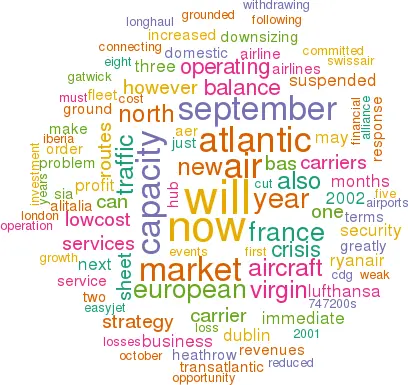

European airlines: crisis positioning

October 2001

Here we review the prospects for Europe's other main carriers in the wake of September 11.

British Airways

BA is the most exposed of the European flag–carriers on the North Atlantic not just in terms of traffic but more critically in terms of operating profit. Nearly all of BA’s operating profit has been earned on the North Atlantic in recent years. Consequently, latest loss forecasts for the year 2001/02 are of the order of £300m–plus. Its share price fell to below Gulf War levels, then staged a partial recovery

BA has about £1bn in cash, and is looking to sell non–aviation assets, mostly property, in order to raise a further £2bn ( this seems a bit optimistic). The balance sheet shows £6.4bn of net debt plus £1.6bn of off balance sheet debt, against shareholder funds of £2.3bn.

It has imposed a freeze on capital expenditure, and grounded 20 aircraft (10 longhaul, 10 short–haul). A further 5,200 job losses have been announced, bringing the total to 7,000, equal to 12.5% of workforce.

BA’s down–sizing strategy has been greatly accelerated — the airline had already reduced capacity by 8% in the first eight months of 2001 — with a further 9% cut. Transatlantic weekly frequencies from Heathrow were reduced from 270 to 240, and Gatwick–JFK was suspended. Middle East services have also been curtailed.

A 30% decrease in capacity over next three years is BA’s target. The airline has now formally abandoned its attempt at running two London hubs, and has suspended eight European routes from Gatwick. Also, Heathrow–Belfast has been dropped completely, a move that BA had wanted to make for some time but which until now has been politically very difficult.

It could be argued that one of reasons for the failure of BA’s strategy of downsizing, withdrawing from unprofitable European routes and concentrating efforts on longhaul, business travel was because it had been unable to make the initial large–scale cost attack and network cutback that was needed. In a way, September 11 has given BA the opportunity to fully implement that strategy.

The major problem, however, is that business traffic in its key market — the Atlantic — had dried up for the present. Somehow, BA will have to reduce its reliance on this market for its profitability.

Fortress Heathrow is not as impregnable as it once was. BA had already recognised the inevitability of a US–UK open skies regime and the emergence of new long haul competition from Delta, Continental and bmi/Lufthansa. Now it has to re–assess its alliance with American — consolidating Heathrow–New York and other US routes is an obvious solution to the collapse in transatlantic traffic, but BA now also has to consider the attitude of its passengers to flying on American.

Air France

Air France was the most phlegmatic of the Euro–Majors in its response to September 11, but the full grimness of the situation has now struck home. It has adopted a hiring freeze and has brought forward plans to retire five A310s and is grounding a B747F. Four more A310s will be retired before February 2002, four 747–200s are to be withdrawn before summer 2002 and three A321s are to be returned to lessors next year.

Air France earns about 25% of its revenues on the North Atlantic and is the second largest European cargo carrier, a business that has also collapsed. Before September 11, it had decided that it would be adding no capacity to North Atlantic this winter. A reduction of capacity now is inevitable given that its partner Delta has cut its total capacity by 15%.

The problem for Air France’s is how to keep its unit costs down when its hub operation is shrinking rather than growing. It also has to address important logistical question at CDG where connections, which weren’t smooth before September 11, are being further complicated by increased security.

On the other hand, Air France will benefit from BA’s partial withdrawal from the European connecting market and from the actual and future airline failures in its home market — Swissair, Sabena, AOM Air Liberte and Air Littoral. Easyjet, if it gets into Orly as it should, will take some of Air France’s traffic but its main effect will be to generate new business in France.

The crisis provides an opportunity to consolidate the Air France/Alitalia alliance and shift some of Alitalia’s long–hauls from Rome and Milan to CDG. A full merger, however, is still too difficult at this point.

Iberia

Iberia has a relatively small exposure to North Atlantic but a weak balance sheet. It was the first of the European carriers to cancel ("indefinitely postpone") new aircraft — 12 A320s and three A340s due for delivery in the next 18 months. Iberia had been in a growth phase, with a 10% increase in capacity first seven months of this year.

In one regard Iberia’s role in oneworld may be clarified by BA’s downsizing — it should not now be competing for connecting traffic to South America, which should enable it to build up the Madrid hub. However, Iberia can expect a wave of new low–cost competition as the low–cost carriers mop up newly available equipment and target leisure markets like Spain.

Lufthansa

Lufthansa is now likely to record an operating loss in current financial year in contrast to its previous forecast of operating profit of €700–750m. However, it is regarded as having the strongest balance sheet of the Euromajors.

Lufthansa’s immediate response has been to ground 28 of its 236–aircraft fleet. Plans to acquire 15 A380s and four B747- 400s have been shelved. The carrier has suspended Frankfurt- Paris Orly, Frankfurt- Valencia, Hamburg–London Stansted, Dusseldorf–Moscow, Dortmund- Copenhagen, and Berlin–Washington It is interesting to note that all but the latter are intra–European routes.

Lufthansa will also be hit by its exposure to US domestic market through its extensive ground support operations — LSG Skychef’s largest customer is American which has stopped supplying food on domestic services. In fact, its wide investment portfolio will not provide any protection — DHL International, Thomas Cook, bmi and Onex Food Services are all impacted by the events of September 11.

Like Air France, Lufthansa can draw comfort from its position in its domestic market, which has just been improved following EC approval for its investment in Eurowings. Deutsche BA is looking very vulnerable, and Lufthansa should be able to draw in extra traffic from Swissair and maybe Sabena.

After a few months Lufthansa and its main Star partners, United and SIA, are going to have to rethink many aspects of the Star alliance, considering factors such as how reconcile the promise of seamless service with security issues at hub airports and passengers' concerns about carrier choice.

Alitalia

Alitalia has a weak balance sheet and a very depressed share price. It is just possible that Air France could take advantage of weakness to make a substantial equity investment. Before September 11, Alitalia expected to record operating losses of over €200m, a figure that is now expected to at least double.

In traffic terms Alitalia has only a small North Atlantic presence but had been losing a greatly disproportionate amount of money in this market before September 11. Rationalisation of the long–hauls through permanently withdrawing some direct service and increased feeding of Air France at CDG would be logical.

As an immediate measure Alitalia is cutting 2,500 or 12% of its 21,000 staff. It has also asked for support from its government by withdrawing the 10% tax on tickets.

KLM

KLM’s immediate response was to reduce transatlantic capacity by 15% and overall capacity by 5%. It has suspended Amsterdam–Atlanta and cut frequency on Amsterdam–JFK and Newark. A further cutback has brought overall capacity reduction to 15%. KLM has added a $5 surcharge on all its tickets to cover increased security and insurance costs and has announced that it will be increasing fares to the US and the Middle East by 5% from October 16.

KLM’s future is of course closely tied in with that of Northwest, which has a very weak balance sheet and is one of the prime candidates for Chapter 11 bankruptcy.

The events of September 11 are likely to hasten the removal of regulatory barriers to consolidation in Europe, which basically means moving swiftly to some form of EUUS open skies. KLM then could return yet again to its search for a merger partner. The problem is that the most likely candidate, BA, is now committed to its downsizing, Fortress Heathrow strategy, and it is very difficult to see how KLM’s Amsterdam hub operation could fit in with the core strategy. Still, BA might find it impossible to resist participating in, say, a rescue rights issue.

Virgin Atlantic

The large majority of Virgin Atlantic’s revenues and nearly all its operating profits are generated on the North Atlantic. Heathrow- JFK is Virgin Atlantic’s key route, probably generating as much profit as the rest of the network put together, pre–September 11. Virgin Atlantic reported net profits of just £27m on revenues of £1.5bn in the year to 30 April 2001. Its net asset value as at April 2001 was £137m including £554m in aircraft assets.

Virgin’s immediate response to the crisis has been to ground five 747–200s, drop service to Chicago and Toronto and lay off some 1,200 employees.

However, the lease rates that Virgin is paying for its five new GECAS 747–400s are believed to be in the order of $1.3m per month whereas the 747–200s which Virgin has been forced to ground would have had a monthly rental of only $200,000 to $250,000 a month.

In addition, Virgin Atlantic is committed to eight deliveries of A340–600s over the next 20 months. These will have to be postponed. And Airbus must be wondering about the solidity of Virgin’s A380 order (the only European carrier apart from Air France to have committed to this type).

The escape route for Sir Richard Branson must involve SIA, 49% owner of Virgin Atlantic. However, SIA cannot directly buy out the remaining 51% , and would have to find a UK company to act as an intermediary.

In the short term, SIA may be more interested in Virgin Blue, which now has the opportunity to expand as the number two Australian domestic carrier after Qantas in the wake of the bankruptcy of Ansett.

Olympic

Olympic is used to being in a perpetual state of financial crisis and so in an odd way was quite well positioned to face the aftermath of September 11. Frequencies to the US and Australia have been reduced but no redundancies have been made.

The Greek government now has two routes it can follow. One, it can give in to the populist voices that will be raised at the October 15 PASOK conference, return to being an unreconstructed state–owned and funded flag–carrier, defy the EC rules on state aid and try to bluff out the consequences.

Two, it can continue with the proposed sale of 70% or so of a new carrier to Axon (theoretical deadline is October 18). This is not dissimilar to the Swissair/Crossair scenario, though Olympic hasn’t the same indebtedness as Swissair and Axon Airlines isn’t in the same league as Crossair. One major problem — how to replace the 14 Chapter 2 737–200s next year — will be greatly alleviated by the availability of cheap narrowbodies on the market.

Aer Lingus

Aer Lingus is heavily exposed to the North Atlantic market, which contributed 60% of operating profits in the last financial year. A downturn in the cargo market would come as almost an equally strong blow as the loss of passenger revenues. Aer Lingus’s forecast losses for the year are now over €100m.

Top management was in confusion prior to September 11, following the accidental death of chairman Bernie Cahill and the resignation of John O'Donovan, the acting CEO. Tom Mulcahy, a banker, is the new CEO. Seven of its fleet of 38 aircraft are grounded and it has suspended service services from Dublin to Newark and Baltimore and Washington plus Dublin- Stockholm.

Privatisation had already been shelved, and now a 25% cost reduction programme is required for survival, which will be hard to achieve against generous wage settlements made to staff earlier this year. Its rival Ryanair grows inexorably and this crisis may finally allow it to come to an agreement with Aer Rianta to develop a new terminal and Dublin airport and resume expansion from there (Ryanair has more or less frozen services from Dublin in recent years because of its dispute with Aer Rianta and concentrated on growing from London Stansted).

SAS

SAS’s management was in crisis prior to September 11, with the entire board resigning over the cartel–building scandal with Maersk Air. SAS had embarked on an aggressive growth strategy, particularly long–haul, to re–capture market share lost in the 1990s.

+-* Now, 2002 will see a 12% decline in the original planned capacity for 2002. There will be a 22% fall in intercontinental capacity in contrast to a planned increase of 20%, and a 10% drop in European capacity versus a planned increase of 10%. SAS is closing these routes: Copenhagen to Kalingrad, Tel Aviv, Barcelona, Delhi and London Stansted; Oslo–Newark; Gothenburg–Paris; and Stockholm–Hamburg. Some 16 aircraft are to be grounded, three widebodies, 10 narrowbodies and three commuter types. The company will make between 800 and 1,100 employees redundant.

Ryanair and easyJet

Following an immediate fall off in bookings, the low–cost carriers report that traffic is now returning to normal levels, boosted helped by aggressive fare sales. The forceful message from Ryanair in particular is that airlines should stimulate demand rather than turning to governments for bail–outs — propaganda but effective. Ryanair has also explicitly stated it expects to meet its profit targets for the year ending March 31 2002 and that its bookings remained "largely unaffected by the recent events in the US".

While the low–cost carriers may be over–blowing their case, it is clear that their model of airline operation is the best adapted for survival in the current crisis. Indeed, the balance of power between the low–cost carriers and the network airlines has shifted significantly further in their favour in both the US and Europe.

Some specific positive factors can be identified:

- Being purely intra–European they have escaped the collapse of the transatlantic market (bmi, by contrast, having started its A330 services to the US, has been severely impacted and forced to implement aircraft grounding and a staff cutting exercise).

- With pure point–to–point operations, they do not have to face the logistical complications associated with increased security at connecting hubs.

- Their clients are used to longer check–in times (many Ryanair passengers are bussed to secondary airports 1.5 hours before departure).

There should be minimal impact on aircraft turn–around times (the extra security time is essentially within the terminals).

- Their brands are neutral in terms of national affiliation and so may be regarded as safer than those of certain flag–carriers.

- In recessionary times more and more business travellers will opt for low–cost travel.

- Important market growth opportunities have appeared — at Paris Orly, Geneva and Gatwick for easyJet, at Dublin, Gatwick and Brussels for Ryanair.

- More secondary airports will be persuaded to sign up with Ryanair.

- The imminent surplus of pilots and mechanics alleviates one significant source of cost pressure.

- Aircraft values and lease rates are plummeting, so fleet expansion will be greatly facilitated (Airbus must be wishing that it has persuaded either of them to build an A320 fleet).

| Pre-tax profits Current FY | Next FY | ||||

| Pre-Sep 11 | Post-Sep 11 | Pre-Sep 11 | Post-Sep 11 | ||

| Air France – Euro (m) | 393 | -33 | 433 | 2 | |

| Alitalia – LIT (bn) | -90 | -701 | -25 | -220 | |

| British Airways - £(m) | 100 | -285 | 171 | -71 | |

| EasyJet - £(m) | 38 | 38 | 56 | 47 | |

| KLM– Euro (m) | 15 | -283 | 74 | -55 | |

| Lufthansa– Euro (m) | 480 | -325 | 580 | -110 | |

| Ryanair– Euro (m) | 140 | 108 | 171 | 146 | |

| Swissair – SF (m) | -350 | -725 | -70 | -470 | |

| 2000 data | North Atlantic | System-wide | North Atlantic |

| RPKs (bn) | RPKs (bn) | as a % of Total | |

| Aer Lingus | 5.93 | 9.48 | 62.6 |

| Air France | 23.17 | 91.85 | 25.2 |

| Alitalia | 11.89 | 40.85 | 29.1 |

| Austrian | 2.57 | 8.80 | 29.2 |

| BA | 46.42 | 119.39 | 38.9 |

| Finnair | 0.91 | 3.62 | 25.1 |

| Iberia | 5.97 | 40.04 | 14.9 |

| Icelandair | 1.98 | 4.11 | 48.2 |

| KLM | 19.21 | 60.33 | 31.8 |

| Lufthansa | 31.21 | 94.29 | 33.1 |

| Malev | 0.59 | 3.56 | 16.6 |

| Olympic | 2.18 | 8.88 | 24.5 |

| Sabena | 6.03 | 19.38 | 31.1 |

| SAS | 4.86 | 22.92 | 21.2 |

| Spanair | 0.68 | 9.71 | 7.0 |

| Swissair | 12.06 | 36.21 | 33.3 |

| TAP | 1.11 | 10.41 | 10.7 |

| Tarom | 0.57 | 2.16 | 26.4 |

| Turkish | 2.03 | 17.40 | 11.7 |

| AF | AZ | BA | EZ | IB | KL | LH | FR* | SK | SR | |

| Net debt/equity(x) at end of next financial year |

1.7 | 3.7 | 2.5 | 0.2 | 4.0 | 2.1 | 1.8 | NM | 0.9 | NA |

| Net assets at end of next FY – Euros (bn) |

4.1 | 1.2 | 5.0 | 0.2 | 1.0 | 2.0 | 4.2 | 0.8 | 2.2 | 0.5 |