Gol: Brazilian version of the LCC model

September 2004

Gol Linhas Aereas Inteligentes, Brazil’s rapidly growing and hugely profitable low–cost carrier (LCC), became better known globally in June when it went public with listings in both New York and Sao Paulo.

The airline will go international in December with service to Buenos Aires in Argentina. Gol has exciting growth potential, but could the strict regulatory regime impede its plans? How will it fare when there is effective competition?

Gol, which began flying in January 2001, is a particularly nice addition to the global LCC ranks because of the positive social impact it is having in Brazil. Its low fares have made air travel affordable to a larger segment of the Brazilian population.

It is providing needed links in a country that is as large as the US but lacks highway and rail infrastructure. It is offering an affordable alternative to the buses — Brazil’s main mode of long–haul transportation. As the first true LCC in Latin America, Gol also has the potential to have significant impact in international markets within the region.

Gol is majority–owned and controlled by Brazil’s Aurea Group, one of the world’s largest bus companies.

Aurea’s founder Constantino de Oliveira, 72, is Gol’s chairman — the airline describes him as "the principal architect of our creation". His son and namesake, "Junior", 35, is Gol’s CEO and credited for introducing the "low cost, low–fare" concept in Brazil.

AIG Capital Partners, the venture capital arm of the insurance giant, acquired a 12.5% equity stake in Gol in February 2003, later selling half of the stake in the IPO.

Because of its position as a low–fare pioneer in Brazil and the dismal financial condition of the country’s other (high–cost) airlines, Gol has captured a 22% domestic market share in just three years. It currently operates a 31–point network with a 25–strong fleet of Boeing 737s.

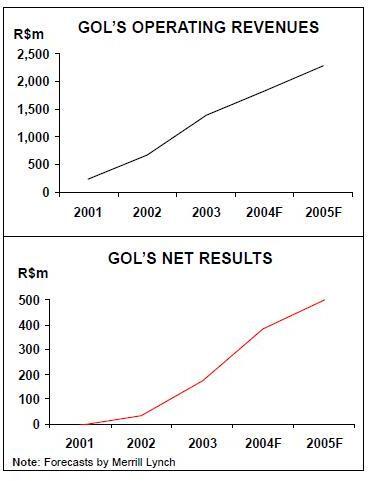

But the most impressive thing about Gol is its financial performance. After becoming modestly profitable in 2002, the airline reported net earnings of R$175m on revenues of R$1.4bn for 2003, representing a 12.5% net margin — among the best in the airline industry worldwide.

The 18.9% pretax margin was 2–3 points higher than JetBlue’s and Virgin Blue’s and 11 points higher than Southwest’s (only Ryanair bested Gol with a 23.3% pretax margin in 2003).

While North American and European LCCs have been feeling the effects of the fuel price hike and escalated competition this year, Gol has continued to improve its profit margins. Net profit for the first half of 2004 was R$163.9m, accounting for 20% of revenues. The second quarter, which is typically the airline’s seasonally weakest, saw a spectacular 29% pretax margin.

The strong profits are due to a combination of strong traffic growth, extremely low unit costs and a relatively healthy airline revenue environment in Brazil. The latter probably explains to a large extent why Gol’s is achieving unusually high profit margins.

The revenue environment in Brazil is relatively healthy because, unlike in the US, there is no excess industry capacity. Also, demand is fairly inelastic since 70% of all domestic trips in Brazil are for business purposes, compared to 30% in the US.

There is no excess capacity partly because of the cutbacks of the financially struggling carriers — the TAM/Varig code–share last year also removed some capacity — and partly because of government controls over capacity addition. The lack of excess capacity has enabled the airlines to maintain pricing power.

Thus Gol, which has wisely invested in a sophisticated yield management system, has been able to use the system to its full effect to maximise revenues.

For example, it has raised some fares to compensate for discounting in other markets

. The result has been stable or improving yields and unit revenues and healthy load factors.

Gol is able to avoid the worst effects of fuel price hikes and adverse exchange rate movements, because both of those are typically largely incorporated into the fare structure in Brazil, with a time lag of 2–4 months.

The airline hedges fuel needs 60–90 days ahead to allow for the delay in raising fares. The ability to link fares and fuel prices is another example of the pricing power that airlines enjoy in Brazil — it would not be possible in the US.

From an international perspective, perhaps the least interesting thing about Gol is the business model that looks like a carbon copy of Southwest’s. However, what makes Gol interesting is that it is applying the common LCC formula in unusual circumstances.

Unique environment

Gol’s circumstances are unusual, first of all, because Brazil is a relatively undeveloped aviation market with huge growth potential.

According to the IPO prospectus, Brazil had only 30m enplanements out of a population of 175m in 2002, compared to 650m enplanements in the US out of a population of 293m in 2003. On a per capita basis, Brazil had 0.17 enplanements, compared to 2.43 in the US, 1.38 in the EU and 0.36 in Argentina.

Brazilians do like to travel — interstate buses carried some 130m passengers in 2000 (the latest year available). Consequently, pulling passengers from the buses represents a large growth opportunity for an LCC.Given the 175m population and the large size of the country, Brazil has the potential to develop into one of the world’s leading domestic aviation markets. As the first LCC, Gol is perfectly positioned to play a Southwest–type role.

The second reason why Gol’s circumstances are unusual is that, unlike most LCCs, it operates currently in a re–regulated regime.

After six or seven years of gradual aviation deregulation, the Brazilian government reintroduced many controls in 2002 as the airline industry losses surged from R$1.47bn in 2001 to R$6.75bn in 2002.

The motive was to protect the industry’s financial performance. The new rules limit route entry, addition of capacity or frequencies, acquisition of new aircraft and the entry of new carriers.

For any changes, airlines must file with the DAC and justify the economic viability of the action.

Third, Gol’s circumstances are unusual because it currently lacks effective competition. The barriers to entry are high, while the three main established airlines — Varig, TAM and Vasp — continue to struggle financially, with high cost levels and heavy debt burdens.

Gol has not been disadvantaged by the new controls; rather, it has probably benefited. First, because of its low cost levels, it must have found it easier than competitors to justify growth. Second, the controls may have stopped potential new LCC entrants in their tracks, or at least delayed them. Third, the new rules have helped keep in business the weakest carriers, which are not capable of challenging Gol.

US–based analysts have expressed admiration for Brazil’s moves, though some fear that Gol might be negatively affected in the future.

Raymond James analyst Jim Parker pondered that "Wouldn’t it be great if the US government required US airlines, particularly the legacy carriers, to demonstrate profitability before adding capacity?" Merrill Lynch analyst Michael Linenberg’s was more measured: "We view this as not necessarily a bad thing, given the industry’s propensity to over–expand, but at some point the increased regulation could become an impediment to Gol’s expansion plans".

How might Gol be affected if the government became absolutely determined to get the legacy carriers back on their feet? In recent weeks there has been speculation about the government assuming control of Varig temporarily to restructure it and sell it to a private investor.

Gol will face competition from new LCC entrants at some point in the future. A pretax profit margin of 29% invites competitive challenges.

Even with the existing limits on new entry, there must be many business plans on the drawing board — one recent newspaper article mentioned a company named Webjet targeting the trunk routes and two others LCC hopefuls aiming for leisure markets.

The June IPO

In late June Gol became the second Brazilian company ever to complete a dual–listing IPO. The airline and certain existing shareholders (AIG and the four de Oliveira brothers) offered a total of 33m preferred shares, in the form of ADSs outside Brazil and preferred shares in Brazil.

Both offerings were priced at the top of their anticipated ranges, at $17 and R$26.57, and were significantly oversubscribed. The ADSs were listed on the NYSE and the preferred shares on Sao Paulo’s Bovespa.

The offerings raised a useful R$878m or US$280.9m in gross proceeds, of which US$151.4m went to the airline and US$115.5m went to the selling shareholders. The proceeds will be used to fund fleet expansion.

The IPO significantly strengthened Gol’s balance sheet, raising its cash position rose by R$505m to R$696m — a healthy 45% of annualised net revenues. The lease–adjusted debt–to capital ratio at the end of June was 62.4%, which is relative low by airline standards.

The offerings had minimal impact on ownership and control. Only 17.6% of Gol’s stock is now in public hands, and Aurea/de Oliveira family remain firmly in control with a 77% ownership stake. The two AIG representatives on Gol’s eight–member board were due to be replaced by independent directors.

The IPO was an important vote of confidence in Gol’s prospects. The local offering had the highest retail demand ever demonstrated in a Brazilian IPO — the airline’s top executives said that they believed many of the investors were actually Gol customers.

Just as importantly, Gol established a foothold in the much larger US capital markets, which it can tap for further funds in the future. While Morgan Stanley was the sole book–runner in the global offering, Gol wisely also brought in other financial powerhouses — Merrill Lynch, JPMorgan, Raymond James and UBS. (By coincidence, it was the analysts from those institutions that initiated coverage on Gol.)

Gol’s valuation was at a discount to North American LCCs, reflecting what one analyst called a "Brazil–related risk discount".

It was valued at only about 11 times expected 2005 earnings, compared JetBlue’s and Southwest’s PE multiples of 20–22 and AirTran’s 15–16. The valuation was attractive given Gol’s profitability and growth prospects, and its share price has already risen from the $17 offer price to over $19 (after a somewhat slow start in the initial two months).

The business model

In its own words, Gol’s is "modelled after the successful strategies of other international low cost airlines". It is mostly in the classic Southwest mould: low costs, low fares, simple product, single- type fleet, high efficiency, strong brand, friendly service, motivated workforce and extensive use of new technology.

Gol’s unit costs are unusually low — at R$0.141 or 4.8 US cents per ASK in 2003, they are lower than many other LCCs' (including Southwest) and about 25% lower than Brazilian legacy carriers'. The unit costs are impressive given Gol’s average stage length of less than 700 kilometres, which is shorter than Southwest’s. The main drivers are low labour costs, a new fleet and high aircraft utilisation.

The airline claims that it operates the newest fleet in South America — 22 leased 737–700/800s, plus three interim 737–300s (another two are due by year–end) on two–year operating leases.

The 300s will facilitate growth until deliveries of new Boeing aircraft start in mid–2006. Gol placed an order in May 2004 for up to 43 737–700/800s — currently 17 of those are firm orders and 26 are options. Gol’s average aircraft utilisation, at 13.3 hours per day in the second quarter and 14 hours in July, is among the highest in the world.

The only other airline with 13–plus hours that comes to mind is JetBlue. In both cases, the high utilisation is due to short turnarounds and night flights.

Offering night flights at bus rates between major domestic cities was a bright idea implemented in December 2003. The flights have very low marginal costs.

One aircraft typically covers six cities. Since travel time is typically cut from 24 to five hours or less, the services have been extremely popular, with average load factors in the high 80s or 90s. Yields are typically just over half of Gol’s system yields.

Gol also benefits from exceptionally high Internet sales. In the first half of 2004, 74% of its sales were through the Internet — about the same as JetBlue’s but more than Southwest’s and AirTran’s. One analyst noted that this is particularly impressive, given that the Internet is not nearly as widespread in Brazil as it is in the US.

Other Brazilian carriers may achieve only 5% maximum. Gol is also 100% ticket–less.

The product is simple — single class, no FFP, no airport lounges, only light snacks and beverages, no expensive entertainment systems.

Seating is pre–assigned, but in all other respects it is Southwest–style, without the JetBlue–style frills. On the pricing front, Gol differentiates itself from competition by offering typically 20–30% lower fares and making most seats available at those fares. As an interesting feature, the airline also offers its customers "a variety of flexible payment mechanisms, such as monthly instalment payments".

According to the IPO prospectus, Gol’s fare structure is "designed to balance load factors and yields to maximise profitability".

This may sound like the opposite of having a "simple fare structure" — the key concept for US LCCs. However, industry practice or government regulations in Brazil already eliminate some of the complexity by not allowing advance purchase restrictions, minimum stays or Saturday night stay requirements. Brazilian airlines are allowed to establish their own fares, but the regulatory authority monitors them to make sure that they do not affect economic viability.

By combining low fares with simple and reliable service, Gol has succeeded in developing a strong brand in Brazil. It is scoring highly in customer surveys and winning "company of the year" type awards. Most importantly, Gol has apparently succeeded in creating a Southwest–style employee culture — something that numerous LCC–hopefuls around the world have tried and failed in. The talk is of a "highly motivated, enthusiastic workforce" that benefits from the best training practices, profit sharing etc.

Like other LCCs, Gol aims to stimulate traffic and has succeeded in that. According to the IPO prospectus, passenger volume at various airports where Gol introduced service during 2001 rose by 8–24% between 2000 to 2002, compared to a mere 6% increase in aggregate traffic at Brazil’s top 50 airports in that period.

Route policy and growth plans

Gol operates in two types of markets. First, there are the high–density competitive markets, such as Sao Paulo–Rio Janeiro, where the airline operates direct point–to–point service.

Second, there are the thinner leisure–oriented markets where it operates multiple–stop service (a linear type network that has all but disappeared in most mature aviation markets). Since the first or last segment is typically a major route such as Sao Paulo–Brasilia, the strategy enables Gol to offer more destinations and frequencies and achieve higher load factors.

Because of the wide variety of markets, flight frequencies range from just one daily to a shuttle–type service with 38 daily flights in the Sao–Paulo- Rio market. Gol is fortunate in being able to establish an early significant presence in high–yield business markets like that.

After introducing two new domestic cities in August, Gol currently has government approval to add two more, Joinville and Uberlandia, in the fourth quarter. The airline will also begin twice–daily Sao Paulo–Buenos Aires service in December, its first international route, which will bring its network to 34 cities.

The airline has potentially substantial growth opportunities, both domestically and within South America, though at this point it is not clear how much of it Gol will have to share with competitors.

Gol’s CFO Richard Lark disclosed in a recent conference call that the company’s three–year plan includes at least 20 medium–sized cities in Brazil that meet its criteria of being overpriced or under–served, plus there will a "connecting the dots" strategy. Outside Brazil, Gol will be targeting principal capital city markets similar to the Sao Paulo–Buenos Aires route. Lark said that the strategy would be to integrate the routes with the rest of the network to maximise connections (almost half of Gol’s passengers are connecting or through passengers). Gol expects to triple its fleet to 69 737–700/800s by year–end 2010.

The current order commitments would mean average annual seat capacity growth of 20% over the next four or five years. However, because operating leases for the existing fleet of 22 737–700/800s will start expiring in 2007, the airline will have flexibility to grow more slowly, depending on the economic and competitive scenarios.

Financial outlook

Gol is expected to continue posting strong earnings growth for the foreseeable future. Merrill Lynch and Raymond James forecasts see the net profit more or less doubling from last year’s R$175m to R$330–380m in 2004, followed by another healthy increase to R$445–500m in 2005.

Pretax profit margin would rise from last year’s 19% to the high 20s or low 30s.

The bullish earnings projections are supported by economic trends in Brazil, which indicate resumption of strong GDP growth this year. One Brazil–based analyst made the point recently that airline revenues in Brazil continue to be closely correlated with GDP growth, generally increasing at three times the GDP rate.

However, Gol’s earnings and share price projections carry a higher than usual amount of risk and uncertainty. In addition to possible regulatory changes, there is exchange rate instability and uncertainty about inflation. Gol–specific risks affecting the share price include low liquidity (a free float of only 17.6%) and the Aurea Group retaining a 77% controlling stake in the company.

| Type | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| 737-700 | 18 | 18 | 24 | 32 | 33 | 34 | 35 | 39 |

| 737-800 | 4 | 4 | 4 | 7 | 12 | 19 | 26 | 31 |

| 737-300 | 0 | 5 | 5 | 0 | 0 | 0 | 0 | 0 |

| Total | 22 | 27 | 33 | 39 | 45 | 53 | 61 | 70 |