IndiGo and the ultra-competitive Indian market

November 2018

IndiGo has suffered a bad quarter thanks to an ultra-competitive and highly price-sensitive domestic Indian market. Is the airline’s continued bullishness about its future justified?

IndiGo was founded by Rahul Batia, owner of Indian conglomerate InterGlobe Enterprises, and Rakesh Gangwal, a former CEO of US Airways, in 2006. Today the LCC operates a fleet of 189 aircraft (160 of which are on operating lease), comprising 127 A320ceos, 50 A320neos and 12 ATR 72-600s. The fleet increased by more than a third (48 aircraft) over the last 12 months, and will increase further thanks to huge outstanding orders for 355 A320neos, 25 A321neos and 38 ATR 72-600s.

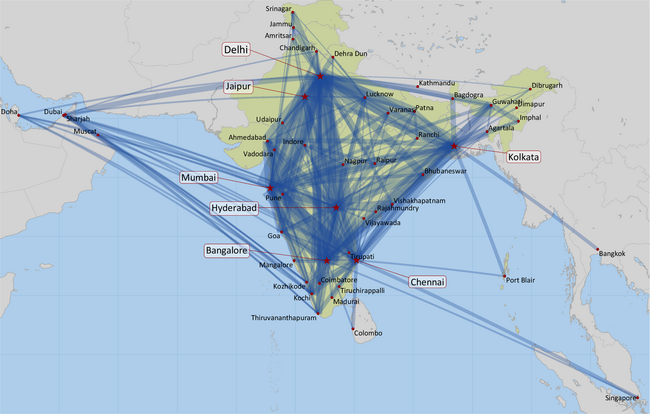

The airline is based in Gurgaon (a satellite city of Delhi) and has bases at Delhi, Mumbai, Chennai, Bangalore, Hyderabad, Ahmedabad and Kolkata, from which IndiGo operates more than 1,300 flights a day to 59 destinations, of which 48 are domestic and 11 are international — Kathmandu, Dhaka, Muscat, Singapore, Kuwait City, Colombo, Bangkok, Abu Dhabi, Dubai, Sharjah, Doha. Four more international destinations are being added imminently — Phuket, Kuala Lumpur and Malé this November and Hong Kong in December.

A terrible quarter

In the first half of the 2018/19 financial year (the six months ending 30 September 2018), IndiGo reported a 16.3% rise in revenue, to ₹133.3bn (US$1,959m), based on a 26.5% rise in passengers carried to 30.8m. In the six-month period ASKs rose by 23.7% year-on-year, and with RPKs up by 24.8% passenger load factor rose 0.8 percentage points to 86.8%

However, profit before tax fell from ₹18.8bn ($295m) in April to September 2017 to a loss of ₹9.6bn ($141m) in H1 2018/19, and at the net level an ₹13.6bn ($214m) profit in H1 17/18 became an ₹6.3bn ($93m) net loss in April-September 2018.

Most of the H1 loss arose in the second quarter of its financial year (July-September 2018), where IndiGo posted a loss before tax of ₹9.9bn ($141m) and a net loss of ₹6.5bn ($93m). More than half of the decline in second quarter profitability came from higher fuel prices, which almost doubled compared with Q2 2017/18, from ₹16.5bn to ₹30.4bn ($434m).

Cost per ASK rose from ₹3.01 in Q2 17/18 to ₹3.74 (5.3US¢) in Q2 18/19 (a 24.1% increase) — although even when stripping out fuel, CASK excluding fuel rose 13.5% quarter-on-quarter, to ₹2.18 (3.1US¢), due to "adverse movements in foreign exchange”. In total the depreciation of the Indian rupee increased costs by ₹4.3bn ($61m) in Q2 18/19 compared with the same quarter a year ago.

Other categories of expense — such as employee payroll and aircraft rentals — also rose, though this is due to the expansion of capacity; in the second quarter the airline added 20 aircraft, launched 35 routes and entered five new city markets.

While fuel prices and depreciation of the Indian rupee are external factors, questions might be asked about management’s hedging policies. More worrying still is the continuing fall in yield, down 9.7% in Q2 2018 compared with Q2 2017; as the chart shows, yield pressure has been relentless over the last 18 months as competition increases both domestically and internationally.

IndiGo gave some detail of the yield pressure it was under in the second quarter of its financial year — whereas previously 60% of its flights were booked in the period outside 15 days from the departure of a flight, that fell to around 54% in the July-September 2018 quarter. That matters because thanks to competitive pressure, fares and yield decline closer to departure. (This Indian characteristic is the opposite of European LCC yield management techniques which aim to push fares up as departure approaches.)

IndiGo insists that it “has to match the activity of the other carriers” with regards to fares, as “obviously we are keen to protect our market share”, and Rahul Batia, CEO of IndiGo, insists that IndiGo is “not leading the charge in terms of low fares. Rather, there are players in the industry who are really hurting, and for them to raise short-term cash they have to do lower fares. As a company, we have no choice but to match them.” Indeed, in May this year IndiGo introduced a fuel surcharge, but it wasn’t matched by competition and so the airline had to withdraw the charge.

But IndiGo also says that overall domestic capacity growth is “almost at par with the growth in traffic, so we do not believe that there is too much capacity coming into the market". Indeed, IndiGo’s capacity increase for entire 18/19 financial year is expected to be around 30% year-on-year.

Overweight domestically

IndiGo’s bullishness in terms of capacity keeping pace with demand needs to be seen within the context of the overall market — and specifically the significant disparity between the airline’s domestic and international business.

In the first six months of the 2018/19 financial year, IndiGo carried 28.8m domestic and 2.0m international passengers, and IndiGo’s overreliance on the domestic market can be seen in the chart, which looks at the 2017/18 financial year (the 12 months ending 31 March 2018).

The international market accounts for just 6.1% of passengers carried, 14.5% of ASKs and 10.9% of revenue. IndiGo provides no breakdown of profits by market, but even assuming international flights are more profitable, the domestic/international split won’t be too far away from these types of figures given the significant disparity between the two types of business.

Domestic pressure

As can be seen in the graph, the domestic Indian market has grown hugely in recent years, with its absolute size increasing more than six-fold from 2004/05 to 2017/18 at an average annual growth rate of 14.9% over that 13-year period.

The reasons for that sustained increase are multiple, but a key driver is India’s GDP growth and higher disposable incomes among the country’s fast-growing urban population, which numbered more than 419m people out of a total population of 1,282m in 2015.

The urban proportion of the overall population (33%) is significantly lower than developed regions such as Europe (74%) and North America (82%), and so there is major potential for future urban growth.

Just as importantly, the current urban population in India is not concentrated in a handful of cities. India has so-called mega-cities (Mumbai had a population of 12.4m and Delhi 11.0m, according to the last census, carried out in 2011), but remarkably had 58 cities with a population of more than 1m in 2015 (compared with just 38 in the whole of Europe). This network of large cities — combined with growing disposable income — has been the impetus for the explosion in domestic aviation travel recently.

The main competition is the vast domestic rail network in India. State-owned Indian Railways employs a staggering 1.3m people and runs more than 120,000km of track linking around 7,400 train stations, making it the fourth largest rail network in the world. However, less than 50% of the network is electrified and while train travel (in the lowest class fares) is very cheap, journeys between cities can be lengthy affairs.

High-speed rail (HSR) links — classified as having operational speeds of more than 120 mph (200 kmh) — do not yet exist in India; the fastest trains between urban cities do not even hit 100 mph. Plans for HSR have been hit by political rows, but the first scheme for HSR linking Mumbai and the western city of Ahmedabad started construction in 2017, with a planned finish date of 2022 and costing more than US$14bn.

The promise is that high-speed trains on this link (which will connect the two cities in a three-hour journey) will cost less than the air fare on the route, but even if true that’s just one city-pair connection, and India’s airlines don’t expect HSR to have a significant constraining impact on the explosive growth in domestic air travel for at least the medium-term.

As can be seen in the chart in the 2017/18 financial year (the 12 months ending March 2018), IndiGo had a 40% share of the domestic market, with its passengers carried increasing by 17.7% compared with 2016/17. That’s significantly above its rivals, who are (in order in market share), Jet Airways (a 15.0% share in 17/18), LCC SpiceJet (13.1%) and flag carrier Air India (12.0%).

Interestingly, the strongest growth in domestic passengers carried in 17/18 compared with 16/17 came from three smaller carriers — GoAir (up 25% year-on-year), AirAsia (87%) and Vistara (52%).

GoAir is an LCC based in Mumbai that largely operates domestically (to 25 destinations) and with just two international destinations — Thailand (Phuket) and Maldives (Malé). It has a fleet of 43 A320 classics and neos — with 122 A320neos on order — and operates out of Mumbai and other hubs at Delhi, Bangalore and Kolkata.

LCC AirAsia India was launched in 2014 as a joint venture between AirAsia and Tata Sons, each of which have a 49% stake. Based in Bangalore, AirAsia India operates 19 A320-200s to 21 domestic destinations out of hubs at Kolkata, Delhi and Karnataka, and like many domestic airlines has plans to launch internationally (see below).

Vistara is a joint venture between Singapore Airlines and Tata Sons, and operates 21 A320ceos and neos between 22 domestic destinations. However, in July this year Vistara signed letters of intent for six 787s and 13 A320neos (estimated actual value $2bn) as part of ambitious domestic and international growth plans that also include the leasing of 37 further A320neos.

International pot of gold?

As shown in the chart, IndiGo had a 6.0% share of passengers carried to-from India in the first half of 2018/19 financial year (April-June 2018), which is significantly higher than the 3.7% share it had in the October to December 2016 quarter.

Unsurprisingly, the Air India group (the mainline plus Air India Express) is the market leader, accounting for 17.1% of the international market in April-June 2018 period, followed by Jet Airways with 12.5%, and with the only other Indian carrier present being SpiceJet (3.4%).

The Indian government is gradually liberalising aviation regulations (see Aviation Strategy, May and September 2017), with perhaps the most important change being a modification of the 5/20 rule, which had previously required a minimum five years of domestic operations and a fleet size of at least 20 aircraft before an Indian airline could launch international operations (and which had been heavily criticised as a barrier to international expansion for Indian airlines).

A new policy enables airlines to commence international routes as long as they deploy 20 aircraft or 20% of total capacity (whichever is higher) for domestic operations, and that’s the release valve that allows Indian airlines overly reliant on the highly competitive domestic market to expand onto international routes quicker and easier.

IndiGo previously said that the LCC had no plans to launch a push into long-haul routes, though the message has now changed subtly but significantly; at the call with analysts following the release of its second quarter 2018 results, IndiGo sad that “long-haul flying with widebodies remains more aspiration than a plan”.

It says the greater opportunity is connecting the Indian domestic market with short-haul international destinations, and “in the interim we continue to add a lot of international markets that are within range of A320 family aircraft”.

The 240-seat A321neos that are arriving from November this year can easily reach the Middle East or south-east Asia as they effectively increase the airline’s range by another hour of flying (over the A320), and IndiGo’s plan is “to continue to grow international aggressively, but opportunistically”.

Prospects

The good news is that IndiGo’s balance sheet is relatively strong: as at September 30th this year, IndiGo had non-current financial liabilities of ₹66.3bn ($915m), which is largely aircraft related but which rose a hefty ₹13.8bn ($190m) in just six months this year. Free cash stood at ₹44.2bn ($610m) at the end of September 2018, some ₹31.8bn ($439m) lower than 12 months earlier.

The imminent problem for IndiGo is that while the domestic market may continue to grow, no-one appears able to stop the erosion in yields. Unless one of more of its domestic rivals go out of business, IndiGo Can expect to come under sustained pressure for a while yet.

Fellow Indian airlines clearly face the same challenges as IndiGo. For example, Jet Airways delayed the release of its first quarter 2018/19 results (covering April to June this year) until late August, and when unveiled the group’s net loss was US$198m, compared with a net profit of $9m in Q1 FY17/18. Jet says it will reduce debt, inject new capital and cut costs as part of a turnaround plan, but if Jet — or indeed any of IndiGo’s rivals — did go under at any point then IndiGo would be in a good position to cherry pick the best routes. Jet is IndiGo’s closest domestic rival (see chart), and there would be scope for route rationalisation and consolidation that might lead to yield strengthening (or at least a reduction in the current downwards pressure).

More importantly perhaps, Jet is the market leader in the international market (see chart), and were Jet to disappear then IndiGo would jump at the chance to take over many of its routes.

However, Jet appears to have put itself up for sale. Press rumours suggest that majority owner Naresh Goyal has agreed to give up control in the failing carrier by selling a stake to one of three interested parties: Etihad (current 24% holding but strategically challenged); Delta/Air France-KLM with whom it has a close cooperation through Europe; and the Tata group.

But regardless of the outcome, IndiGo — like every other Indian airline — is in any case pinning its hopes on international expansion in the medium-term.

The specific challenge for Indigo is just what will it do with its vast orderbook? The order made in August 2017 for 50 ATR 72-600s might make sense from the domestic point-of-view, as does the imminent A321neos for an expanded medium-haul network. But on top of that an astonishing 355 A320neos are on order.

Even allowing for the replacement of the 160 aircraft that are currently leased, that’s still an immense amount of new capacity that needs to be placed into the market profitably. IndiGo is the most efficient of the domestic Indian airline but the government continues to prop up Air India, so that capacity is only reducing slowly. Given the supply/demand balance in the domestic market, can IndiGo management find enough short/medium-haul international traffic to fill those seats?

| In service | On order | |

|---|---|---|

| A320ceo | 126 | |

| A320neo | 58 | 224 |

| A321neo | 150 | |

| ATR-72 | 12 | 38 |

| Total | 196 | 412 |

Source: Company reports. Note YE March.

Source: AAI. Note: Year ends March 31st.

Source: AAI. Note: Year ends March 31st.

Note: thickness of lines directly related to annual seats operated

(Jan-Jun 2018)

(YE March 2018)