Ryanair: a Southwest-type quasi-hub strategy for the long term?

September 2000

Under chief executive Michael O'Leary, Ryanair has explicitly copied the Southwest formula for success. This has resulted in Southwest–type profit margins and a stock–market rating that is actually higher than Southwest’s (and well above all the other quoted European airlines). The clear message is that Ryanair will be the Southwest of Europe. But, in reality, it has some way to go before it achieves that status. In this article we draw on some parallels with Southwest in order to speculate on how Ryanair might grow over the next ten years.

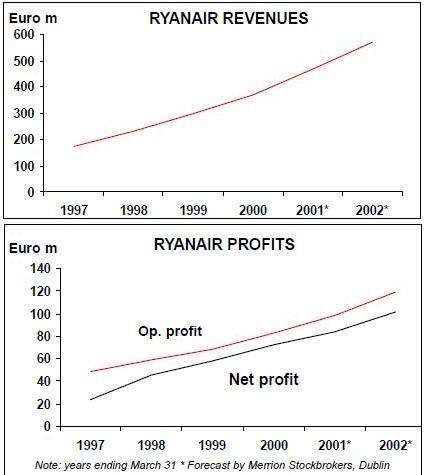

For its financial year 1999/2000 Ryanair Holdings Plc again produced very impressive results Total revenues grew by 25% to €370.1m, reflecting a 13% increase in passenger volumes to 5.6m, an increase in average fares due to a longer sector length, and the increased strength of Sterling to the Euro. Operating expenses increased by 26% which, as expected, was fractionally ahead of revenue growth reflecting the increased costs (primarily staff and, airport and handling costs) associated with the growth of the airline, and the launch of eight new routes. As a result profits increased by 26% to a new record of €72.5m for the year.

For the first quarter of 2000/01 Ryanair again pleased the stock–markets — passengers up 32%, revenues by 37%, pre–tax profit by 24%. Its stock–market capitalisation has risen to €3.2bn, equating to a prospective p/e ratio of around 33 (twice that of BA).

Ryanair has faithfully followed all the main elements of Southwest’s strategy — point–to–point operations, use of secondary airports, homogenous fleet, direct marketing, payment for frills, reliance of low fares to stimulate markets, effective application of its yield management system, charismatic leadership from O’Leary, and (mostly) good labour relations. Its success looks as if will be reinforced by the impact of its low fares website, ryanair.com, which has reduced commissions from 7.5% to 5%.

Where in 2010?

Currently, Ryanair accounts for about 2.5% of intra–European mainline scheduled passengers (estimated at about 230m passengers in 1999) . Assuming that Ryanair achieves a 20% a year growth rate and the AEA carriers' growth slows to 3% a year, then by 2010 Ryanair would be carrying about 35m passengers and would command about 10% of the market, which will probably put it close to the top three carriers (Lufthansa, which today the largest intra- European carrier, has about 14% of the total market).

For comparison, Southwest increased its share of the US Majors' domestic market (about 353m passengers in 1999) from 5% to 16% in the 1990s by growing at an average of about 15% a year, having grown at an average of 20% during the 1980s. Southwest is now second only to Delta in terms of US domestic traffic volumes, and will almost certainly overtake Delta in the near future.

So there is a clear precedent for Ryanair, though there are myriad uncertainties about the development of the European market, including:

- A possible collapse in the Euro–Majors' intra–European traffic volumes as they withdraw more and more from unprofitable routes to concentrate of high yielding sectors and long–haul feed

- The now inevitable disappearance or disintegration of some of the weaker flag–carriers;

- Further incursions by Ryanair into charter airlines’ market which currently totals about 80m passengers a year intra–Europe;

- Increased competition from other new entrants (Ryanair tends to dismiss the strategies of most of the other new entrants, believes that the low–cost subsidiaries — go, Buzz, etc. — will be re–absorbed into their parents, but accepts that easyJet has also an effective low–cost strategy and will play a key role in the European market); and

- Increased competition from (subsidised) high–speed trains.

In order to emulate the Southwest strategy, Ryanair will not only have to achieve a 20% a year growth rate (Ryanair itself regularly refers to a 25% growth), it will also have to keep pushing up yields, as Southwest has managed to do, by an annual average of 2.1% since 1990. Before speculating about how Ryanair might achieve these aims, it would be useful to review its current route network and the traffic characteristics (see summary table on page 12).

Current routes

Although the Dublin–London route is now the busiest in Europe, Ryanair’s expansion from Dublin seems to have been halted. An increasingly acrimonious dispute with Aer Rianta has meant that Ryanair has looked to expand at airports where it can achieve lower landing and passenger charges.

In 1999, Ryanair proposed financing the construction of a pier as an extension to an existing terminal building at Dublin. Aer Rianta would operate the pier and Ryanair would recover its financing costs through a heavily discounted passenger service charge over an extended period of years. Under the arrangement Ryanair would also guarantee a minimum level of additional passengers at Dublin on new routes. This plan has made no progress partly because of the issues it raises over the policy of non–discriminatory charges and partly because Aer Rianta is being prepared for privatisation.

So the Dublin network remains heavily skewed towards the UK, with a strong year round VFR traffic base and growing economic links between the UK and Ireland. Ryanair operates only two non–UK services from Dublin, to Paris (Beauvais) and Brussels (Charleroi). Given that the former is 35 miles north–west of Paris and the latter 37 miles south of Paris it is unlikely that Ryanair diverts too much business traffic away from the full–service carriers.

Ryanair operates two services from Shannon airport. The Frankfurt Hahn service probably benefits from the number of Germans who have bought holiday homes on the Irish west coast in general and in particular in Conemarra. The Shannon–Stansted service competes directly with Virgin Express, which may harbour ambitions to make Shannon a second hub (after Brussels).

Like Shannon, Glasgow Prestwick has only a limited number of services at present, to Frankfurt Hahn, Dublin and to Paris Beauvais.

London Stansted is by far the most important airport in terms of destinations served. Ryanair was the first of the low cost airlines to form a base there, go and Buzz being relative latecomers. Stansted offers a substantial catchment area and room for growth.

Ryanair’s route network is very different to that of go and Buzz. Whereas they serve usually mainline primary airports with a strong business content, very few of Ryanair’s routes fall into this category.

Ryanair serves six points in Ireland (north and south) from Stansted, with perhaps only Dublin offering the prospect of substantial business traffic. Most of the continental European routes served from Stansted are either leisure or VFR ( the southern Italian points, for example). The exceptions are Glasgow, Hamburg, St. Etienne, Turin and Genoa, which should have reasonable business content. Also the use of secondary airports at Frankfurt, Oslo and Stockholm means that they are not likely to be used by time–sensitive business travellers- Frankfurt Hahn is 60 miles west of Frankfurt, Oslo Torp 65 miles south of Oslo and Stockholm Skavsta 55 miles south of Stockholm.

Many of the routes are therefore being developed on VFR traffic, with Ireland–UK being probably the biggest VFR market in Europe, supplemented by leisure travel, in particular that associated with ownership of secondary homes. the city break market and price–conscious business travellers.

Route/network possibilities

Ryanair claims that all the eight new routes it opened out of the UK last year have already turned profitable, but to achieve the 20%-plus growth target, Ryanair surely cannot rely just on traffic to/from the UK or Ireland. Other important VFR flows within Europe or Europe plus Mediterranean countries include: Germany–Turkey, Germany–Greece, France- North Africa, France–Portugal, Belgium–Italy, Switzerland–Spain. These are of course also important leisure routes.

To grow at Southwest–type rates, Ryanair will at some point have to find a way to exploit these mostly north–south flows,. This implies building connecting points linking in with its current west–east/southeast services. Frankfurt and Paris would appear to be obvious points.

But doesn’t this mean that Ryanair would be building a hub network, which is anathema to a low–cost point–to–point operator?

Again a parallel with Southwest is useful. It is true that Southwest does not operate a typical US hub operation, with for instance 500 flights a day from the hub and 10–15 from the spokes; it operates numerous services out of many cities. Currently, seven of the airports on its network have over 100 flights a day, and is becoming more like a quasi–hub carrier

Southwest will never say this explicitly, partly because it needs to differentiate itself politically from the network carriers which are causing such misery in the US this summer and partly for investor relations reasons to differentiate from the other low–margin Majors. Nevertheless, Southwest, as it has built up the number of points served, has begun to depend more and more on flow traffic. For example, Phoenix is a classic “rolling hub”, Chicago Midway is used to connect east–west routes, and Baltimore connects traffic on its new services on the East coast to the rest of the network. The cities now served by Soouthwest now enable the airline to offer service to over 90% of the population.

What Southwest does not do is schedule its flights for connections — there are no waves of Southwest 737s arriving at roughly the same time and taking off together an hour later. Passengers simply have to wait for the next available flight to their destination, having collected and re–checked their baggage.

This works when there is a high frequency on the routes, which Southwest has achieved in many cases — eight round–trips a day minimum on business orientated routes. But Ryanair at present has only one route with that type of frequency — Dublin–Stansted.

Southwest, in effect, schedules for the aircraft not for the passenger. Connecting passengers generally have a longer wait than at a traditional hub, but the aircraft can be turned round very rapidly (15–20 minutes usually). This is essential for Southwest’s cost structure as it enable the carrier to maximise utilisation and simplify crew rostering.

The implications for Ryanair are that, if it to follow the Southwest model, it not only has to continue building up frequencies from its British and Irish points, but also it has to start operating from continental European bases to non–UK destinations. It will then have the opportunity of selling connecting tickets (but not building hub operations). EasyJet has already started along this route in its efforts to build up services from Geneva and Amsterdam.

Establishing bases in the continental European markets is a huge opportunity and a huge challenge for Ryanair. There is practically no low–cost airline competition based in Germany, and in France the alternative to the Air France Group is Swissair’s amalgam of Air Liberté/Air Litoral/ AOM, which shouldn’t be a frightening prospect for Ryanair.

On the other hand, there are barriers to entry — competition from the train service, resistance to credit card sales, but these are problems that can be tackled; less tangible is the traditional ability of certain flag–carriers to repulse through matching prices regardless of their own cost structure, flooding sectors with new capacity blocking access etc.

But as the US majors have found, it is now futile to try to resist a concerted attack by Southwest. And the EC competition authorities will surely have some role to play — Ryanair and go both have lodged unfair competition complaints against Lufthansa.

So by 2010, if Ryanair has translated the Southwest strategy into a European context, one might expect to see maybe five continental bases in addition to those in the British Isles. The carrier will have built up high frequencies on the key routes, which should allow it to overcome many of the perceived disadvantages of operating to secondary airports, and so it should be able to win over more business travellers. It will have effective coverage of most of the main European conglomerations. It will continue to schedule its aircraft like a point–to–point operator but will rely more and more on connecting traffic attracted by its low fares and high frequencies.

From a secondary airport perspective, the possibility of evolving from an obscure aerodrome to a Ryanair hub should be seen as a major opportunity. This prospect will strengthen even further Ryanair’s negotiating position on fees and facilities.

To operate this future network Ryanair will need a fleet of at least 120 737–800s and 737–700s (replacing the hush–kitted 737- 200s). This means orders for an additional 75 737–types to be delivered before 2010 in addition to existing orders and options. Not quite in Southwest’s class — with a current backlog of 167 737s, it is the largest airline customer in the world in terms of units ordered — but a worthy Euro–equivalent.

| Dublin to | London Stansted to | ||

| UK | Ireland | ||

| Glasgow (Prestwick) | B+V+L | Derry | V+L |

| Teeside | V+L | Knock | V+L |

| Leeds/Bradford | V+L | Shannon | V+L+B |

| Manchester | B+V+L | Dublin | B+V+L |

| Liverpool | V+L | Cork | V+L |

| Birmingham | B+V+L | Kerry | V+L |

| Luton | V+L | ||

| Bristol | V+L | UK | |

| Cardiff | V+L | Glasgow | B+V+L |

| Bournemouth | V+L | ||

| Gatwick | B+V+L | Scandinavia | |

| Stansted | B+V+L | Oslo Torp | V+L |

| Stockholm Skavsta | V+L | ||

| Continental Europe | Kristianstad | V+L | |

| Brussels (Charleroi) | V+L | Malmo | V+L |

| Paris (Beauvais) | V+L | Aarhus | V+L |

| Shannon to | Germany | ||

| Hamburg (Lubeck) | V+B | ||

| Stansted | V+L+B | Frankfurt Hahn | V+B |

| Frankfurt Hahn | V | France | |

| Glasgow to | Dinard | L | |

| Biarritz | L | ||

| Frankfurt Hahn | V | Carcassone | L |

| Paris (Beauvais) | V+L | Perpignan | L |

| Dublin | B+V+L | Nimes | L |

| St. Etienne | L+B | ||

| Italy | |||

| Turin | B+V+L | ||

| Genoa | B+V+L | ||

| Brescia | L+V | ||

| Venice (Treviso) | L+V | ||

| Rimini | L+V | ||

| Key | Pisa | L+V | |

| B = Business | Ancona | L+V | |

| L = Leisure/City Break | Alghero | L+V | |

| V = VFR | Lamezia | L+V |