Iberia: challenges of the Third Director Plan

November 2003

Following the proposed Air France/KLM merger, some analysts have speculated on an Iberia/ British Airways merger.

This is highly improbable and would be a hugely misguided for Iberia, which is now facing some growing problems following its relative success in recent years.

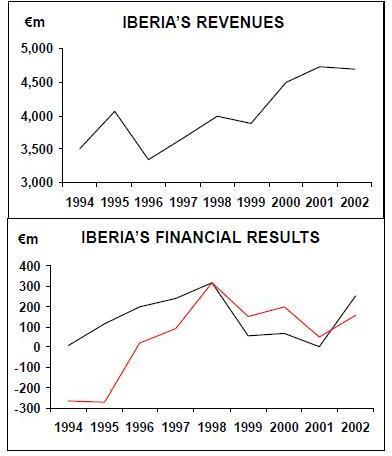

A question mark about Iberia’s future may appear unduly pessimistic given the airline’s impressive results in 2002, when it posted an operating profit of €249m and net profit of €157m, compared with a €5m operating profit and €50m net profit in 2001. To some extent Iberia was protected from the effects of September 11, as its intercontinental operations concentrate on the South rather than the North Atlantic.

Iberia’s performance in 2002 was a result of what the airline called its "anti–crisis" plan, which put long–term growth on hold in favour of urgent cost–cutting and capacity reduction.

During the year Iberia delayed delivery of nine A320s and five A321s, retired six A300s and cancelled a number of wet and operating leases. Overall capacity was cut by 5.2% in 2002, although Iberia saw its load factor rise by 2.3% as traffic only dropped by 1.2%.

The capacity cuts were not evenly distributed through Iberia’s network — the largest reduction in ASKs came in the domestic market, down 11.5% in 2002, with just a 3.9% cut on long–haul and a 1.6% reduction on intra- European routes. Iberia was helped by not having as much exposure to the North Atlantic market as many of its European competitors, but the airline also benefited from deep cost–cutting that saw 2,700 redundancies through the year — around 10% of the workforce — and operational improvements that saw fleet utilisation rise by 5% to 8.7 hours per day in 2002.

Yet even as the "anti–crisis plan" was being implemented, Iberia’s management was planning ahead, and at the end of 2002 the airline announced it was scrapping its existing long–term strategy in favour of what it called its third "Director Plan", which covers the period 2003–2005. By 2005, the Third Director Plan’s objectives are to:

- Reduce unit costs by 8–10% in nominal terms.

- Increase EBITDAR margin above 19%.

- Achieve a ROE of at least 15%.

These targets appear achievable, given Iberia’s 2002 EBITDAR margin of 17.1% (compared with 13.8% in 2001) and ROE of 12% — margins that many of Iberia’s competitors can only dream of. Practically, the Third Director Plan aims to achieve these objectives by further cost–cutting, preserving Iberia’s leading position on Europe–Latin America routes and trying to make a profit on domestic and European point–to–point routes.

Specific targets include a capacity increase of at least 22% over the three–year period, a rise in fleet utilisation of 9% and a reduction in costs of 15%.

Operationally, the focus is very much back on growth following the capacity cuts imposed after September 11. On short–haul, A320/321 orders that were postponed after September 11 will begin arriving by the end of 2003/early 2004, but much of Iberia’s capacity increases will come on transatlantic routes now that Iberia has finally made a decision on longhaul fleet renewal. Iberia’s 747s are being replaced by eight A340–600s, all of which are to be assigned on routes to South and North America. The first A340–600 was delivered in June 2003 and is one of three aircraft that were previously destined for Swissair.

These are being leased from Airbus and will replace three leased 747–300s. The remaining five A340s are an existing order, although conversion of options for a further seven A340–600s is being put on hold for the moment until traffic becomes stronger on European feeder routes from Germany, France and Italy.Once the long–haul fleet is renewed, Iberia will have brought to an end a compete overhaul of its fleet mix, which over the last two years has resulted in the number of aircraft types being halved, from ten to five. The less complicated fleet helped increase cockpit crew productivity by 4.2% and aircraft utilisation by 5.3% in 2002, even though overall capacity was reduced.

Airport expansion

Iberia will also take full advantage of runway and terminal development at Barcelona and Madrid, and the airline plans to at least keep its existing market shares at these airports.

Madrid Barajas will open two new runways and a terminal in 2004, while Barcelona El Prat will open a runway in 2004 and a terminal in 2005. This will result in passenger capacity growth of between 30–40% at Barcelona and Madrid in 2004–2006 — way above any of these airports' major European competitors. And that will come on top of estimated passenger CAGR over 1999–2004 of 8.5% at Madrid and 6.5% at Barcelona, compared with 6.5% at Paris CDG, 5.0% at Schiphol, 4.0% at Frankfurt and just 1.5% at London Heathrow.

Altogether, Iberia is to spend more than €1.5bn on aircraft and terminal improvements, and management claims that if aircraft productivity targets are not achieved then capacity will be increased even further than planned through additional wet leasing. As for further cost–cutting, Iberia intends to copy the low cost carriers (LCCs) and axe many of the standard free frills on its economy class product such as meals and paper tickets, which will subsequently only be available for an extra charge. This will enable the airline to reduce its comparatively high economy fares — which travellers to/from Spain have long complained about — thereby increasing demand and hopefully turning more of Iberia’s intra–European routes profitable.

A nice plan, but ...

Just months after the Third Director Plan was launched, Iberia’s managers decided it needed to be altered following the tough economic and aviation environment of early 2003 — even though SARS has not had an effect on Iberia’s traffic, fuel risk was hedged ahead of the Iraq crisis and the depreciation of the dollar had had a net positive impact on Iberia’s costs and interest payments. Despite all this positive news, in the first half of 2003 Iberia’s operating profits fell by 79% to €21m compared with January–June 2002, and net profits were down by 57% to €29m. Iberia claims the plunge in half–year profits was due to overcapacity and cheaper fares — although increasing capacity and reducing fares is at the core of the new three–year Director Plan.

Iberia’s passenger yields fell by a worrying 8.1% over the first half of 2003.

As a result, just a few months into 2003 Iberia decided to "revise and update" the 2003–05 Director Plan, delaying deliveries of new aircraft and cutting back its planned capacity increases. In the first half of 2003 overall ASKs were down 2.1% on 1H 2002, with domestic ASKs down 0.1%, intra — European up 0.8% and long–haul down 4.6%. But overall, RPKs rose 0.4% in the half–year, leading to a 1.8 percentage point improvement in load factor.

In the revised Director Plan there now appears to be a scaling back of the fleet plan.

Whereas previously Iberia forecast a 2005 fleet of 170 aircraft (30 of which would be long–haul), it is now talking about a fleet of 140–150 aircraft in 2005, this downward adjustment to be achieved by not renewing existing operating leases, letting aircraft options lapse and cancelling previously–planned wet leases.

Iberia argues the 2003 capacity reductions are tactical and just a response to market conditions, but they appear to be more a strategic U–turn than a short–term tweaking of capacity, and therefore put a serious question mark over the achievability of the Third Director Plan as a whole.

Here come the LCCs

A serious threat to the success of the Third Director Plan comes from increasing competition from the LCCs. While the lack of capacity constraint at Barcelona and Madrid is a key competitive advantage for Iberia, it also means the airline will increasingly come under attack from the LCCs as they too expand operations at Spanish airports.

According to an investors road show given by Iberia in July 2003, the "competitive environment considered in the scenario of the Director Plan has changed considerably in the first months of 2003". Lower traffic and higher fuel process are temporary effects, but "growing competition of the LCCs in Europe" has lead to more "structural changes" — Iberiaspeak for increasing pressure on yields.

At present, easyJet operates to Barcelona, Madrid, Bilbao, Alicante, Malaga, Ibiza and Palma from seven UK airports as well as Paris Orly, Amsterdam and Geneva. Ryanair, which previously had avoided Spain because it could not strike favourable airport deals, now operates to five Spanish airports from the UK, Ireland and Frankfurt (Hahn), Milan (Bergamo) and Brussels (Charleroi).

Germanwings flies to four Spanish cities from Cologne/Bonn and Stuttgart.

Iberia has responded by cutting cut fares by up to 30% on off–peak flights on some European routes believed to have been seriously affected by competition from LCCs — particularly UK–Spain routes. But will limited fare reductions seriously dent the advance of the LCCs given that there are few capacity restraints at the major Spanish airports? A Spanish–based analyst forecasts that easyJet and Ryanair’s combined market share of traffic to/from Spain will grow from just under 2% in 2002 to well over 10% by 2005.

The only substantive response Iberia can make to the LCCs long–term is to cut fares aggressively, but to do that and achieve profitability on intra–Europe routes (as targeted in the Director Plan) will require Iberia to put further downward pressure on costs that have already been reduced substantially.

Iberia has told its investors that it is now accelerating its timetable for certain measures in the Director Plan, such as reducing travel agents commissions (now to be implemented in January 2004), restructuring of foreign offices (starting now) and implementation of new on board service levels (again with immediate effect).

But how much room for further cost cutting is left at Iberia? According to Iberia’s own calculations, its unit costs — at less than 8 Euro cents per ASK in 2002 — are lower than all of the Euro–Majors and not far behind the LCCs.

Cost–cutting of €61m was achieved in 2002 — €7m higher than its target — and in 2003 the airline aims to reduce costs again by another €54m. These cost targets are accumulative, and each subsequent round of cost cutting is harder to achieve. Indeed unit costs remained level in nominal terms through the first half of 2003, and productivity improvements have already levelled off.

So what areas could be squeezed further? A detailed analysis of Iberia versus the LCCs reveals that LCCs still have a cost advantage over Iberia in the key areas of fleet, maintenance, flight personnel and commercial despite Iberia cutting costs in these areas already. However, in the commercial category there is a huge difference between the sleek, efficient management structures of the LCCs and the bloated overheads of expensive office locations and middle/senior management at Iberia — and these are areas that Iberia must target ruthlessly.

If anything, the pressure on Iberia’s costs will be upwards rather than downwards in the immediate future as management’s uneasy peace with Iberia’s workforce is close to breaking down. Management has recently tried to push through further changes to work practices, but the unions see this as a concession too far for a workforce that has seen few of the rewards that other stakeholders have received in the two or three years.

The latest proposed changes include cross–training of A320 and A340 pilots, further outsourcing of non–core activities and moves to increase staff flexibility across different duties. Unions expect to agree a compromise deal, but they have little choice given the fact that industrial action is ruled out until early 2005 as part of an earlier deal between unions and management struck in July 2001 (see Aviation Strategy, March 2002), and renewed in November 2002. But the new row signifies that underlying poor relations between the workforce and management do not appear to be improving. In 2005, once the "no–strike" agreement ends, it is almost inevitable that unions will initiate moves to claw back some of the concessions they have made over the last few years, and grab a share of Iberia’s recent profitability.

The current row with the workforce is not a great start for new Iberia chairman Fernando Conte, whom the Iberia unions had hoped would be less aggressive than predecessor Xabier de Irala, who succeeded in turning around the Spanish flag–carrier from a bloated, inefficient, state–run organisation totally dependent on state aid to a commercially successful airline, in the process straining union relationships. Union officials in Madrid look with some trepidation at the job cutbacks that have been implemented at BA.

Conte, however, has little room for manoeuvre. Although each subsequent layer of cost cutting is harder to achieve, it becomes even more necessary given the yield pressure from the aggressive intrusion of the LCCs into the Spanish market.

In addition, Iberia faces a challenge to its domestic routes from the introduction of new high–speed trains in Spain. Given all this, there must be a doubt as to whether Iberia’s European routes can ever become profitable (as stated in the objectives of the Third Director Plan) — particularly as the airline’s partner, BA, has been struggling to make a profit intra–Europe for years. At worst, yield erosion may increase intra–European losses so much that they wipe out a large part of the profits that Iberia makes on long–haul routes — the airline’s key asset.

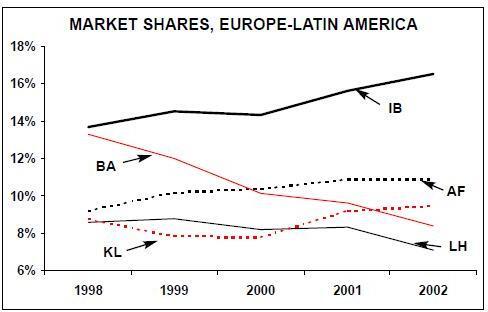

Iberia predicts strong growth rates on its Latin American network, which includes routes to 28 cities in 17 countries. Altogether, Latin America routes accounted for 36% of all Iberia’s ASKs in 2002, 38% of its RPKs, and a large proportion of its operating profits. Iberia has increased its market share on Latin American routes over the last five years (see chart on left), which is unsurprising given the weakness of competitors like Aerolineas Argentinas and Varig.

But even here Iberia will face increasing competition in the future. The infrastructure improvements at Barcelona and Madrid provide not only an opportunity for the LCCs intra–Europe, but also for the Euro–Majors on long haul to Latin America — if traffic rights can be obtained. The threat to Iberia’s LatinAmerica profits could be even stronger if cost cutting goes too far and business passengers start noticing differences between the products of "full–service" competitors and Iberia’s flights.

BA/Iberia alliance

According to reports in the Spanish press, Rod Eddington, BA’s CEO, states that Iberia is "an absolute key partner for us", and that once BA sorts out its own profitability, its next priority will be consolidation in Europe, and "our relationship with Iberia will be the cornerstone of that".

But before the two airlines can take deepen the existing relationship through coordination of scheduling and fares, antitrust immunity from the EC for the BA/Iberia alliance still has to be secured. The airlines applied for immunity last year, and in September 2003 — following negotiations with the EC — BA and Iberia agreed to give up seven daily slot pairs on London–Spain routes in order to win this immunity. However, this deal has still to be formally approved by the EC, and bmi has described it as "wholly inadequate".

It is hard to see what BA can gain by a full merger or increased equity stake that it cannot achieve by closer co–operation (once it gets the all–clear from the EC) under the existing partnership. There is little overlap between BA and Iberia, so cost savings would be insignificant. The key asset for BA is Iberia’s grip on the Latin America market, which it should be able to exploit anyway via close co–ordination of schedules at Madrid and perhaps some juggling of the two carriers' long–haul routes.

And if BA bought a larger stake in Iberia it would be tying itself even closer to an airline whose European network struggles to make a profit, even after the substantial cost–cutting that has already been achieved, and is even more unlikely to do so in the future given the advance of the LCCs. BA has enough yield pressure of its own in Europe without taking on Iberia’s own intra–European problems, and that’s even before the headache of getting a BA/Iberia merger past the EC.

Surely BA will not be panicked into making such a major strategic move just because of the dubious benefits of Air France/KLM? Naturally, Iberia is doing its best to talk up its long–term prospects, and in June 2003 outgoing president Xavier de Irala claimed Iberia wanted to assume a leadership position and play a role in European strategic consolidation.

But Iberia needs to concentrate on putting its own house in order first, and if Iberia is part of European consolidation it will only be a consequence of what others — and in particular BA — want.

Iberia reportedly is considering an investment in the soon–to–be privatised TAP Air Portugal, but this would be a relatively insignificant strategic advantage for a combined BA/Iberia, with the only real benefit being access to TAP traffic to/from Brazil (something that the regulators would inevitably take a close look at).

Iberia’s equity interest in TAP appears illogical, given that it can gain virtually all of the benefits of a costly equity link–up via its existing code–sharing deal (see Aviation Strategy, March 2003).

Hopefully this type of strategic grandstanding will not be a feature of the new chairman, Fernando Conte. Conte was previously CEO of an engineering company and has been an independent board member at Iberia since 2001. He has a massive task ahead, and the first indication of how he has done since taking over as chairman in June will be the third quarter results, due out on November 17.

Longer–term, investors should also keep an eye on the Third Director Plan and its specific objectives. Iberia’s message to investors — in July 2003 at least — was that its core 2005 unit cost, EBITDAR and ROE margin targets remain the same, despite the wobbles of early 2003. These targets are a key indication of how Iberia is faring. If they are watered down or even axed, then Iberia will give a clear indication that its Third Director Plan was too ambitious and that yield pressure in Europe is becoming dangerous.

| Fleet | Orders | Options | |||

| A319 | 4 | 8 | 9 | ||

| A320 | 56 | 11 | 3 | ||

| A321 | 6 | 9 | 11 | ||

| A340 | 21 | 7 | 7 | ||

| 747 | 7 | ||||

| 757 | 17 | ||||

| MD87 | 24 | ||||

| MD88 | 14 | ||||

| TOTAL | 149 | 35 | 30 |