SAir Group: how many turn-arounds can it cope with?

October 2000

There has been a subtle change in the SAir Group strategy following the announcement of disappointing first–half results. Previously SAir proclaimed that it wanted to be a “market orientated, network minded and quality driven” company. Now it has announced a simpler and clearer approach.

There are two basic elements to the strategy. One, consolidate the Qualiflyer Group and deepen the intercontinental alliances. Two, grow organically the airline–related businesses. This would suggest that the buying sprees are over — no more minority and stakes or purchases of ground–handling or catering businesses to fit into the three non–airline divisions.

The SAir Group is split into four companies:

- SAirLines, comprising Swissair and associates;

- SAirServices which holds the Group’s interests in aircraft maintenance, ground handling and information technology;

- SAirLogistics, covering freight forwarding and cargo; and

- SairRelations, encompassing in–flight catering and sales.

The broad thinking behind the structure is that SAir is not just an airline. It is a travel and transportation company within which benefits can be generated through “global networks” and “team spirit” plus careful brand management.

In practice, SAir has concentrated on cross–selling its different services, and has used its alliance strategy to open up new markets. As well as the standard network benefits that can be achieved through code–sharing, joint frequent flier programmes etc., an airline entering an alliance with Swissair is also expected to buy into other SAir Group activities such as ground handling (through Swissport), catering (through Gategourmet) and duty–free (through Nuance).

SAir has up until now it has taken an equity-based approach to its Qualiflyer alliance. It may be that SAir has had no other choice given that the Swissair itself is ranked a long way behind Europe’s big three (Lufthansa, Air France and BA) in terms of scale. So instead SAir has used its balance sheet to “buy” its partners, often outbidding the “big three” in the process (see Aviation Strategy, September 1999). SAir’s argument is that because it can extract synergies across a broad spectrum of businesses it can afford to pay a higher price for the equity.

Good in theory, but has it worked? The SAir Group share price performance indicates the stock–market’s view on the strategy. The headline operating profit figure for the SAir Group for the first half of 2000 was SFr 143 ($84m) but SAirLines alone managed to post an operating loss of SFr155m ($92m) loss versus a SFr 84m profit in the first half of 1999. Of the SFr155 loss, Crossair contributed SFr 6m its first half year deficit since 1992, and Swissair and Balair a further SFr 76m loss. Minority holdings in Sabena, LOT, Volare, Air Littoral, AOM and South African Airways contributed further losses to the tune of SFr 74m.

The first half results for 2000 also saw SAir taking a SFr 360m ($207m) charge to cover restructuring costs associated with its French airline interests and a SFr 347m ($200m charge) associated with the restructuring of LTU.

Because of ownership restrictions, SAir has been limited to a minority stake in its partner airlines, which greatly weakens its managerial control. And even if full control were politically possible, SAir probably no longer has the funds available to make further investments. As at the middle of the year the Group’s net debt totalled SFr 4.53bn against SFr 3.93bn of equity, and the balance sheet contains SFr1.8bn of intangible assets related to goodwill in the companies it has bought into.

The SAirLines part of the SAir Group is now faced with pulling off a large number of turn–around strategies at the same time. Whether Swissair has the management resources to achieve this is in question; for instance, Paul Reutlinger, who achieved success at Sabena, has had to be switched to dealing with the very challenging task of integrating SAir’s three French associates and Jeff Katz, the former chief executive, has defected to Orbitz, the e–distribution start–up.

SAir now has so many code–names for its various turn–around projects that it is difficult to keep track. The following summarises the current situation.

Swissair

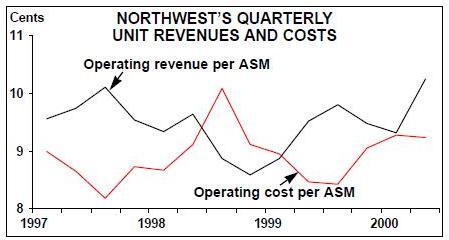

Swissair itself if finding that its unit cost are growing more quickly than its unit revenues — a trend which it blames largely on the increase in fuel prices.

Project “Clean Slate” has set a cost reduction target of SFr 225m by 2002, which seems quite modest given the scale of the airline’s recent losses. The Airline Management Partnership (AMP) with Sabena includes integration of the sales forces worldwide, capturing network synergies from operating one network but with two hubs, and reducing distribution costs.

Crossair

Having recorded its first first half–year loss since 1992, the Swiss regional carrier has been awarded an “improvement” project, code–named “Columbus”. Improvements of SFr 50m have already been identified primarily through reduced growth, network optimisation and cost savings.

LOT

SAir outbid both BA and Lufthansa for a 38% stake in LOT, but the airline is currently operating in the red. First half 2000 losses were the equivalent of $16m, though the carrier expects to recover this in the second half. SAir has set a target of $100m in improvements over three years. Priorities for LOT are building the Warsaw hub, increasing revenues and home market share, and systems redesign.

Sabena

At present the Belgian Government retains a 50.5% stake in Sabena, the remainder being held by the SAir Group, which intends to increase its stake to 85% but can only do so after ratification of a treaty between Switzerland and the EU.

It is not clear as to whether SAir’s ambitions to take majority ownership of Sabena remain intact. Fresh concerns over Sabena’s viability have arisen following the announcement of its six–month results which showed a sixfold rise in net losses to €83.6m ($75.6m) despite an 11% rise in passenger numbers. Sabena last made a profit in 1998,and in 1999 recorded a net losses of €14.1m.

Sabena’s new Chief Executive, Christophe Müller (ex–Lufthansa) in September warned that if Sabena was “not making significant progress by the end of the winter” he would be forced “to question the raison d’être of the company”.

He went onto to say that if the company is neither in the position to reach an agreement with employees nor to undergo structural changes the situation could become “life threatening”.

Whether the Belgian Government will give the necessary political support to SAir to make these structural changes, which may result in job losses remains in question. The Belgian Minister for state–owned companies response was simply that Sabena was “of too much strategic importance to disappear”.

Müller’s target is to achieve net profits of €100m within three years. His turn–around strategy, code–named Blue Sky, includes:

- Selling parts of the airline’s 90 subsidiaries in order to concentrate on the core business;

- Freezing any further new investments including re–negotiating with Airbus to slow down the delivery rates for the 34 A320s it has on order;

- Stopping capacity expansion and selling two seven–year–old A340–200 aircraft;

- Restructuring business procedures, such as stock control;

- Accelerating the integration of Sabena with the SAir Group in order to “use all possible synergies”. Sales, marketing and route planning have already been put together within the Airline Management Partnership (AMP);

- Improving levels of productivity (in the recent past the strike–prone airline had to calm its employees by granting them extra holidays); and

- Negotiations on new pay levels, planned to take place in autumn.

Air Littoral/Air Liberté/AOM

As mentioned above, SAir has dispatched Sabena’s former Chief Executive, Paul Reutlinger to France to take over the operational responsibility for the merger of AOM, Air Littoral, and Air Liberte, three French airline affiliates. Very few examples exist of successful airline mergers, so putting three French airlines together represents a Herculean task. Nevertheless, SAir expects to succeed where previous raiders into the French market have failed, notably BA and KLM, and deliver profits, slated for the second quarter of 2002.

Under a common brand to be announced probably in 2001, the newly merged airline will have a mainline operation, which will operate aircraft above 100 seats, and a regional division operating smaller types from bases at Nice and Montpellier.

The new airline, which will in theory have a 30% share of the French domestic market, can expect fierce competition from a resurgent Air France itself has recently announced a plan to strengthened its control over the domestic market by merging its regional franchisees (Brit Air, Protéus and Regional).

LTU

SAir has had serious problems in its leisure division. The original strategy of creating “charter hubs” and maximising aircraft utilisation by sharing equipment among LTU, Air Europe Sobelair etc. looked over–ambitious and has proved to be impossible.

The German tour operator and airline, LTU , has suffered from overcapacity in the German holiday market, and has been producing heavy losses , estimated at SFr130m at least for this year. SAir has sought to resolve this situation by promoting consolidation with the hope of eliminating overcapacity. Following various failed transactions, the German tourism company, Rewe Touristik, has agreed to buy outright LTU Touristik, and take a 40% stake in the troubled LTU charter airline. West LB bank will have a 10.1% stake in LTU, leaving SAir with the remaining 49.9%.

LTU is forecast to continue making losses through 2001, and achieve break–even in 2002.

TAP

TAP’s strategy is called MOP (Modernization and Restructuring Project). A financial turnaround date has been set for TAP of 2002 with €110m of improvements targeted. Improving the Lisbon hub is the major priority. The other element of its Portuguese strategy was to have been cooperation with Portugalia in which SAir expected to take a 42% stake. However, it has been thwarted by an EC ruling that investments in both the main Portuguese carriers would be anti–competitive.

Volare and Air Europe

It is unlikely that SAir will emerge as a serious partner for Alitalia, but it has tied up the Italian charter sector through purchasing stakes in the leading long–haul charter, Air Europe, and short–haul charter Volare, both of which are loss–making.

The two airlines are to be brought under one holding company, the newly branded Volare Group, which will form Italy’s second largest airline. Although there are some possibilities for developing scheduled routes, this remains essentially a charter operation while AirOne, in which SAir tried but failed to buy a stake, provides the main domestic scheduled competition to Alitalia.

THY

THY Turkish Airlines now describes itself as a “dormant member” of the Qualiflyer Alliance. At one point it looked likely that SAir would participate in its privatisation, planned for next year, but this is now improbable.

SAA

SAA is the most profitable of SAir’s investments, and provides a good example of the cross–selling strategy. GATX Flightlease, the joint venture between GATX Capital and the SAir Group, has placed eight SAir–owned 737–800s with SAA, and Flightlease is in its own right supplying an additional eight 737–800 aircraft. In return SAA is trading seven A320s into the GATX Flightlease. However, SAA, despite SAir’s 20% stake, remains in the Star alliance.

The American alliance

The defection of former partner Delta to Air France has been quickly made up for by the substitution of American Airlines. The fact that Switzerland and Belgium have “Open Skies” agreements with the US has allowed both Swissair and Sabena to develop a range of code–share flights with American. Sabena code–shares to 81 US cities beyond its US gateways, and Swissair to 74 US cities.

American of course remains in oneworld, and BA may well now attempt to restore full relation with the US carriers in the wake of the ending of the KLM negotiations.

The whole group

The other three pillars of the SAir Group fared much better in the first half of 2000. SAirServices had an operating margin of 6.0% and contributed SFr 91m in operating profits. SR Technics has been re–branded SR Technics Group in order to help push for a “global presence” and now encompasses regional operations in Switzerland, France and the US. The maintenance company is also finalising joint ventures in South Africa with SAA and is hoping to form a component overhaul business in Hong Kong with Cathay Pacific. Swissport (ground handling) is now the largest ground handler in the world thanks to the acquisition of Dynair.

SAirRelations enjoyed an operating margin of 4.1% for the first half of 2000 and contributed operating profit of SFr 120m. Gate Gourmet is now ranked number two globally following the acquisition of the Dobbs Group.

SAirLogistics provided the strongest result of the four divisions in the first half contributing operating profits of SFr 60m with an operating margin of 7.8%.

The two key questions about the SAir strategy are: is the sum of the parts truly reflected in the share price and are the benefits generated by the ancillary services justified by the airline investments. If the answers are no, pressure will be exerted by shareholders to break the group up.

| June 00 | Dec 99 | Change | |

| Operating net working capital | -431 | -360 | -19.8% |

| Intangible fixed assets | 1,806 | 1,767 | 2.2% |

| Tangible fixed assets | 7,395 | 6,844 | 8.1% |

| Operating investments | 1,035 | 1,169 | -11.5% |

| Operating provisions | -1,733 | -1,059 | 63.6% |

| Net invested capital | 8,071 | 8,360 | -3.5% |

| Financial assets | 1,564 | 1,379 | 13.4% |

| Financial liabilities | -958 | -909 | -5.4% |

| Net debts | -4,534 | -4,268 | -6.2% |

| Minorities | -190 | -212 | -10.4% |

| Equity | 3,953 | 4,181 | -9.1% |

| SAir | SAir | SAir | SAir | SAir | |

| Lines | Services | Logistics Relations | Group | ||

| Revenue | 3,315 | 1,506 | 769 | 2,941 | 7,512 |

| EBITDAR | 345 | 181 | 62 | 253 | 873 |

| EBITDAR margin | 10.4% | 12.0% | 8.1% | 8.6% | 11.6% |

| EBIT | -155 | 91 | 60 | 120 | 143 |

| EBIT margin | -4.7% | 6.1% | 7.8% | 4.1% | 1.9% |

| Net invested capital | 3,039 | 1,504 | 132 | 3,004 | 8,071 |

| ROIC | -10.2% | 12.0% | 91.0% | 8.0% | 3.5% |

| Headcount | 11,281 | 18,288 | 1,421 | 41,436 | 72,617 |