Market balance - don't worry too much

November 1997

The last aviation recession, in 1991/92, was a traumatic experience and as a consequence many of its lessons have been forgotten. One of those lessons was to keep monitoring the global supply/demand balance, especially when things seem to be going rather well.

Currently the manufacturers, particularly Boeing, are having some well-publicised difficulties coping with increased demand. Boeing had been aiming for 350 deliveries this year but has cut this back to 335, which is still 63% up on last year. In 1998 it intends to ramp up production to 480. Airbus will probably deliver 195 jets this year, 53% up on 1996. In 1998 production should rise to 230 or maybe more, as it now says that it plans to push production of the A320 family alone up to 216 a year by 1999 if the USAirways mega-order is confirmed. Overall deliveries (including Bombardier, Embraer, AVRO and MDC) will touch 700 this year, some 40% up on 1996.

More significantly, based on current orderbooks, over the period 1997-2001 some 4,160 jets are predicted to be delivered, in contrast to 2,940 in the previous five-year period. Can the market absorb this increase?

Ed Greenslet, of ESG Aviation Services, regularly produces forecasts of the global commercial aviation market and has a deserved reputation for identifying trends - he clearly foresaw and quantified the huge surplus that appeared in the early 1990s.

To summarise (and greatly simplify) the ESG methodology: the actual or projected number of RPMs is converted into aircraft by factoring in the average global load factor in order to get to ASMs, which are then divided by optimal average utilisation, speed per hour and average seating to give an estimated demand (cargo jets are also added in). This demand figure can then be subtracted from the actual or projected supply of aircraft in the worldwide commercial aviation fleet, the fleet projections taking account of future deliveries and retirements. The difference between demand and supply is the surplus, which can manifest itself in jets parked in the desert or in underutilised and under-occupied aircraft flying around.

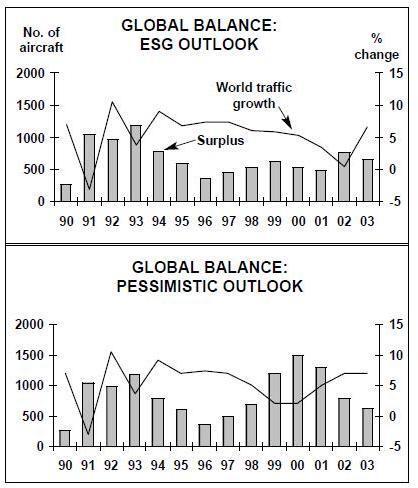

ESG's forecast shows the surplus growing significantly from the low point of 1996, although it gets nowhere near the 1,000-plus surplus of 1991-93. Greenslet sums up the outlook in this way:

"The healthy market we enjoy today is in great danger of ending in two years or so. By almost doubling production between 1996 and 1999 the industry will greatly increase its exposure to the risk of unanticipated events of which an early recession is the largest. The prospects do not give cause for panic but they certainly do make a case for worrying.

” Suitably worried, we have rerun the ESG forecast, plugging in a two-year downturn during 1999-2000 when traffic growth falls to 2% pa from 5-6% in the other years of the outlook (whereas ESG had assumed a one year recession in the year 2002). The result is that the surplus shoots up to well over 1,000 for a three year period 1999-2001, at least as bad as the early 1990s recession.

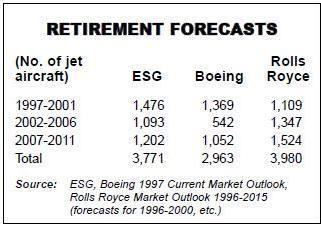

The perennial unknown is what will happen with retirements. The risk of another severe recession would be obviated if the long-awaited acceleration in retirements materialised. One would expect this to happen because airlines are supposedly more sophisticated in controlling capacity and because Chapter 3 noise legislation will force airlines to phase out older aircraft from the year 2000 in the US and 2003 in Europe.

The apparent surplus that we show appearing can then simply be dismissed as a backlog of noisy, elderly types awaiting demolition or sale to the Third World.

Based on life cycles of 26-30 years for various passenger types and 46 years for freighters, ESG forecasts 1,476 retirements in the next five years compared with just 663 during 1992-96. On a five year view ESG is more aggressive on retirements than Boeing and Rolls-Royce, both of which have a vested interest in promoting aircraft scrapping, and on the 15-year outlook is also well above Boeing.

Close monitoring of the situation is needed.

| No. of jet aircraft |

ESG | Boeing | Rolls Royce |

| 1997-2001 | 1476 | 1369 | 1109 |

| 2002-206 | 1093 | 542 | 1347 |

| 2007-2011 | 1202 | 1052 | 1524 |

| Total | 3771 | 2963 | 3980 |