Southwest: New initiatives

plus tax breaks

May 2018

Recent weeks have been tough for Southwest Airlines, the largest US carrier in terms of domestic passengers. Southwest suffered a horrific accident on April 17, in which debris from a failed CFM56-7B engine broke the window of the 737-800, leading to a passenger being partially sucked out and dying from her injuries.

The effects have been severe in terms of a reduction in bookings and unit revenues. Southwest’s shares have fallen sharply and its first-half financial results will fall short of original projections.

However, the negative effects of the Flight 1380 tragedy are likely to be short-lived (as tends to be the case with aviation accidents). Southwest expects to be fully back of track financially in the second half of this year.

Southwest is benefiting from several factors this year. First, after staging an unusually disruptive fleet transition in September 2017, when it retired all of its remaining 737-300 Classics, Southwest will get its fleet “back in balance” in the second half of 2018 with new aircraft deliveries.

Second, Southwest will start reaping significant benefits from a new reservation system deployed last year. Enhancements to revenue management will start taking effect in mid-2018, leading to $200m incremental revenues this year.

Third, Southwest will enjoy significant tax windfalls this year as a result of the Tax Cuts and Jobs Act of December 2017, which reduced the US corporate tax rate from 35% to 21% and changed tax depreciation rules to allow 100% first year capital allowances.

Southwest is the biggest beneficiary of the tax reform among US airlines, because it is a full US taxpayer and has significant ongoing fleet capex. An estimated 23-23.5% tax rate this year (including state taxes), down from 36% in 2017, will significantly boost its cash flow and net earnings in 2018.

Fourth, unlike other US carriers, Southwest has fuel hedges in place that will provide meaningful protection in an environment of rising fuel prices.

2017 was a challenging year for Southwest because of the implementation of the two strategic initiatives (fleet transition and reservation system). CEO Gary Kelly noted in the latest annual report that 2018 would be the first year in a decade with no major deployment planned and that Southwest would focus on harvesting the benefits of the past investments.

After a three-year growth spurt in near-international markets, which included significant investment in US gateway airports, Southwest will also be taking it easy on the international front in 2018.

But there is a new high-profile expansion project on the horizon: adding Hawaii to the network with 737-800 ETOPS-operations in late 2018 or early 2019.

Financially, Southwest is looking as strong ever. Despite fuel and labour cost pressures, 2017 was the third best year in the airline’s history, with an operating margin of 16.3%, net margin excluding special items of 10% and pretax ROIC of 25.9%. The margins were among the highest in the industry. It was Southwest’s 45th consecutive year of profitability — a record unmatched in the US airline industry and possibly in all of corporate America.

Southwest also still has one of the best balance sheets in the industry, with strong liquidity and very low debt. At the end of March, the leverage ratio was around 30%.

The fleet transition

Southwest became the first airline in North America to fly the MAX 8 in October 2017 and had received 13 of the type by year-end (15 as of mid-May). But it still took delivery of 39 737-800s from Boeing last year, along with 18 pre-owned 737-700s.

The decision to retire all remaining 62 737-300s in September 2017, to coincide with the MAX 8’s introduction, was interesting to say the least. It was not only expensive (a $96m charge was recorded in 2017) but disruptive in that the sharp reduction in the number of aircraft forced Southwest to temporarily operate a “sub-optimal flight schedule”, with more flights in the less profitable off-peak hours. Southwest’s fleet declined from 735 aircraft in mid-2017 to 706 at the end of 2017.

But Southwest calculated that the negative effects would be more than offset by $200m of economic benefits through 2020 (from reduced fuel, maintenance and out-of-service costs). Southwest expects to “re-optimise” its schedule by the second half of 2018 thanks to new aircraft deliveries. It expects to grow the fleet by 46 units this year to a new high of 752 aircraft.

Since December Southwest has revised its Boeing order commitments twice, which essentially meant exercising 80 MAX 8 options for 2019-2022 delivery, bringing forward some MAX 8 deliveries and deferring some MAX 7 firm orders.

The new MAX 8 orders are mainly for 737-700 replacement, though Southwest will have the option to keep some of the 700s longer if good growth opportunities materialise.

At the end of March, Southwest’s fleet consisted of 513 737-700s, 190 737-800s and 14 MAX 8s. The owned/leased split was 83%/17%. The firm orderbook included 236 MAX 8s (plus 115 options), 30 MAX 7s and 17 737-800s.

The aggressive fleet modernisation and upgauging will help keep unit costs in check. Southwest has seen its cost advantage narrow in the past decade (legacy carriers’ cost cuts, service to more expensive airports, international expansion, ageing of the workforce, 83% unionisation, expensive labour deals especially in 2016, etc.).

Reservation system benefits

The switchover to a new reservation system in 2017 was the culmination of a multi-year effort to completely transition to the Amadeus Altea Passenger Service System. The project involved a $500m investment and the benefits are now ramping up, with $200m in pretax benefits expected in 2018, escalating to $500m by 2020.

The main initial benefit, according to Southwest executives, is “O&D bid pricing capability” — an opportunity to “maximise revenue by really optimising the mix of nonstop and connecting passengers on the network”. The old method apparently optimised revenues at the flight level. The new O&D functionality was introduced in the first quarter and will be fully deployed in the coming months.

Later the new reservation system will also facilitate foreign point of sale, schedule optimisation, better yield management of ancillary offerings, passenger service improvements and more codeshare deals.

International growth spurt

Southwest entered the international arena relatively late, at least compared to the newer-generation North American LCCs. The airline took its time because its business model was built on simplicity and it did not have the systems or technology in place to handle international flights.

The initial opportunity arose via Southwest’s 2011 acquisition of AirTran Airways, which operated some near-international services to the Caribbean. Southwest took over those services in the second half of 2014, after spending three years to upgrade its reservations systems, learn from AirTran’s international experience and train employees.

In early 2015 Southwest added its first new international destinations (San Jose in Costa Rica and Puerto Vallarta in Mexico), but the main growth spurt came in October 2015 with the inauguration of the airline’s new international terminal at Houston Hobby (HOU). Southwest began daily flights to six destinations in Mexico, the Caribbean and Central America on the same day, and added more routes later that quarter.

Southwest chose to build HOU into a major international gateway, because the Wright Amendment prohibits international flights from its Dallas Love Field home base and it already operated extensive domestic services from HOU. Houston, with its sizable Latin population and large local market, makes an excellent gateway to Latin America.

The $150m international concourse at HOU, which has five gates and an estimated capacity of 25 daily departures, was initially paid for by Southwest, but this year the airline received a $116m reimbursement from the City of Houston and will recoup the remainder through reduced rental payments.

As its second major gateway project, Southwest opened a new five-gate international concourse at Ft. Lauderdale-Hollywood International Airport (FLL) in the spring of 2017. The new facility enabled it to expand its South Florida international schedule to nine nonstop destinations.

The new concourse, which was part of FLL’s Terminal 1 modernisation project (due to be completed in mid-2018), was paid for by the local authority but was overseen and managed by Southwest, thus ensuring that the airline got exactly what it wanted.

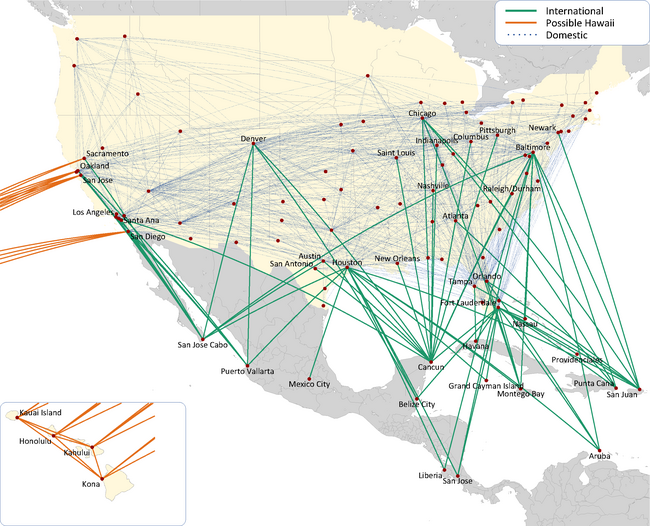

Aside from those two high-profile gateway projects, Southwest’s strategy has been to add international service from a large number of US cities (around 16) to a relatively small number of overseas destinations (14 so far). The ten countries served are: Mexico, Jamaica, The Bahamas, Aruba, Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands and the Turks and Caicos.

Such a strategy minimises risk and is most cost-efficient. Southwest’s leading or strong position at numerous US airports ensures significant domestic feed to its international services.

Costs are also minimised by keeping aircraft mostly interchangeable between the domestic and international networks.

In both Houston and South Florida, Southwest faces significant competition from other US airlines’ international services. At Houston, the primary competitor is United, which operates from IAH but matches Southwest’s fares when necessary. FLL is a Latin America/Caribbean gateway also for JetBlue and Spirit. That said, Southwest thrives in head-to-head competition with other carriers.

Among the less successful markets, Cuba has been challenging for US airlines, especially in the Trump era. Southwest originally initiated service to three destinations in Cuba, but in 2017 it pulled out of Varadero and Santa Clara, in favour of concentrating its service on Havana.

Southwest’s international revenues have more than doubled in the past two years, from $287m in 2015 to $595m in 2017. Generally speaking, the markets are maturing nicely. It seems that the Southwest brand has been just as highly regarded internationally as in the domestic market. The airline offers good value to both the leisure and business traveller. Having international routes is important to FFP members, many of whom are business travellers, and to Southwest employees.

But the international network is still small (in comparison with the massive domestic network), accounting for only 4% of system ASMs and 2.8% of revenues last year.

Hawaii calling

Southwest’s current expansion priority is to add Hawaii to its network with flights from California. The launch date has not yet been announced, because the airline is still awaiting ETOPS clearance, but the management hopes to at least start selling the flights this year.

The Hawaii destinations and the California gateway cities were announced in early May, though the routes are not yet known. Southwest will fly in some combination from Oakland, San Diego, San Jose and Sacramento to Honolulu, Lihue, Kona and Kahului, using the 737-800s. The airline has said that there could be additional tag routes in Hawaii.

The Hawaii move is certain to be a success, in the first place, because of Southwest’s formidable market position in California. Southwest accounts for 63% of the intra-California market and 26% of all commercial air travel (including international) to and from California.

Southwest has added much capacity in California in the past couple of years in response to Alaska’s acquisition of Virgin America. The aggressive Hawaii plans are part of that response (though Southwest’s management had talked about Hawaii for many years).

Because of the ALK-VA merger and the competitive responses, California is seeing intense competition and not the healthiest of unit revenue trends. But Southwest claims that it has been able to increase load factors and generate strong profits in California. Since West Coast customers already know the airline, the management expects the Hawaii operations to become profitable relatively quickly.

The move is of concern to Hawaiian and Alaska Airlines, which have the biggest exposures to the West Coast-Hawaii market. Then again, those routes have long been very competitive, desirable for airlines of all shapes and sizes (important to staff morale and the success of FFPs).

Southwest feels that it is in a good position to launch Hawaii this year also because it does not have any other major expansion projects in the works. Currently 3% or less of its markets are “under development” — a low percentage by historical standards.

Although Southwest anticipates growing total ASMs in the “low 5% range” in 2018, which would be higher than last year’s 3.6% growth, it would still be modest by historical standards and not out of line with other airlines’ plans. International growth will be in the “low-to-mid single digits”.

While Southwest will continue to compete aggressively in California and other key markets such as Denver, Houston and Chicago, it is consolidating its Central Michigan operations in Detroit by ceasing service to Flint in June.

Southwest is able to strengthen its presence at New York LGA and Washington DCA because of a recent agreement with Alaska to lease 12 and eight slots, respectively, at those airports for a decade or so. Alaska has no use for those slots until perimeter rules at LGA and DCA are relaxed to allow nonstop service to the West Coast.

Because of the decades-long speculation that Southwest is running out of growth opportunities (at least domestically), CEO Gary Kelly likes to comment on that subject at AGMs. This time, at the May 16 event, he said that, in addition to Hawaii, Southwest had identified “as many as 50 additional opportunities to expand our route network in North America and parts of South America”. That would take the airline from the current 100 to over 150 destinations. Kelly never mentions a time frame, but Southwest clearly has the aircraft orderbook to support such growth, at whatever pace it chooses.

While Southwest’s business model has evolved quite a bit in the past decade, the key attributes remain unchanged: primarily point-to-point service (76% of its customers flew nonstop in 2017); low fares; high-frequency, conveniently timed short-haul flights; some long-haul services; and carefully thought-out ancillary offerings. The latter means no bag fees, no change fees, free live TV and “the most generous FFP in the world”. Southwest believes that especially the “bags fly free” policy gives it a competitive advantage over the rest of the US industry.

Capital allocation plans

The investment-grade balance sheet and strong cash flow and profit generation have meant generous employee profit-sharing payments ($543m for 2017), significant shareholder returns via dividends and share buybacks ($1.9bn in 2017, adding up to $8.2bn since 2011) and significant investment in fleet modernisation, facilities and technology.

Southwest seems to be taking a similar (balanced) approach with the use of the tax reform windfalls. First, it was one of four US airlines that followed the example of numerous S&P 500 companies and paid its employees a $1,000 cash bonus specifically related to the tax reform in early January. (A bit of a no-brainer since the bonus was tax-deductible and, if booked in 2017, offered the greatest tax savings.)

Shareholders got their extra rewards at the AGM in mid-May. Southwest raised its quarterly dividend by 28%, citing the strong Q1 results and savings from the tax reform. The annualised dividend is now $370m. Southwest also authorised a new $2bn share repurchase programme, which will kick in on the completion of the $350m remaining from the previous $2bn programme.

In early January Southwest was quick to announce a “further investment in its Boeing fleet” specifically to take advantage of the tax reform. It was about the exercise of the 40 MAX 8 options and would clearly have happened anyway. However, some analysts have commented in recent months that, even though the management had not specifically said so, Southwest could accelerate international growth in the new tax environment.

The management stated in April that after the Boeing order revisions, this year’s total capex would be $2-2.1bn, of which $1.2bn would be aircraft capex. CFO Tammy Romo talked about aircraft capex averaging $1.2-1.3bn annually in the next five years — a level she described as “manageable”.

Southwest clearly could afford to help the US airline industry consolidate a bit more in the coming years, and analysts grilled the management on that subject in the Q1 call. The answer was predictable: Southwest’s priority now is to grow organically, but should an acquisition opportunity arise that improved shareholder value, the airline would take a look at it.

At the AGM, CEO Kelly had some encouraging news about the accident investigation: Southwest had completed the inspection of 35,500 CFM engine fan blades and had found no problems. The fan blades would be further examined by GE. So, although the full impact remains unclear, the worst-case scenario could be just more frequent engine inspections, plus some litigation costs (lawsuits from passengers).

Southwest is expecting its RASM performance to bottom out in the current quarter and the second half of 2018 to see improvement, reflecting a recovery from the accident, flight schedule re-optimisation and the new revenue management capabilities.

Cost pressures are also easing, with the recovery from the fleet deficit and hence restoration of former efficiency levels, as well as faster ASM growth. Despite hefty pay awards granted to mechanics under a new deal reached in April, Southwest expects its CASM-ex to remain flattish in 2018.

So Southwest is looking at another year of strong operating earnings, with the margin remaining similar to last year’s, and substantially higher net earnings because of the lower tax rate. Analysts expect the operating results to improve significantly in 2019 as Southwest sets about to fully monetise the new reservation system.

After surging by 30% in 2017 (beating its peers), Southwest’s share price has been the industry’s worst performer year-to-date. In late May the shares were almost uniformly recommended as a strong buy or buy. Among the three or so neutrals, JP Morgan analysts said that their rating simply reflected “better risk-to-reward at the legacy carriers”; the latter have more exposure to the current strong recovery trends in international and corporate demand.

| Firm | Options | Extra | |||||

|---|---|---|---|---|---|---|---|

| 737-800 | 737 MAX 7 | 737 MAX 8† | 737 MAX 8 | 737-700 | 737 MAX 8 | Total | |

| 2018 | 26 | 19 | 1 | 46 | |||

| 2019 | 7 | 20 | 3 | 30 | |||

| 2020 | 35 | 35 | |||||

| 2021 | 44 | 44 | |||||

| 2022 | 27 | 14 | 41 | ||||

| 2023 | 12 | 22 | 23 | 57 | |||

| 2024 | 11 | 30 | 23 | 64 | |||

| 2025 | 40 | 36 | 76 | ||||

| 2026 | 19 | 19 | |||||

| Total | 26 | 30 | 237 | 115 | 1 | 3 | 412 |

Note: † Southwest has flexibility to substitute MAX 7s for MAX 8 firm orders beginning in 2019. As of April 25, Southwest had taken delivery of 11 737-800s, one 737-700 and one MAX 8 this year.

Source: Southwest

Notes: The figures include AirTran's results from May 2, 2011 onwards.

Source: Company reports

Note: Possible Hawaii -- Southwest has announced the cities it plans to serve but not yet specified the routes (see text)