The US Big Three: ROIC goals for Delta, American and United

November 2010

With record third–quarter profits under their belt, and with prospects for continued recovery looking promising, will the three largest US carriers focus on international growth and alliance building in 2011? Or will they, at long last, make achieving margin and ROIC goals a priority?

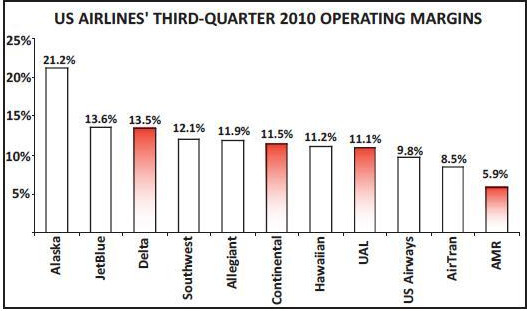

Like many of their counterparts in other world regions, US airlines enjoyed a spectacular revenue–led recovery in the quarter ended September 30. The 11 largest passenger airlines (excluding regional operators) achieved an unprecedented 11.2% combined operating margin and a 7.6% net margin before special items (see table, page 4).

On the topic of what will happen next – assuming that the recovery will continue in 2011, which looks likely — there were two discussion threads of note in the airlines’ third–quarter earnings conference calls.

First of all, there is concern in the financial community that the remarkable capacity discipline of the past few years will not be sustained. At least Southwest and American are returning to modest 4–5% ASM growth in 2011. Both United and American are looking to enter the Los Angeles–Shanghai market, hinting of a return to market share battles.

But commentary from the airline executives also indicated that the carriers are taking financial targets and shareholder returns more seriously. Perhaps it is only natural since, for the first time ever, sustained profitability and margin and ROIC goals seem within reach for many US airlines (other than just Southwest).

Could it really be that after a decade of restructuring, many Chapter 11 visits, an intensive new consolidation phase, better pricing models, smarter managements, etc., things have really changed permanently? Could US airlines soon start generating the kinds of returns other industries do? Or are they likely to fall back into the traps of the past?

Executives such as US Airways’ CEO Doug Parker believe that, this time around, things really are different. In his 3Q comments, Parker also noted the unique current situation that the airlines have been producing record results when other industries are struggling.

Delta: a picture of restraint

One of the problems is that the three largest US legacies are currently in very different situations, each with different priorities. Delta, having successfully integrated Northwest and achieved stellar results, is ready to de–leverage and think of shareholders. But American, which has been left out of the merger process and now suddenly has unique alliance opportunities, is feeling the pressure to grow and expand its global footprint. And the new United, having just closed a merger, faces the tough challenge of integrating two airlines. How is all of this likely to play out in terms of capacity growth and industry health in 2011? Delta may have lost its ranking as the world’s largest airline, but the Atlanta–based carrier has plenty to be happy about: being at last able to show concrete benefits from the 2008 acquisition of Northwest and returning to strong profitability. Delta led the legacy pack with a 13.5% operating margin in the third quarter and is on track to achieve its first profitable December quarter since 2000. It is making progress towards its goal of “consistent profitability with 10–12% annual operating margins”.

Delta outperformed its peers in terms of unit revenue growth in the third quarter. Its total PRASM surged by 16%, driven by a higher corporate revenue and international mix. In particular, Delta benefited from its high Asia exposure (which came with Northwest); its Pacific PRASM rose by 45%, aided by the appreciation of the Yen. Overall corporate revenue was up by 35%.

At the same time, Delta’s unit costs continue to be among the lowest in the legacy sector. The airline has managed to keep its non–fuel costs flat in the past three years, while bringing employee pay up to industry standards, and despite a 5% overall reduction in capacity.

The third quarter results reflected significant benefits from the merger, because Delta has only been able to free–flow aircraft since May – a key component of both the revenue and cost synergies. Delta claims to have clocked up $1.4bn in accumulated synergies so far and expects to reach the full run–rate of $2bn by the end of 2011.

So Delta is under no pressure to flex its muscle or respond to United/Continental. Quite the opposite: the Atlanta–based carrier is a picture of restraint. It is sticking to what are probably the most conservative spending and balance sheet management policies among the US legacy carriers, despite having a relatively old fleet and a much smaller orderbook than its peers.

Deleveraging is one of the top priorities. Delta announced late last year that it planned to use virtually all of the $6–7bn free cash flow projected for the 2010–2012 period to pay down debt. In the third quarter it paid down $750m of debt and is on target to reduce net debt by more than $2bn in 2010. The three–year plan aims to reduce lease–adjusted net debt from $17bn to $10bn or less by the end of 2012.

Commenting on the strategy in the 3Q earnings call, Delta executives argued that “this step and similar steps are the most accretive things we can do for our shareholders”. They noted that airlines trade at a discount to the S&P500 Index and that “in order to get to parity, we need to de–risk the business”.

Delta is focused on building a “sustainable industry model” and has an ROIC goal of 8–10%. The executives noted: “We owe it to our shareholders to get to that return on capital goal.” That means being “very judicious about how we use our capital” and being firmly committed to capacity discipline. “We’ll further streamline our fleet in 2011 and utilise aircraft more effectively. Capital–intensive capacity growth is not in our plans.”

Delta expects its ASMs to increase by 1- 3% in 2011, following 1% growth this year, thus keeping capacity growth “within GDP rates”. Only international markets are likely to see growth. First, there will new daily services to Tokyo–Haneda from Detroit and Los Angeles, starting in February; Delta was fortunate to secure half of the total daily slots available to US carriers at Haneda next year. Second, Delta is seeking to serve Heathrow from Boston and Miami from March – slots that BA/American are required to divest at Heathrow. Third, Delta is looking to boost operations to Africa, where it has a stronger presence other US airlines.

Delta has made much headway recently in streamlining the unwieldy combined fleet, which at one point totalled 1,400 aircraft. In the third quarter it managed to reduce its owned fleet by 180 units – mostly regional aircraft but also including 25 DC9s – to 821 aircraft at the end of September. Some 128 regional aircraft were disposed of through the sale of two regional subsidiaries inherited from Northwest (Mesaba and Compass), though those aircraft merely changed ownership and remain in Delta Connection. Some of the RJ flying has been replaced by MD–80s. That Delta has been able to get rid of large numbers of aircraft while still growing ASMs by 1% this year speaks volumes of the network synergies offered by the merger; it has been possible to significantly boost aircraft utilisation through tighter scheduling.

Delta is looking to shed another 20–30 aircraft in 2011 – more 50–seat RJs, DC9s and some Saabs. It has decided to shrink its only remaining regional subsidiary, Comair, by more than half in the next two years.

Significantly, Delta has finally reached a deal with Boeing to reaffirm Northwest’s order for 18 787s. The aircraft, which were originally scheduled to arrive between 2008 and 2010, will now be delivered in 2020- 2022. Another important investment will be a $1.2bn project to enhance and expand Delta’s New York JFK facilities.

On the alliance front, Delta is benefiting enormously from its immunised transatlantic JV with Air France/KLM/Alitalia, which has become more deeply integrated this year. But the fate of its relationship with V Australia and Virgin Blue is uncertain because the US DOT recently turned down their application for ATI (on grounds that the carriers could not demonstrate sufficient public benefits).

But otherwise the future thrust of Delta’s alliance–building will be to develop SkyTeam around the world, particularly in Asia, where Vietnam Airlines is the latest addition and China Eastern and China Airlines are due to join in 2011. Recent months have also seen progress in Latin America: Aerolineas Argentinas has just begun the process of joining SkyTeam as the second Latin member (after Aeromexico).

Mexico has posed both challenges and opportunities for global alliances (and particularly US carriers) this year because of Mexicana’s demise and because of the FAA’s decision to downgrade Mexico to category 2 under the IASA safety assessment programme at the end of July. The downgrade, while only temporary, means that Mexican airlines cannot currently launch new service to the US or use their aircraft for code–shares with US carriers. It appears that Delta is benefiting: it is picking up traffic that would have flown on the Mexican carriers.

American: under pressure to grow

Delta’s executives made the point that the global alliances, particularly when immunised, “de–risk the hiccups”, which have also included recent strikes at Air France. In “metal neutral” alliances, where the airlines are agnostic as to whose metal customer flies, the partners are able to work closely together to make sure that the unaffected airline can temporarily switch to larger aircraft and pick up the traffic for the alliance. In such situations the alliance “acts as an insurance policy”, to prevent traffic ending up at competing alliances. In contrast to Delta’s situation, American is making an all–out effort to strengthen its network, be it via organic growth or alliances. There are several reasons why the company’s focus has changed after it was the staunchest proponent of capacity discipline for many years. First, AMR trails in the profit margin league; it was the worst–performing US carrier in the third quarter. Second, competitor mergers have knocked AMR from the largest US airline to number three. Third, AMR has lost market share in key international business markets such as the transatlantic because of its inability (until very recently) to obtain antitrust immunity (ATI) for its alliance with BA. Fourth, all of a sudden there are now alliance–building opportunities.

The growth/network focus will not help AMR close the profit gap in the short term, but AMR feels that it has a lot of catching up to do on the network front. The company’s executives recently described the strategy as “building the strongest network in the most important markets across the globe for the long term”.

AMR’s third–quarter results did show substantial improvement: operating and exitem net profits of $342m and $143m, respectively, up from losses of $194m and $265m a year earlier. But the 5.9% operating margin was the lowest in the industry,and the margin gap has only worsened. AMR under–performed its peers on PRASM (up by only 10.7%) is expected to post losses for the current quarter and for 2010.

There are many reasons why AMR is under–performing its peers. It has higher labour and pension expenses – a consequence of having avoided bankruptcy. On the revenue side, it has been handicapped by its lack of alliance ATI. It is likely to have lost business traffic market share to Delta. This year American’s entity mix has also been unfavourable: lack of exposure to Asia, which has seen the sharpest recovery, and a significant presence in Latin America/Caribbean, which weathered the recession relatively well in 2009 and is therefore now seeing more modest recovery.

American’s new network initiatives focus on four areas. First, American, BA and Iberia are now going full–steam ahead with the implementation of their immunised transatlantic joint business, which they formally kicked off on October 1. The airlines have announced four new routes from April 2011: JFK–Budapest and Chicago–Helsinki by American, Heathrow–San Diego by BA and Madrid–LA by Iberia. American will boost frequencies on JFK–Barcelona and Miami- Madrid routes. The airlines have coordinated their schedules, started code–sharing on numerous additional routes and improved and better aligned their FFPs.

The venture’s biggest competitive strength will be in the JFK–Heathrow market, where BA and American currently offer 11 daily flights. Those flights will be more evenly spaced throughout the day and in the evening the airlines will offer a shuttle–type service with flights every half hour.

The airlines are contractually prohibited from releasing financial details, but it is known that revenues from the JV, which is initially a $7–8bn business, will be shared based on the capacity that each airline offers. This is intended to remove any incentive to channel passengers to a particular airline. But profitability levels are likely to differ since the airlines have different cost levels.

American’s second major new network initiative is the planned JV with JAL on USJapan routes, which received all the necessary regulatory clearances in October and is likely to be launched in early 2011. It is expected to essentially replicate the transatlantic JV. It represents a significant growth opportunity for American in the long term as the Pacific region currently accounts for only around 4% of its system capacity. Separately, early next year American will launch flights from JFK to Haneda, where it will be able to connect to JAL’s strong domestic operations from that airport.

Third, American has announced plans to boost its strategic position in Los Angeles with new services and alliance–building next spring. This is the next step in the carrier’s so–called “cornerstone strategy”, which focuses service in five key markets: New York, Chicago, Dallas, Miami and Los Angeles. American will be launching LAShanghai flights in April, adding nine new domestic markets and expanding code–sharing with Alaska Airlines (to Mexico). Including also Iberia’s Madrid–LA flights, oneworld will then offer 18 daily international departures from LA.

The fourth component of American’s network–strengthening effort is forging numerous “bilateral partnerships” with smaller carriers. Recent additions include three major LCCs in the Americas: GOL, JetBlue and WestJet. Of course, American continues to launch code–shares with new and prospective oneworld entrants; the latest such relationship is with Air Berlin.Mexicana’s demise has been a major setback for American and oneworld.

American anticipates over $500m in annual revenue benefits and cost savings from the two JVs and the cornerstone initiatives. A large portion of the benefits are expected to be realised in 2011, with the full value to be achieved by the end of 2012.

The most controversial aspect of American’s plans is that they will mean consolidated ASMs growing by 4% in 2011, or by 1% domestically and 8% internationally. This may not sound unreasonable by global carrier standards, but it would be the highest rate among the US legacies. Analysts are unhappy about it because they fear that it risks a supply response from competitors and a return to market share battles. JPMorgan analysts said on October 20 that they were “discouraged by the first legacy example of ASM growth in excess of our 2.5% real GDP forecast”. BofA Merrill Lynch suggested that “AMR feels compelled to expand in its core markets to defend its premium share of corporate contracts”.

But everyone understands the logic of AMR’s moves. In addition to the Shanghai, Haneda and new European flights, American will be adding services to Brazil and Mexico (the latter to backfill some of Mexicana’s capacity). Part of the 4% ASM increase is accounted for by the full impact of the Chicago–Beijing service that was introduced this year after a one–year delay. American executives made the point that “all of these services make sense in terms of our network strategy and alliance partnerships”. Furthermore, American says that its longer–term strategy is to grow the network “consistent with GDP growth in the regions of the world that we operate”.

The company continues to take a “measured” approach to capital spending. Total capex will decline from this year’s $2.1bn to $900m in 2011, as 737–800 deliveries are reduced from 45 in 2010 to 15 in 2011. AMR also continues to pay off debt; it remains extremely highly leveraged but has a healthy cash position and many assets that could potentially be monetised, including regional carrier American Eagle.

The new United: integration challenges

Financially, the trends are in the right direction. American’s labour cost disadvantage is expected to diminish in the coming years as its competitors negotiate new labour contracts. Analysts expect AMR to start improving its relative unit revenues and reducing the operating margin gap in 2011. Much of the effort of the management of United Continental Holdings (UAL), the entity created when United and Continental closed their merger on October 1, will obviously focus on tackling the numerous merger integration challenges in the next couple of years. However, it was still reassuring to hear from CEO Jeff Smisek at the 3Q earnings call that the new United will remain committed to capacity discipline. Total capacity at the combined company is currently slated to grow by just 1–2% in 2011.

Both United and Continental reported strong third–quarter results: operating margins of 11.1% and 11.5% and ex–item net margins of 7.25 and 9.3%, respectively. Combined operating cash flow was $750m. The executives said that the company is well positioned on the path to sustained profitability, but they disappointed analysts by not providing any specific financial targets.

The combine’s unit revenue results were among the best in the industry. Interestingly, however, while United benefited enormously from its strong Asian presence (“China continues to be on fire”, the executives exclaimed), Continental outperformed it in every other region and surpassed it as the unit revenue leader (its mainline PRASM surged by 20.8%, compared to United’s 18.9% increase). Continental has a large Mexican presence and benefited from Mexicana’s demise. On the revenue front, the future is obviously very bright, because the formidable combined network should attract many new corporate contracts.

When the merger closed, the two immediately introduced reciprocal FFP and preferred seating benefits. They have begun optimising the network and schedules, to offer customers more travel options. To start with, inter–hub schedules are being optimised to improve time of day coverage. Travellers will begin to see a more unified product in the spring of 2011, as key customer service and marketing activities are integrated. UAL currently expects to obtain a single operating certificate by the end of 2011, well ahead of the original schedule.

Optimising the fleet will obviously take time. At the end of September, the combined fleet in service totalled 708 mainline aircraft, plus 547 regional aircraft flown under capacity purchase agreements. UAL executives noted in the 3Q call that each airline brought much value to the merger in terms of fleets, that the combined orderbook is “very good” and that there is also much flexibility. Continental has 25 787s on order for delivery from 2H2011, while United has 25 A350s on order.

UAL expects to deliver $1–1.2bn of annual net synergies from the merger by 2013 and is focused on harvesting 25% of those benefits next year. One–time costs are estimated at $1.2bn, to be largely incurred over the next 12 months.

The fact that United and Continental have worked together over the past two years as alliance and JV partners bodes well for a successful integration. However, labour integration is often a contentious and lengthy process. CEO Smisek has set a goal of obtaining all of the joint collective bargaining agreements by the time a single operating certificate is secured. This seems ambitious, though at least the airlines have reached a “transition and process agreement” with both pilot groups.

The combine had an unprecedented $9.1bn in unrestricted cash, or 27.6% of trailing 12–month revenues, at the end of September. Carrying such an amount of excess cash gives UAL flexibility as it integrates and manages its debt maturities.

Since UAL has not yet sorted out its fleet plan for 2011 or even decided on aircraft interior configurations (whether to operate two classes or, like Continental, three classes), the 2011 capacity guidance is likely to be revised. So far, the airlines have announced new domestic expansion from their hub cities and four new routes to Mexico. Longhaul plans include United entering the Los Angeles–Shanghai market in 2011 (for a confrontation with American) and Continental launching Newark–Cairo flights in May 2011 (subject to government approvals).

On the alliance front, Continental has been busy developing cooperation with its Star partners around the world since joining that alliance a year ago. It is apparently already connecting more than twice as many passengers with Star partners at international gateways than it did with its former SkyTeam partners.

While United and Continental have implemented many aspects of their transatlantic JV with Lufthansa and Air Canada, the revenue share structure is only going in place in the current quarter (retroactive to January 1, 2010). Because of this delay, and because United and Continental have had strong transatlantic results this year, they are currently in the odd temporary situation of having a $100m liability for revenue sharing payments to their JV partners.

Last month the new United entered into an MoU with Air Canada to establish a revenue–sharing JV for trans–border flights, which is expected to come into effect in early 2011 (the airlines already have ATI). Also early next year, the combine will start implementing its planned immunised alliance and JV with ANA on US–Japan routes.

| 3Q10 | 3Q10 | 3Q10 | ||||||||||||||

| Operating | % change | Operating | Operating | Ex-item | ||||||||||||

| revenue | result | margin % | Net result | Net margin % | ||||||||||||

| $ (m) | vs 3Q09 | $ (m) | $ (m) | |||||||||||||

| Delta | 8,950 | 18.0 | 1,209 | 13.5 | 929 | 10.4 | ||||||||||

| AMR Corp. | 5,842 | 14.0 | 342 | 5.9 | 143 | 2.4 | ||||||||||

| UAL Corp. | 5,394 | 21.7 | 598 | 11.1 | 473 | 7.2 | ||||||||||

| Continental | 3,953 | 19.2 | 454 | 11.5 | 367 | 9.3 | ||||||||||

| Southwest | 3,192 | 19.7 | 388 | 12.1 | 195 | 6.1 | ||||||||||

| US Airways Group | 3,179 | 16.9 | 312 | 9.8 | 243 | 7.6 | ||||||||||

| Alaska Air Group | 1,068 | 10.3 | 226 | 21.2 | 118 | 11.1 | ||||||||||

| JetBlue | 1,030 | 20.5 | 140 | 13.6 | 59 | 5.7 | ||||||||||

| AirTran | 668 | 11.8 | 57 | 8.5 | 18 | 2.7 | ||||||||||

| Hawaiian | 352 | 15.2 | 39 | 11.2 | 20 | 5.7 | ||||||||||

| Allegiant | 164 | 22.9 | 20 | 11.9 | 13 | 8.1 | ||||||||||

| Total | 33,792 | 17.8 | 3,785 | 11.2 | 2,578 | 7.6 | ||||||||||

| Source: Individual airlines | ||||||||||||||||