Chapter 11 and pension laws: can the loopholes be fixed?

October 2004

Recent developments at United, US Airways and Delta have highlighted some potentially serious deficiencies in US pension and Chapter 11 bankruptcy laws.

If the loopholes are not fixed, the consequences could be dire for airline workers and taxpayers — and the US legacy carriers' post–September 11 restructuring process could end up in total disarray.

Little surprise, therefore, that Chapter 11 and pension issues are again at the top of Congress' agenda and hotly debated at industry gatherings (for a detailed analysis of the background to the pension crisis, see Aviation Strategy, December 2003).

In early October, a Senate commerce committee held a hearing on the effect of pension policy and bankruptcy law on the airline industry, as a result of which there are likely to be new legislative proposals. But can anything be done quickly enough to avert a crisis?

Some of the problems should probably have been foreseen — after all, the flaws in US bankruptcy laws have been widely acknowledged in the past. In particular, it has long been obvious that Chapter 11 is way too helpful to failed airlines.

The process has enabled carriers that are clearly not long–term survivors to continue operating for many years — through long–drawn out or serial Chapter 11 filings — and wreak havoc on the rest of the industry through irresponsible capacity addition and price–cutting.

Pension reform, in turn, has been on Congress' agenda since the Pension Benefit Guaranty Corporation (PBGC), the federal agency that insures corporate pensions in the US, had to bail out large steel industry pension plans a few years ago.

There is also a legal precedent for airline pension plan termination in Chapter 11.

US Airways terminated its expensive defined benefit pilot pension plan near the end of its first Chapter 11 visit in early 2003, opting for a cheaper plan and saddling the PBGC with $2.2bn in liabilities. But that never became a public issue, because the impact on the PBGC was relatively small and because wider industry implications were not expected.

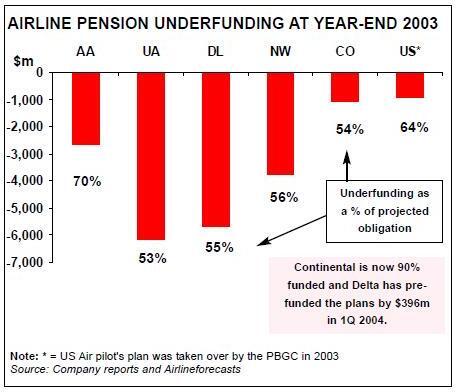

Also, it has been known for at least a year that the largest US carriers have significantly underfunded pension plans and might find it difficult to meet those obligations in the future. Congress provided some temporary relief in April, allowing airlines to delay some of their near–term obligations.

The measure represented a potential saving of $1.3bn for the five largest airlines. What is new now is that the two legacy carriers in bankruptcy — United and US Airways — have shelved and are considering shedding their pension obligations.

They have decided that such actions are an acceptable part of the Chapter 11 restructuring process and appear to be getting away with it — notions that have shocked Washington lawmakers. Concerns are all the greater because of the size and number of the potential plan terminations and the likely impact on solvent airlines.

The bankrupt carriers' actions

United started it all in the summer when it announced that it would not make any more contributions to its four employee pension plans while in bankruptcy.

It has missed $570m of pension payments since July (including amounts due in October).

It has also warned in court filings that it expects to have to cancel and replace all of its pension plans.

United’s motive is to maintain adequate cash reserves — first, to meet the minimum cash requirements set by its recently amended interim DIP financing deal, which doubled the funding to $1bn and extended loan maturity to mid–2005. Second, the airline needs to attract Chapter 11 exit financing from the private sector, having had its final federal loan guarantee application turned down.

The request to stop pension payments was debated in bankruptcy court in late August. Despite fierce opposition from United’s unions, the PBGC and the US Labor Department, Judge Eugene Wedoff approved it. United’s lawyers had argued that federal bankruptcy laws take precedence over employee–benefit legislation, and that in Chapter 11 company pension plans hold the same status as any other unsecured creditor.

The Labor Department may still bring a lawsuit to force United to make its pension payments, once United has breached certain minimum funding rules set by the IRS.

Skipping pension payments transgresses the Employee Retirement Security Act and the Internal Revenue Code. The PBGC made the point that it also "violates bankruptcy principles".

One Washington lawmaker who has taken an active interest in this matter, Senator Peter Fitzgerald of Illinois, noted that despite defaulting on its pension payments, United remained committed to proceeding with the expansion of Chicago’s O'Hare Airport. Its share of the project cost (including debt service) is estimated to reach $522m annually, assuming that it retains its current 47.5% share of operations at O'Hare. Fitzgerald’s view: "It is unbelievable to me the bankruptcy laws are so weak".

Under Chapter 11 rules, a company is free to accept or reject any contract or obligation, as long as it can justify the action to the bankruptcy judge. It is obviously totally unfair to competitors if United is allowed to divert funds to major capital projects, but such actions may be essential to its long term survival.

United poses a unique dilemma to the government. If it terminates its four pension plans, it would be the largest–ever pension default by a US company, involving almost 120,000 workers and retirees. But United’s pension obligations — $7.5bn in underfunded liabilities, plus $4.1bn in contributions needed through 2008 — are viewed as such a huge burden by the capital markets that there is no way the airline can secure exit funding without terminating the pension plans.

When filing for Chapter 11 for the second time last month, US Airways told the court that it would not be able to survive if it met its pension obligations. It expects to terminate its two remaining defined–benefit pension plans (flight attendants and mechanics) which need at least $531m in contributions over the next five years.

The airline skipped a $110m pension payment on September 15, but apparently intends to make two much smaller ($14.5m) payments due on October 15 and January 15.

US Airways ruffled many feathers in Washington when it said in its Chapter 11 filing that it would be "irrational" to make pension contributions because such action "provides no benefit to the estate".

However, as a promising sign, Judge Stephen Mitchell (who also presided over US Airways' first Chapter 11) postponed ruling on the pension and wage cut proposals at a key hearing on October 7, citing "too complex" legal issues.

This indicated that the bankruptcy court might be taking note of the legal manoeuvring in Washington. Of course, there is a high likelihood that the US Airways pensions are already a lost cause. Even if pension and wage relief is obtained, the airline is still headed for a cash crisis in January or February.

Public confidence is eroding, there are no unencumbered assets and the chances of attracting Chapter 11 exit financing seem slim.

Industry implications

The biggest fear is that there might be a domino effect in the rest of the airline industry. If United and US Airways terminate their pension plans, they will have a significant cost advantage over the other legacy carriers.

However, terminating pension plans is probably not possible outside the bankruptcy process, so solvent carriers like American, Continental and Northwest could in theory have no choice but to file for Chapter 11 themselves.

Delta, of course, is a likely Chapter 11 candidate anyway. If it files, which analysts currently suggest could be by year–end, the situation would worsen for the solvent carriers.

It would mean 42% of the US industry capacity flying under Chapter 11.

Delta itself has already been affected by United’s and US Airways' actions. In recent months, fears that Delta too might terminate its pension plans led to an exodus of senior pilots, who decided to take early lump–sum payments in lieu of full pensions (an option that few other airlines offer). That way they at least secured half of their retirement benefit.

Delta managed to avert a potentially serious pilot shortage by securing a deal with the union that will allow it to re–hire retired pilots on temporary contracts. It reportedly assured the pilots that their pension plan would not be terminated before February.

The problem is that preserving pension benefits is the number one priority for US legacy airline pilots. Surveys have shown that American’s pilots agreed to significant wage concessions in early 2003 only to protect their pensions, which they knew could be at risk in bankruptcy.

Delta may not be able to accomplish what American did because it may have to file for Chapter 11 anyway, to restructure debt and leases. Citigroup Smith Barney analyst Daniel McKenzie suggested in an October 7 research note that Delta may not get its $1bn pilot concessions outside Chapter 11 simply because it cannot promise the pilots that their pension plan will be safe. McKenzie saw a "high probability" of a Chapter 11 filing by the end of October.

The impact on workers and taxpayers

The PBGC has confirmed that it would take over the airlines' defined–benefit pension plans if they were terminated. How would airline workers and retirees be affected?

And could the agency really afford it?

When the PBGC takes over a pension plan, it does not assume 100% of the liabilities, only the maximum guaranteed benefit which is currently about $44,400 a year at age 65. Since airline employees are relatively modestly paid, it would appear that most workers would receive full pension benefits.

Pilots, a highly paid group, are the biggest exception — they would lose out significantly.

The PBGC has estimated that it would be liable for $6.4bn of United’s total $8.3bn pension plan under–funding. Therefore United’s employees would lose $1.9bn in aggregate.

According to the PBGC’s testimony to Senate, US Airways' pension plans would add $2.1bn in liabilities to the $6.4bn United figure. The agency’s deficit would increase but it would continue to be able to make payments in the short term. However, its long–term solvency is already at risk without additional airline liabilities, suggesting that higher premiums from healthy companies or even a taxpayer bailout may be necessary at some point. That point would come sooner if all the US airlines defaulted on their defined benefit pension plans, which are underfunded to the tune of $31bn.

Possible solutions

There will be attempts to tackle the pension issues on many different fronts. As regards to legislative fixes, the focus will be on ensuring that corporations meet their pension obligations whether they are in bankruptcy or not.Under one new bill introduced immediately after the hearing, companies that terminate their underfunded pensions in bankruptcy would be prohibited from paying special pensions to their top executives for the following five years. Delta and United have set up special bankruptcy–proof pension trusts for their top executives in recent years.

There has also been talk of giving the PBGC some powers to make companies pay, as well as higher stature in bankruptcy claims.

Senate commerce committee chairman John McCain promised at the hearing that "Congress will act" if the PBGC recommends specific measures.

Hopefully more concrete measures will follow. The problem, of course, is that it will take time to get the legislation approved. The threat of closing the loopholes could spur additional Chapter 11 filings before Congress can act.

In the near term, there is probably nothing much that can be done other than try to appeal to the bankrupt airlines and Chapter 11 judges to do the right thing.

One such letter, authored by Senator Edward Kennedy and signed by 140 lawmakers, went to UAL CEO Glenn Tilton in late September.

Defined–benefit pension plans will almost certainly disappear at some point at the US legacy airlines — they are too expensive and LCCs do not have them. The industry will be working to try to find orderly ways to transfer to more affordable alternatives, such as 401Ks or defined contribution plans, but that may have to be a very gradual process (at least with the pilots).

Abolish Chapter 11?

American’s ex–CEO Bob Crandall, a pioneer of many new aviation concepts and an outspoken critic of the industry, has a simple solution: abolish Chapter 11.

In a late- September speech at New York’s Wing’s Club, and in subsequent testimony to Congress, Crandall blamed the industry’s ills on lax US bankruptcy laws. He said that the laws have allowed "failed ventures to continue operating until the last dollar of available cash has been spent" and that they have acted as a "fail safe for imprudent managements and unions". The laws have allowed failed ventures to maintain excess capacity in the market — one of the industry’s key problems at present — and to impose cheaper contracts on unions and to dump pension plans, thus punishing solvent companies with uncompetitive operating costs.

Crandall made the point that tougher bankruptcy laws would weed out weak airlines, thus removing excess capacity from the market, and force unions and managements to cooperate to avoid bankruptcy.

"The spectre of liquidation would provide some real incentive to work together", he observed.

Lax Chapter 11 laws distort and nullify the work of free–market forces. When filing for Chapter 11 for the second time, US Airways repeated the reason it gave for its previous Chapter 11 filing two years ago, namely that "the industry has really transformed".

So what? If US Airways is not able to adapt and keep up with the pace, maybe it does not deserve to be there.