The new Atlantic

November 2004

United’s announcement at the beginning of October that it was going to concentrate on "more profitable" long haul routes is likely to be followed by the other legacy carriers as they seek some relief from the super–competitive US domestic market.

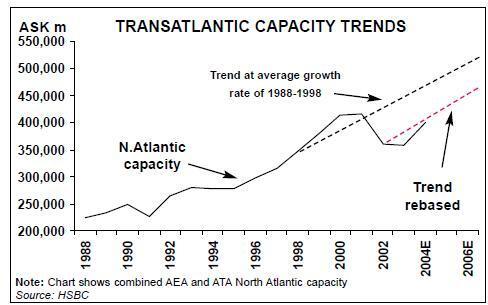

This inevitably raises concerns about a European reaction and market imbalance. HSBC airline analysts, in a detailed report entitled "Ripples across the pond", worry that " North Atlantic market profitability could be reduced in 2005 by 10–20% for each percentage point of total capacity growth above the 4.4% trend rate" (see graph below).

The airlines themselves are unlikely to see the market that way.

With load factors in the mid 80s for the last three months, their expectation will be that they can add capacity next year without too much yield dilution, considering that North Atlantic traffic is still about 2% below pre–September 11 levels.

Moreover, HSBC’s profitability impact forecast seems too pessimistic to us, possibly because of an over–estimate of the marginal costs of supplying new capacity on the Atlantic.

As with the domestic US and intra–European markets, the transatlantic market will be impacted at least as much by structural changes as cyclical factors. These include:

- Expansion on the part of the US legacy airlines but also consolidation as competitors are finally removed through Chapter 7 bankruptcy;

- Changes among the European network carriers, with Atlantic operations being consolidated at four hubs (Heathrow, CDG, Schiphol and Frankfurt) and in three airlines (BA, Air France/KLM and Lufthansa), while the other European flag–carriers retreat further to niche city–pairs.

- Extension of LCC–type strategies to the North Atlantic, for example through BA.com distribution and Aer Lingus’s new simplified, no–restrictions, one–way pricing system.

- Emergence of specialist Atlantic operators, like PrivatAir with its all–business product and franchise agreement with Lufthansa or new long–haul LCCs, for example, SkyLink, which plans to start up out of Washington/Baltimore to European cities.