Pegasus Airlines:

Hybrid ULCC

November 2015

Since becoming an LCC, Pegasus Airlines has experienced rapid growth in both passengers carried and profitability as the Turkish aviation market has boomed. Can the upward trend continue?

Pegasus Hava Taşımacılığı was launched as a charter airline through a joint venture between Aer Lingus and two Turkish companies — Silkar Yatırım ve Insaat Organizasyonu and Net Holding — back in 1990.

Pegasus grew slowly over the next few years before Aer Lingus and Net sold their stakes to İstanbul-based Yapı Kreditbank in 1994. The airline continued to develop, but in January 2005 it was acquired by Turkish entrepreneur Sevket Sabancı through the vehicle of his family’s private equity holding company, called ESAS Holding.

This was the beginning of rapid transformation for Pegasus. The airline became Turkey’s first LCC within a few months (with Ray Webster, former CEO of easyJet, being appointed to the board), and by the end of that same year it placed an order for 12 737-800s.

Perfect timing

Pegasus’s conversion into an LCC came at the perfect time, thanks to two key factors. First, the Turkish aviation market was liberalised through the 2000s, starting with the removal of domestic aviation tariffs in the early part of the decade. Second, at the same time, the Turkish economy underwent significant growth — Turkey’s GDP (measured in current US$) grew by a CAGR of 10.5% between 2003 and 2013. With rapidly increasing disposable income and lower fares thanks to increased competition, the Turkish aviation market boomed. During the 2003-2013 period, combined domestic and international passengers grew at a CAGR of 13.1% (with the fastest growth coming from domestic passengers, with a 15.1% CAGR).

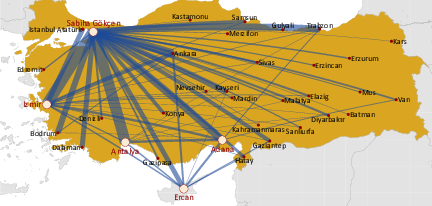

As a result of this growth, four domestic Turkish routes now feature in the list of the top ten highest density routes in Europe — from İstanbul to İzmir, Antalya, Ankara and Adana — with compound annual rates of growth of 16% in the past five years (see table).

With this favourable background, Pegasus made considerable inroads against what had been the dominant incumbent prior to the 2000s — Turkish Airlines (THY). As can be seen in the chart, Pegasus steadily increased its market share in the international market to/from Turkey — but it saw much faster growth in its share of the domestic Turkish market. That domestic share has grown from just 1% in 2005 — when it became an LCC — to 28% as of last year (out of a total domestic market of 43m passengers in 2014). In total Pegasus carried 19.7m passengers in 2014, 17.4% higher than in 2013.

In fact its growth has been so rapid that in each of 2011, 2012 and 2013, Pegasus was fastest growing airline (in terms of capacity offered) of any major European carrier. Impressively, that didn’t come at the expense of the bottom line — in 2014 Pegasus saw revenue rise 28.7% compared with 2013, to ₺3.1bn (€1.1bn), with operating profit of ₺324.7m (€112.3m) — 25.8% up on 2013 — and net profit of ₺143.3m (€49.6m) — 62.3% up year-on-year.

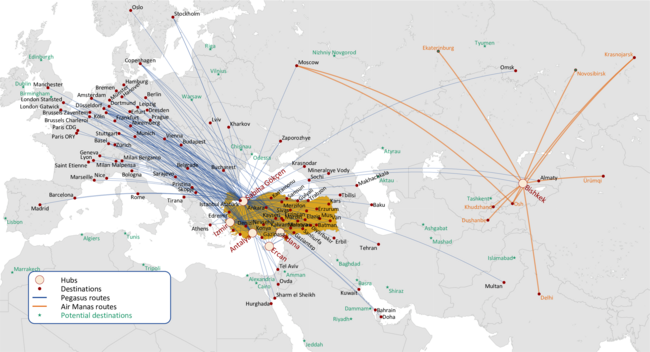

Today the airline (and its affiliates) operates to 31 domestic destinations and 67 international airports across 36 countries, with a fleet of nine A320-200s, 56 737-800s and one 737-400 that have an average age of less than five and a half years. Of that total fleet, 30 aircraft are on operating leases.

On firm order are 57 A320neos and 18 A321neos, placed in December 2012 and which at the time — with a list value of $12bn — was the largest ever order for commercial aircraft by a Turkish carrier. Pegasus also has options for another 25 aircraft. The A320neos will start arriving in 2016 (seven will be delivered that year) and the order will be completed by 2021. The A321neos will be delivered later — five will arrive in 2021 and 13 in 2022. The options — if exercised — are for deliveries that will commence after 2022.

The company's strategy is to see its total fleet grow to 100 units by 2022 up from the current 67. With 39 aircraft on operating lease it has a significant level of flexibility and could given market conditions increase the fleet to 127 units by that year or constrain growth, as shown in the chart.

Pegasus also owns 100% of İZair, an İzmir, Turkey-based airline that was founded by Turkish entrepreneurs as İzmir Hava Yolları in 2005 before ESAS Holding acquired a 20% stake in 2007 and Pegasus bought another 72.6% in 2010. It operates seven 737-800s (owned by Pegasus) between 11 domestic and 10 international destinations.

In June 2012 Pegasus also bought 49% of Air Manas, an airline based in Bishkek, Kyrgyzstan, that was launched as a charter airline by local investors in 2006 and which changed its name to Pegasus Asia and became an LCC after being acquired by the Turkish carrier. It operates four 737-400s and six 737-800s between two domestic Kyrgyzstan cities and nine international destinations in India, Russia, Turkey and China. However, in September this year the airline announced it was rebranding itself back to Air Manas, saying that it had “matured enough to grow and develop further on our own” — though the LCC model and ownership structure will remain the same.

A “bespoke” LCC

Pegasus is based at Sabiha Gökçen International airport in İstanbul and its LCC business model includes a single class and paid-for frills — though in some other ways it’s not an LCC at all. For example, it sells tickets via travel agents (a key part of the Turkish industry), and in 2011 it launched an FFP called Pegasus Plus.

Its key variation from the LCC model is its use of a hub-and-spoke network. That hub is İstanbul’s Sabiha Gökçen International airport, at which it serves all the destinations on its route map directly. In contrast, Pegasus operates just a handful of routes from its other key Turkish bases of İzmir and Ankara, and it has no point-to-point routes that connect any cities outside of Turkey. But with İstanbul being so far to the east of Europe (where the majority of Pegasus’s routes serve), the carrier has relatively few customers that use Sabiha Gökçen as a connecting airport, other than to/from domestic destinations and a handful of points to the east and north of Turkey.

İstanbul however is a large city with an estimated population of 14.5m (compared with Paris or London — the best aviation O&D cities in the EU — with 14m and 10m inhabitants in the greater metropolitan areas respectively) and has the potential to become an important O&D market in its own right.

Pegasus is only a point-to-point airline in the sense that one point is fixed — İstanbul. Indeed its management describes Pegasus as having a “bespoke LCC model”.

In reality, as it’s not a true pan-European point-to-point LCC, Pegasus does not compete against easyJet and Ryanair — easyJet doesn’t operate to İstanbul, instead flying from the UK only to Turkish holiday destinations (with six routes from the UK to Bodrum, five to Dalaman, three to Antalya and one to İzmir). Ryanair doesn’t operate to Turkey at all, although it has been considering the country as a destination for a number of years, reportedly considering Cyprus as a potential base of operation to Turkey (though this would potentially cause political problems with the Turkish government).

Instead, Pegasus is competing primarily against Turkish Airlines. The Turkish flag carrier operates most of its routes out of Atatürk airport in İstanbul, but at Sabiha Gökçen it also operates routes to 30 destinations, of which 24 are international. In addition THY’s “low cost” feeder subsidiary AndoluJet also has a base at Sabiha Gökçen, from which it operates to 19 domestic destinations with a fleet of 737s and Embraer E-190/195s.

In terms of direct competition between THY/AndoluJet and Pegasus at Sabiha Gökçen, the airlines clash on 19 international and 17 domestic routes, and that explains the reason for the launch of Pegasus’s FFP — to directly lure regular leisure and business passengers away from loyalty to the flag carrier.

Currently Pegasus approximately has a two-thirds share of seat capacity at Sabiha Gökçen, with THY in second place with around 25%; the remainder is with an assortment of small LCCs and regional airlines.

Airport challenge

Opened in October 2009, Sabiha Gökçen International airport is located 35km southeast of central İstanbul (on the city’s Asian side, which has much faster population growth than the European side) and which was built in order to relieve the pressure on Atatürk airport. Sabiha Gökçen airport has a single terminal that can handle up to 25m passengers a year, but it’s already operating at close to that level; in 2014 it handled 15m domestic and 8.5m international passengers. By contrast Atatürk airport handled 18.8m domestic and 38.2m international passengers in 2014, though LCCs have little presence here as the airport is dominated by THY, which accounts for approximately 75% of all international seat capacity.

The success of Sabiha Gökçen airport (largely driven — though not exclusively — by the growth of Pegasus) is presenting new challenges to the LCC. Sabiha Gökçen’s capacity was not supposed to be reached until 2023, but it’s likely to pass through that level in 2015, and Pegasus needs more capacity in order to cater for its expansion plans as its new A320 aircraft come on board. The airport is now owned fully by Malaysia Airport Holdings Bhd, and a plan for a second runway and a new satellite terminal is likely to be finalised sometime in 2017. In the meantime the Turkish ministry of transportation is assessing whether to reduce the separation between approaching aircraft from eight to six miles, and whether to build high-speed exit taxi ramps.

Pegasus would like Sabiha Gökçen to be developed much quicker than that, but that is unlikely given the plans for İstanbul New Airport, which began construction in May this year on the north-western (European) side of the city, some 35km as the crow flies from the city centre. With a capacity of 150m passengers a year it will become one of the largest airports in the world when it becomes fully operational by the end of 2028, although its first phase will handle 90mppa when it opens sometime in 2018. Atatürk airport is likely to be closed once İstanbul New Airport opens, and if THY moves all its operations from Atatürk and Sabiha Gökçen to the new facility (which its key shareholder, the Turkish government, is likely to want to happen), that will free up considerable space at Sabiha Gökçen, which in essence will become a specialist airport for LCCs. THY, however, may want to maintain its presence at Sabiha Gökçen in order to block growth by Pegasus.

Whatever happens in terms of airports, with passenger traffic within and to/from Turkey forecast to double over the next decade, Pegasus sees continued profitable expansion as its key goal over the next few years, and that long-term ambition is unlikely to be thwarted unless one or both of easyJet and Ryanair decide to launch a base out of İstanbul. This is unlikely to occur in the short-term; although the EU has a long term aim of developing closer ties with Turkey (and the country remains a candidate for accession to the EU), current air services are dealt with under a horizontal agreement alongside existing bilaterals; and both easyJet and Ryanair have more accessible markets to develop. But when — inevitably — it does happen then Pegasus will face a different kind of challenge altogether to the one it currently faces from THY.

Immediate challenges

Regardless of whether/when the main European LCCs start competing, there are signs that things are already becoming tougher for Pegasus. After a decade of significant growth, Turkey’s GDP fell by 2.9% in 2014, and although the economy is doing better this year, of perhaps greater concern is continuing domestic political turbulence.

In the first nine months of 2015, Pegasus recorded revenue of ₺2.7bn (€805.2m), 13.6% higher than the same period of 2014, and based on a 12.1% rise in passengers carried, to 16.8m. However, operating profit fell to ₺280.3m (€82.5m), 8.1% down compared with Q1-Q3 2014, and the net profit fell even more — by 15.5% — to ₺197.9m (€58.2m) in January-September 2015.

That is still a great set of results by any standards and, importantly, as at the end of September this year net debt stood at just ₺228.3m (€67.2m), representing a significant 54.1% fall compared with 12 months earlier, thanks largely to a 58.5% rise in cash and cash equivalents over the 12 months to ₺1.4bn (€399.5m) as at September 30th 2015.

There are other challenges though. The Turkish Lira has fallen by 40% against the US Dollar in the past five years. As with many airlines Pegasus has a high level of US Dollar exposure (on equipment and fuel). Around 55% of total expenditure is in dollars (with 20% in Turkish Lira and 23% in Euros) while only 35% of revenues are dollar denominated (and 29% in lira and 22% in Euros). However, from July this year all international fares originating in Turkey have been priced in USD and the company stated that US dollar denomiated revenues increased by 16 percentage points in the three months ending September from the previous quarter.

Pegasus came to the İstanbul stock exchange through an IPO in April 2013, with 34.5% of the airline floated (with 62.9% staying under ownership of ESAS and 2.6% owned directly by the Sabancı family). Since then, however, the share price has not had a stellar performance — after an initial steep rise through 2013, the price has fallen since, and 2015 has seen the shares significantly underperform those of its main European LCC peer group — easyJet and Ryanair.

Turkey is rapidly developing as a new centre of European aviation activity. Pegasus is emerging as a new hybrid force.

| Fleet | Orders | |

| A320-200 | 9 | |

| A320neo | 57 | |

| A321neo | 18 | |

| 737-400 | 1 | |

| 737-800 | 56 | |

| Total | 66 | 75 |

| City Pair | Annual Seats (m) | Rank | LCC Market Share | CAGR | |||||

| 2010 | 2015 | 2010 | 2015 | 2010 | 2015 | Total | LCC | ||

| Izmir-Istanbul | 3.05 | 6.66 | 10 | ↗ | 1 | 25% | 34% | 17% | 25% |

| Dublin-London | 4.80 | 5.81 | 2 | → | 2 | 39% | 37% | 4% | 3% |

| Antalya-Istanbul | 2.20 | 5.39 | 18 | ↗ | 3 | 16% | 30% | 20% | 35% |

| Ankara-Istanbul | 2.96 | 5.34 | 11 | ↗ | 4 | 13% | 23% | 12% | 26% |

| Amsterdam-London | 3.80 | 4.82 | 5 | → | 5 | 29% | 34% | 5% | 8% |

| Edinburgh-London | 3.83 | 4.68 | 4 | ↘ | 6 | 30% | 39% | 4% | 10% |

| Paris-Toulouse | 4.10 | 4.26 | 3 | ↘ | 7 | 17% | 19% | 1% | 4% |

| London-Madrid | 3.06 | 3.71 | 9 | ↗ | 8 | 37% | 34% | 4% | 3% |

| Nice-Paris | 3.77 | 3.52 | 6 | ↘ | 9 | 22% | 26% | -1% | 2% |

| Adana-Istanbul | 1.33 | 3.31 | 36 | ↗ | 10 | 17% | 33% | 20% | 36% |

Source: OAG

† rolling 12 months to September 2015

Source: Company reports. 2015 numbers for 9 months to September. Pct chg and total bar height reflect companyfull year estimates.

Source: Devlet Hava Meydanları İşletmesi (DHMİ).

Note DHMİ double counts domestic passengers: numbers adjusted accordingly.

Note: Thickness of lines directly related to daily frequencies.