Strategic alliances - how to choose the right partner

September 1998

It is very easy to make a bad mistake when rushing into a strategic alliance. Here, Tim Coombs sets out how an airline should manage the process of choosing the right alliance partner.

With most of the large jigsaw pieces of major strategic alliances in place, focus is now turning to the smaller niche airlines that need to plug the gaps in their global coverage. In particular, the spotlight is on airlines located in the Middle East, Eastern Europe, and some of the smaller carriers in Asia and South America that have yet to decide which major strategic grouping to join.

The lessons of Fiction Air

But just how do they choose the right partner? It is perhaps useful to create a fictional airline to highlight some of the issues that arise when considering whether to join a strategic alliance. Fiction Air is a small/medium- sized airline operating a number of domestic and international services in Asia. So far it has a number of route specific marketing agreements with other airlines that work well, but it has not entered into a major strategic alliance agreement with another airline or multi–airline grouping.

Fiction Air’s strategic planning department has for some time been warning senior management that although the airline is currently profitable, it is increasingly being marginalised by the new major alliance groupings. The way in which the industry competes is no longer on a route–by–route basis but by network competition. The strategists say that Fiction Air must join a strategic alliance in order to allow the airline to compete on a level playing field, or else it will face the prospect of a progressive decline in profitability that in the long–term may threaten the viability of the airline.

Senior management also face outside pressures. Most of the airlines that Fiction Air has enjoyed bilateral agreements with in the past are now also members of strategic alliance groupings. These groupings are themselves becoming more exclusive and pressure is mounting on Fiction Air either to become a fully fledged member of an alliance or abandon the bilateral relationships it has with smaller carriers that have now joined larger groupings.

Equity or not?

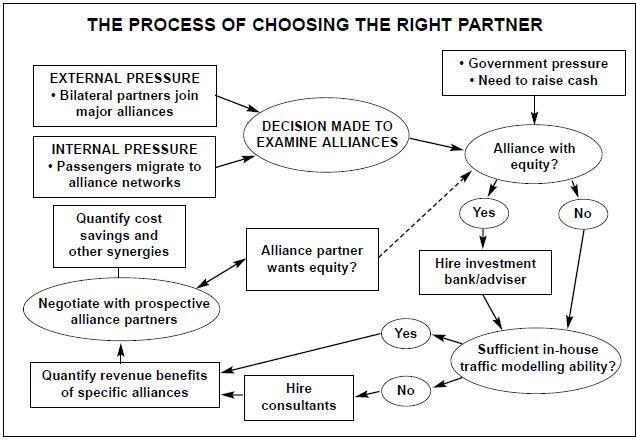

What steps should the senior management of Fiction Air take? One decision needs to be taken first, and it must be thought through carefully: is there a desire that an alliance involves equity participation or not?

The process of evaluating the benefits that membership of a strategic alliance brings and the negotiation of joining an alliance are far easier if equity is not on the agenda. But for many smaller regional airlines equity alliances can make sense. Reasons for this include:

- The airline may need to raise cash (to finance expansion and/or to pay off debt); and/or

- The airline may be government–owned and the alliance may be seen as an integral part of the privatisation process, with the government able to raise more from the sale process if it is perceived that the airline — through a strategic alliance — has a more “secure” future; and/or

- The strategic airline partner may wish to acquire equity in order to cement the relationship and exert a measure of control, perhaps through board representation.

The involvement of equity in alliances is clearly a complicating factor, and there are numerous examples of equity alliances that have failed. It is obvious, but often ignored, that entering the right alliance is the most important priority. And the right alliance is the one that offers the best blend of economic benefits, rather than the one that offers modest benefits but perhaps carries the highest valuation of the equity.

But if the decision is made that equity is a requirement of the strategic alliance then it is likely that the airline and/or its shareholders will find it both necessary and appropriate to hire an investment bank and a firm of legal advisors to handle the process. Valuation and finding an appropriate structure for sale of equity is a process that is beyond the scope of the internal resources at most airlines.

And whether equity is a consideration or not, most airlines have also found it necessary to appoint consultants in order to quantify the benefits that are on offer from joining one or other of the major alliance groupings. Outside consultants can also be very useful in identifying the strengths and weaknesses of the client airline, as perceived by different potential alliance partners.

An airline should already have a strong understanding as to how its own route system operates, how traffic flows across its own network and the benefits that its existing tactical alliances bring. However, apart from all but the largest carriers, few airlines have the complex traffic modelling capability that is necessary to conduct a thorough analysis of the changes in traffic flows that would result from joining a strategic alliance.

Traffic modelling

The strategic planning department of Fiction Air has already identified several different competitive scenarios that may impact on the airline in the medium–term. These include the impact of changes in the regulatory environment in which Fiction Air operates (the government has indicated that it will license another international carrier in the near future and wishes to sign an “open skies” agreement with the US within 12 months), and that Fiction Air’s major competitor is strongly rumoured to be joining the Star Alliance.

The consultants must be allowed access to most of the airline’s most sensitive traffic data if they are able to do their job effectively. Security of information should be a priority and confidentiality agreements must be put in place. It is vital that the consultants produce a base model of the existing network and that this model is calibrated accurately.

When this is completed, modelling of different scenarios can begin. This process is time–consuming and complex, because the model redistributes today’s actual traffic flows.

In an alliance with Star for instance, Fiction Air can expect to capture a much greater percentage of US west coast traffic onto its San Francisco service than with its existing US partner, US Airways. The model accounts for passenger preference for larger aircraft types, frequency, the marketing impact of code–shares, frequent flyer cooperation and a whole host of other variables.

In Fiction Air’s case it will be necessary to examine under the existing and future regulatory scenarios the benefits or otherwise of joining each of the alliance groupings; the likely competitive reaction; and the changes that will occur in its existing tactical relationships.

For Fiction Air this means effectively that the whole transpacific market will have to be modelled. Each individual run may take the modellers a long time as the process will involve millions of iterations. Clear thinking at this stage as to the scenarios that have to be modelled will save much time and money.

The output from the traffic modelling will identify which of the alliance groupings will bring the most revenue enhancement to Fiction Air and, equally importantly, how much additional revenue will be generated for the prospective alliance partners.

Negotiating the terms

This is not only important in terms of ranking the alliance groupings but vital when it comes to the actual negotiation of the terms under which Fiction Air joins a strategic alliance grouping. For instance, if Fiction Air benefits to the tune of $5m per annum from joining Star, but Star partner United generates $20m additional revenues per annum from the relationship, then some mechanism should be considered in order to equalise the benefits. This is obviously even more important when equity is being discussed.

The complexity of market dynamics means that the traffic allocation model can only serve as a rough guide to some of the benefits that may accrue to Fiction Air if it joins a strategic alliance.

It is also important to conduct reality checks with the consultants to make sure that load factors remain realistic and that competitive reaction is properly accounted for.

Armed with the consultants’ results, Fiction Air’s CEO can then conduct discussions with potential suitors with some knowledge of the range of revenue benefits that can be available. Of course revenue generation is only one benefit that may accrue from joining a strategic alliance, but it is probably the most important. If Fiction Air and its strategic alliance partners cannot produce measurable revenue enhancement then there will be no cement on which to build the relationship in other ways, such as cost savings and productivity improvement programmes.

At this stage of the process Fiction Air’s CEO introduces himself (or herself) to prospective airline partners. He should possess a clearly thought–out list of objectives for his airline, and his strategic planning department should have briefed him on the strengths and weaknesses of the potential partners.

Agenda items should include how Fiction Air’s network might develop under each alliance, how deep the alliance might go, the terms of frequent flier participation and the scope for achieving significant synergy benefits.

A myriad of factors will determine the right partner choice for Fiction Air, and this choice will be easier if a set of management alliance objectives have been made. Correctly managing the process of choosing the right partner, as described above (and shown in the diagram, left) is essential. And, above all else, the best way to make certain that a strategic alliance will work is to ensure that there is the right chemistry between the two prospective airline partners.