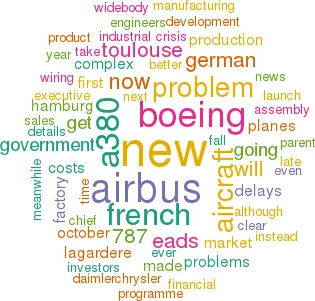

Airbus: Pitfalls of economic nationalism

October 2006

The first question about the escalating crisis that has engulfed Airbus is: will it get worse before it gets better? The second is: will it ever get better?

The reason the second question even arises is that the delays at the A380 coincide with financial stress caused by the strength of the Euro against the US dollar and a growing problem in product development. Not only is Boeing outselling it overall this year, it is cleaning up in the long–haul market, with its 777s and new 787. Airbus has been so pre–occupied with the A380 that it has fumbled the response to the 787, which was designed originally to replace the 767, but is now promising so much that it is shaping the whole long–haul medium–large aircraft market. Even though there are growing murmurs of technical problems with the new aircraft, Boeing chief executive James McNerney reassured investors at the end of October that it would be on time.

Airbus also has to consider spending on the next generation of single–aisle aircraft, the area where it really made its mark with a superior competitor (in terms of attractive cabin) to the 737. With its stronger financial position and experience of lightweight composites developed for the 787, Boeing could be better placed to develop a new 737 single–aisle, while Airbus’ problems delay its upgrade of the A320 family. (In a recovery step at the end of October, Airbus announced its first assembly factory in China, along with a big order for 150 A320s and a letter of intent for the 20 of the upcoming A350XWB, assuming it is formally launched.)

Meanwhile, the A380 bad news just keeps dribbling out. The problem with the A380 was not the fault of Airbus’s distributed manufacturing system per se. After all, Boeing is successfully imitating it with its global risk–sharing development and production of the 787 in Japan and Italy, as well as Kansas and Seattle. Boeing has the great advantage that it was easily able to sell off its fuselage factory in Wichita to a private equity firm which promptly slashed the workforce, the pay rates and the cost to Boeing of obtaining fuselages. Yet the hints of problems with the new Boeing include difficulties bringing the supply chain up to speed with meeting weight targets.

The basic manufacturing problem for Airbus was just that the A380, with widely varying cabin configurations to attract launch customers, was complex from the start. Also, the reality of work–sharing to garner political support needed for government launch aid from four countries meant some fuselage assembly was allocated to Hamburg. So this site was making its debut on more complex wide–body assembly with a notoriously difficult product, insofar as final wiring was concerned. It is a cardinal rule of complex manufacturing such as in automobiles or aircraft that you do not start a new factory and a new workforce with a new product and new technology. It transpired that Hamburg was not up to speed with the new 3D software to tell its engineers how and where the complex wiring looms could thread through the new aircraft.

The fact that many wires were of lightweight, but bulkier, aluminium compounded this deficiency. When the German rear fuselages reached Toulouse they could not, as supposed, be snapped together with the French sub–sections from factories in Normandy and the Vendee. The practical problems on the shop–floor were not dealt with swiftly enough by Toulouse engineers, allegedly because of a "Not my problem" mentality that created a gulf between designer engineers and shop–floor, aggravated by the fact that the problem originated with the Germans.

French hierarchical management culture may have led to the problem being concealed: to generalise, French and German middle managers hate passing bad news up the line of command, whereas Americans live with this unpleasant but necessary aspect of industrial life. A good example of this was Boeing in 1997/98, when its factories collapsed into chaos. It was trying to ramp up output with a new production system that was to track more efficiently bought–in components. It did not work. Half–finished planes littered the hangars in Seattle. But within four months the boss of Boeing Commercial Airplanes Group was fired, and a new manager quickly brought the problem under control.

Credibility?

October opened with the first remotely credible assessment of the impact of the delays to the A380 programme caused by the wiring difficulties in the Hamburg factory. Broadly, Airbus said that the whole production programme was going to run two years late: instead of nine aircraft produced next year, only one will leave Toulouse, two years late. It will take until 2010 before Airbus hits its planned production rate of 25 aircraft a year. The financial hit between now and then is US$6bn of cash–flow, including compensation claims and delayed payments. Some of that will obviously be recovered later.

Ominously that announcement was lacking in details about how Airbus was going to cope with its other underlying problem: the 30% fall in the dollar (its revenues) against the Euro (which accounts for most of its costs). The reason for the vagueness on the Eurozone cost–cutting was soon clear, when Christian Streiff, the outsider brought in from French building materials group Saint- Gobain, resigned only days after his update on the crisis. Although he had talked bravely about a new cost–cutting plan called Power8 to lop €1bn off annual costs and measures to cut overheads by 30%, there were no details about where the axe would fall in France, Germany, Spain or the UK. Instead details were being withheld for further discussions and would not be clarified until January. As he made abundantly clear in press interviews,

Streiff left because he was not going to be allowed the freedom to do what he thought best at Airbus. He would have to pilot his plans through the board of the parent company, EADS. The parent company is now more than ever hands–on in Toulouse since BAe sold its one–fifth stake to its erstwhile partner for barely $2bn, half what it was supposed to be worth only a few months ago before the delays began to get worse.

Louis Gallois, the French co–chief executive of EADS, stepped in as chief executive of Airbus, with Fabrice Bregier due to come over from EADS’s Eurocopter as chief operating officer and obvious successor. Gallois is a smooth operator, a typical $1é$2 French top civil servant who knows how to navigate the murky waters of French industrial politics. Although Bregier is one of the "Lagardere boys" now being blamed for the fall of Airbus, he has earned respect for his work at Eurocopter. But, ominously, the news of Bregier’s appointment had to be delayed until a heavyweight German could be found to balance this increase in French control in Toulouse.

In late October the A380 crisis spread wider when EADS told investors in Hamburg what the damage would do to the economics of the A380 programme. Instead of breaking even at 250 planes, it would now take sales of 420 before the non–recurring costs had been recovered. Airbus reiterated its view that there was a market for 1,500 planes of more than 450–seat capacity. It expected to get half that with the A380. Meanwhile, Boeing has revised upwards its forecast of sales for planes of 400–plus seats to 900, which it hopes to address with its new 747–800–the latest version of the venerable jumbo.

In the event, Boeing has not needed to do that. Although the 777, launched in 1994 (on time, a rarity), undoubtedly ran over budget on development costs, it has outperformed the A340 on its own merits. Now the problem that Airbus has, for the first time, in responding to Boeing’s 787 is that it risks cannibalising sales of its own medium- haul twin engine A330 with some versions of the A350. Meanwhile, the profitability of the A380, always problematic, is made more difficult by the delays to its entry into service. Expect few, if any new orders, until it finally shows its paces in service in 2008.

The next big decision for Airbus’s parent EADS is whether or not to approve the industrial launch of the extra widebody A350–the belated contender to challenge the 787, the most successful new widebodied aircraft ever, with some 400 orders already. It is inconceivable that EADS would not approve this project, because that would hand Boeing a monopoly in the biggest part of the widebody market. But finance is going to be tight in Toulouse as it works its way slowly out of the A380 mess. It will need to tap both bond markets and governments to get the new plane off the ground.

While all this is going on a pall of uncertainty still hangs over ownership of EADS. Both DaimlerChrysler and Lagardere have sold tranches of shares worth 7.5% of the equity. That leaves the French government with 15% (plus 2.5% bought by a government- owned bank, CDC), DaimlerChrysler with 22.5%, Lagardere 7.5%, the Spanish state holding firm SEPI with about 5%, and the rest free floating, some of it (around 5%) in the hands of a Russian state bank. Lagardere has made clear it wants to sell out completely, while DaimlerChrysler wants to reduce its stake further to 15%.

The German government has been trying to round up private sector investors to take the car company’s place, but with little success. The talk now is of the German government reluctantly keeping parity with the French shareholders with the help of state–owned banks and German lander (regional governments). EADS/Airbus looks set for creeping nationalisation, a trend that seems inevitable given the economic nationalism that seems to be dictating decisions about where it builds its aircraft.

| Firm | |||||||||||

| Orders | Options | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

| Emirates | 45 | 10 | 3 | 6 | 9 | 14 | 7 | 6 | 0 | 0 | 0 |

| Lufthansa | 15 | 0 | 0 | 2 | 4 | 3 | 1 | 1 | 1 | 2 | 1 |

| Qantas | 12 | 10 | 3 | 3 | 6 | 0 | 0 | 0 | 0 | 0 | 0 |

| Air France | 10 | 4 | 0 | 2 | 3 | 4 | 1 | 0 | 0 | 0 | 0 |

| FedEx | 10 | 10 | 0 | 0 | 3 | 3 | 3 | 1 | 0 | 0 | 0 |

| SIA | 10 | 15 | 3 | 6 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| UPS | 10 | 10 | 0 | 0 | 2 | 3 | 3 | 2 | 0 | 0 | 0 |

| ILFC | 8 | 10 | 0 | 1 | 3 | 4 | 1 | 0 | 0 | 0 | 0 |

| Malaysian | 6 | 0 | 0 | 0 | 0 | 2 | 2 | 2 | 0 | 0 | 0 |

| Thai AW | 6 | 0 | 0 | 2 | 2 | 2 | 0 | 0 | 0 | 0 | 0 |

| Virgin Atlantic | 6 | 6 | 0 | 0 | 2 | 3 | 1 | 0 | 0 | 0 | 0 |

| China Southern | 5 | 0 | 0 | 2 | 2 | 1 | 0 | 0 | 0 | 0 | 0 |

| Kingfisher | 5 | 0 | 0 | 0 | 0 | 2 | 3 | 0 | 0 | 0 | 0 |

| KAL | 5 | 3 | 0 | 1 | 2 | 1 | 1 | 0 | 0 | 0 | 0 |

| Etihad | 4 | 0 | 0 | 2 | 2 | 0 | 0 | 0 | 0 | 0 | 0 |

| Qatar AW | 2 | 2 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 0 |

| Total | 159 | 80 | 9 | 27 | 40 | 44 | 23 | 12 | 1 | 2 | 1 |