IndiGo: Airline investing

can be fun

October 2015

IndiGo , India’s leading LCC, was floated on the Delhi stock exchange in late October, a combination of new shares and the disposal of shares by the airline’s founders, raising an estimated $460m. The implied market capitalisation of the carrier would then be around $4.3bn, with an historic p/e of 21, roughly the same as Ryanair.

IndiGo is the leading Indian LCC with a 37% share of domestic traffic and, unlike every other Indian airline, it has been consistently profitable over the past seven years — in FY 2015, it achieved total revenues of Rp143bn ($2.2bn) and net profits of Rp13bn ($200bn). The latest balance sheet (June 2015), however, showed negative shareholders funds, Rp(1.4)bn, largely the result of a generous dividend policy. 0ver the past five years, the shareholders — principally Rahul Bhatia, head of the InterGlobe tourism, air transport and technology conglomerate, and Rakesh Gangwal, who, among many other achievements, was a CEO of USAirways — have received Rp35bn ($530m) of dividends, for a modest initial investment in the start-up (and they will continue to be majority shareholders after the IPO). At least this proves that it is possible to make a decent fortune in airlines, providing the timing, model and implementation are all correct.

IndiGo was launched in 2006, just after SpiceJet, the first of the Indian LCCs (indeed the founders of the two airlines were originally in the same investment syndicate). The timing was propitious — the new LCC model had already been proven in Europe and was being adapted to the Middle East and Asia. Indian bureaucrats were gradually releasing their stranglehold on domestic aviation, glimly perceiving that protecting Air India/Indian Airways was not such a good idea. The immediate target for IndiGo was to divert middle class passengers from the very slow railways to aeroplanes. In FY 2015 IndiGo carried 25.2m passengers, roughly twice the total domestic air traffic volume of ten years ago. 10-15% domestic traffic growth in the next ten years is feasible.

IndiGo’s operating model is (almost) classic LCC:

- A320 utilisation of 11.4 block hours per day on a point-to-point network with no interlining.

- 180 seats per aircraft, load factor of 90%.

- On time performance of 88% (brilliant for India).

- No frills, of any type but consistent service — Skytrax awarded IndiGo the “Best Low Cost Airline in India and Central Asia” title each year from 2010 to 2015.

- Ancillaries are about 11% of revenues, quite low by Western standards.

- Travel agents still account for 78% of sales, reflecting their dominance of Indian distribution channels.

- Highly efficient, low maintenance fleet, 3 years old on average, based on short- term sale and leasebacks.

- Building in a capital cost advantage through mega-orders: IndiGo ordered 180 A320neos in 2011 and a further 250 in August this year, the single largest order for this type received by Airbus.

Even by the standards of Indian regulatory overkill, the prospectus seems obsessed by identifying risk. Indeed some of the key risks identified appear more like opportunities.

Fuel costs in India are still a major problem. Government owned monopoly suppliers dominate the market, and sales and excise taxes push per gallon costs up by at least 40%. In the peak oil market, 2009-2012, over half of IndiGo’s operating costs were accounted for by fuel; now it is down to about 40%. Still, it is reasonable to expect, that the Indian authorities, will start to deregulate the fuel supply sector, as they have other sectors of the Indian economy.

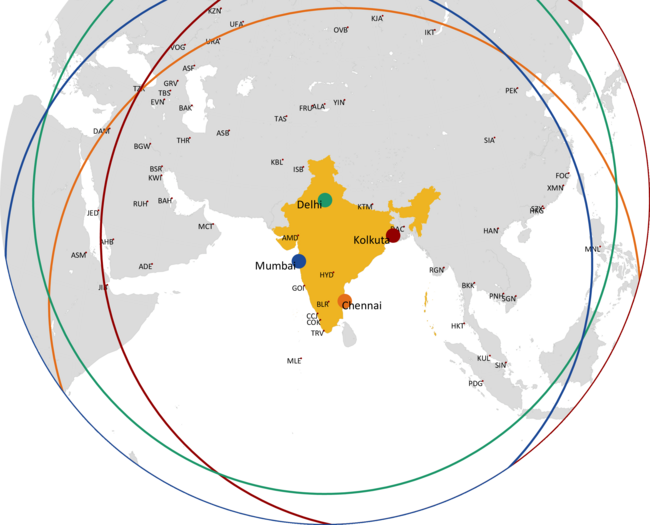

IndiGo is a relative newcomer to the international market, starting up services in 2011, and still only operating six routes. There, are however, are at least 60 viable points that could be served with the A320neo from Delhi or Mumbai, many of which would generate 50,000 pax/year which is IndiGo’s minimum target.