Airline consolidation: Myth and reality

November 2006

The drumbeat of press comments suggests that airline consolidation is both inevitable, and critical to improving the industry’s economic health. This drumbeat (see sample quotes below) largely stems from speeches and interviews by a handful of industry leaders although these advocates of "consolidation" are actually talking about different things. Doug Parker’s comments pertain strictly to the shakeout of US flag carrier capacity (and the Legacy sector in particular), which could occur under today’s laws and regulations. The Giovanni Bisignani quote addresses the challenge of full mergers across borders, which requires major aeropolitical changes. Glenn Tilton is proposing greater cross–border capital investment, which would involve an intermediate level of liberalisation, and is also advocating US mergers independently of any industry shake–out process. Unfortunately most press reports lump these very different positions together under the same "airline consolidation" banner.

The core of the airline consolidation argument is that the industry would be better off with fewer airlines, that bigger is better, and that there is a strong correlation between size and efficiency throughout aviation. No one has attempted to lay out the argument formally, and much of the logic depends on an intuitive sense that "there are too many airlines", or is based on casual observation of trends in the US, where only 20 of the 90 mainline jet carriers that have operated since deregulation are still in business. Europe does not need all its historic flag carriers; not all of the LCCs that started service in recent years can possibly survive; and China did not need all of the 20–plus airlines created after the breakup of CAAC. Observers often refer to the business school concept of a "natural" life–cycle of new entry and expansion, competitive turmoil, and market maturity followed by shakeout and consolidation. This "natural life–cycle" was originally based on consumer products, but was also observed in technology–driven industries. Airline consolidation advocates imply that the natural process of shaking out winners and losers is being obstructed, and that active encouragement of consolidation would provide a major boost to the longer–term financial strength of the industry.

Because of the dangers of extrapolating "intuitive" evaluations of isolated markets into macro trends, the first section of this article looks at the actual changes in the number of commercial airlines around the world over the last 25 years, in order to understand whether industry concentration is actually increasing.

To help assess whether consolidation would be "good for the industry" the second section of the article examines recent and future changes in industry structure in the context of regional market conditions, and looks for evidence of financial and competitive benefits from reducing the number of competitors. Efficiency gains from having fewer, larger airlines can come from either operating scale economies (reduced unit costs, as from distribution leverage or reduced overhead) or network scope economies (improved unit revenue, from online connection synergies or consumer preferences for stronger brands). Changes that are "good for the industry" lead to higher returns for airlines with higher productivity and whose service is more highly valued by consumers, and thus lead to improved capital allocation across the industry. Individual carriers with higher costs and less competitive service may suffer, but the improvements force other airlines to become more efficient, the industry as a whole earns higher returns, and is better able to attract the capital needed for future growth.

Consolidation and merger confusion

It is dangerous to confuse the question of whether consolidation is inevitable and an important driver of industry efficiency, with the question of whether mergers are an efficient way to achieve consolidation. In fact the two questions are almost totally independent of one another. Over half of the roughly 1,400 commercial airlines of the last 25 years have already gone out of business. Mergers account for only a tiny portion of the historical shakeout, and since they are expensive and difficult to implement in the best of cases, could never play a major role in future industry contraction. But mergers clearly make sense under certain conditions and many individual mergers might be good for the industry even if industry–wide consolidation was not happening or not necessary.

Sensible airline mergers fall into two major categories: "efficiency/synergy" driven mergers between two viable airlines, and "quasi–restructuring" mergers where one (or both) has serious financing and competitive problems, and the merger accomplishes some of the same cost/debt restructuring as a bankruptcy reorganisation. A merger where the financial returns were predominately from scale economies, network synergies or restructuring is assumed to be good for the industry as a whole, since it made assets more productive and more competitive, improved the industry–wide allocation of capital, created competitive pressure on other airlines to make further improvement, and thus encouraged future growth and investment. A merger that yields a more efficient competitor might hurt a weaker, badly run competitor, but aggregate industry profitability will improve, as will the industry–wide allocation of capital.

The success rate of past airline mergers is quite low, and there is no reason to automatically assume that a given merger will be "good for the industry" simply because an individual investor sees a profit opportunity. The challenge here is to distinguish between mergers that are clearly driven by tangible economic improvements, from mergers overwhelmingly based on exploiting artificial barriers to competition (where one group of shareholders profit at the expense of the industry as a whole), and from mergers that don’t make sense for either the investors or the industry. Anti–competitive mergers are rare but not impossible, for example a hypothetical merger between carriers dominating a slot–constrained hub (BA/BD at LHR, AA/UA at ORD, JL/NH at NRT) might be wildly profitable for the participants, but by shielding carriers from competition from better run, more efficient airlines, the industry would clearly be worse off. Mergers can also be bad for the industry if investor returns are not linked to improvements in the long–term value of the airline (the Swissair–Sabena- Qualiflyer deals made money only for the banks financing them) or if they involve subsidies of one type or another (the merger of Swissair assets into Crossair depended on over US$3bn in subsidies).

Is consolidation happening?

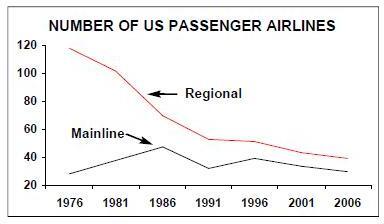

US RegionalsThe idea that airlines will naturally consolidate after a period of dynamic growth is largely shaped by the shrinkage of the US flag sector, where there were nearly 150 total airlines when the industry was deregulated in 1976, but only half that many airlines today. However, the US experience reflects two completely different patterns. The regional sector has been steadily shrinking in numbers for three decades. Only the first phase (during the 1980s) was based on exploiting scale economies, with more efficient large regionals replacing the small, entrepreneurial airlines that started service in the 60s and early 70s. The shrinkage of the last 15 years (and what one is likely to observe in the near future) is the absolute decline of the sector, due to the overall decline of large domestic hubs, reduced economic leverage with their Mainline partners and the declining attractiveness of short haul flights in a more security- intensive era. No other aviation region follows this pattern because the underlying drivers of US regional economics (fee–for departure contracts, widespread domestic hubbing) are totally unique. In short, this sector doesn’t provide any useful lessons for understanding consolidation elsewhere

US Mainline The US Mainline jet sector expanded from 28 to 48 carriers in the decade after deregulation, shrank to 31 during an initial shakeout phase in the late 80s, grew to 40 with another round of new entry during the strongly profitable early 90s, and has contracted back to 30 during the long recent period of financial losses. These numbers only give a partial picture of a very dynamic process. 107 different mainline airlines operated in the US during these years, 77 have disappeared through merger or liquidation. Thus a great deal of "consolidation" of weak/inefficient airlines can occur even when the total number of carriers rises or remains steady.

The US Mainline experience illustrates that competition is an ongoing process and there is no reason to expect any single entry/shakeout cycle to produce stable long term profitability. The 1980s cycle reflected a battle between carriers unable to adjust to full regulatory freedom (e.g. Eastern, Pan Am, Braniff), and the carriers rapidly changing their fleets, networks and pricing approaches. Business models continually evolve and the current shakeout cycle, which is not yet complete, involves sorting out a new competitive equilibrium between the traditional Legacy/Big Hub business model, and the LCC/Quasi–Network business model. The Big Hub model appeared to be in terminal decline, but has rebounded after aggressively restructuring Legacy costs and financial obligations over the past four years.

There is no evidence that the US market is entering the "mature" phase of a "natural life–cycle" with a final set of winners and losers. Markets can show short–term tendencies towards consolidation (as in the 80s when large scale hubs expanded) or fragmentation (as in recent years with rapid LCC growth) as business models continue to evolve. Because hubs are much less important outside America, and markets tend to be more diverse, one would expect other markets to show even less tendencies towards concentration than America. Cyclical downturns (in 1990–2 and 2000–02 in America) explain most periods when airline numbers shrink. There is simply no evidence of any "natural" pressure towards consolidation in America that would overwhelm cyclical forces or basic business model economics.

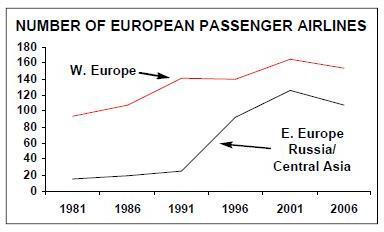

Western Europe A much stronger long term pattern of aggregate expansion is seen here. There is no real evidence of consolidation to date, just occasional pauses for short–term corrections before expansion resumes.

The industry has been just as dynamic as the US, as 160 (out of 312 total commercial airlines) have been "consolidated" out of business during this period, even though the industry totals have been steadily growing. The larger number of carriers and the steadier growth relative to the United States reflect weaker scale/scope economies, given fragmented markets and more routes served by point–to–point (LCC/Charter) carriers. There is no reason to believe that European business models have already reached their most advanced state, and every reason to expect this process of competitive entry/innovation and dynamic industry churn will continue.

Russia/Eastern EuropeThese markets show the pattern of a newly created industry with a large, extended boom from a very low base. The base of carriers has shrunk 15% from the peak, but the highly dynamic process observed in the US and Europe, with a large number of ongoing failures and new entrants has not developed. The number of airlines created in the former Soviet republics following the Aeroflot breakup was based on historic and political considerations, not on any understanding of what the efficient size of airlines might be in open competitive markets. The capital markets and legal processes required to drive the reorganisation process are also at an early stage of development. One can speculate that the total number of airlines will decline a bit further, but it also seem likely that access to capital, local economic development and processes to facilitate the transfer of assets to better markets and better managers will be much more important to future airline profitability than simply reducing the number of airlines.

Asia/PacificAirline expansion has tapered off after 20 years off strong growth, but there is little evidence of a general shakeout or contraction. Consolidation has occurred in China as a result of explicit government policy (see below), but this has been offset by new expansion elsewhere (India, Indonesia, Southeast Asian LCCs). Some individual pockets of over–expansion (Taiwan domestic, Australian regional) have already been worked out within the larger pattern of growth. Strong government controls over the industry have limited most of the dynamic change to short haul markets; only China, Korea and Taiwan have permitted carriers that didn’t exist 25 years ago to seriously compete on long–haul markets.

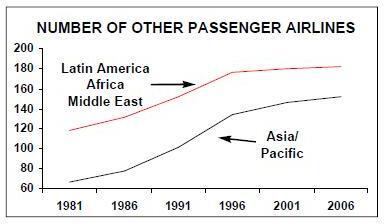

Smaller markets elsewhereIn most other parts of the world it is very difficult to create large airlines due to the small size of the countries those airlines are tied to. Nonetheless, there has been a clear pattern of airline expansion in these markets. The only region where the industry has contracted is the Caribbean/Central America, which expanded from 24 to 41 carriers in the 80s, but has shrunk back to only 31. South America has been stable since the 80s with 40–43 carriers; it has also been a dynamic environment where there are limited barriers to either new entry or to letting weak carriers go out of business. While some regions may have hit the limits of how many airlines can be supported in a relatively liberal environment, other areas have yet to experience meaningful liberalisation, so there is still potential for further expansion.

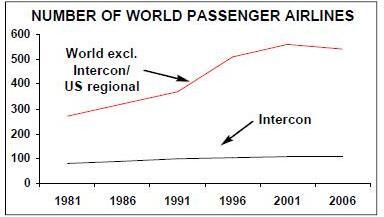

Intercon vs. medium/short haulThe number of intercontinental carriers (those flying aircraft with intercontinental range) has remained virtually unchanged over the last 25 years. A handful of carriers have exited (Pan Am, Canadian, Sabena) offset by very limited (most Asian) new entry. Liberalisation and economic growth has had a huge impact on airline industry structure, but only on domestic and regional airlines. Intercontinental airlines have greater scale economies (due to hubs and sales infrastructure) but one sees neither competitive pressure of open market entry, or evidence that inefficient carriers can be restructured or forced to exit the market.

What consolidation trend?There is not only no evidence of any industry movement towards consolidation, but the major trends all favour expansion. The strongest historical evidence shows a powerful link between market liberalisation and increased market fragmentation, aside from the highly protected intercontinental airlines. Governments still actively interfere in many airline markets and further liberalisation will presumably lead to further expansion. While large airlines will have a clear competitive advantage over small ones under particular conditions, these types of scale/scope economics have not made the industry more concentrated over the past two decades, and the importance of these factors are rapidly diminishing. Many of the major changes of the last two decades (LCC networks, internet distribution, extensive outsourcing, greater use and flexibility of aircraft leases) reduce the importance of scale and make it much easier for smaller airlines to compete with larger ones.

The "intuitive" sense that airlines have a "natural" tendency towards concentration is clearly contrary to the historical evidence, and the claim that global industry consolidation is inevitable just doesn’t make sense. The logic behind "natural life–cycles" is based on much narrower product/industry categories, based on narrow technologies, and is totally inappropriate to aviation. Video recorder production may have a "natural" life–cycle of rapid growth, maturity and decline but the primary category (home entertainment) continues to grow without any tendency towards concentration. Certain very narrow airline business models (US regionals, European charter carriers) may decline, but the basic demand for transportation remains strong. Future aviation growth can not only be spurred by a wide range of technological improvements (airframe, engine, distribution, network design, financial systems and customer management) but by aeropolitical liberalisation and new business models.

Industry growth and "dynamic churn"Evidence from the most open competitive markets suggests that the more airlines are "consolidated" out of business (exit the market due to liquidation, or in rarer cases, mergers), the more the total number of airlines expands. This "dynamic churn" is critical to the process of reallocating capital away from unprofitable uses, and encouraging innovation and new capital investment. If 77 American and 160 European carriers don’t go away, the profit opportunities for better run incumbents and new entrants become very limited. This dynamic drives productivity and service improvements, which makes airline service more affordable and more attractive.

The claim that industry consolidation would improve the industry’s economic health not only contradicts the last 25 years of history (when profitability and the number of airlines both steadily increased) but it ignores the basic processes behind competition and efficiency. Many of the industry’s gains in recent decades can be linked to increased market entry and fewer restrictions on price and network competition, but the low barriers to market exit needed to sustain this "dynamic churn" are just as important.

Recent US mergers

There have been only two mergers between large US airlines this decade, and only one other merger was formally proposed. As was widely predicted at the time, the 2001 American–TWA merger was a complete failure. Most of TWA routes and assets were subsequently liquidated, and American’s shareholders did not realise any benefits that could have possibly justified the acquisition and implementation costs. American, like other Legacy carriers in the 90s, had wildly unrealistic expectations that larger size would drive increased brand and pricing power and that mergers and scale would overcome the problems of growing competition from more efficient carriers such as Southwest and jetBlue and the reckless Legacy over–expansion of the late 90s.*

Immediately following AA/TW, United announced a $4.3bn bid for USAirways; since both were bankrupt within a year, this merger might well have become the biggest debacle in aviation history had it ever been consummated. United clearly believed (as had American) in the power of a larger, more ubiquitous network, and that a merger could suddenly make weak hubs and routes much more profitable, and somehow neutralise LCC competition. Unlike AA/TW, this merger would not have benefited from any bankruptcy- driven cost savings, and the proposal was undoubtedly motivated by compensation schemes that would have allowed top managers to pocket tens of millions in bonuses, regardless of the long–tern success of the merger. Delta, Northwest and Continental had also held various merger discussions in the late 90s, but the benefits were never sufficient to justify a formal merger proposal.

Given the failure of these Legacy merger attempts, it is not surprising that the only merger of the last five years, America West/USAirways in 2005, followed a very different approach, tied to the unique conditions of the US bankruptcy process. Both carriers were truly desperate, and it is unclear whether either could have successfully reorganised on an independent basis. USAirways' CEO Bruce Lakefield had not been part of the airline’s decline and collapse, and was perfectly willing to cede control to an acquirer. Although both HP and US had already achieved major labour and creditor concessions, HP Chairman Doug Parker, aggressively used the Chapter 11 process to extract even deeper cost cuts, before proceeding with the merger. Parker had long argued that deeper cuts in industry capacity were needed to restore a sustainable revenue environment, and he made sure that merger plan eliminated a sizeable chunk of HP/US operations. United’s proposed 2001 acquisition of USAirways would have been a classic "efficiency/synergy" merger- adding two airlines together in the hope that "bigger is better" effects would drive a huge profit improvement. America West’s deal was a classic "quasi–restructuring", where the merger provides the context for big cost cuts and asset reallocation, and UA/US type "merger synergies" are secondary, at best.

Parker’s merger plan also cleverly exploited the workings of US capital markets. No one invests in US airlines based on long–term fundamentals; the market is dominated by traders looking to profit from short term price fluctuations. Since the market had written both HP and US off for dead, Parker funded the merger with investments from groups willing to speculate (successfully, it turns out) on a post–merger stock improvement.

The transaction clearly increased the economic value of the combined carriers (albeit from a very low base), and helped improve the efficiency and competitiveness of the US domestic industry as a whole. But those gains were strictly due to Parker’s aggressive use of the US Bankruptcy code and his ability to exploit a creative source of financing. USAirways' turnaround is not due to "bigger is better" effects. The primary cause of USAirways' strong stock appreciation in the summer was stronger industry–wide pricing following the shut down of Independence Air, several rounds of Southwest–led fare increases, and the capacity cuts Parker had made. Parker deserves full credit for bringing both airlines back from the edge of the abyss, but much of the messy parts of the merger, such as work force integration, are yet to come. Much of their new financing has been cashed out as this investment had nothing to do with the airline’s long–term viability. As with all other US hub carriers, the jury on sustainable profitability is still out, but at least Parker can point to major improvements in corporate value, while the others cannot.

Merger outlook

Parker has long been calling for domestic US consolidation. But the problem he is addressing is the hopelessly unprofitable Legacy capacity that still distorts competition and discourages investment, and the consolidation he is advocating is based very narrowly on the bankruptcy based HP/US model. Delta and Northwest are still in bankruptcy, and mergers involving either carrier could exploit the same type of capacity/cost cutting that was achieved in the US/HP deal. Any such deal could boost the profitability of the entire US domestic industry, to the extent that it succeeded in liquidating another significant block of hopeless Legacy capacity, and reallocating assets to stronger network positions. USAirways has been actively pursuing a possible deal with Delta throughout most of 2006, but Delta had firmly rebuffed each overture, refusing to even enter into exploratory discussions. On 15 November, Parker proposed a hostile bid to acquire Delta out of bankruptcy, offering creditors roughly 50 cents on the dollar.

The major obstacle to further "quasi–restructuring" deals is a change in how the courts have handled airline bankruptcy cases. Bankruptcy judges have given incumbent airline management nearly complete, open–ended control over the reorganisation process, despite management’s role in driving these airlines into bankruptcy in the first place. Management and trade creditors, who are motivated to keep as much of the $1 as possible, have every reason to block competing proposals, which would involve larger cost and capacity cuts, loss of control and reduced management compensation. It is obviously possible that an independent, management–led plan could emerge as the best for all concerned but recent history has not been encouraging.** Delta blew off USAirways' 15 November proposal by simply reasserting that the "Court has granted Delta the exclusive right to create the plan of reorganisation until Feb. 15, 2007." Whether the Court continues to defend the absolute control of incumbent management in the face of a credible alternative proposal, or whether Delta management can assemble an independent reorganisation plan that offers clearly superior terms for the creditors remains to be seen.

The most outspoken US proponent of industry consolidation has been United Chairman Glenn Tilton. Tilton had exclusive control over United’s four year Chapter 11 reorganisation, which concluded in February 2006 under an independent, management- led plan financed by $3bn in bank loans. For United’s reorganisation to succeed, it will need $6bn in cash on hand six years from now (to repay principle and interest) on top of the cash needed to fund ongoing operations, capital investment and fleet renewal. Tilton favours mergers between today’s large Legacy US carriers, and fewer restrictions on cross–border minority shareholdings, and in the longer–term, freedom for full cross–border mergers.

In contrast to Doug Parker, Tilton has been publicly advocating Legacy mergers outside the Chapter 11 process, sees the reduction in the number of competing airlines as a desirable end in itself (as opposed to a means to achieving other objectives such as cost or capacity reductions), and has explicitly argued that the very large intercontinental carriers ought to be free to merge into much larger companies, both within and across national borders. Tilton has argued that "we ought to be able to create, in this country, powerful combinations of companies.", and that he believes global alliances have run their course, and will need to be superseded by full mergers.

Given United’s enormous leverage, Tilton’s active campaign for changes that could create more merger candidates and financing sources for United is not terribly surprising. Driving up the stock price is Tilton’s job, and since he ended up personally owning 20% of the company’s stock, motivation is not a problem. Recent industry rumours suggest that United’s key objectives would be either to acquire Continental or a management–led leveraged buyout of the shares held by United’s bankruptcy creditors.

The arguments against any "efficiency/synergy" merger along the lines of UA/CO appear overwhelming, and it is difficult to image why the capital markets would consider funding it. Unlike HP/US, investors cannot exploit an unexpected turnaround equity play, cannot obtain a significant shareholding, would need to pay a large acquisition premium (unlike HP which acquired US at near–liquidation cost), and the existing $3bn bank debt would always have higher financial priority. Unlike HP/US or US/DL, they could not use Chapter 11 to achieve greater cost reductions, or reallocate assets across the new network, and would need to fund huge implementation costs and management payouts. A UA/CO merger would have a strong route network, especially internationally, but it is inconceivable that it could shift enough revenue from competitors to justify the huge ($4–5bn) transaction costs and risks.

It is even more difficult to imagine how a leveraged buyout of United could possibly create significant economic value, or be "good for the industry". United’s last (1994) buyout destroyed the company’s finances and helped precipitate the collapse of the entire Legacy sector. As with a CO merger, it is not clear why any bank would lend management the $5bn cost, given United’s existing $3bn debt, and the absence of billions in obvious economic benefits. There is serious risk that a deal like this could create a huge windfall for select insiders involved in the transaction, while undermining the long–term value of the airline.

A recent research note by Jamie Baker of JP MorganChase highlights the underlying economic issue: "Consolidation potential is inversely related to fundamentals", noting that the need for merger increases when an airline’s situation is dire (as with HP/US) but "as profits swell most will opt to remain single". Baker also addresses the "will this be good for the industry?" question: "any combination resulting in reduced capacity would be a positive, in our view, but consolidation on any other grounds could materially harm the industry, as United’s attempt (to merge with USAirways) in 2000 clearly did". Capacity cuts will be a major challenge for any US/DL merger. Big cuts would be ideal for long–term viability given considerable network overlap (ATL/CLT, JFK/PHL) and the potential to shed higher Delta costs, and big cuts would provide a powerful boost to industry yields. However US will need to compromise to get the DL employee–dominated Creditor Committee to approve any deal. But US/DL will be much more leveraged than US/HP and won’t have the same stock appreciation potential, so too much of a compromise could undermine the merger’s basic rationale.

Combining two large US Legacy carriers would not pose an insurmountable threat to future competition in itself, but granting antitrust immunity that would allow active international price and scheduling collusion between a much larger set of former competitors (CO–UA–US–LH–SK–AC–LX–OS–TPLO- BD in this hypothetical case) is a much more serious issue, and if permitted would likely lead to further combinations and extreme concentration. Alliance immunity was hugely pro–competitive in the 1990s when there were many pairings with modest market positions, and intense competition coming from many directions. These international markets are healthy and profitable as they stand today; there is no plausible argument that they are in the declining phase of a "natural life–cycle" and that consolidation is inevitable. Extreme concentration of a market like the North Atlantic (including the full mergers Tilton envisions in the longer–term) would never happen as a result of market forces, but would only occur if proactive steps to eliminate competition were sanctioned by the governments involved.

Mergers/consolidation in China

Two major events are especially critical to the course of airline competition in China- Beijing’s 2000 "Three Airline" policy guidance that called for the Chinese flag passenger carriers that had begun service in the years since the breakup of CAAC to consolidate into three groups led by Air China, China Southern and China Eastern, and this year’s sale of Hong Kong Dragonair by CNAC (Air China’s principal shareholder) to Cathay Pacific, which in return took a large minority shareholding in Air China.

The short–term objective of "Three Airline" policy was to facilitate (in a politically acceptable manner) a major restructuring of smaller carriers (China Northwest, China Northern) with unsupportable levels of debt or other serious management deficiencies. The longer–term objective was to expand the Chinese flag share of international traffic by creating multiple carriers that could develop the scale and management skills to compete with foreign carriers and their well established Asian hubs. It was hoped that each of the three could utilise their large respective home market bases (Beijing, Guangzhou and Shanghai) and other inherent strengths (lower costs, domestic feed) to compete internationally, and to gain experience from that competition that could strengthen their overall financial performance. It is too soon to render a final verdict, but at the moment both elements of this policy appear to have failed badly.

There is a fundamental disconnect between extreme concentration and the basic economics of domestic Chinese aviation. The Chinese market has none of the major features that led to even moderate concentration in other settings. Domestic hubs make no sense; Chinese geography has none of the characteristics found in the American Southeast and Midwest (a rich mix of small markets) that dictated the development of hubs such as Atlanta and Chicago. Southwest–style networks seem ideally suited to provide the service and low fares the market wants, and point–to–point networks can support many more competitors than hub networks.

The economics of Chinese long haul and domestic markets are totally different; any attempt to succeed internationally could totally undermine the cost discipline and operational simplicity needed to succeed domestically. While there is considerable long–term potential, the market today is a tiny fraction of domestic demand, and major expansion of (still uncompetitive) international service may take years to pay off. Asia already has an overabundance of large gateway hubs. For Beijing, Pudong and Guangzhou to succeed internationally they will need a strong advantage serving flows to and from interior Chinese cities, and must also be able to compete for the long haul flows now transiting Narita, Singapore, Incheon, Dubai and elsewhere.

Beijing’s desire to develop more internationally competitive carriers is fully understandable, but a government policy emphasising domestic mergers and industry consolidation was the wrong way to go about it. While intended to strengthen Chinese carriers on both the domestic and international sides, the "Three Airline" consolidation policy has managed to combine the worst of both worlds. It has undermined the cost discipline and operational standardisation the domestic market required, without creating meaningful domestic long haul feeder networks at any the three hubs, or doing anything to address the deficiencies of the three airports (capacity at Beijing, layouts unsuitable for transit hubs at CAN/PVG, CAN’s close proximity to HKG, poor domestic feed at PVG).

It is unlikely that China Eastern and China Southern could have ever become viable long haul competitors, but CNAC’s sale of Dragonair dealt the final death blow to any hopes that may have existed. Cathay Pacific will now have overwhelming advantage connecting interior Chinese cities to long haul destinations, while Air China will continue to dominate the large Beijing–long haul market.

Cathay and Air China have not only strengthened themselves, but the industry as a whole gains from the reduced threat of hopeless MU/CZ expansion. Without significant feed, China Eastern will be limited to whatever long haul flights the local Shanghai market can support. China Southern can operate regional services to Guangzhou, but will struggle to operate and develop any significant base of profitable long haul services. Nothing in the CX/KA merger is exploiting artificial competitive constraints, and there are still many strong Asian hubs competing with Beijing and Hong Kong. There are some risks of future collusion between Cathay and Air China; hopefully the cross–shareholdings will be managed in a way to prevent this.

These failures highlight the problems governments usually face when they try to override market forces in order to engineer a particular airline industry structure. There is a tendency to presume an ideal industry structure that can deliver strong economic performance over many decades, when (as the US experience demonstrates) growth and profits depend on a highly dynamic process, with totally unexpected changes in business models and cost structures regularly emerging. Government engineering also tends to be biased towards the interests of the largest, most politically adept carriers and the more "glamorous" parts of the business (premium and international service), even when this threatens the efficiency of much larger parts of the industry. The international carriers focus on how to get governments to rig the easiest possible market conditions. (The same pattern was seen before deregulation when the US CAB gave excessive preference to Transcon carriers and Pan Am, without understanding the short/medium haul routes that were the actual heart of the industry).

It is difficult to predict how the Chinese industry will develop in the near future. Sensing the vulnerability of the Big Three, five new carriers following LCC approaches have recently begun service, and investors are pursuing a number of other LCC–type start–up opportunities. A strong case can be made for reversing the domestic concentration policy and greater segregation of the two (domestic/LCC and international/complex) business models, but it is not clear whether these new start–ups will be able to drive that process. Rather than passively cede a large part of the market to CZ and MU, CNAC and Cathay have developed a market–based response, which Beijing appears to have accepted. It is not clear whether China Southern or China Eastern understand that the "Three Airline" path is already dead, and that it is up to them to figure out a new one.

Mergers in Europe - short haul

The US and China have both moved from an industry where all carriers followed the same business model to one where two distinct models can (or should) coexist. In Europe the single "Flag Carrier" business model of 20 years ago is evolving into three models: the very large intercontinental hubs; the LCCs and former charter carriers, (serving high demand, price sensitive markets from lower cost airports); and the "City Network" carriers (operating more business–oriented short haul routes from main airports with lower labour costs and simpler operations than the Intercontinental carriers).***

Demand for low–fare travel is still vibrant, and competition remains highly dynamic, with carriers frequently entering and exiting the market, and there is no reason to expect mergers to play more than a limited role in the future development of this sector. Mergers in this sector can make sense when slots or similar assets are scarce, or as a way to efficiently expedite the shakeout in a specific national market, as with easyJet’s 2002 purchase of Go, and this year’s Air Berlin–DBA deal. The fundamental economics of the LCC model, aggressively minimising "overhead" or "fixed" costs, limits classic scale economies, and the extreme point–to point approach reduces network scope effects. The "barriers to exit" are much lower in this sector — unlike traditional flag carriers, financially unsuccessful LCCs and charter carriers in Europe tend to go away fairly quickly–thus there is less need to use mergers as a substitute for a normal reorganisation and shakeout process. In Europe, very small charter and point–to–point operators can be just as efficient as larger ones, given a strong, flexible base of suppliers, and smaller scale can actually reduce financial risk and certain cost pressures.

No carrier following the City Network model has yet achieved strong financial success comparable to Ryanair or British Airways. Most originated as Flag Carriers with intercontinental routes and Legacy costs. The most successful (Aer Lingus and SN Brussels) are the ones who have most dramatically restructured costs and product complexity. The 2005 merger of Austrian and Lauda and this year’s acquisition of Portugalia by TAP eliminated the last two cases of where more than one traditional (interlining) jet operators had a network based at the same European airport.

The more interesting development is the attempt to merge carriers pursuing different City Network and LCC business models, starting with the SN Brussels Airlines/Virgin Express merger and the recent Ryanair–Aer Lingus takeover proposal. There were no serious competitive issues in the SNBA/VEX case, as there is ample access for new entry at Brussels. This was a "quasi–restructuring" deal as VEX had not succeeded financially (indeed the LCC model has not worked at any large, traditional Continental airport), and the carriers used the merger transition to develop a new strategy and product mix. While there is an advantage to having a unified brand and distribution system, and there will be some overhead cost savings, it would have been impossible to justify the transaction on these types of "merger synergies". Nonetheless, it is extremely difficult to make money on short haul flights at traditional European airports, and it remains to be seen whether the new Brussels Airlines can get its costs and selling proposition where they need to be.

It is not clear how Ryanair would address the carriers' incompatible business models. Ryanair’s strong financial success is in large part due to its rigorous adherence to its original ultra–low cost strategy (no interlining or online connecting traffic, no outside distribution channels, strong avoidance of traditional high–fee airports). Airlines have occasionally owned carriers following different models (Lufthansa and Condor) but have kept operations and marketing strongly segregated. The success rate when models are closely aligned, or serve common markets (Delta/Song, Air Canada/Tango, SAS/Snowflake) is abysmally low. Possible exceptions all involve cases where the parent airline already has a powerful, dominant market position and had a protected long haul profit base which it could use to finance a challenge to new short haul competition e.g. Qantas/Jetstar, Thai/Nok.

Nonetheless it is fair to wonder what Ryanair’s primary motives really are. Have they perhaps realised that they are close to the natural limits of the ultra–low strategy, or is this really just an opportunistic effort to neutralise Aer Lingus' growing competitiveness in the short–term?

There might well be good business reasons for not completing the merger, but as the Michael O'Leary quote suggests (see page three), there don’t appear to be good reasons for governments to intervene to block it. The two carriers have a strong, but not overwhelming share of Irish traffic, the current market overlap is not large, there are no capacity or other barriers to new entry (especially if a second Dublin terminal is built). It is difficult to understand how the antitrust logic that that permitted Austrian- Lauda and TAP–Portugalia (not to mention bigger national tie–ups of the past such as Air France–UTA–Air Inter and BA–BCal) could suddenly be used to ban this one. Ireland has a bit less airline competition today than Belgium or Austria, but that is because the two Irish carriers have much lower costs than most of the non–Irish airlines that might consider flying there.

Mergers in Europe - intercontinental

In 2000 there were 13 European hubs with a significant number of intercontinental flights dependent on EU connecting traffic. Four were very large (LHR, CDG, FRA, AMS), five were somewhat large (LGW,ZRH, MUC, MXP, CPH) and four had a much smaller volume of long haul traffic (VIE, BRU, MAD, FCO). Since only 35–50% of the traffic on these intercontinental flights is originating or terminating at the hub city, all of these hubs were directly competing for the same base of connecting traffic (European O&D long haul demand not served by non stops). Since 2000, intercontinental operations at several of the hubs have been downsized (LGW, ZRH, BRU, MXP) and others have continued to struggle financially (CPH, VIE, FCO). The economics driving competition and consolidation are markedly different in intercontinental and short haul markets. The connection potential of large hubs and the high cost marketing infrastructure needed to support global sales suggest limits to the number of intercontinental hubs that can successfully compete. On the other hand, these markets are strongly dynamic, with huge long–term demand growth and clear potential for ongoing innovation and productivity gains. The consolidation associated with mature, slow–growth industries cannot be justified here. And governments have always had a huge impact on these markets, and will always be subject to pressure from incumbent carriers wanting government intervention to manipulate competitive forces in their favour.

One example of a merger that did not threaten long haul competition was Lufthansa’s 2005 acquisition of Swiss. Although this gives Lufthansa control of three of Europe’s intercontinental hubs, Swiss was a failed company that never had a coherent strategy for managing the former Swissair and Crossair route network. This acquisition should be seen as the reorganisation of assets that were on the verge of liquidation; acquisitions of failed airline assets are almost never anti–competitive. The only serious anti–competitive issues were in the short haul German–Swiss markets, where there is little likelihood that new competition could constrain LH–LX pricing power. Whether these risks will be offset by a successful restructuring of the Zurich hub remains to be seen.

Whether the anti–competitive risks of the Air France–KLM merger can be offset by efficiency gains is far more problematic. KLM was the fourth largest intercontinental competitor in Europe, had been a major source of service innovation over the years (including the world’s most successful intercontinental alliance). By acquiring KLM, Air France not only eliminates a viable competing network, but it eliminates one of the market’s most aggressive price competitors. While no one ever expected all 13 hubs to survive, it is absurd to argue that in a robustly growing market, the profitable number four hub could not survive long–term, and that no more than three airlines could ever hope make money. Given major British Airways cutbacks of capacity serving long haul connect traffic, and the ongoing shakeout of weaker hubs, Amsterdam’s competitive and financial prospects seemed quite attractive

It is implausible that Air France could have justified paying a 40% premium for KLM on pure "efficiency/synergy" grounds. The increased profitability of the AF–KL group appears largely driven by the strong revenue conditions in many long haul markets, but these yield improvements either come from neutralising KLM price competition or would have occurred without the merger. Since there have been no staff cuts, capacity reductions or operational integration, the cost savings (€100 m per year) that have been claimed are likely to include many savings that the two companies could have achieved independently. Strong current network profitability versus carriers such as Lufthansa and British Airways reflects the relative absence of LCC competition in AF/KL markets (especially Paris) and Air France’s sensible avoidance of the non–core subsidiaries that have hurt Lufthansa’s results.

This merger can best be described as an attempt to engineer a two–airline duopoly of the huge continental Europe–intercon market in the longer–term, while neutralising the threat of serious price competition in the short–term, and Jean–Cyril Spinetta speech (quoted on page three) confirms as much. But this merger is totally different from Cathay–Dragonair, which was a market based solution, explicitly designed to thwart government efforts to engineer a much less efficient competitive outcome. Spinetta’s claimed need for "pan–European leaders" demonstrates that he does not want a market solution based on open competition, but that he is asking the EC to actively intervene in the selection of winners and losers. Air France wants Brussels to give them a much more favourable carve up of the highly lucrative long haul market so that Ryanair, easyJet, Iberia and Air Berlin won’t be able to compete effectively with them on short haul routes.

Some have interpreted EC permission for AF–KL as a politically acceptable way to expedite the exit of hopelessly unprofitable long haul competitors such as Alitalia. The "barriers to exit" among large, inefficient flag carriers is a serious impediment to industry efficiency, but like the Chinese "Three Airline" policy, government attempts to engineer a specific competitive outcome, are rarely in the best long–term interests of the entire industry. The EC’s unwillingness to deal with market protections and distortions favouring Alitalia, or Swiss, or Olympic cannot justify a policy favouring more politically adept carriers.

The biggest anti–competitive risk of AFKL is that it quickly leads down a slippery slope of further collusion and mergers, each justified by government approval of the previous move. Air France will also want immunity for full price and schedule collusion with all alliance partners (for example NW–DL–CO–OK and possibly AZ on the North Atlantic); at which point the Star and oneworld carriers will demand the same right to collude. Having accepted KLAF, the EC must now decide whether to breakup all the transatlantic alliances, or agree to the extreme consolidation of the entire North Atlantic. While there were dozens of airlines on the North Atlantic ten years ago, the goal here is that Lufthansa and Air France–led groups control 90% or more of the Continent–US market while British Airways dominates (perhaps jointly with American) the largely separate UK–US market.

It was widely assumed that AF–KL would trigger a parallel American merger; Delta, Northwest and Continental have been pursuing various combinations of such a merger for years, and it remains a serious possibility. United’s interest in Continental follows this script, is undoubtedly being carefully coordinated with Lufthansa, and would be consistent with manoeuvring to achieve the best possible position before the final duopoly is set. Spinetta’s claimed need for huge airlines to "match the size of the huge Single Market" makes no sense unless one shares this vision of a government–engineered process to radically reduce (via collusion or eventual multi–national mergers) competition between the world’s Intercontinental airlines.

Unlike any of the other recent or prospective mergers discussed here, Air France–KLM could be a very good deal for their shareholders, but only by damaging competition and efficiency elsewhere in the industry. The key going forward is whether the EC continues down this slippery slope of active interference in Europe–intercon market competition in order to establish the desired "pan–European leaders". Many EC officials (like the one quoted at the beginning of this analysis) are on record as advocates of "widespread consolidation". The EC was unconcerned about the competitive impacts of KL–AF, and has appeared receptive to wider collusion between alliance members. The irony is that just like the Chinese, any government attempts to engineer the strongest intercon position for EU flag carriers will likely have the opposite results. The Air France/Lufthansa dream of dominating two of the world’s three global airlines is oddly similar to Swissair’s vision of a complex set of cross–border mergers that they would dominate culturally and financially.

The campaign is being led by a set of carriers harbouring a vision of a world where dozens of these huge intercontinental carriers will be merged into perhaps three airlines. This vision makes no sense unless governments agree to massively reduce the exposure of intercontinental airlines to market forces. The track record of big airline mergers has been dismal and the challenge of integrating disparate brands and corporate cultures would be larger than anyone has ever faced. There is no evidence that any of these carriers are currently too small to fully exploit scale economies, and the importance of scale continues to shrink. The radical aeropolitical reforms that would make true intercontinental mergers possible is decades away. The vision follows a classic Legacy/Flag pattern of responding to competition in new markets by reducing competition and driving up prices in old markets. It is not clear why Air France or Lufthansa would become the centrepiece (and primary financial beneficiary) of a mega–global merger. The vision is also oddly similar to Swissair’s vision of a complex set of cross–border mergers that they would dominate and become the primary financial beneficiary.

Consolidation in smaller countries

The possibility of other mergers between European long haul carriers, principally Alitalia–Air France and Iberia–British Airways, are often mentioned in the press, but there is little evidence of serious efforts in these directions. Alitalia has already been through one failed merger attempt, and Iberia’s investment in Aerolineas Argentinas collapsed in 2001. If the expected returns from Air France’s investment in KLM were primarily from cost efficiencies or network synergies, one would expect comparable potential from these mergers, or other hypothetical combinations such as Lufthansa–SAS. Since no one believes these efficiencies and synergies are significant, European intercontinental mergers are only being pursued under quasi–liquidation conditions (LH–LX) or if there is the possibility of huge gains from reduced competition (AF–KL). Air France has sensibly stated that they would not consider closer ties with Alitalia until it completed a major cost restructuring and downsizing, but will undoubtedly face pressure to move sooner as a $1 for EU acquiescence in the AF/LH long haul duopoly. Speeches extolling huge economic benefits from cross–border consolidation are generally motivated by one of three largely unrelated concerns:

- the desire for an initial breakthrough to help improve airline efficiency and service in smaller countries

- the desire to facilitate global mega–mergers between very large intercontinental carriers (e.g. United–Lufthansa) or

- the desire for incremental reforms that include perhaps greater foreign shareholdings (for example allowing Lufthansa to own 49% of United instead of only 20%) and greater cross–border marketing and management coordination.

The strongest economic case for airline consolidation can be made for the first category, countries whose market base is too small to support efficiently sized airlines. Airlines in small countries clearly lack scale economies, have less access to capital providers that understand aviation, and have a much shallower base of managers, suppliers and technical talent to draw on. Most importantly, small countries cannot support the "dynamic churn" of ongoing market entry and exit that is critical to ensuring long–term efficiency. The obvious problem is that the Chicago Convention based aeropolitical system makes it nearly impossible to achieve efficiencies that require multi–national operating scale. In an ideal world where airlines could be organised without regard to national boundaries, the number of airlines in smaller countries would undoubtedly shrink, and consumers would benefit from more service from a smaller number of larger, more efficient carriers.

Whatever the theoretical merits, it is absurd to even discuss the possibility of true multi–national airlines, within any reasonable timeframe. Giving airlines the same flexibility as consumer product companies would require a total reworking of all safety and economic regulations, which could not reasonably begin until preliminary versions of new frameworks had been tested in more developed environments such as Europe or the North Atlantic. Multinational aviation blocs are always possible, but the Scandinavian grouping supporting SAS is the only one in the last half–century that has actually worked. The EC shows no signs of being able to organise a true "European AOC" including the fully–integrated safety oversight and the full delegation of political authority from the member states that would be required. The Chicago framework gives effective veto power to any country that doesn’t want to move from a bilateral to a multinational system, so there is no point to a United–Lufthansa merger unless every country they fly to agrees to accept the new ownership arrangements.****

Any hope of cross–border efficiency gains in the next decade must come within the Chicago framework, but none of this would lead to industry consolidation anytime soon. The leaders of this incremental approach have been the TACA and LAN carriers in Latin America, and there are several examples of progress in Asia (Bangkok/Siem Reap Air, Jetstar in Singapore and Australia, Air Asia in Malaysia, Thailand and Indonesia). Any reforms under a Chicago framework would actually increase the number of airlines (e.g. multiple LAN–branded carriers), and the savings are more modest since duplicate operating and management structures must be maintained. Progress along this path has been very slow, since each set of reforms needs to be negotiated country–by country. If more airlines could show bigger gains, the case for more radical cross–border reform would be easier to make.

IATA is the only organisation with the global reach and perspective needed to play a leadership role on any of these three categories of cross–border liberalisation. Leadership to accelerate the pace of LAN/TACA type reforms, or on addressing the small country airline problem could create a politically valuable link between aeropolitical reform and improved service in the parts of the world that need it most. Leadership on longer–term more radical cross–border reforms could be critical to finding solutions to the safety oversight question, and diffusing the many protectionist and other parochial obstacles to progress. Director General Bisignani (see page three) is clearly focused on cross–border questions, but it is not clear whether IATA is actually willing to devote the serious resources needed to actually make progress on these issues. Most of Bisignani’s speeches emphasise "industry consolidation" among the large intercontinental carriers, closely echoing the LH/AF publicity campaign. This is a unique opportunity where IATA could play a decisive role in the future of the industry, but speeches that simplistically link "consolidation" with "efficiency" suggests that Bisignani and the IATA Board may not have thought the issues through very carefully.

A merger scorecard

In a perfect world, capital markets would decide to finance mergers after evaluating the potential efficiency, synergy or restructuring gains against the acquisition and implementation costs and governments would only intervene in the very rare cases where returns from exploiting artificial competitive barriers clearly outweighed efficiency benefits. In the real world, most airline mergers that have been seriously proposed or implemented in recent decades have failed to provide meaningful returns for investors and have failed to improve the industry–wide allocation of capital.

Is consolidation necessary?

The table on the right summarises the key comments about major airline mergers (recent or under discussion). Mergers are categorised as primarily "efficiency/synergy", "quasi–restructuring", or "not sensible". This short list illustrates the limited, secondary role that mergers play in shaping industry structure. Note that only one of the mergers is primarily based on efficiencies and synergies; if bankruptcy–type restructuring processes were more efficient, the number of mergers would be significantly smaller. Note also that only one of the mergers creates competitive problems that cannot be mitigated by positive economic gains. The general claim that consolidation is critical to future industry profitability, and arguments that governments ought to actively intervene to force major consolidation cannot be defended by anyone seriously concerned with the long–term economic health of aviation.

The number of airlines has been steadily expanding, and the major forces (market liberalisation and economic innovation) that drove this expansion are likely to continue. These innovations (LCC business models, the reduced value of connecting hubs, the major improvement in IT and distribution technology, and increased outsourcing) have significantly reduced the importance of "bigger is better" scale/scope economies. There is no basis for claiming that "natural" forces common to many industries will force an inevitable aviation consolidation. The industry is not maturing. Demand is robust, and there are many likely sources of future productivity gains to fuel growth. Modest levels of consolidation in certain markets have, and will undoubtedly continue to occur, but most cases are explained by cyclical downturns, temporary pockets of overcapacity or the evolution of specific business models.

Airline competition needs to constantly evolve because business models, technology and customer needs will continue to evolve. This evolution depends on a variety of competitive processes including open market entry, pricing and network freedom, capital market discipline, and bankruptcy systems. If functioning properly, these processes will speed the introduction of innovative new models and technology, reward the most efficient companies, facilitate the reallocation of capital to more productive uses, and encourage the new investment needed for future growth. Ongoing merger and restructuring activity do not signal any trend towards consolidation, but are a critical part of these market forces, and actively support expansion.

Airline industry structure and competition is far from perfect, and the biggest problem are the "barriers to exit" that protect hopeless incumbents from needed restructuring and block opportunities for more efficient, better run airlines. These include explicit subsidies, the lack of effective bankruptcy processes, capital market imperfections, and many other issues. But industry consolidation would eventually make these problems even worse. Very large carriers, immune from any serious threat of new entry, quickly tend to become less efficient, much more resistant to change, and "too big to fail". Cross–border constraints due to aviation’s Chicago Convention framework also limits industry efficiency, especially in smaller countries, although there is little evidence of progress on the huge set of changes that would be needed to resolve those constraints.

The "optimal number of airlines" should be driven by competitive economics and will always be subject to change; over the past 25 years these market forces have dictated more airlines, not fewer. Those advocating industry consolidation want to ignore that history, do not want the number of airlines set by competitive economics and do not want to let market forces adjust the number over time. Competition reform is a difficult task, as the last four decades have demonstrated, but attempts to improve the "ground rules" or the process of competition have yielded huge benefits while attempts to engineer a specific market outcome (such as the number of airlines) have almost always been counterproductive.

Consolidation is least likely in the one area where it is most economically justified, small countries which might be better served by larger, multinational carriers. Eliminating the aeropolitical obstacles could bring important benefits to many relatively less developed countries on the world, but this has not been an important priority for aviation leaders in the more developed countries, and there is little evidence of meaningful progress on this front. Claims consolidation among large carriers in places like Europe or America would somehow help improve the cause of airline efficiency in small countries are absurd.

Role of governments

Two of the people arguing for airline consolidation at the beginning of this analysis were arguing for mergers in a very specific, narrow context. Doug Parker’s approach (restructuring type mergers with significant cost and capacity cuts) is not only strongly based on market economics, but he successfully implemented a merger that demonstrated its value. Michael O'Leary wants to implement a merger that he thinks can be financially justified; investors may debate the merits of his proposal, but he is only asking that governments not interfere by applying much more onerous conditions that were applied to the mergers of many of his competitors. Decisions on specific proposals such as these can, and should be left to the capital markets. All of the other quotes citing the "industry consolidation is inevitable" mantra are part of a publicity campaign designed to not only encourage mergers between very large Intercontinental airlines but to get governments, starting with the EC, back in the business of actively deciding what the outcome of airline competition ought to be. Needing to create the sense of a problem that consolidation would solve, the publicity campaign dwells on the intuitive sense that there are "more airlines than the world really needs" even though this is totally unrelated to Intercontinental carriers, whose numbers haven’t changed much in decades, and is meaningless as a justification for mega–mergers. There may have been "too many software companies" that started business since the dot–com era, but that wouldn’t justify a merger between Microsoft and Google.

The key issue going forward is not whether there are "more airlines than the world really needs" but the role of government. If the EC’s primary objective is to get government out of the aviation business so that markets can allocate resources, then it would not care whether those market forces happen to produce a larger or smaller number of airlines, and it would never talk about consolidation. If the EC’s new objective is to engineer a radically new industry structure based on extensive collusion (and eventually mergers) between large Intercontinental carriers, and to establish Air France and Lufthansa as the "pan–European leaders" positioned to dominate that new structure, then its public statements and growing indifference to competitive issues make much more sense.