US Legacies: Mergers not the answer

November 2007

New York–based hedge fund Pardus Capital Management is urging Delta to seek a merger with another carrier, preferably United, "given the rapid rise in fuel prices and the increased risk to the business as a standalone entity". But mergers would do nothing to help US airline finances in 2008. If anything, starting the merger process now would only divert management effort from the real challenge: how to cope with the potential double whammy of $100–a-barrel oil and a slowing economy in 2008.

Pardus' proposal to Delta’s management, made public on November 14 after discreet talks with the airlines went nowhere, is only the latest in a string of investor attempts to spur airlines into taking concrete action to create shareholder value. American has faced pressure from FL Group, one of its largest shareholders, to spin off its FFP and other non–core assets.

At Goldman Sachs' recent Global Industrials conference in New York, investors, who normally ask a broad spectrum of intelligent questions, had a one–track mind. They really badgered airline CFOs about creating shareholder value. How much profit is your MRO business making? Why haven’t you said anything about asset spin–offs in the past three weeks? And so on.

In its letter, Pardus expressed concerns that "fuel costs and other macroeconomic factors could once again drive US airlines towards financial insolvency". However, there is little chance of that happening in the short–to–medium term, and hedge funds do not usually think long–term. Rather, Pardus' real motive was to breathe life into airline stocks that would otherwise languish because there is nothing positive on the horizon. The hedge fund holds 2–5% stakes in Delta and UAL.

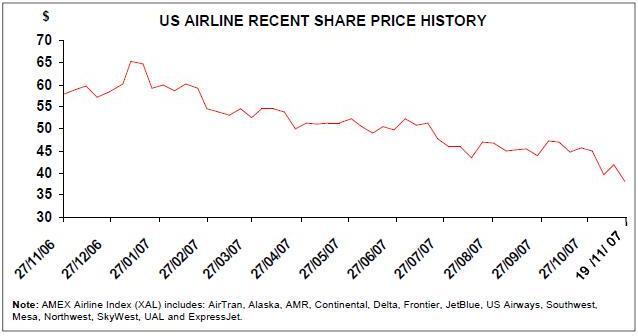

Just putting the idea forward led to an immediate surge in major airline share prices (helped by initial speculation that Delta and United were already in negotiations, which the airlines firmly denied). Delta’s and UAL’s shares were up by more than 10% at the peak on November 14, despite a $3–per–barrel increase in WTI oil prices that day, though since then prices have eased off. Merrill Lynch analyst Michael Linenberg suggested on November 15 that major airline stocks could rise by 20–30% in the coming months "as M&A headlines and chatter intensifies".

But the involvement of Gordon Bethune, Continental’s highly respected former CEO, as an advisor to Pardus gave the proposal instant credibility. Bethune had been hired some months ago to analyse different airline combinations, and on November 16 he helped Pardus pitch the Delta/United proposal to other major shareholders (at a meeting reportedly hosted by Merrill Lynch).

Pardus proposed a stock–for–stock merger in which Delta shares would be issued to UAL holders and Delta’s management team would be in charge. The combined company could achieve net synergies of $585m and a share price of $53 by 2012; the latter would be 70% higher than Delta’s current share price. The hedge fund recommends the Delta/UAL combination because it was found to offer much greater synergies than Delta/Northwest or Delta/Continental.

Delta and United were quick to declare that they were not negotiating, though both indicated that they were open to mergers. Delta said that with oil over $90 a barrel, analysis of its strategic options "takes on a heightened importance as we factor those prices into our long–term planning process" and that it had established a special board committee to review its options.

The large US carriers are all broadly in favour of consolidation, with United, US Airways, Delta and Northwest being the most vocal proponents of the idea. However, the airlines will not be pushed into transactions that do not make total sense, are not consensual or are too risky. They have learned lessons from past mergers or merger attempts, including US Airways' failed hostile bid for Delta in early 2007.

"We cannot do anything that’s hostile", noted UAL’s CFO Jake Brace at the GS conference. Brace also did not accept the argument that a trigger such as fuel prices was needed to prompt mergers. "The event for us prompting the action is that there is a lot of shareholder value created."

One thing holding off airline consolidation is that most of the legacy airlines have labour contracts in place until at least the end of 2009. A merger transaction would give unions an easy opportunity to reopen contracts. While labour has always been one of the biggest obstacles to successful mergers, it would certainly seem to be the case now, as workers at many airlines are extremely unhappy about concessions granted in bankruptcy, generous stock awards collected by managements, etc.

There is some pressure to get the merger process started right now, to give the DOJ of the Bush administration the 8–12 months it needs to complete its reviews; if the Democrats take over in January 2009 (as seems likely), regulatory approval could be near–impossible. However, a Delta/United deal (the second- and third–largest US airlines by revenue) would probably be unpalatable for any administration.

Fuel prices and fare rises

Some analysts have suggested that smaller transactions might be the way to go. For example, a couple of months ago JP Morgan’s Jamie Baker mentioned a Delta/Alaska combination as a "less ambitious and lower–risk" alternative to a Delta/Northwest marriage. But airline managements will have their hands more than full in the coming months as they figure out how to respond to oil price and economic challenges. WTI oil prices have risen by about 40% since August, hovered in the $90–95 per–barrel range in the first half of November and are widely expected to hit the $100–mark (at least briefly) in the coming months. Although air travel demand has been strong since the second quarter and US airlines have not yet seen any fall–off in demand, economic trends are not very encouraging, with slowdown widely expected in 2008. In past cycles, a slowing economy often helped lower fuel prices, but that is not expected to be the case next year, so the airlines may face both sluggish demand and higher fuel prices.

The best solution to $100–a-barrel oil is simple in theory but very hard to implement in the fiercely competitive US domestic market: raise fares. So far so good: there have been six industry–wide fare increases since Labour Day, with American leading a record–setting $20 round trip fare hike on November 1. The efforts have been successful because LCCs have often joined in. However, the fare hikes have only partially compensated for the higher fuel prices.

The biggest fear now is that demand will soften either in response to the fare hikes or worries about the economy. It is hard to predict what will happen, but airlines are trying to spread the message that domestic air fares are still below where they were in2000.

As many airline executives have pointed out in recent weeks, either the industry passes on the higher fuel prices to consumers or there will have to be a drastic domestic capacity reduction.

Potential capacity cuts

The good news is that many of the legacies have significant flexibility in their domestic fleets. According to Jake Brace, United has some 100 unencumbered aircraft that could be grounded if necessary (including 50 737s), plus another 13 narrowbody aircraft and one 757 coming off lease in 2008. Northwest has 103 unencumbered DC9s that could be grounded (see separate briefing). American has at least 75 and Delta 60 aircraft that could potentially be grounded even though they are not unencumbered.

JP Morgan’s Baker has identified more than 450 legacy aircraft, representing 17% of the total fleet, that are either unencumbered, coming off lease or otherwise suitable for grounding. There are labour impediments, but Baker believes that domestic industry capacity could shrink by 3% in 2008 "without breaking a sweat".

Currently, industry capacity (including LCCs and regional airlines) is still expected to grow by 2.5% next year, but Baker believes that the reality will be something significantly lower.

Mergers are often suggested as a good way to shed capacity — US Airways CEO Doug Parker made that point at GS. But who needs mergers if there is fleet flexibility and willingness to voluntarily pull down capacity?

The bad news for the rest of the world is that the US legacies' anticipated domestic contraction in 2008 will make them keener than ever to expand in international markets, where fuel surcharges are the norm and fares usually at healthy levels. United indicated that there is still potential to shift aircraft from domestic to international routes.

Despite the alarming outlook, US legacy carriers have been so successful in cutting costs in recent years that they are still expected to make an aggregate profit in 2008. Jamie Baker’s latest (November 13), below–consensus forecast is an industry EBIT of $3.6bn next year, down from an earlier forecast of $7bn but similar to the 2006 profit. The new forecast is based on $92 oil and assumes a 2.5% mainline capacity reduction and sharply higher fares. Baker said that he took a "deliberately bearish view" but noted that JP Morgan’s house view was that oil prices would fall to average $68- a–barrel in 2008 — a scenario that would make next year highly profitable for US carriers.