JetBlue: profits warning

November 2005

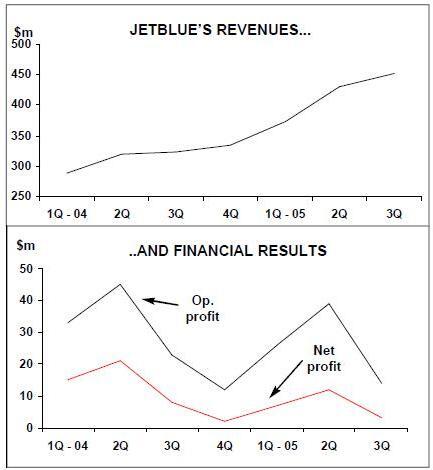

The past month’s third–quarter earnings reports from US airlines gave no reason to celebrate, but there was one especially unsettling development: the disappearance of profits at JetBlue Airways. The formerly highly profitable New York–based low–cost carrier managed to earn only US$13.8m and US$2.7m operating and net profits, respectively, in what is typically its most lucrative period, representing profit margins of 3.1% and 0.6%.

JetBlue’s management disclosed that the airline was likely to incur an operating loss to the tune of 5–7% of revenues in the current quarter and that it would probably report a small net loss also for the full year. The current First Call consensus forecast is a loss of 3 cents per share. It would be JetBlue’s first annual loss since 2001 (its first full year of operation).

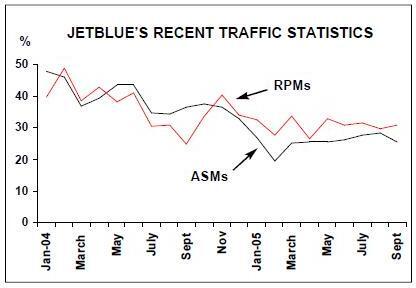

The profit deterioration has been a two–year phenomenon: after the spectacular 16- 17% operating margins achieved in 2002 and 2003 came low–double digits and high single digits during 2004, followed by low single- digits and break–even this year.

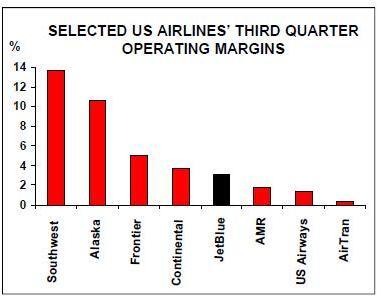

No–one expected JetBlue to be immune to the fuel and revenue environment. It could not have matched the performance of Southwest, which achieved a 14% operating margin in the third quarter largely because it has been uniquely lucky with fuel hedges.

However, the deterioration in JetBlue’s earnings has been sharper than anyone could have envisaged.

This is unsettling, first of all, because JetBlue’s financial performance is currently no better than that of the solvent legacy carriers.

Its 3.1% third–quarter operating margin was tucked right in there between Continental and AMR, a little worse than Continental’s 3.7% though better than AMR’s 1.8%. Shouldn’t JetBlue be performing much better at its industry–leading 6.9- cent unit costs? Or is this an indication that the legacy carriers have finally got their act together and the stakes with LCCs are evening out?

Another major concern is that, although JetBlue’s longer–term growth prospects are still promising, its profitability is now likely to remain well below the company’s longer–term objectives.

All of that has taken a toll on JetBlue’s stock and credit ratings and its share performance. Over the past two years, the share price has more than halved from the peak of high–40s in late 2003 to US$18–20 in recent months (the April 2002 IPO price level). After the third–quarter results, several analysts reduced their recommendations on the stock, which is currently mostly rated "neutral".

Also, in late October Standard & Poor’s again downgraded JetBlue’s various ratings — its corporate credit rating is now a modest "B–plus".

Fuel prices were obviously the main culprit for the poor third–quarter performance. JetBlue saw its average fuel price soar by 58%, from US$1.08 to US$1.70 per gallon. This caused unit costs (CASM) to surge by 13.8% to 6.93 cents. Fuel accounted for 35% of the airline’s operating costs. Had fuel prices remained unchanged from 3Q04, the 3Q05 operating margin would have been 12.6%.

The dramatic fuel price increases obscured a solid 9.4% unit revenue (RASM) improvement to 7.15 cents (part of an industry- wide trend) and what the airline indicated was satisfactory non–fuel CASM performance. However, there were new pressures in both of those categories too. On the revenue side, JetBlue was hit by an unusually tough hurricane season and intensified competition from Delta’s low–fare unit Song in the Northeast–Florida markets, as Delta evidently shifted its focus away from Atlanta (where it competes with AirTran). Because of Song, JetBlue was unable to implement fare increases in those markets (unlike on east–west routes, where fares have been raised modestly).

On the non–fuel cost side, JetBlue is beginning to feel the impact of higher maintenance costs (up 34% in the third quarter due to a large number of C–checks) after the initial "maintenance holiday" associated with the new fleet.

While US airlines are benefiting from a return to more normal pre–Katrina crack spreads in the current quarter, jet fuel prices are expected to remain high through 2006 and 2007. JetBlue has hedged 20% of its current quarter’s needs at just under US$30 per barrel, but beyond that it only has some caps in place at US$68 or higher, which it calls "catastrophic insurance". No airline is finding it worthwhile to buy new fuel hedges at the current prices.

There is not much that JetBlue can do on the non–fuel cost side either. It is already extremely lean and efficient, but it will face higher non–fuel CASM because of the A320 maintenance, as well as the start–up costs, smaller size and shorter stage lengths associated with the new 100–seat E190s.

JetBlue's revenue strategy

Consequently, growth and revenue strategies will be the key. If fuel prices stay high, will JetBlue slow growth or find some means of boosting revenues? JetBlue appears to have adopted a three–pronged approach to managing revenues in the current tough environment. First, the air–line is making extra efforts to boost non–passenger revenues. Second, it hopes to boost yield by operating the E190s in shorter–haul, higher–yield and overpriced markets. Third, there will be limited, if any, capacity cuts or fare increases in competitive markets where JetBlue is building a long–term position.

Non-passenger revenues After demonstrating flair for extra–curricular activities early on with the LiveTV acquisition, JetBlue has done a great job this year in boosting the "other revenue" category (up by 84% in the third quarter to US$21.4m, or 4.7% of total revenues). This is probably a natural focus for a carrier that has succeeded in developing a strong brand and considerable customer loyalty.

This year’s most significant initiatives have included a co–branded credit card and membership rewards programme with American Express. Also, JetBlue has launched its own online programme of customisable "Getaway" travel packages.

JetBlue has also increased flight change fees and has started selling upgraded headsets for a small fee. However, the airline is not going to follow the legacy carrier route of charging extra for everything; for example, LiveTV will continue to available to everyone as part of the "JetBlue experience".

The E190 as a yield-booster The E190, which JetBlue introduced to service on November 8 in the New York–Boston market, will also be targeted at less competitive medium–density routes that currently have 50- or 70–seat regional jet service with high walk–up fares. While JetBlue will offer fares that are substantially below what other carriers are charging, it expects the E190 to achieve yield premiums over the A320 on comparable stage lengths.

Maintaining pressure in competitive markets Even as fuel prices have surged, JetBlue has been hesitant to reduce capacity or raise fares in competitive markets so as not to lose market share as it grows. In other words, building a strong market position currently appears to take precedence over high profit margins.

That has certainly been the case on routes that JetBlue feels are its natural markets, such as New York–Florida, and where it over–performs a key competitor (Song).

According to JetBlue’s management, in the third quarter JetBlue achieved a 32% RASM premium over Song on the Florida routes, while its CASM may be 20–25% lower than Song’s. CEO David Neeleman explained it in the company’s third–quarter earnings conference call as follows: "If we continue to keep the pressure on, to do what we do, I think we’ll be rewarded for it. We're going to stay strong. This is our market."

By coincidence, just a week later Delta announced that it would discontinue the Song brand in May 2006. The low–fare unit will be integrated into Delta mainline service with some of Song’s best features and its 757s reconfigured to include first–class cabins. This "new and unique long–haul domestic Song service" will take over Delta’s transcontinental flights from autumn 2006 and will be expanded to all domestic routes over 1,750 miles over two years.

So far analyst opinion has been divided as to whether this is good or bad for JetBlue. On balance, the positive of losing a dedicated Northeast–Florida competitor and an estimated 7% of Delta/Song capacity in those markets in mid–2006 probably outweighs anything that Delta may or may not accomplish in the longer run.

Long-term growth plan unchanged

JetBlue has no intention of slowing its extremely rapid growth — it continues to "build the business for the long term".

Following this year’s 24–26% capacity growth, 2006’s ASM growth looks likely to be around 30%. This is by far the fastest growth among the US non–regional airlines — only AirTran comes close with 25% ASM growth planned for 2006 (Southwest and Frontier are next with 10%).

JetBlue is adding typically 17–18 A320s and 18 E190s to its fleet annually over the next 6–7 years. At year–end, it will have 85 A320s and eight E190s. If all of the current firm orders and options were taken, the fleet would grow to 433 aircraft by 2016. There should be no difficulty financing the aircraft, given the strong balance sheet. JetBlue has the industry’s best cash position — US$491m at the end of September, or 40% of annual revenues (Southwest’s was 36% by comparison).

To make sure than debt leverage remains below the target of around 75%, given the current quarter’s loss and the substantial planned capital spending, JetBlue revisited the equity markets in early November to raise US$155m in gross proceeds in a public offering. This improved the airline’s debt to- capital ratio (excluding leases) to 71.5%. JetBlue arranges aircraft financing well ahead of deliveries. The first 30 E190s have committed sale/leaseback financing with GE Capital, covering deliveries through April 2007. All of this year’s A320 deliveries were pre–funded with a EETC in November 2004.

All but three of next year’s A320 deliveries apparently already have term sheets for bank debt prepared, and the interest rates are as competitive as in previous bank financings.

Also, JetBlue is among the best–positioned airlines to grow because it is still internally in good shape, with industry leading CASM, productivity and product offering. Furthermore, the loss forecasts released by the airline in late October may actually represent the worst–case scenarios, because in recent weeks fuel prices have declined while the general pricing environment continues to improve gradually.

But perhaps the most valid reason to grow is because there are good immediate market opportunities particularly with the E190. In addition to launching a New York- Boston shuttle service (up to 10 daily flights), the E190s will initially open new service from both of those cities to Austin (Texas) and Richmond (Virginia), add Boston to West Palm Beach and Nassau (Bahamas) flights and increase frequencies on JFK–Buffalo and JFK–Burlington routes. JetBlue’s management has called the E190 "tailor–made for Boston", and the plan is to triple the destinations from that city by April. Otherwise, the airline will have a hard time deciding where to put the E190s — the initial 2003 analyses identified almost 900 potential markets.

One major benefit of the E190 expansion is that it will reduce JetBlue’s current heavy exposure to the two most competitive domestic markets: transcontinental and Northeast–Florida. Coast–to–coast services account for 61% of the airline’s ASMs, while north–south flights along the East Coast account for 28% (Caribbean accounts for 7.5% and short haul markets 3.5%). Despite its JFK stronghold, JetBlue has chosen to establish presence at all three New York area airports as slots and gates have become available. LaGuardia was added in September 2004, and Newark followed last month with service to five cities in Florida and to Puerto Rico. JetBlue has found that only 5% of its Newark customer base comes from Manhattan, so there is little traffic diversion from JFK and LaGuardia.

Newark is a key hub for Continental, but competitive clashes will be limited because JetBlue has only two gates there and the airport is extremely gate–constrained.

Of course, JetBlue remains committed to JFK, where it plans to build a US$850m, 26- gate terminal jointly with the airport operator, for completion in mid–2008. Under an interim agreement, the airline is able to add seven temporary gates to the 14 it already has, to facilitate growth in daily departures from the current 130 to almost 200.