Delta: great financial shape, but what about the unions?

October 1999

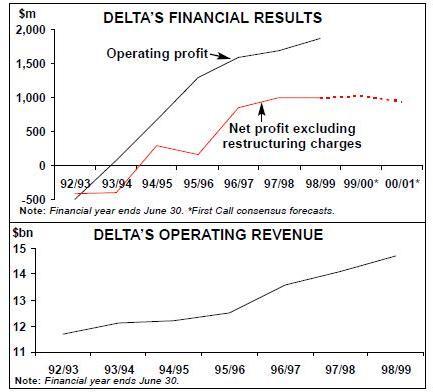

Delta has continued to perform extremely well financially. It reported record operating and net earnings of $1.9bn and $1.1bn for its financial year ended June 30, up 10% on the previous year. The results represented profit margins of 12.7% and 7.5% respectively. Delta was one of few major US carriers to post improved earnings for the June quarter.

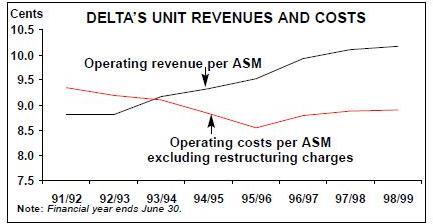

The strong results reflect the company’s ability to retain a low unit cost structure while steadily improving unit revenues. The 1994–96 “Leadership 7.5” project, which slashed operating costs by $1.6bn, made Delta the lowest–cost major network carrier in the US. The project had to be abandoned early due to the more pressing need to restore service quality and employee morale. But a favourable four–year pilot contract in April 1996, low cost subsidiary Delta Express (October 1996) and, above all, tight cost controls have helped keep unit costs stable — at an enviable 8.80–8.90 cents per ASM — over the past three years.

Delta’s unit revenues have improved steadily since 1994. For more than a year now, the carrier has outpaced the industry in revenue per ASM growth virtually every month, and it went against the industry trend by posting a small improvement in the June quarter. This reflects success in restoring on–time performance and making progress in mending customer service, which Delta’s new CEO Leo Mullin made his top priority soon after taking up his position two years ago.

Delta’s fuel–hedging strategy has taken the sting out of the rise in fuel prices. Taking advantage of favourable market conditions earlier this year, the carrier hedged about 80% of its estimated jet fuel purchases in the current financial year ending June 30, 2000. This will give it a competitive advantage. Another positive is that the Atlanta hub has been relatively insulated from the air traffic control problems that have plagued the US airline industry in recent months. Overall, Delta is in great financial shape. The earlier restructuring gave it a lower debt structure and investment–grade credit ratings. It pays regular cash dividends, implemented a two–for–one common stock split a year ago and has repurchased $1.7bn worth of common stock since the programme was introduced in April 1996.

All of that, plus a puzzlingly sharp fall in Delta’s share price this year, have made Delta one of the best–liked long–haul carriers on Wall Street (Southwest is the perennial short–haul favourite). Many analysts feel that the stock is undervalued in the light of the earnings strength and long–term potential.

As the outlook for US airlines has worsened in recent months, Delta’s earnings are also expected to fall this year and next, beginning with the quarter ended September 30. September was a bad month for Delta, its wholly–owned commuter partner Atlantic Southeast (ASA) and Delta Express because of the havoc wreaked by Hurricane Floyd all along the East coast. Merrill Lynch calculated the damage at 1,100 flight cancellations.

Add to that softening domestic demand and renewed pressure on transatlantic yields, and Delta’s September quarter earnings are now expected to fall from last year’s $2.08 to $1.94 per share. This would still be better than the profit falls anticipated for many other large network carriers. And in the longer term, Delta’s performance is certainly expected to exceed the industry average. The latest First Call consensus forecast is a profit of $6.72 per diluted share for FY2000 (to June 30), which would represent a 5.4% decline from last year’s $7.10.

But Delta faces tough challenges on the labour front. Over the past year alliance plans have been scuppered and the fleet strategy has been jeopardised by the pilots’ refusal to co–operate. First, talks on domestic code–sharing with United had to be abandoned a year ago when ALPA refused to give the deal its blessing without gaining a voting board seat. Then in June Delta had to defer deliveries of all 777- 200s on order because it could not secure agreement with ALPA on pay rates and work rules for the aircraft.

The carrier explained at the time that in light of its commitment to superior customer service, it could not risk taking delivery of any new aircraft without prior agreement with the pilots. It had already initiated a substitution process by agreeing to accept delivery of four 767–300ERs.

The two sides reached tentative agreement on the 777 on September 23. But even if the deal is ratified, labour pressures will not ease as by May Delta has to secure a new contract with its pilots. It also has to continue to try to deter further unionisation. Work also remains to be done to restore customer service to the pre–Leadership 7.5 levels. This will be all the more important in the light of the sharply increased competition in East coast markets. Delta’s extensive operations there make it probably the second most vulnerable of the major carriers (after US Airways) to new domestic yield pressures, which are now the greatest in the East.

And then there is the challenge of implementing and expanding the newly–formed global alliance with Air France — relatively late in the day compared to competitors’ efforts. How does Delta intend to catch up?

Labour issues and fleet plans

The recent tentative agreement with the pilots covers pay rates and work rules for the 777 as well as the 767–400, for which Delta is the launch customer with 21 aircraft on order for delivery from May next year.

The pay rates — $250 an hour for the 777 and $230 for the 767–400 — seem a fairly straight compromise on the original widely diverging positions. They still make Delta’s pilots the best–paid in the industry — by comparison, American’s top 777 rate is believed to be $225.

The package also includes improvements that apply to all 9,200 Delta pilots, including converting the present profit–sharing plan into a 6% pay rise on January 1, granting a separate 3% pay rise for all other than 777, 767–400 and new–generation 737 pilots, and eliminating the “B–scale” pay rate. But these provisions will be subject to renegotiation during full–scale contract talks.

The deal was due to go to ALPA’s Master Executive Council for approval on September 30 and will then be submitted for a membership ratification vote, with ballot count tentatively scheduled for November. It is hard to envisage a voting–down scenario as the pilots would be the biggest losers, but then again recent industry experience is not encouraging.

Once ratified, Delta is expected to put back on track the earlier 777 order as the aircraft was an integral part of its growth plans and a perfect fit for its European routes. The two 777s already in the fleet look likely to return to service in the winter schedule. The 767–400s will replace Delta’s domestic L–1011 fleet. Agreement with the pilots on new–generation 737 flying was reached amicably last year. About a year ago Delta accelerated the retirement of its 727 fleet — all will now be phased out by 2005 as 737–800s are delivered. In March the carrier announced a tentative agreement to sell the 727 fleet to United Technologies over six years, which will simplify the retirement process and provide substantial incremental cash flow.

The 777 deal offers some hope for the overall pilot contract negotiations, which began six months early on September 8 so that a deal could be reached by the May 2 target. However, it will be a tough process as the pilots expect significant pay increases in the light of the company’s record profits. Many still fret over the $1bn wage and benefit concessions made in 1996.

As the talks opened, the pilots asked for improved overtime pay and retirement benefits, a voting board seat, elimination of a two–tier wage system (due to Delta Express) and more restrictions on marketing agreements with foreign and domestic partners. Although wage demands have not yet been specified, ALPA said that the pilots would require a 21% rise simply to cover inflation and the 1996 concessions.

Regional jets are likely be a major issue because of Delta’s ambitious plans for its feeder partners. The current pilot contract is unusually liberal in that it places no limit on the number of RJs with 70 or fewer seats, but at the very least ALPA is likely to want the numbers linked to mainline growth.

Demands such as a voting board seat and changes to Delta Express pay rates are likely to be totally unacceptable to the company, which is otherwise committed to keeping its workers at or near the top industry compensation rates in return for superior productivity. The 777/767–400 deal and the next pilot contract will be horrendously costly to Delta, but that is probably inevitable in the present labour climate.

One important challenge for Delta is to try to deter further unionisation. It is the least unionised of the major carriers (only pilots and dispatchers), but there continues to be attempts to organise flight attendants, mechanics, ramp workers and ticket agents.

Mending customer service

Delta’s current service quality drive began in late 1997, when plans were unveiled to overhaul, modernise and streamline just about everything from lounges and gates to boarding procedures and information technology systems, and to speed up a programme to refurbish aircraft interiors.

The aircraft refurbishment programme covering the whole fleet was completed by the summer. Facilities at numerous airports have been renovated. New gate and boarding procedures have been introduced to simplify check–in. Delta has also invested $314m in a new intercontinental premium business–class product (BusinessElite), which was phased in during the first half of this year. And it has forged partnerships with priceline.com and with iXL to expand access to customers through the Internet.

As a result, operational performance has improved dramatically. Delta moved up from last position in 1997 to second position in the year ended May 1999 in the DoT’s domestic on–time performance rankings. It also came second or third in fewest mishandled bags and customer complaints and has even won a few awards.

But aspects of Delta’s customer service still lag behind competitors’ standards. These include an unacceptably high volume of involuntary denied boardings, which the airline now intends to remedy.

Otherwise, Delta is enthusiastically promoting its version of the industry–wide 12- point plan to tackle service problems.

Domestic strategic moves

The inability to expand the April 1998 strategic alliance with United to include domestic code–sharing has not really been a handicap — after all, American and US Airways have not gone ahead with code–sharing either (and appear reluctant to take up the matter with their pilot groups).

Because of the large number of overlapping markets, Delta–United code–sharing would have been frowned upon by the regulators.

Like American and US Airways, Delta and United have no doubt benefited from their FFP links. That said, Delta’s market position is relatively strong because of its dominance at Atlanta, number one position at JFK and on the North Atlantic, growing presence in Latin America and Delta Express’s operation on the East coast.

Delta’s domestic strategy, like that of Continental and others, has focused on expanding and improving the economics of its main hubs: Atlanta, Cincinnati, Salt Lake City and New York (JFK). Last winter’s schedule saw expanded service between Atlanta and key East coast cities, and this autumn the carrier is boosting Atlanta–West coast flights.

Delta Express has expanded at a steady pace in Northeast–Florida markets. With about 170 daily flights and a fleet of 37 737–200s, it is not a major profit generator. But its good operational reliability and customer appeal have helped Delta retain low–fare markets.

Delta Shuttle is now seeing service enhancements, seemingly in response to US Airways’ recent moves. There are new early morning departures, a new direct Boston- Washington connection and improved menus, and Shuttle will start receiving a fleet of 16 new 737–800s next summer.

Delta has made several strategic moves recently that will further strengthen its domestic position. In June it completed the $700m acquisition of its regional partner ASA, which now operates as a wholly–owned subsidiary. The move was spurred by Delta’s dissatisfaction with ASA’s service quality, and financial gains are expected from more efficient operations, market growth and higher aircraft utilisation.

In recent months ASA’s schedules have been integrated more closely with Delta’s at Atlanta and the carrier has introduced new CRJ services, which have freed larger Delta jets to long–haul markets. The plan is to substantially expand ASA’s RJ fleet, though the carrier is also acquiring additional ATR 72s.

In another move marking a major venture into RJ operations, in early September Delta signed up Atlantic Coast (ACA) as a new regional partner in the Northeast. The 10- year agreement gives Delta exclusive use of 45 aircraft (25 Fairchild Dornier 328JETs and 20 CRJs) ACA has on firm order, plus access to possible future options, and the rights to determine routes and schedules. ACA has formed a separate Delta Connection unit (it also operates as United Express) and expects to begin Delta service next April.

The ACA deal received an enthusiastic response from analysts because of its profit–generating potential. Delta needed a strong feeder partner to boost its presence in the Northeast. Its current partner in that region, Business Express, was recently acquired by AMR and the Delta contract is due to expire in March. But the overall success of the RJ strategy will obviously depend on the stance adopted by the pilots in the current contract talks.

International struggles

Delta’s aggressive foray into Latin America, which began with a batch of services to Central America and Venezuela in April 1998 (after its limited previous operations to Mexico and Brazil) and was followed by Peru a year ago, appears to have been reasonably successful despite overcapacity and economic problems in that region. However, its Latin America operating profits fell by 33% to $32m in 1998 as the load factor plummeted by 12 points to just 55%.

The carrier got burnt with the AeroPeru investment but has continued to build on its successful code–share relationship with Aeromexico, as well as the more recent deals with Aeropostal, Transbrasil and Air Jamaica. It hopes to introduce service to Buenos Aires in September next year, following the recent signing of a new US–Argentina ASA, and is also seeking authority to Colombia, Montevideo, Uruguay and Chile.

Asia has been more of a struggle as Delta has not had much luck with its Asian partners. First it lost SIA and then ANA defected to the Star alliance. The promising code–share co–operation with Korean had to be suspended in April pending a safety review of KAL’s operations, leaving China Southern as the only code–share partner.

Delta was able to enter the Atlanta–Tokyo market in June last year, followed by Portland–Fukuoka a few months later, but the latter has just been suspended due to financial losses. Operating profits from the Pacific division plummeted from $38m in 1997 to just $1.8m in 1998, but the carrier continues to serve Tokyo from Atlanta, Los Angeles and Portland and Nagoya from Portland.

The transatlantic market, where Delta is the largest US carrier, has continued to perform relatively well despite recent overcapacity and yield pressures. This year Delta has introduced new non–stop service from Atlanta to Athens, Barcelona, Istanbul and Rome and from New York to Dublin and Shannon — the latter meant the ending of its code–share relationship with Aer Lingus.

Delta has benefited substantially from the rapid expansion of code–sharing with Swissair, Sabena and Austrian since the former Atlantic Excellence alliance secured antitrust immunity in the US in June 1996.

Recently it pulled out of the Atlanta–Vienna market in favour of code–sharing on that route and on services to Dubai and Zimbabwe with Austrian. However, there may be some changes in the light of Delta’s and Air France’s decision to form a broader global alliance and Austrian’s defection to Star. As a prelude to their new relationship, in March Delta and Air France substantially expanded their code–sharing on US–France routes.

Global alliance prospects

Delta’s exclusive long–term agreement with Air France was a major coup for Delta as Air France had also been courted by its other US code–share partner Continental.

The deal was extremely attractive because of Air France’s stronghold at CDG and extensive presence in Europe, Middle East and Africa. It represented a major break for Delta, which has suffered many setbacks in its search for alliance partners and seemed in danger of being left out of the game altogether.

However, the two will not be able to press for immediate antitrust authority as the US–France ASA will take five years to make the transition to full open skies. Delta and Air France have pulled their code–share partner Aeromexico into the grouping, while Korean Air has been mentioned as a likely Asian partner (assuming that it can successfully tackle its safety issues). But Delta must be concerned about secondary transatlantic relationships. Austrian’s decision to join Star was a blow, and Swissair/Sabena will distance themselves further from Air France/Delta, though British Midland is a possible partner (see pages 2–3).

As a result of all the alliance turmoil, and in line with its strategy of selling non–core assets, Delta has now sold its 35.2m shares in SIA and repurchased SIA’s holding of Delta stock. This formally ended the three–way alliance formed ten years ago as SIA and Swissair also recently disposed of their equity stakes in each other. Furthermore, Delta is likely to sell its holding in Swissair if the latter decides to join another global alliance. The SIA transactions will result in a $140m pre–tax gain and $75m net cash proceeds to Delta, adding to the $115m pre–tax proceeds Delta received from the sale of some of its stock in priceline.com in the Internet venture’s recent public offering.

| Current fleet | Orders | Options | Delivery/retirement schedule | |

|---|---|---|---|---|

| 727-200 | 120 | 0 | 0 | To be retired by 2005 |

| 737-200 | 54 | 0 | 0 | |

| 737-300 | 26 | 0 | 0 | |

| 737-800 | 8 | 99 | 0 | Delivery in 1999-2003 |

| 757-200 | 97 | 18 | 0 | Delivery in 1999-2000 |

| 757-200EM | 4 | 0 | 0 | |

| 767-200 | 15 | 0 | 0 | |

| 767-300 | 26 | 0 | 0 | |

| 767-300EREM | 53 | 8 | 0 | Delivery by 2006 |

| 767-400EREM | 0 | 21 | 0 | Delivery by 2006 |

| 777-200ER | 2 | 11 | 0 | Delivery by 2005 |

| MD-88 | 120 | 0 | 0 | |

| MD-90 | 16 | 0 | 101 | |

| MD-11 | 15 | 0 | 116 | |

| L-1011-1 | 20 | 0 | 0 | |

| L-1011-40 | 4 | 0 | 0 | |

| L-1011-200 | 1 | 0 | 0 | |

| L-1011-250 | 6 | 0 | 0 | |

| L-1011-500 | 16 | 0 | 0 | |

| TOTAL | 603 | 157 | 217 |