Brazil's Gol: Short-term struggles, long-term potential

November 2011

Gol Linhas Aereas Inteligentes, Latin America’s leading LCC, has plunged into losses this year due to fierce price wars in Brazil, higher labour expenses and adverse currency movements. However, the latest yield trends and industry capacity plans suggest a more rational 2012. What strategies is Gol deploying to ensure a return to profitability next year and success in the longer term in a changing competitive landscape?

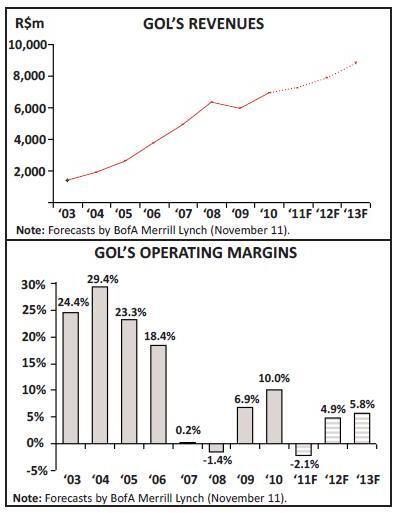

This time last year, in the wake of its 2010 investor day in New York, Gol’s financial outlook seemed very bright. The Sao Paulo–based carrier had recovered from its near–disastrous April 2007 acquisition of Varig after spending two years “getting back to basics” of being an LCC, rebuilding profit margins and repairing its balance sheet, while capitalising on the competitive strengths gained through the merger. Gol had almost attained its pre–Varig unit cost levels and dramatically improved its cash position (see Aviation Strategy briefing, December 2010). Gol posted a double–digit operating margin in 2010 — for the first time since 2006 – and looked set to improve earnings in 2011.

Alas, that was not to be. Intense competition in Brazil’s domestic market, amid aggressive expansion by new entrants, has sent yields tumbling this year. On top of the rise in fuel prices, Gol has had labour cost pressures. And the weakening of the Brazilian Real against the US dollar in recent months has had significant negative impact on costs.

Gol has posted losses for the past two quarters and will also incur a loss in 2011.

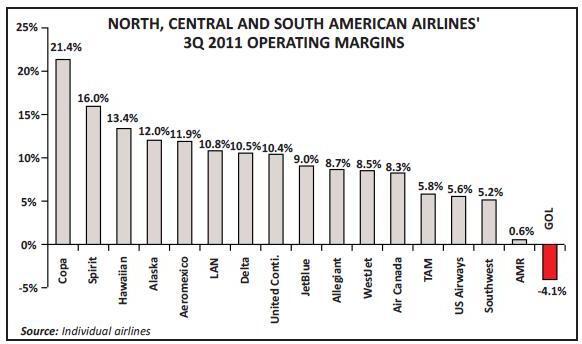

It is hard to believe that this former high–flyer (and an extremely well–managed LCC with great potential) was the only sizeable airline in the Americas to report an operating loss for the September quarter (see chart below).

On a positive note, the latest yield and RASK statistics have hinted at a new positive trend. All the key players have indicated that they will maintain capacity discipline in 2012. So, there is reason to hope that, despite the likely slowing of GDP growth, 2012 will bring a more rational and profitable environment for airlines in Brazil. However, knowing that the international investment community would treat such predictions with a healthy dose of scepticism, at its 2011 investor day in New York on October 26 Gol sought to draw attention to its excellent long–term growth opportunities. The airline brought along a top economist, Dr. Marcelo Nero from the Center for Social Studies in Brazil, to talk about the incredible “new middle class prospects” in Brazil. Gol’s CEO Constantino de Oliveira Junior even invited Nero to the podium first, before any of the management presentations.

The Brazilian air travel market is seeing tremendous growth due to continued healthy GDP growth and rising incomes.

Domestic RPKs doubled between 2005 and 2010, and the first nine months of 2011 saw 18.5% growth. A population segment known as “C class” has expanded rapidly, made up of many people who had not flown before. Tapping that new middle class, which has grown from 76m people in 2003 to 106m this year and is projected to expand to 130m–plus, is the cornerstone of Gol’s strategy. Only 20m people currently fly in a population of 192m. Domestic passenger numbers could double, triple or even quadruple in the next 5–10 years.

Then there will be the added boost provided by the major international sports events secured by Brazil – the World Cup in 2014 and the Olympics in 2016.

All of that adds up to significant growth opportunities for Brazil’s airlines in the next decade or so. Gol is well positioned to tap those opportunities because of its competitive advantages, including formidable slot–holdings at the main airports, focus on short–haul flights, cost leadership, standardised fleet of 737NGs, largest e–commerce platform in Latin America and a strong loyalty programme.

Of course, Gol is intensely focused on dealing with the near–term challenges as it seeks to return to profitability in 2012.

First, it is determined to maintain capacity discipline: just 7% ASM growth this year, followed by a 0–4% growth in 2012. Second, even though its unit costs are still competitive, it has a new programme in place to reduce ex–fuel CASM in 2012. Third, Gol is determined to maintain strong liquidity and a healthy balance sheet. Its cash reserves now amount to almost 30% annual revenues, up from 11% two years ago. Fourth, Gol is seeking to grow higher–margin ancillary activities; revenues from those sources are projected to comprise at least 15% of total revenues by 2014.

Gol is also making moves to boost its market position in response to the impending LAN/TAM merger, which will create a dominant player in Latin America and a stronger competitor in Brazil (that deal is expected to close late in 1Q12). On the domestic front, Gol recently acquired Webjet, a Rio de Janeiro–based LCC with a 5% market share. On the international front, Gol has been forging code–share deals with the most important global carriers that serve Brazil.

This year’s challenges

Gol’s main problem this year has been a sharp decline in domestic yields and RASK due to competition, even as healthy demand growth has continued and load factors have improved (given Gol’s constrained capacity addition). But Gol has also seen significant cost pressures, especially in the fuel and labour categories, and has recorded sizeable one–time items. And foreign exchange movements played havoc with the latest quarterly net results.

The first quarter was still strong for Gol, with yields remaining stable, revenues increasing by 9.6% and operating margin amounting to a healthy 10.2%. But the subsequent onset of industry price wars – which caused average domestic air fares in May to plummet to the lowest level seen since records began in 2002 — led to dismal results in the second quarter. With its yield falling by 13.8% while fuel prices were up significantly, Gol recorded a R$271m operating loss (17.3% of revenues) for the period.

The third quarter was still weak operationally.

As yield declined by 7.6%, revenues inched up by 3.1% and operating costs surged by 19.7%, Gol reported an operating loss of R$75m (4.1% of revenues).

The main culprits on the cost side were fuel (up 28.5%), payroll costs (up 17.6%) and “other” costs (up 64.2%). The latter included some R$50m of one–time expenses associated with restructuring and system improvements.

Gol reported a staggering R$517m net loss for the September quarter (28% of revenues), compared to a profit of R$110m (6% of revenues) a year earlier. But more than 90% of the net loss was due to a non–cash foreign exchange loss (R$476.4m) recorded as a result of the Brazilian Real’s depreciation against the US dollar during the quarter, which increased Gol’s dollar denominated liabilities (72.4% of its debt was dollar–denominated in the period). The dollar strengthened from R$1.56 at the end of June to R$1.85 at the end of September, an 18.6% increase. It was purely an accounting impact and of little concern at present, especially because Gol has stretched out its debt maturities.

In recent years Gol’s net results have fluctuated wildly due to currency movements. For example, Gol had a R$1.2bn net loss in 2008 (19.3% of revenues) when the Real fell sharply after the start of the global financial crisis. The situation was reversed in 2009, when the Real recovered by 34%, producing a R$711m non–cash gain that boosted Gol’s net profit to R$891m (14.8% of revenues). Therefore Gol’s results are best examined on an operating basis.

However, this year’s third–quarter results were dismal even on an operating basis. By comparison, TAM had a modest positive operating margin of 5.8%, in part because it benefited from a much greater international exposure (40% of its revenues).

TAM’s international yield rose by 10.3% in the third quarter, though its domestic yield performance (up 2.2%) was also better than Gol’s.

According to Gol’s figures, in 3Q the two airlines’ domestic ASK growth rates were similar: Gol’s up by 10.2% and TAM’s up by 9.1% (compared to an industry increase of 14.2%).

However, Gol’s domestic traffic (RPKs) rose by 13.5%, compared to TAM’s modest 4.8% increase. So, Gol improved its load factor and market share, but it did so at the expense of yield. TAM, by contrast, let its load factor and market share slip but improved its yield – clearly a more profitable strategy.

Recent months have seen Gol attain a domestic market share lead for the first time. Between May and September, Gol’s share of domestic RPKs increased by 3.5 points, from 35.4% to 38.9%. In the same period, TAM’s domestic market share fell by more than six points, from 44.5% to 38.2%. The smaller carriers, especially Azul, took some of TAM’s share.

Cost and capacity discipline

When disclosing the 2Q losses in August, Gol announced a new cost–cutting programme that aims to shave R$650m from operating costs in 2012. That would be about 10% of the airline’s 2010 operating costs. Under the plan, ex–fuel CASK would decline by R$1.10 to R$8.50.

As of early November, Gol had identified more than R$500m of the planned savings, which would in theory bring ex–fuel unit costs below R$9, which the management has indicated they would be happy with. The savings will come from revised contracts, lower lease expenses, lower maintenance expenses (through a new five–year MRO agreement signed with Delta earlier this year), fuel saving initiatives and suchlike.

However, attaining even the R$9 target will not be an easy task because of inflationary pressures and possible continued devaluation effects. Partly because of the volatility in currency movements, Gol decided not to revise its 2012 guidance when announcing the 3Q results. CFO Leonardo Pereira warned that if the adverse foreign exchange trends persist, Gol will have to be even more aggressive in pursuing cost reductions.

On the positive side, Gol’s unit costs remain competitive relative to peers.

According to Gol’s own calculations, on a stage–length adjusted basis, its 3Q ex–fuel CASK of 5.4 US cents was 44% lower than LAN’s 9.6 cents, 25% lower than TAM’s 7.2 cents and 5% lower than Copa’s 5.7 cents, but a little higher than Southwest’s 5.2 cents.

Furthermore, as an LCC in a major growth market, Gol has to balance the cost cuts with the need to grow the business.

Its best cost cuts are probably those that take the business model “back to basics” after the Varig acquisition. On that front, earlier this year Gol decided to get rid of the final six ex–Varig 767s, a fleet that it had reactivated a year or so earlier. Four of the aircraft had been operating charters, which Gol decided to discontinue because of the hike in fuel prices (the other two 767s were leased out). Gol had negotiated early returns for two aircraft and was working on the other four; disposing of the six will mean a US$36m annual saving in lease costs.

On the network front, Gol terminated service to Bogotá in June. It had been a marginal route, with operating restrictions due to the airport’s high altitude, and it was more profitable to deploy the 737–800s to domestic routes. Gol is now more focused on routes of three hours or less, where its low–cost advantage is more pronounced.

In September Gol implemented another organisational restructuring aimed at increasing synergies and efficiency. Among other things, it included reducing the number of departments. An important part of the restructuring was to make Smiles FFP a new business unit – the first step in the process of preparing it for growth (and eventual spin–off).

In recent months Gol has sought to reassure the investment community that it will remain disciplined in respect to capacity addition. This may be more important than cost cuts, because capacity constraint means less likelihood of heavy fare discounting.

The plan is to grow domestic ASKs (including Webjet’s) by only 0–4% in 2012. Gol’s management said in early November that they were currently in the middle of that range. It would be significantly less than demand growth, which Gol projects to be 2.5–3 times GDP growth in 2012.

Gol’s current fleet plan for the next three years is conservative. The airline is scheduled to add just four 737–800s in 2012, two in 2013 and four in 2014, to bring the total 700/800 fleet to 125 by the end of 2014 (40 700s and 85 800s). There is little scope to squeeze more ASMs through increased utilisation now that daily aircraft utilisation already averages 13.8 hours (3Q), though the 71.5% system load factor could probably be improved. The 737–800 deliveries pick up in 2015, following a new order for up to 30 aircraft placed in 2010.

However, Gol’s fleet plan for 2012 and beyond is currently under review in light of the Webjet acquisition (which is discussed in the section below). Webjet operates 24 older–technology 737–300s that are mostly on operating leases expiring in the next year or two, so there is a potential opportunity to quickly give it a modern fleet.

Gol’s leadership indicated in July that, from both the fuel and network perspective, they would like to replace the 737–300s with 737–700/800s within two years.

However, new 700/800s from Boeing might not be available until 2016. Furthermore, Gol may be hesitant to make long–term fleet decisions in this very volatile FX/economic environment. So Gol must also be looking at the option of leasing.

Maintaining strong liquidity

The Varig acquisition brought Gol close to a liquidity crunch in early 2009: its cash reserves amounted to only 5% of annual revenues in March 2009. Although Gol was subsequently able to quickly raise funds from a variety of sources to dramatically improve its liquidity, it seems that the experience prompted it to adopt much more conservative spending and balance sheet management policies.

To start with, Gol now has a minimum cash target of 25% of annual revenues. Despite this year’s losses, it has managed to maintain a very strong cash position: R$2,127m at the end of September — 29.6% of lagging 12–month revenues and 4.8 times the financial obligations due in the next 12 months. In the 3Q call CFO Pereira described maintaining strong liquidity as “a very important component of our strategy”.

Another key component of the strategy is to maintain an “appropriate debt amortisation profile with a low refinancing risk”.

This means refinancing any debt that Gol is not totally comfortable with well ahead of maturity dates. The company always works to eliminate any refinancing risk in the next three–year period. Accordingly, Gol’s and Webjet’s combined debt maturities for the next three years are modest: R$260m in 2012, R$81m in 2013 and R$50m in 2014 (but jump to R$632m in 2015).

Gol also plans to de–leverage its balance sheet in the future. The latest leverage ratios have been negatively impacted by the currency movements. Gol’s adjusted gross debt was 8.7 times EBITDAR at the end of September, compared to 5.6 a year ago. CFO Pereira said that he wanted this ratio back to “below 5 times” by the end of 2012.

The Webjet acquisition

In light of the impending LAN/TAM merger and TAM’s announcement earlier this year that it planned to buy a stake in TRIP Linhas Aereas, Gol was fortunate to get an opportunity last summer to acquire Webjet Linhas Aereas – a move that will strengthen its domestic market position.

Following an MoU signed in July, the transaction quickly secured ANAC’s approval and was completed in early October. Gol paid R$70m for 100% of Webjet’s capital stock (down from R$96m originally) and assumed about R$215m of debt. Webjet is now Gol subsidiary Varig’s fully owned subsidiary. However, the airlines will not be able to combine operations until they secure approval from Brazil’s antitrust commission CADE; in the meantime they can only code–share.

Webjet is an LCC that was founded in 2005. It is Brazil’s fourth largest airline, with R$764m revenues in 2010 (around 10% of Gol’s revenues) and a 5.6% domestic market share in September. Its network covers 16 cities in Brazil (compared to Gol’s 59 cities in Brazil and 14 in other countries). Webjet was profitable last year, earning an operating margin of 5.4%. Gol’s management described it as an “operationally efficient company with a highly motivated staff”.

Webjet’s small size will limit the benefits for Gol, but it also makes CADE approval likely. However, Gol’s domestic market share has increased significantly since the deal was announced. Based on the May figures that were widely quoted in July, the combined Gol/Webjet 40.6% market share was comfortably below TAM’s 44.4% share.

But in September the combined Gol/Webjet 44.5% market share significantly exceeded TAM’s 38.2%.

Gol originally estimated the synergies from the deal at R$100m within two years.

However, analysts have been sceptical of the operational or network synergies. JP Morgan pointed out in a July report that the LCC business models are very different (with Webjet utilising ageing aircraft economics and Ryanair–style unbundling) and that there do not appear to be any markets that Webjet serves that Gol otherwise could not.

Rather, the main attraction to Gol is Webjet’s slots at key Brazilian airports – scarce assets in light of the country’s airport capacity constraints. According to BofA Merrill Lynch, Webjet’s slot holdings include 20 at Sao Paulo’s Guarulhos, 16 at Rio’s Santos Dumont, 8 at Rio’s Galeao, 17 at Belo Horizonte’s Confins, 13 at Brasilia and 12 at Porto Alegre’s Salgado Filho.

BofA Merrill Lynch analysts also considered the Webjet acquisition to be a defensive move by Gol, given that Ryanair was reportedly eyeing Webjet for either a stake purchase or a deeper commercial partnership.

All analysts like the implications of the deal for industry capacity and pricing discipline. JP Morgan noted the “potential removal of a domestic competitor at what appears to be favourable purchase economics”.

Webjet had hoped to complete an IPO this year but evidently had to shelve it due to weak market conditions.

On the domestic front, in the past year or so Gol has also forged commercial partnerships with at least two regional carriers, NOAR Linhas Aereas and Passaredo Linhas Aereas.

Since Gol no longer has any plans to enter long–haul international markets, in the past two years it has forged a large number of code–share deals with global carriers.

It has been able to link with both SkyTeam and oneworld carriers, including both American and Delta, and both AF–KLM and Iberia, which account for the bulk of the US–Brazil and Europe–Brazil traffic, respectively. Gol’s leadership has said on many occasions that they do not see benefit in joining a global alliance, simply because Gol does not need support from alliance partners at foreign destinations because it does not fly long–haul.

Cautious optimism about 2012

Gol’s share price fell sharply in the summer when the magnitude of the second quarter losses became known. But the airline managed to take advantage of that by instigating a buyback programme covering 10% of its outstanding shares, to create value for shareholders. That was followed by the announcement of a substantial new cost–cutting programme.

By the 3Q call in early November, Gol’s management was seeing the “beginning of a gradual and steady recovery in operating margins”. Gol’s yield had recovered by 7% in October, returning to the 20–cent level that analysts consider adequate – an improvement that Gol believes is sustainable.

Furthermore, the management argued that the industry is showing signs of greater rationality going forward. Apparently all the major players in Brazil have indicated, for different reasons, that they would be conservative with capacity addition in 2012 – something that had never happened before.

Even though Brazil’s economic growth is likely to slow in 2012 (Gol’s current forecast is 3–3.5%), domestic air travel demand will still increase at a healthy rate (2.5–3 times the GDP growth, in Gol’s prediction). That, in combination with constrained capacity addition, should create an environment of improving yields and profitability. Gol expects to “once again achieve operating margins in 2012 that are appropriate for its business model”.

Some analysts and investors remain sceptical and continue to see challenges ahead for Gol and the Brazilian market. But others have turned bullish. Notably, in October Gol’s two key US institutional shareholders, Wellington Management and Fidelity Investments, both increased their stakes in the carrier. And even after Gol’s share price had surged in October, in early November Morgan Stanley analysts upgraded their recommendation on the airline from “underweight” to “overweight”.

Many investors may view Gol as a long term investment, given the special circumstances and tremendous potential offered by the Brazilian market. The domestic market is so large and dynamic that there is probably enough traffic for everyone. The World Cup and the Olympics will provide special stimulus in the medium term. The rapid rise of the C class is expected to continue for at least a decade or two. It is an untapped market that needs to be stimulated, and Gol is perfectly positioned to do that. Slot constraints at the main airports will limit smaller competitors. And many of the new entrants in Brazil today have professional managements that focus on providing returns to investors.

Perhaps the biggest concern is whether the aviation infrastructure will be there to support the demand growth. Some reports have suggested that Brazil’s airports will not be ready for the 2014 World Cup, but Gol’s CEO said recently that his understanding was that the investments were on track. Of course, the infrastructure provision needs to focus not just on the sports events but for the long–term.