IAG explains the Anglo-Hispanic plan

November 2011

The inaugural annual capital markets day of IAG (the new holding company for British Airways and Iberia) took place in Madrid earlier this month. One of the more interesting elements of the day was to see the fusion of the disparate Anglo–Hispanic cultures; given that the management of the new holding company is equally split between representatives of the formerly independent national flag carriers (with Willy Walsh firmly in command as CEO) the flavour of the presentations cleverly mixed Iberia’s former fondness for “directors' five year plans” with BA’s predilection for firm financial targets. Further, most of the (male) members of the British Airways contingent were sporting uncharacteristic facial hair growth in line with the Movember movement and in sympathy for Colin Marshall, BA’s former CEO and Chairman.

The day encompassed presentations on the Group’s financial targets; progress and plans for cost and revenue synergies from the merger of the two operating companies and integration of the Group; progress reports on developments at BA and Iberia. The Group stated as its prime strategic objectives:

- Leadership in the main hubs (i.e. London Heathrow and Madrid Barajas)

- Leadership across the Atlantic (both North and South)

- Stronger Europe–Asia position in critical markets

- Grow share of Europe–Africa routes

- Stronger intra–European profitability

- Competitive cost position across the business Unlike the other two European majors in their strategy presentations IAG made no suggestion that it had any aim to maintain industry market share nor grow at the same rate as total demand.

Naturally the management would not say much about the possible acquisition of bmi – as they are still in negotiation with Lufthansa, and the regulators will still have a say – nor about the professed interest in the potential privatisation of TAP except that any acquisition would have to adhere to the fundamentals of these strategic objectives.

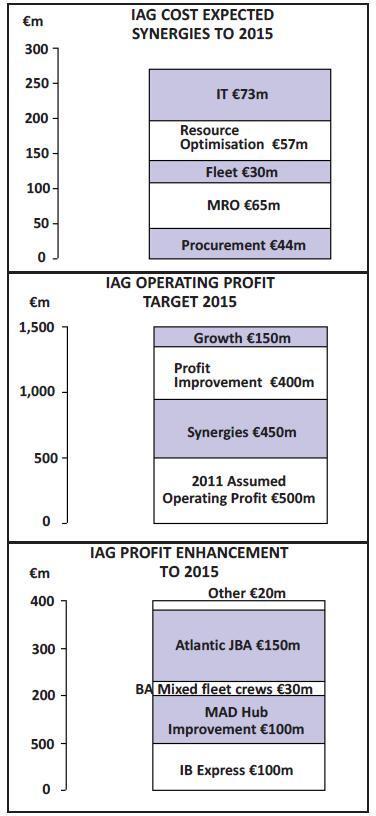

Seemingly leaving behind some of BA’s former complex financial communications, the Group CFO Enrique Dupuy presented a simple headline target of a 50 €cent fully diluted earnings per share by 2015; which given consensus current year forecasts implies a €1bn improvement in operating profits over the next four years to give total annual operating profits of €1.5bn and a return on capital employed of about 12%; and this appears to be based on a modest 2.5% organic annual growth (accounting for 15% of the total improvement) and assumptions of fuel at $120/bbl.

Synergy benefits are expected to provide 45% of this profit enhancement (of which 60% from cost and 40% revenue) and the remaining 40% from “profit improvement” measures. Intriguingly the IAG target in fact appears little changed from BA’s previous plans – which it finally achieved at the top of the last cycle. This time there was no mention explicitly of a target through the cycle – although there appeared an implicit suggestion that the improvements planned would provide a permanent uplift to a sustainable level of profits.

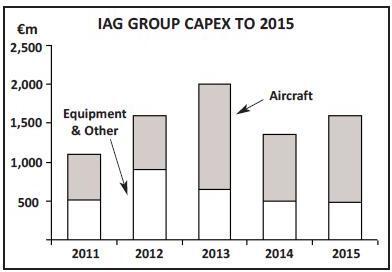

On the balance sheet ratios the Group is targeting a net debt to EBITDA of less than three times (and gross debt of less than four times) implying gearing of below 50% net debt (including capitalised leases) to total capital. At the same time the Group is aiming for net free cash generation over the period – despite the fairly hefty capital spending plans as BA starts the longhaul fleet re–equipment with deliveries of 787s and A380s (see fleet table, below); and is hoping thereby to regain an investment grade rating.

In the short run – as other network carriers have reported – there is disappointing traffic weakness in Economy class (particularly in Spain), but premium traffic appears to be holding up well on long–haul routes. The Group continues to expect operating profits for the full year to end December of over €450m – double that of last year – but if weak consumer and business confidence continues to depress demand, IAG is ready to adjust capacity further. For 2012 quite reasonably the Group has little real visibility but the management guided for a 14% increase in fuel unit costs (based on $1,030 jet/tonne), non fuel unit costs flat year–on–year and an increase in capacity of 2.5% — mostly coming from British Airways' long–haul routes.

In summary the Group states that it:

- is focussed internally on generating synergies and improving competitiveness

- will allocate a prudent level of growth to markets to cement or develop leadership

- will actively manage the network portfolio to react quickly to underlying demand

- will reduce exposure to markets where it believes there is structural or irrational capacity

- and aims to transform the Group’s profitability by being disciplined with capacity, and retain the synergy benefits and profit improvements for the shareholders.

Centre-led models and global platforms

IAG stated that the first year cost synergies had so far come in a bit better than anticipated (by about 15%) at around €30m and that the Group was on track for an €80m saving in 2012.

However, it has also raised its five year targets by around 10% beyond original concepts to some €270m. The Group is actively working to create a centre–led model for all “back office” functions – covering everything from common procurement (insurance, fuel, handling, catering, crew hotels), MRO (using Iberia’s engineering expertise for in–sourcing some of BA’s requirements but also line maintenance at stations, single group inventory), fleet purchasing (claiming a gain from moving the Iberia RFP for the A330 to Group level), resource “optimisation” (combining sales forces, integrating airport operations, and corporate centre functions). Underpinning much of this is development in IT to create a base platform for the group businesses. Seemingly more than the other two network groups in Europe, IAG is initially creating a single scalable “global services platform” into which other new acquisitions (if any) could easily be plugged – and IT is expected to provide 27% of the total cost savings by 2015.

For expected revenue synergies, the Group has again raised its initial forecasts – by nearly 50% to €230m over the five year period. This still seems to be more nebulous. Although both of the main hubs are on the edges of Europe, the management continues to point at the possibility of multi–hub routings and managing demand on medium–haul connections through Madrid and/or London onto the South and North Atlantic respectively. It is easy to understand the potential for BA to boost returns by coordinating through common connections in Latin America (where BA is relatively weak). However one of the charts presented suggested that over time the London and Madrid hubs were well positioned to attack Far East (where BA is relatively weak and IB not present) to Brazil markets in competition with the super–connectors in the Middle East as providing potential routings closest to the great circle path. Conveniently that idea ignores the fact that Air France–KLM and Lufthansa (who each have greater presence in the Far East) can claim exactly the same through their own hubs.

The two individual hubs are nevertheless quite strong. London is by far the strongest long–haul O&D market in Europe – present in six of the world’s top ten O&D routes – and by far the largest European transatlantic gateway; and on the top long–haul routes out of Europe tends to have twice as many passengers as near estrivals. It is however severely constrained; and over time as BA has to sacrifice short–haul slots to (profitable) long–haul services, and as congestion delays are bound to increase, the attractiveness as a transfer hub is likely to deteriorate – although BA’s Terminal 5 is now a definite competitive asset. As it stands there is almost a continuous wave pattern through the day; only 35% of total terminal passenger numbers at Heathrow connect (although nearer 45% of BA’s own traffic).

Madrid Barajas meanwhile is Europe’s fourth largest airport in terms of terminal passengers and has a leading position as Europe’s gateway to Latin America. It is present in six of the top ten O&D routes on the South Atlantic – to Caracas, Buenos Aires, Lima, Mexico, Quito and Sao Paolo — (the others represented by Lisbon, Paris and London to Sao Paolo and Amsterdam to Paramaribo). With the opening of the third and fourth runways and the building of Terminal 4 and its satellite, Iberia was able to establish a five wave system and an increasingly efficient domestic and medium–haul feed — and now over 70% of Iberia’s passengers connect.

One of the areas where the Group seems to have found greater revenue potential than originally expected is in Cargo. This again is one area where it is creating a common group platform that could in future be scalable with any new group acquisitions; and it was intriguing to see that it is now apparently worthwhile to operate widebodies occasionally between London and Madrid (using an Iberia A340/ BA 767) to provide belly–hold capacity to link the cargo potential of the two hubs (Far East to South America) – of course parcels don’t care much how many times they have to transfer. Nevertheless IAG is in the process of creating a single group cargo operation (one point of sale, one strategy, one product range and one network) to attempt “to unlock commercial value”. As the Group stands at the moment the freight operations have somewhat of a competitive disadvantage in comparison with the other two major network groups – with the English Channel and Pyrenees acting as natural barriers against required intra–European trucking operations.

A further area of integration to create scalability for future acquisitions is in the combination of the two frequent flyer rewards programmes.

Unable to use the “Air Miles” brand outside the UK, the Group has re–branded the rewards currency to “Avios”. The separate airlines will keep the names of their respective frequent flyer plans (Iberia Plus and Executive Club); but the rewards will be a single currency. The hope no doubt is that the success of the UK Air Miles programme as a multi vendor loyalty system with a reusable currency can be exported to other areas. The combination will provide 20 million members (of which 5.5 million are stated as being “active”)who between them provide 40% of flown revenue; and the company states that this makes it the third largest airline currency database.

Profit enhancements

IAG’s immunised metal–neutral joint venture with American on the Atlantic (the “Joint Business”) finally started earlier this year. The scope of the agreement covers a business with an estimated $7.9bn of revenues, accounts for 20% of the Europe–US market (and 25% of the premium market), and includes 24% of IAG’s total revenues (37% of BA’s and 13% of IB's).

One of the most important aspects of the JV is that it finally puts the group on a competitive level with Air France–KLM and Lufthansa; and that BA and American can at last open the joint venture routes to earn–and–burn opportunities for the joint 70 million frequent flyers.

While it could be expected that there could be passenger dissatisfaction at the differing quality of the on–board quality of service of the actual operating airline – especially in premium classes – IAG is hoping to take advantage to these very product differences in creating a series of price entry points in the distribution channels; and the greater the range of products on the shelf, the theory goes, the greater the returns. As an example: whereas before for a business class ticket from LHR to LAX BA would show up only once in the booking engines, now the joint venture could appear six times and at six different prices depending on operator and routing. (Interestingly BA itself has taken this theory to a revamp of its own website with the aim of treating it as a proper retail channel using retailer’s techniques.) The management stated an estimate of a net incremental annual benefit by 2015 of at least €150m – estimating that it has already achieved a near one percentage point increase in its share of the Atlantic premium market.

Although there was no public discussion of the woes at American Airlines, in private conversations management stated that they were not particularly concerned should AA have to file for Chapter 11 protection (after all it made no real difference to its rivals with similar concerns) especially since it would appear that IAG will currently be a net payer of cash to American as a balancing item under the JV agreement and therefore a vital part of the business that would remain. In addition, Chapter 11 would at least allow American to restructure.

Two other major planks of the profit enhancement plans relate to Iberia’s performance in Madrid. For short–haul operations it has been under increasing pressure from LCC penetration at its home hub – and unlike for BA at Heathrow, there is still space for new entrants and no other cheaper airport within easy use. As part of the carrier’s withdrawal from non–Madrid flying it had set up Clickair (now merged with Vueling) in Barcelona to retain presence in the Catalan capital and following the merger had started using Vueling for some feed services into Barajas. It has decided to establish a (relatively?) low cost operation as a separate and separately managed subsidiary – Iberia Express – under its own AOC.

It is planned to be a two class service using A320s (but with a higher density seating than Iberia’s main line services) and provide feed. It will start operations in 2012 with an initial four aircraft (building to 13 by the year end) – and the aim is to increase the fleet by around ten aircraft a year. The Group hopes that this will add more than €100m to profitability by year four – presumably through cost reduction more than anything else. They say they will recruit at “market rates” which suggests that there will be significant opposition from the Iberia pilot’s union; and with no current collective agreement with the pilots (still in negotiation since the last one expired in December 2009) the likelihood of industrial action may be high.

In addition, the company sees a need to improve the performance of the Madrid hub itself. On long–haul operations it is to be taking delivery of A330s in part replacement of the expensive four engined A340s as an interim fleet “until the next generation of aircraft become available” – which will significantly help to reduce fuel burn. At Madrid Barajas itself it wants to “develop ... as a world class hub” and significantly improve short–haul turnaround times and minimum connection times by ten minutes or 20% (although here it is a bit stymied by the connection between T4 and T4S). It also needs to improve punctuality and has set itself targets of 85% on–time performance.

The aim is that these measures will further add at least €100m to total profits by 2015. As part of this process it will be looking to a full re–branding of Iberia (the brand itself has hardly changed since the 1970s) – and will also introduce new state–of–the–art premium and non–premium seating on long–haul – in the anticipation that the brand renewal will help in providing a catalyst for change.

Future acquisitions?

Learning from the pioneers of intra- European cross–border mergers it is specifically establishing a framework that from the start can be scaled to slot in newcomers as and when necessary; and Willy Walsh’s ambitions may not just be left to intra–European operations.

He was adamant in stating that any acquisition would have to fit in with the stated strategic objectives.

The Group was probably a bit surprised that bmi was put on the table so quickly after BA had bought a bundle of winter slots from them at Heathrow; but Lufthansa has obviously given up any hope of being able to turn it around (see Aviation Strategy, October 2011). It may appear surprising that LH would think of selling it to one of its prime rivals in the industry – but BA is probably the only who can afford to take it on and would buy it purely for the slots. Having had to sacrifice short–haul operations at LHR to long–haul ambitions because of the slot constraints at the airport, it alone would be able to merge the 10% of the airport slot base that bmi retains in with its own portfolio of slots, expand on long–haul and strengthen some of the short–haul feed it has foregone. The deal is still under negotiation and subject to regulatory approval – but at least until Brussels starts to consider network competition instead of the usual point–to–point concerns (and bmi has tended to avoid direct competition with BA) and gives up its predilection for supporting the three majors, approval seems likely.

The Group has stated interest in TAP when and if it comes up for privatisation – this at least would consolidate a strategic objective of retaining leadership on the south Atlantic with its strong presence in Brazil. However, it may come up against traditional cultural rivalry between Portugal and Spain, and with TAP firmly in the Star Alliance, an approach from Lufthansa may be more favoured. However, the Global Branded Alliances are in flux (and the final choice from LatAm is eagerly awaited by both one world and Star).

Other things being equal IAG should achieve the financial targets it has set itself. However, things are never that equal – and with the current low consumer and business confidence, threats to European economic performance through the Euro crisis, and fears of extended double–dip recession, the risks on the downside in the short term may be increasing.

| Operator | Aircraft Type |

In Service |

On Order |

Options | LOI | In Storage |

2015 Fleet |

|---|---|---|---|---|---|---|---|

| BA Cityflyer | E170 | 6 | 15 | ns | |||

| E190 | 7 | 1 | ns | ||||

| BA | 737 | 19 | ns | ||||

| 747 | 51 | 4 | 45 | ||||

| 757 | 3 | 0 | |||||

| 767 | 21 | 1 | |||||

| 777 | 50 | 2 | 4 | 54 | |||

| 787 | 24 | 18 | 16 | ||||

| A318 | 2 | 2 | |||||

| A320 family | 84 | 1 | 13 | 1 | 95 | ||

| A380 | 12 | 7 | 9 | ||||

| Iberia | A320 | 68 | 19 | 9 | 4 | 76 | |

| A330 | 8 | 8 | 16 | ||||

| A340 | 36 | 4 | 24 | ||||

| OpenSkies | 757 | 4 | ns | ||||

| 348 | 66 | 64 | 15 | 12 | 372 | ||

| Vueling | A319 | 1 | ns | ||||

| A320 | 49 | 1 | ns | ||||

| Total | 398 | 67 | 64 | 15 | 12 |