BAA: the impact of September 11

November 2001

The effects of the post–September 11 downturn in traffic are being felt throughout the travel supply chain — especially at airports. BAA’s half–year results presented in late October gave an insight into emerging trends.

Airports of course do not have the same level of operational gearing towards passenger numbers that airlines do, but much of their revenue in the short run does relate to terminal passenger throughput and this does tend to be the principal business driver. Unlike airlines, however, they cannot get rid of the infrastructure and still have to build and plan for the long term. Many are sure to be revisiting their long–term growth forecasts and capital spending needs.

The impact on an individual airport will depend on the effect on the airlines that serve it, the relative proportion of long haul, transatlantic, transfer, short haul and domestic traffic, the dependence on passenger charges and retail income.

BAA plc, in its published results to the end of September, highlighted the impact of the terrorist attacks on September 11 in reasonable detail. Inevitably, the company stated "it is still too soon to predict the future for aviation with any degree of certainty". However, in line with the forecasts published in Aviation Strategy last month, "although the aviation industry is currently experiencing significant disruption to passenger volumes, we are confident that in the future growth will return to those markets currently depressed".

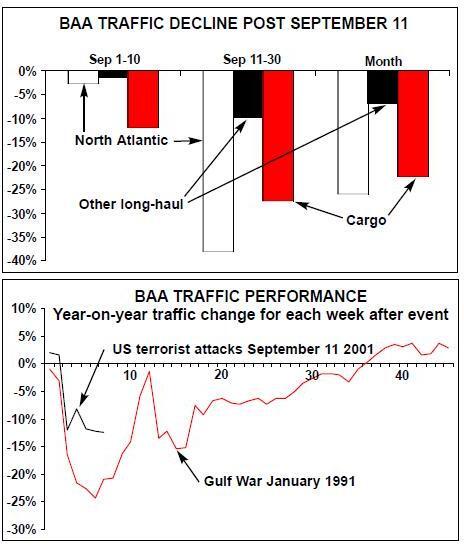

The immediate reaction is to compare the events of September with those at the start of the Gulf War in 1991. As the chart below shows, the fall off in traffic for BAA’s airports initially has mirrored that during the Gulf War, but the decline has tailed off at around 12% year on year decline. We would have one major observation, however, to offset any optimism: the Gulf War started in January, which is the weakest month for traffic, and that traffic tends to be very highly discretionary. September/October is the real start of the business travel season after the traditional summer break.

The principal traffic impact was on long haul services. These were already mildly weak as a result of the combined factors of the weakening US economy, the continued impact of the UK foot and mouth epidemic and the slowdown in world trade. In the second half of the month however, North Atlantic traffic fell by nearly two fifths against prior year levels, and freight traffic — affected mainly by the cancellation of air services rather than demand — fell by 25%.

London’s Heathrow airport is the largest in the group and the most affected by transatlantic traffic — so it is not surprising that it experienced the greatest year on year declines in passenger numbers in September with a 13% fall. Stansted airport, the low–cost haven, continued to register increases with a remarkable 11% growth in September.

The impact by market is more pronounced: domestic and Irish traffic static, a 26% fall in transatlantic traffic, 7% fall in other long haul and a 2% decline in European traffic — the latter decline reflecting the transfers to and from long haul.

In the first three weeks of October, the company stated that passenger numbers continued to show declines of 12% year on year.

Financial implications

"Safety and security continues to be BAA’s number one priority." As a result of September’s events increased security measures were imposed and put in place. This is likely to cost the group an extra £25m a year (or 25p per passenger). Over time of course this will be passed on to the airlines and the passengers. As we mentioned in the Management article last month on airport security, there will be increased pressure on landside and airside capacity — which ironically in Heathrow’s case increases the need for the building of the long–awaited fifth terminal.

For BAA, half its airport revenue comes from passenger spending through its retail outlets. This is likely to be more heavily affected by the slow down in long–haul traffic. Overall traffic fell by 6% in September, but the net retail income per passenger grew by 5%, two percentage points below recent trend and net retail revenues for the month fell by 1% to £45m. Given the abolition of intra–European duty free, the long haul passengers provide the best net value from retail sales at the airports. As the company stated, "the expected downturn in traffic could have a disproportionately adverse effect on income".

During the period of the Gulf War in 1991, BAA’s profits received a hit of 20%, but bounced back as the war’s effects on the industry receded. This time it appears that it also received a 20% hit to profitability in the second half of September and the likely conclusion is that trend would continue for the short run. As BAA’s CEO Mike Hodgkinson said in his statement on the results: "There seems no reason to believe that once confidence is restored air travel will not return to growth. The key to our success will be to achieve the correct balance between short term actions and the need to provide in the long term infrastructure the country and our customers want."

| Net income £m | % chg | Income per pax | % chg | |

| Five months to Aug | 216 | 8% | £3.71 | 7% |

| September | 45 | -1% | £4.04 | 5% |

| Six months to Sept | 261 | 7% | £3.76 | 7% |

| Operating profits (£m) | 2001 | 2000 | Change |

| Five months to August | 293 | 279 | 5.0% |

| September | 52 | 58 | -10.3% |

| Six months to September | 345 | 337 | 2.4% |