United: M&A posturing

September 2006

Among the large US network carriers, United continues to be an enigma. The airline, the second largest in the world, has so much going for it — a powerful global franchise, unrivalled exposure to high–yield traffic and, as a result of its Chapter 11 restructuring, LCC–level labour costs also. Yet, United seems chronically incapable of capitalising on its strengths.

Instead of solid results, we are getting a lot of hype about turnarounds and arrogant posturing about mergers and acquisitions. How can CEO Glenn Tilton claim, as he did in a recent speech, that United is now "on a solid footing to participate in mergers and acquisitions"? How can he portray United as a potential acquirer when it is one of the financially worst–performing US airlines outside Chapter 11?

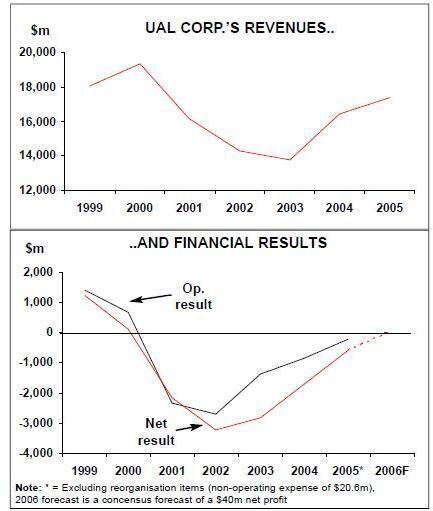

United’s parent UAL Corporation emerged from its three–year Chapter 11 reorganisation in February 2006 with what was effectively a strong vote of confidence from the financial community (see Aviation Strategy briefing, April 2006). But, despite all the hard work — including $7bn cost cuts, debt and lease restructuring and the shedding of pension obligations — UAL has continued to post below–par financial results.

The first quarter saw a $306m net loss before special items — similar to the $302m year–earlier loss. And although UAL returned to profitability in the second quarter, with operating and net earnings of $260m and $119m respectively, the results trailed those of other solvent network carriers. UAL’s operating margin was only 5.5%, compared to US Airways' 11%, AMR’s 8% and Continental’s 7%.

The results were certainly an improvement over the second quarter of 2005, when UAL earned a meagre $48m operating profit (1.5% of revenues). The airline outperformed competitors on the revenue front, recording 19.7% growth in domestic mainline passenger revenues, compared with 9.5% for the industry. Domestic mainline unit revenues (PRASM) were up by 14%, despite 5% higher capacity (contrasting with competitors' capacity reductions, but United had cut heavily in 2005). Also, it was UAL’s first second quarter net profit since 2000.

But investors expect to see at least industry–par financial performance in the wake of a successful Chapter 11 reorganisation — after all, Chapter 11 is the ultimate opportunity to put one’s house in order, get rid of unwanted aircraft, get out of undesired contracts, etc. If an airline does turn in robust performance immediately after, it is often a sign that something fundamental was overlooked and that a repeat Chapter 11 visit may be necessary.

In United’s case, there have been nagging doubts about two things in particular. First, the airline did not cut its unit costs sufficiently in Chapter 11. As rating agency S&P noted in July, United’s second–quarter CASM, at 11.43 cents, was "materially higher" than American’s 10.88 cents (the two airlines have similar average stage lengths and RASMs).

Second, United has adopted a questionable "multiple branding" strategy, which aims to retain both premium and lower–end customers with specific products, such as Ted (the low–cost unit), "p.s." (premium transcontinental service), "Economy Plus" (section offering extra legroom on mainline flights) and "Explus" (first–class seating on regional partners' RJs). The strategy, discussed in detail in the April 2006 issue of Aviation Strategy, contrasts with other network carriers' efforts to streamline operations and reduce costs throughout their system.

Then there is the growing competitive threat from Southwest. The leading LCC (also the largest US airline in terms of domestic passengers) entered United’s Denver hub in January 2006 and is rapidly building operations there. On October 5 Southwest will also begin serving Washington Dulles, United’s East Coast hub.

In addition, given United’s history of labour strife and this year’s less–than–desirable operational performance, there continue to be concerns about its corporate culture. And it does not help that United has what can probably be fairly described as one of the least respected management teams in the US airline industry.

Add it all up, and it is no surprise that UAL has been among the worst performing US airline stocks in the past six months. The share price halved from a high of $43 in late March to around $22 in mid–August, though it has since recovered to the $27–28 level.

Most analysts have a "neutral" rating on the stock, though there are a few "buy" recommendations. The common theme is total lack of enthusiasm — the investment community is in a wait and- see mode about United’s ability to consolidate the recovery and catch up with the other solvent network carriers.

United clearly has a lot more work to do, especially on the cost cutting front. On the positive side, however, the cost differential with American is believed to derive from non–labour costs — those should be the easiest cuts to make. In other words, while in Chapter 11, United accomplished the toughest task of wringing significant concessions from its workers. But, with the management preoccupied with labour, fleet and bankruptcy issues, United got left behind in non–labour cost cutting — an area that American and the other solvent carriers have focused on intensely and with great success in recent years (hub de–peaking, etc.).

New cost cutting programme

In the spring, United announced plans to reduce its annual operating costs by another $700m, of which $300m would be realised this year and the remainder in 2007 and beyond. The programme, which is running ahead of schedule, aims to strengthen the core business. The airline is cutting purchased services costs by $200m, general and administrative costs by $100m and advertising and marketing costs by $60m. The measures include eliminating at least 1,000 salaried and management jobs out of 9,400 by year–end and moving the company’s headquarters from suburban Chicago to the city centre in early 2007 (UAL will be able to consolidate real estate holdings and obtain city, state and landlord grants).

Operational efficiency improvements are expected to contribute another $40m in annual savings. United’s goal is to reduce average aircraft turnaround times by eight minutes system–wide by the end of 2006 through more efficient hub operations. The programme was initiated at the San Francisco hub in January 2006, with Ted markets following in February and Denver and Los Angeles in the second quarter. Washington Dulles and Chicago are getting the optimised processes this autumn. Despite the current extremely high passenger load factors — United’s was 84.9% in the second quarter — the airline has reduced Denver and Los Angeles turnarounds by four minutes. In the second quarter, average daily aircraft utilisation improved by 3% to 11.3 hours.

United is also trying to tackle distribution costs. Among other things, in an effort to cut its $265m annual GDS bill, the airline recently added a $3.50 per–segment charge on bookings made on non–preferred distribution channels (not including Sabre, Worldspan or Galileo).

On the revenue side, United has played a prominent role this year in trying to keep domestic fares at healthy levels. In the first quarter alone, the airline initiated 16 domestic fare increases (of which less than half stuck) and numerous international "tactical" fare increases.

The domestic mainline premium class product has been winning awards and appears to be a good revenue–generator. "Economy Plus" upgrade revenues are expected to double to $50m this year and double again to $100m in 2007. The "Explus" product on RJs is also believed to be revenue–accretive. Among the new initiatives, United is rolling out a new international premium class product in 2007; this is believed to involve a $165m investment in new seats and in–flight entertainment systems.

In contrast, United is keeping a low profile about Ted. The low–cost unit, which does not have a separate management, plays a useful role in the leisure markets out of Denver but is not expected to see significant further expansion.

Focus on network optimisation

Much of United’s current effort focuses on optimising its global network to maximise revenue and profit opportunities. This means adding service to Asia–Pacific, strengthening the Washington Dulles hub and pulling out of unprofitable non–strategic markets.

To solidify its position as the world’s largest transpacific carrier, United recently announced plans to add 40 new weekly year–round flights to Asia–Pacific over nine months. This includes a new daily 777 Dulles–Tokyo service from late October (replacing the airline’s highly unprofitable JFK–Tokyo flights) and expanded service from San Francisco to Taipei, Seoul and Hong Kong.

United is also introducing a three–per–week 777–200 Dulles–Kuwait service from late October, becoming the first US airline to fly to that country following the recent signing of a US/Kuwait open skies ASA. The airline said that it is considering other opportunities in the Middle East and that it chose Kuwait because of strong demand for military and business travel on the route.

In addition, United has applied to operate Dulles–Beijing from next spring, when the ASA allows the addition of one new US–China route by an existing US operator. There is understandably hot competition for that one route, with Northwest, American, and Continental all proposing service to Beijing from other US cities. United has a good chance because Washington is the largest metropolitan region without non–stop service to China and it has a large Chinese population — the application is getting strong political support.

United is boosting service at Washington Dulles by 22 new flights this autumn, following the addition of 84 flights in the past 12 months, as part of strengthening commitment to what it described as its "key hub". In addition to the first air links with Japan and Kuwait, Dulles is receiving three new domestic destinations (West Palm Beach and Fort Myers in Florida and Tucson in Arizona). By November United will have 321 daily departures from Dulles, up 13% year–over–year, serving 75 domestic and 22 international destinations.

This is quite an achievement when considering that only a few years ago numerous experts and even some creditors were recommending that United close the Dulles hub, which had remained small since it was opened in 1986. The premise was that United had too many hubs and that Dulles' remote location made it unsuitable. But United held its ground, even when challenged by Independence Air, and is now using Dulles to boost its East Coast position.

As part of the route optimisation effort, this past summer United made the headline–grabbing announcement that it is selling its New York- London route authority to Delta for $21m. The deal, which is subject to government approval, will mean United discontinuing its last remaining daily JFK–Heathrow flight at the end of October and Delta launching a daily JFK–Gatwick service (under the existing ASA, only American and United are permitted to serve Heathrow).

The move has raised many eyebrows because United is giving up an extremely scarce Heathrow slot and therefore weakening the US side’s position. But the airline has such a weak presence in New York that the London flight is not a profit–generator. It makes more sense for United to rely on the Star Alliance, which offers 125 international connections through JFK. United will continue to operate to Heathrow from its Chicago O'Hare, Dulles and Los Angeles hubs.

What about the future?

In the very short term, United’s leadership can probably get away with portraying the airline as an acquirer, because UAL is poised to report healthy earnings for the third quarter — traditionally its best period. But that would only mean a marginal net profit for the year. The current consensus forecast is a net profit of only 27 cents per share (about $40m) in 2006.

It would be UAL’s first profitable year since 2000. However, virtually every US airline (except Delta and Northwest, which are in Chapter 11, and JetBlue, which is experiencing growing pains) is likely to be profitable in 2006, especially now that fuel prices have declined (though those benefits may be offset by weaker demand and slower RASM growth). A marginal profit would place United among the US industry’s worst performers in 2006.

But could United impress investors in 2007? It is too early to tell, but there are fears that 2007 could be a tougher year for the industry because of resumption of domestic capacity growth and a possible slowdown in the economy, both of which would mean a weaker pricing environment. Reflecting uncertainty about both industry conditions and UAL’s situation, there is considerable variation in individual analysts' 2007 forecasts for the company. UAL’s profit estimates for next year range from $1.28 to $5.47 per share ($200m to $860m).

United has staying power because of its current healthy cash reserves ($5.1bn at the end of June) and limited near–term debt obligations and capital spending requirements. However, in a couple of years' time UAL should earn reasonable profits in order to meet its still–significant debt and lease obligations and fleet investment needs.

US Airways and AWA demonstrated that a merger (which they executed as US Airways emerged from Chapter 11) can be a nice way to raise significant equity funds — something that UAL did not accomplish in its own Chapter 11 (it only raised secured debt). However, outside equity investors, such as hedge funds, will only get involved if they see definitive strategic value in the transaction.

Those two factors — uncertain 2007 profit prospects and the potential to raise significant equity funds through US Airways/AWA–type transactions — help explain why United’s leadership is so interested in mergers. That said, CEO Glenn Tilton happens to be a big proponent of the creation of powerful combinations of companies. In his pre–UAL days, he helped oversee Texaco’s $35bn merger with Chevron in 2001. He has talked about the airline industry’s need to consolidate constantly since UAL emerged from Chapter 11 and has made it clear that he wants UAL to be part of the process.

On September 25 Crain’s Chicago Business, citing unidentified sources close to United, reported that UAL has retained Goldman Sachs to explore strategic options, including possible mergers. The investment bank will apparently help assess the value of United’s domestic and international holdings, advise on sales or purchases of domestic or international routes and "scout for mergers".

That move seemed less headline–grabbing when it emerged that James Sprayregen, UAL’s lead counsel through its Chapter 11 reorganisation, had moved from his Chicago law firm in June 2006 to take up a position as head of Goldman Sachs’ restructuring practice. In other words, Tilton wants to continue consulting one of his most trusted advisors. But the move is another indication of United’s interest in being part of the industry consolidation process, which many analysts believe will start in 2007.

Rumours about merger talks involving UAL and Continental or Delta have been circulating for months, but no such talks are believed to be currently taking place. Both Continental and Delta have denied the rumours. Delta has repeatedly said that it is focused on completing its restructuring and emerging from Chapter 11 as a standalone carrier in mid–2007.

The reason only those two names are being linked to UAL is that no other combinations involving large network carriers make sense. Both Continental and Delta would offer highly complementary networks — strong in southern US, Atlantic and Latin America, while United focuses on the West and Pacific.

Many people view Delta as the more likely partner for United because it is in bankruptcy. US Airways' CEO Doug Parker has often made the point that Chapter 11 was the key to making the AWA merger work, in that it facilitated steeper cost cuts and fleet reductions and gave the companies more flexibility to combine their networks. On the other hand, Continental is a higher–quality and more efficient airline and it has been interested in United in the past.

Many of the past merger talks ended when the two parties could not agree on who should run the combination. This could be a problem in the future, except possibly with Delta. As Calyon Securities analyst Ray Neidl noted in response to the UAL speculation: "At this point, it appears to us that most of the current airline managers would want to be the acquirers".

Neidl suggested that it may be too early for the process to begin. While strategically the industry is ready and would benefit from consolidation, financially the legacy carriers have much work to do to get their balance sheets in order, and the regulatory climate may not have changed.

Many people believe that the consolidation process will not begin until US Airways and AWA have successfully integrated their labour forces — in other words, proved that it can be done. This is because most mergers in the past have failed due to terrible labour issues. Those issues would be no easier at United; however, once the process is under way, United could be a sought–after partner because of its relative low labour cost structure.