Capacity bubble in the Middle East

November 2005

The Middle East "super–connectors" — Emirates, Etihad and Qatar Airways — have built up an impressive aircraft backlog — 51 A380s and 129 A330/340/777 types. These are firm orders, and include Emirates' 42x777 order announced at the Dubai airshow in mid–November.

Is this a petrodollar–fuelled folly or an aggressive but rational strategy to establish competitive global connecting networks? Or both?

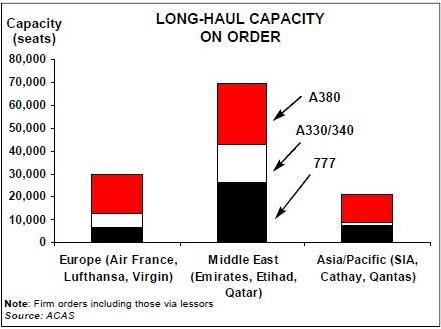

The chart below compares long–haul capacity on order at Emirates, Etihad and Qatar Airways with their main European competitors — Lufthansa, Air France/KLM and Virgin Atlantic (BA has no current long–haul orders) and their main Asian competitors (SIA, Cathay Pacific and Qantas). The Middle East carriers have 36% more long–haul seats on order than the European and Asian airlines combined. And whereas the Middle East capacity is almost all destined for Sixth Freedom Europe–Asia operations, the European/Asian airlines capacity will be deployed as Atlantic, Pacific and intra–Asian routes as well as Europe–Asia.

When the Middle East carriers' total of 70,000 seats are eventually all delivered, they will have additional capacity sufficient to carry over 25m passengers a year. For comparison, the total volume of passengers flown on all AEA airlines to/from the Middle East and to/from the Far East in 2004 was 21m.

Another slightly disconcerting statistic is that the combined population of Dubai, Abu Dhabi and Qatar, the home states of the three Middle East carriers, amounts to a maximum of 3m people. Sothere should be relatively little potential local traffic growth at the airlines' bases.

However, Emirates does present an intriguing case for the development of major tourism flows to its fantastical resorts in the Gulf. The projects really are mind–boggling — Sea World, for example, where artificial islands in the Arabian Gulf have been constructed to replicate in miniature the world’s continents. If you're rich enough, you can you can buy a luxury property in the shape of your favourite country — Rod Stewart has just snapped up Scotland, or possibly the whole of Great Britain.

Back in the world of intercontinental airline competition, the Middle East carriers have a two–pronged strategy. The A380s will allow them to expand at slot–constrained airports like Heathrow and Frankfurt, where their scale economies potentially give them a unit cost advantage over 747 operators like BA. The 777s and A330s will be targeted directly at smaller points like Hamburg, Dusseldorf and Manchester, where they potentially threaten to divert business travellers from connecting over the home carriers' main hubs. Lufthansa appears to be particularly at risk here as a high percentage of German business travellers are based at cities other than Frankfurt and Munich.

Air France has responded by urging the European Commission to investigate Emirates for unfair state subsidies, and Qantas is resisting Emirates' planned expansion of services to Australia by complaining to its government about the advantages Emirates enjoys as a result of its state ownership and minimal tax regime.

SIA is the airline that is most at risk from the Middle East expansion. But SIA is not going to concede its Sixth Freedom traffic without a strong competitive response. And its Changi hub is intrinsically much stronger than Dubai, drawing in traffic from densely populated South East Asia to complement Europe–Asia flows.

Liberalisation at last of the Indian subcontinent is also changing the competitive landscape. More direct service between the subcontinent and Europe will inevitably reduce demand for connecting services over Middle East hubs. Then there is the complicated issue of competition among the Middle East carriers. As noted above, Emirates claims that its profitability is not subsidised by the Emirate of Dubai and produces evidence to support its case. But Qatar Airways' "Five Star" operation is unashamedly based on support from the state — the annual budget presented to the Ruling Council specifies the amount of funding that the airline will require to cover its costs. Etihad is the Emirate of Abu Dhabi’s attempt to duplicate Dubai’s flag carrier, and there are local reports that it is starting to hurt Emirates. Abu Dhabi has just announced its withdrawal from Gulf Air, which originally was a multinational venture involving Abu Dhabi, Qatar, Bahrain and Oman. Now only Bahrain and Oman are left, and Oman has its own airline, Oman Airways. A couple of years ago it looked as if Gulf Air might disappear, which would have eased overcapacity in the Middle East, but its turnaround programme, under James Hogan, has apparently been quite successful, and the $1 Bahraini flag–carrier will continue to a presence in the intercontinental market.

All the indications are of a major overcapacity issue on Europe–Asia routes, which will be very difficult to resolve.