Air France in the ascendancy

October 1999

Air France has moved from the ranks of perennial under–performer to at least a position of equality with some of the top flight of European Majors. What is behind the turnaround?

The new bilateral with the US (which will lead to open skies in a maximum of five years), has unblocked some of the capacity constraints that have faced Air France since 1991. In 1998 the number of US cities served by Air France grew from 36 to 94 through code–sharing with Delta and Continental. This figure will increase to 162 this year.

Air France had in the 1990s steadily been losing transatlantic market share to carriers at London and Amsterdam. It is now able to offer an improved frequency to attract business class travellers and is altering its fleet mix (747 to 777) to increase both the proportion and the number of business class seats available. In the first quarter of Air France’s current financial year, to June 30th 1999, unit revenues on the Atlantic were only down 1% against an estimated industry average decline of 8–10%.

Overall, unit revenues were actually up by 1% in the latest quarter in contrast to a fall of about 6% at British Airways. As well as capturing more business travellers, Air France is operating at high load factors, 76%, presumably because of the increased connecting possibilities at Charles de Gaulle (CDG).

The huge advantage of being based at CDG is that Air France has much greater freedom than all of its competitors to grow its network. Environmental opposition is muted and government support strong.

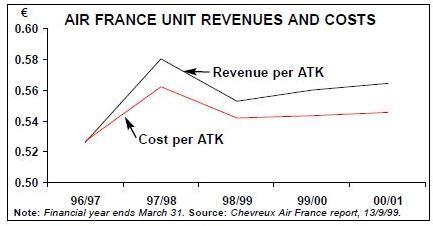

In 1999 Air France introduced a new six–wave system at CDG, and this summer there has been a 44% increase in connecting opportunities. The opening of the third runway at CDG in April 1999 has further increased Air France’s ability to fine tune operations. For winter 1999/2000 the longhaul schedule will have 87% non–stop services, the highest percentage of all European Majors, and over half mediumhaul destinations have at least four daily frequencies. The speed of capacity growth is, at least for the moment, constraining unit costs. Although total costs in the last quarter rose by 12%, unit costs fell by just under 1%.

Air France has also benefited from the comparative weakness of the Euro, which has boosted US dollar, sterling and other revenues, and has given a fillip to tourism. The “Franc Fort” policy of successive French governments had depressed inbound flows.

Senior management at Air France has been focussed on getting the core business in good shape ahead of the airline’s full flotation. It has managed not to be distracted by protracted alliance negotiations, regulatory arguments and troublesome subsidiaries (having learnt the painful lesson of the state aid sagas and unproductive investments in Sabena and CSA).

Staff morale seems to be well up. The move from the public to private sector has left the employees with 11.4% of total share capital, which should logically curtail their propensity to strike.

Of course, it helps greatly that Air France has so far escaped serious competition from low–cost airlines. The French generally continue to be loyal to French products, so with no alternative choice of French carrier on medium/long–haul routes, Air France is in a quite enviable situation.

The break–up of Air France’s relationship with Continental once it formally joins the KLM/Northwest/Alitalia alliance will be more than compensated by a closer relationship with alliance partner Delta, one of Air France’s largest transatlantic competitors. Air France predicts Ff1bn (€152m) of net benefits from the Delta alliance over the next three years; interestingly, 70% of these benefits are to come from the revenue side, 30% from cost reduction.

Comparisons

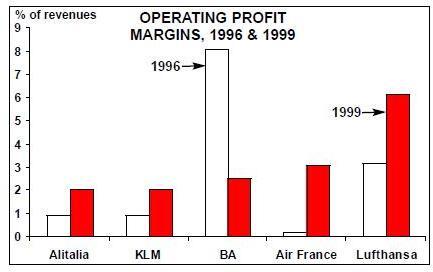

When Air France was constructing its turnaround plan in the mid–1990s, Lufthansa was regarded as the model, as it was considered to be too much of a leap to try to emulate British Airways. Since then, however, the European scene has changed. Air France, on an operating profit margin measure, is now ahead of British Airways (and KLM and Alitalia), but is still well behind Lufthansa.

The ordering will change again. And a potential threat to Air France comes from low–cost competition (Ryanair’s 1999 operating profit margin of 22% would be up the scale of this graph), a challenge which Air France is not prepared for. And, given the struggle to contain costs so far, it is very difficult to see how Air France could prepare itself for a concerted attack.