Asian airlines' bungee recovery

September 1999

The collapse of the Asian economies and its aviation industry in the second half of 1997 was unexpected. The speed with which the economies are recovering and the airlines are recovering is equally remarkable, and the strength of the airline recovery may be the swing factor in the global aviation balance.

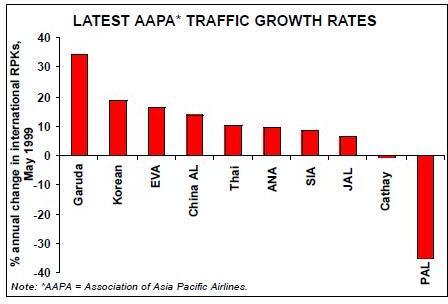

The graph below shows the latest AAPA traffic statistics for May. Most of the airlines are achieving 10%-plus rates, and this is the eighth consecutive month of overall positive traffic numbers. Average load factors are up to 68.1% compared with 64.2% a year ago. Garuda, starting to emerge from its crisis, and PAL, which is still mired in its are at opposite extremes in terms of traffic numbers.

The combination of happy events that is leading to a return to profitability for most of the airlines includes:

- A general recovery in passenger numbers as consumer confidence returns;

- Potentially an increase in the Hong Kong and Japan markets as those key economies recover;

- A strengthening in yield on the back of local currency appreciation;

- Continuing boom in the cargo markets, though with a continuing directional imbalance;

- Cost benefits flowing from the emergency rationalisation plans that had to implemented in 1997 and 1998; and

- Minimal overall capacity growth as yet.

There are two key questions about the future of the Asian business.

First, will the recovery be strong enough to suck back capacity from other markets, particularly the Atlantic, so ensuring a better global market balance? There is little sign of this happening yet.

Second, will the airlines continue with key structural reforms, in particular distancing themselves from government interference. Slippage in the timetables of the privatisation candidates — Thai International, China Airlines, for example — would be worrying.