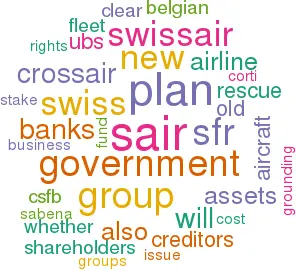

Swissair: an audacious rescue plan

October 2001

It was debatable whether the plan devised during the summer by SAir Group’s newly appointed chairman, Mario Corti, would have rescued the troubled airline group. After September 11 it became clear that the plan was unworkable. With the SAir Group running out of cash, that plan has been dispensed with, and a radical new plan devised, which is going to win few friends in any quarter of the industry.

To recap, the original Corti plan called for the sale of aircraft and other assets to raise an estimated SFr 4.5bn. This would be used to help pay off some of SAir Group’s SFr 15bn of debts, which given the airline had just SFr 555m of equity, left the company skating on thin ice. Post September 11, it became clear that aircraft asset values have fallen to unknown levels (difficult to be precise when there are no buyers) and that there were no immediate realistic prospects that it expected the Swiss banks to come up with a rescue plan, and CSFB and UBS have performed (although the coordination between Swissair and UBS was anything but precise, leading to an unnecessary fleet grounding).

The two banks have set up a fund (51% UBS, 49% CSFB) in which they have invested a total of SFr 1bn. The fund has acquired a 70% stake in Crossair and the banks are underwriting the SFr 350m rights issue for the other 30% stake in the remainder of Crossair. It is expected that the Swiss government and cantons will participate in this issue. The banks are also providing a SFr 0.5bn line of credit to the new SAir/Crossair Group. Unexpectedly, the Swiss government had also to step in following the fleet grounding with an emergency funding facility of SFr 450m).

The new plan calls for Crossair to become the core of the new Swissair Group, assuming the old SAir Group’s profitable assets and the Swissair brand. The new banking consortium has been allowed to cherry–pick for the new Crossair 134 out of SAir’s 162 aircraft fleet, and has chosen to slim down the network from 35 long–haul destinations to 26. The pilots, cabin crew and other staff who are to be retained are presumably going to be asked to take pay cuts to put them in line with their new Crossair colleagues.

It would appear that the rump of the business will contain little value. UBS and CSFB are providing bridging finance of SFr 250m which it is intended to allow time for assets remaining in the SAir Group to be sold. The old SAir Group has sought protection from creditors by applying to the Swiss courts for a "moratorium of debt enforcement" which covers Flightlease and SAirLines (including LTU of Germany) but does not include other assets such as the catering arm, Gate Gourmet. Whether bondholders, shareholders, creditors and lessors have any rights under Swiss law to object to the plan and its terms is unclear at present; after all this is an unprecedented situation.

What will remain in terms of a payout for creditors, bondholders and shareholders will depend on what assets can be realised and of being able to sell subsidiaries such as Nuance (the worlds' largest airport retailer) or Swissport (its airport ground handling company).

Corti’s Plan B is more radical than anyone had been expecting, particularly the banks, creditors and shareholders. They had been assuming that since Switzerland was outside the EU and therefore not subject to state aid regulations, that the Swiss government would simply bail out the airline with a rescue rights issue.

While the government has made it clear that Swissair has a vital role in the national economy, the government has not chosen the simple bail–out option. It is clear that Corti has been given the backing of the Swiss government to do whatever it takes to rescue the airline and preserve one of Switzerland’s national icons, no matter who it upsets. The Swiss government annouced how much of the SFr 17bn of the company’s debt remains in the old SAir. It is not known whether the 24 aircraft that are not wanted by Crossair have any economic value (they may be on operating leases). Also it assumed that the old SAir Group would have responsibility for paying for the redundancy costs of the 2,650 staff who are to axed.

The new plan has also had a knock–on effect elsewhere. On October 1 the SAir Group informed Sabena and the Belgian government that it would not be making its cash payment of SFr 200m to the Belgian airline. The Belgian government has provided Sabena with a bridging loan and embarked on legal action against the SAir Group. The survival of Sabena seems now to depend on what stance the EC takes on the affair. The Belgian government appears to have the will to perform a bail–out but not necessarily the means.

The SAir Group has also said it would not be making further payments to its French loss–making subsidiaries, AOM — Air Liberte, now re–branded Air Lib, (FFr 250m due in December) and to LTU (which SAir had agreed to fund until 2005). TAP is also impacted as Swissair was the guarantor for a € 40m three–year loan that the airline provided after it reneged on its previous agreement to buy a 34% stake in the Portuguese carrier. Another loser would appear to include Airbus, which had an order for A340- 600s from the old SAir.

The two Swiss banks are taking somewhat of a gamble themselves. Crossair does enjoy a lower cost base than Swissair, but whether its cost base is low enough to deal with aggressive low cost competition remains to be seen. The strategy is to concentrate on the European business traveller. The grounding of its fleet and the adverse publicity that arises from creditors seizing aircraft assets has damaged the up–market Swissair brand. UBS and CSFB are unlikely to long–term investors in the new Swissair and will seek an exit if the business proves successful, either through a flotation or a trade sale. For many banks and shareholders though this rescue plan will have been a harrowing experience. And once bitten, twice shy.