amounted to only 11.6% of last year’s revenues — the norm (and what is generally considered healthy) for global airlines these days is around 20%.

An important vote of confidence came in mid- July, when Moody’s upgraded ANA’s senior unsecured debt rating (from Ba1 to Baa3). When airlines begin growing, rating agencies often become concerned because they fear — quite correctly — that debt levels will rise. But in ANA’s case, Moody’s cited its stable profitability and "strong financial profile" and noted that even though the next midterm plan is likely to include significantly higher aircraft spending, ANA would "maintain its adequate financial flexibility going forward".