American and Continental: Leading the Legacy rebound

October 2006

While the US LCC sector struggled in the third quarter, with JetBlue and AirTran recording losses and Southwest only flat earnings, American and Continental saw their profits soar. Significantly, these two airlines — the only ones of the "big six" US network carriers to have avoided Chapter 11 in the post- September 11 environment (AMR has never been in bankruptcy) — have stepped up their balance sheet repair efforts, which have already resulted in credit rating upgrades. But why is Continental continuing to grow at a heady pace when American is cutting capacity in 2007?

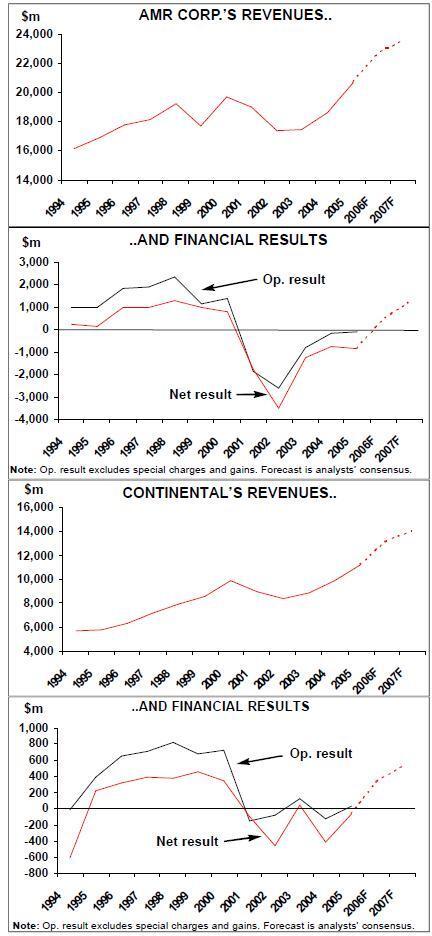

American’s parent AMR Corp. reported a $114m net profit before a $99m non–cash charge (related to fuel hedges) for the third quarter, contrasting with a $95m loss a year earlier. Revenues rose by 6.6% to $5.8bn. Operating income was $284m, representing a 4.9% margin, up from 1.8%. This was the first time in six years that AMR achieved net profits in two consecutive quarters.

Continental, in turn, saw its net profit before special items more than double from $61m to $146m, as revenues surged by 17.2% to $3.5bn. Including a $92m gain from the sale of its stock in Copa, net income quadrupled to $237m. Operating income was $192m or 5.5% of revenues — a margin similar to AMR’s — compared to $109m or 3.7% of revenues in the year–earlier period.

American’s and Continental’s operating margins in the third quarter, though obviously in a different category from Southwest’s 11.1% (which was down by 2.3 points), were slightly better than the 4.4% operating margin achieved by US Airways — this year’s star performer among the network carriers.

The results were impressive in light of the fact that the airlines still paid 15–18% higher average fuel prices in the third quarter than a year earlier. Also, the profits were achieved despite the negative impact of the tighter security procedures and restrictions on carry–on baggage put in place in the wake of the August 10 London terrorist threats.

The new security regulations made the latter half of the third quarter challenging for all airlines. However, contrary to the initial expectation that transatlantic operators would be the worst affected, in the US domestic operators suffered the most. This was probably because the new rules were the biggest hassle for short–haul passengers, who tend to carry on their luggage.

American and Continental tentatively estimated the 3Q revenue impact of the security rules at $50m and $25–30m, respectively, though both said that it was hard to separate it from other possible factors contributing to a softening of revenue trends. In any case, the impact was only temporary as the new security measures were relaxed in late September. In all other respects, the airlines enjoyed a uniquely strong industry environment in the third quarter. Demand trends were robust, domestic fares were at healthy levels and industry capacity was under control.

American’s mainline unit revenues (RASM) still grew by 7.7% and yield by 7%, while Continental’s RASM was up by 6.8% and yield by 5.5%. The fact that the transatlantic was Continental’s weakest RASM area (a mere 1.4% increase) probably had more to do with the airline’s 15% capacity addition in that region than the August 10 factor. Mainline load factors were at record levels — Continental’s was 82.7% and American’s 81.7%.

Cost controls have remained excellent. American’s ex–fuel CASM only inched up by 1%, while Continental’s declined by 0.8% in the third quarter. Including fuel, American’s CASM rose by 3.8% and Continental’s by 5.9%. There had been some concerns that demand might be slowing in response to a possible weakening of the economy, but neither airline has detected any such trends. Most of the US airlines have reported strong advance bookings, which bodes well for the fourth quarter. However, RASM growth is decelerating and is likely to continue at single–digit rates, if only because year–over–year comparisons are becoming more difficult.

Of course, airlines are currently benefiting from lower fuel prices. AMR’s management has reduced its second–half 2006 fuel cost projection by $528m from the previous estimate made in mid–July. However, fuel prices remain at historically high levels and continue to be volatile. AMR’s current forecast assumes that its average per–gallon price will decline from $2.16 in 3Q to $1.85 in 4Q but that the price will average at the higher $2.10 level in 2007.

Add to that the fact that American and Continental are potentially disadvantaged on the cost front for not having had the Chapter 11 opportunity to slash labour and aircraft ownership costs, and it is hardly surprising that both airlines continue to emphasise cost cutting and now see it as an ongoing process.

American is on track to achieve $700m in cost cuts in 2006, on top of the $4bn achieved in the previous three years (including labour concessions in 2003 when the company came close to filing for Chapter 11). Continental said recently that it does not have a specific overall financial target for further cost cuts following the $1.6bn in cost saving and revenue generating initiatives achieved since 2002 (including $500m in wage and benefit reductions).

Both airlines currently focus on simplifying processes, improving efficiency and productivity, reducing distribution costs and improving fuel conservation. Continental is using a method it describes as a "metric–based target initiative", which involves identifying and setting targets for key operational metrics to drive productivity. For example, the target could be to improve fuel burn per ASM. Continental is also in the process of installing winglets for its 737 and 757 fleets.

Continental benefits from the youngest fleet among the large network carriers. With an average age of 8.8 years in the second quarter, compared to American’s 13.4 years and Northwest’s 17.1 years, the fleet, according to Continental’s calculations, is about 10% more efficient than American’s and Northwest’s in terms of fuel burn per ASM. That 10% difference amounts to a significant competitive advantage in the current fuel environment.

Balance sheets repair efforts

On the ancillary revenue side, both airlines proudly reported that they have secured five–year mail contracts with the US Postal Service. American’s contract is potentially worth $500m in revenue, while Continental’s is valued at $258m. Both airlines have been very successful in recent cash raising efforts. Continental raised $203m from a public equity offering in October 2005, and AMR followed suit with a $400m public offering in May 2006. Continental has also raised $328m in total from the sale of its stock in Copa, first in December 2005 as part of Copa’s IPO and in a follow–on offering in July 2006.

The cash raising and improved operating results — and in American’s case also a pullback in growth–related capital spending — have given both airlines exceptionally strong liquidity positions. AMR ended the third quarter with total cash of $5.5bn, up from $4.3bn at year end 2005. The unrestricted cash balance was $5bn, or 24.2% of 2005 revenues. Continental had $2.5bn in unrestricted cash on September 30, accounting for 22.3% of 2005 revenues and up from $1.9bn at the end of last year.

The improvement is particularly important for Continental, because its historically below normal cash reserves — typically around $1.5bn in the past five years, which actually was the company’s target — made it the most likely candidate to succumb to an event–specific liquidity crisis.

In addition to raising cash, Continental has reduced its 2007 debt obligations from $937m to $556m by paying off about $100m of debt early and completing two refinancings this past summer. The first of those refinanced a $292m debt facility, lowering the interest rate and extending the maturity date from December 2007 to June 2013. The other deal lowered the interest rate on a $350m loan due in 2011, resulting in total savings of $30m.

AMR began reducing its leverage by repurchasing $128m of debt in the first nine months of 2006. This was in addition to making $1.1bn of scheduled debt payments. However, the move provided no relief for 2007, when debt and capital lease obligations add up to around $2bn.

The recently passed pension bill has enhanced both airlines' ability to fund their pension obligations. American expects to contribute $360m (a greatly reduced amount) and Continental $200m to pension plans in 2007.

The improvements are being recognised by the rating agencies — something that will help reduce future borrowing costs. On October 20, the day after American and Continental released their third–quarter results, Fitch raised both airlines' corporate credit ratings from "CCC" to "B–minus" (still speculative grade) and debt ratings from "CC" to "CCC". Also, S&P revised Continental’s outlook from "negative" to "stable", which may not seem much but is a step in the right direction. Both agencies cited improved earnings, cash flow and liquidity.

Contrasting growth philosophies

But the airlines are keenly aware that they have a long way to go in mending their balance sheets. According to Calyon Securities, AMR’s and Continental’s debt and capital lease obligations amounted to $20.3bn and $11.9bn, respectively, at the end of June. The lease adjusted debt–to–capital ratios were 103% and 95%. By comparison, United’s debt and lease obligations and the debt–to–capital ratio were a more reasonable $14.8bn and 88%. While both American and Continental focus on international expansion, they provide a fascinating contrast in terms of growth philosophies. American continues to exercise extreme restraint about capacity addition; its latest plan, disclosed in the 3Q call, anticipates its overall capacity shrinking by 1% in 2007.

Even though American is planning some international expansion — notably Dallas- Beijing from March 2007, if it is lucky enough to be selected for the one new US–China route allowed by the ASA next year (United, Continental and Northwest have also applied) — the leadership stressed that any flights to be added must be profitable on a year–round basis. American’s CEO Gerard Arpey has also repeatedly said that the airline will not be able to grow until it reduces its $20bn debt.

Because of American’s size, its continued capacity discipline is obviously great news for the industry. Several analysts noted after the call that industry prospects for 2007 suddenly looked much better.

By contrast, Continental — the only one of the "big six" that has expanded in size significantly since 2001 — intends to grow its mainline capacity by 5% in 2007. This is at the lower end of the 5–7% annual growth range envisaged by the carrier’s long–term plan, mainly because Continental is a little aircraft–constrained, with only two 777s scheduled for delivery next year.

While the focus is heavily on international expansion, unlike the other legacies, Continental is also growing domestically. This year’s mainline domestic growth is expected to be 5.1% and international 13.5%, for total mainline growth of 8.8%. However, the airline will substantially scale back RJ operations in the first half of 2007.

Continental justifies the domestic growth by a need to provide feed to the rapidly expanding international network, which already accounts for 48% of its flights. As its executives explained at Continental’s recent investor day, the airline aims for "balanced" growth and "does not want to become a carrier that is too international, like TWA or Pan Am".

A key aim is to take advantage of the powerful Newark hub, which caters for the huge and wealthy New York market and therefore has strong O&D traffic. Newark is Continental’s key strength — a unique asset not unlike Heathrow is to BA.

Continental also feels comfortable growing at the 5–7% rate because it has a flexible fleet plan, making it possible to accelerate or slow growth to suit market conditions. In the "maximum fleet" scenario (see table, right), the airline could expand its fleet from 368 aircraft in 2007 to 461 in 2011 by taking all current orders and options and not retiring aircraft. At the other extreme, the "minimum fleet" scenario would mean no growth at all, as the airline would only take firm orders, let leases expire and retire the 737–300s (its oldest aircraft), as well as some of its 737–500s and 767s. It would not mean parking any aircraft in the desert.

The airline also feels justified at growing because of its relative size (smaller than American, United and Delta) and the promising growth opportunities around the world. In the past year, it has added India and China to its route map — both huge developing markets.

During the investor day, Continental’s executives stressed that the company believes that "there is an opportunity for a significant amount of long haul international growth to be added". Somewhat ominously (from non–US airlines' point of view), the executives said that the airline is ready to up capacity growth to take advantage of the A380 delays.

While Continental’s profit margins could well be higher if it grew at a lesser rate, good growth opportunities are so rare that they are worth pursuing.

| Fleet | Orders | Delivery schedule | |

| 787 | 0 | 20 | Three in 09;Rest in 2010+ |

| 777-200ER | 18 | 2 | 2007 |

| 767-400ER | 16 | 0 | |

| 767-200ER | 10 | 0 | |

| 757-300 | 17 | 0 | |

| 757-200 | 41 | 0 | |

| 737-900 | 12 | 3 | 2008-2009 |

| 737-800 | 99 | 22 | Six in 2H06; Rest in 08-09 |

| 737-700 | 36 | 41 | 2008-2009 |

| 737-500 | 63 | 0 | |

| 737-300 | 48 | 0 | |

| Total mainline | 360 | 88 | |

| ExpressJet | |||

| ERJ-145XR | 104 | 0 | |

| ERJ-145 | 140 | 0 | |

| ERJ-135 | 30 | 0 | |

| Total RJs* | 274 | 0 |

| Max. fleet size | Min. fleet size | |

| YE2006 | 366 | 366 |

| YE2007 | 368 | 368 |

| YE2008 | 398 | 371 |

| YE2009 | 431 | 370 |

| YE2010 | 448 | 366 |

| Year2011 | 461 | 365 |